Guarantee Contract In Law

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

Precisely prepared formal documents serve as a key safeguard against complications and legal disputes, yet acquiring them without the help of a lawyer might require some time.

Whether you need to swiftly locate a contemporary Guarantee Contract In Law or various templates for employment, family, or business purposes, US Legal Forms is consistently available to assist.

The process becomes even more straightforward for existing users of the US Legal Forms repository. If your subscription is active, simply Log In to your account and click the Download button next to the chosen document. Furthermore, you can retrieve the Guarantee Contract In Law at any time, as all documents obtained on the platform remain accessible in the My documents section of your profile. Conserve time and resources on preparing formal documents. Experience US Legal Forms today!

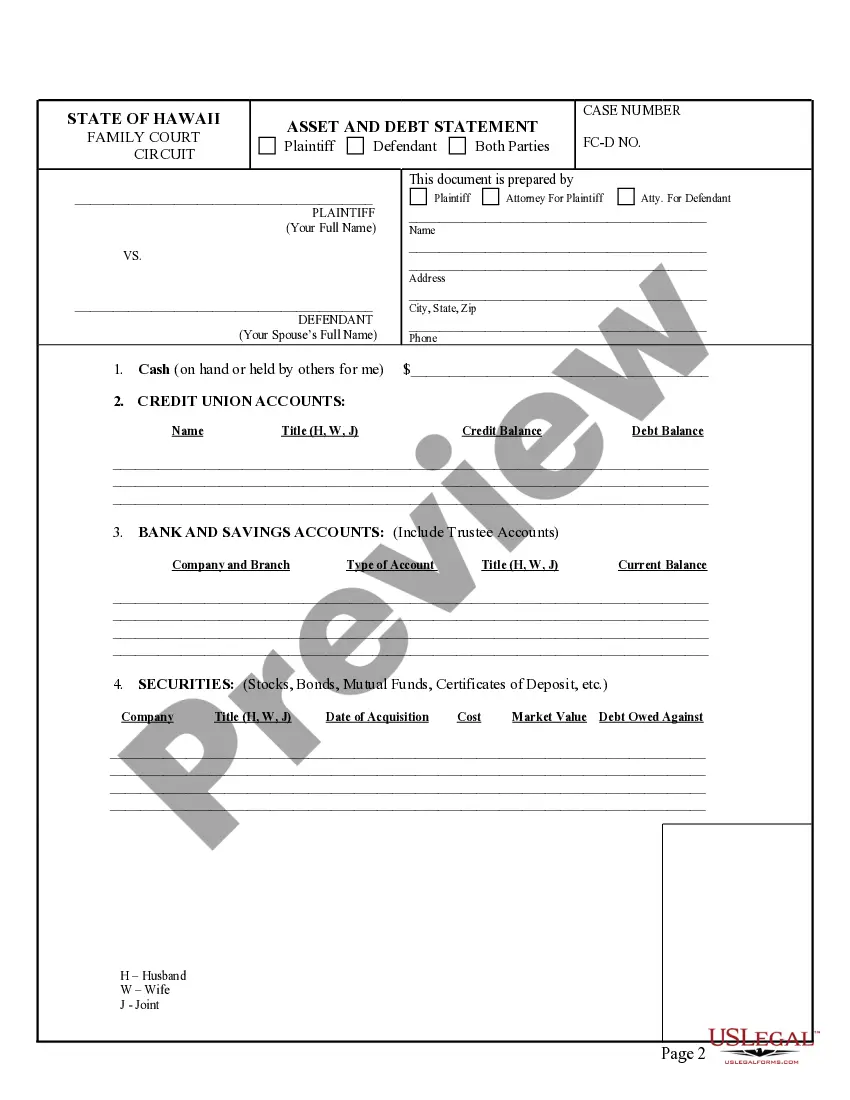

- Verify that the form meets your requirements and jurisdiction by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the header of the page.

- Press Buy Now when you discover the right template.

- Choose your pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose either PDF or DOCX file format for your Guarantee Contract In Law.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

How to Write a Personal Guarantee?Information About the Parties.Information About the Loan.Subject of the Guarantee.Terms and Conditions.Contact Information.Signatures.Witness.

For example, A promises to deliver certain goods to B for Rs. 2,000 every month. C comes in and promises to indemnify B's losses if A fails to so deliver the goods. This is how B and C will enter into contractual obligations of indemnity.

Example 1 : When A requests B to lend `10,000 to C and guarantees that C will repay the amount within the agreed time and that on C falling to do so, he will himself pay to B, there is a contract of guarantee.

A "contract of guarantee" is a contract to perform the promise, or discharge the liability, of a third person in case of his default.

A financial guarantee can be regarded as a form of a bank guarantee. Essentially, it is an obligation of a specialized insurance company to repay the remaining interest payments and the principal amount of a bond or similar financial instrument to the lender in case of the borrower's default.