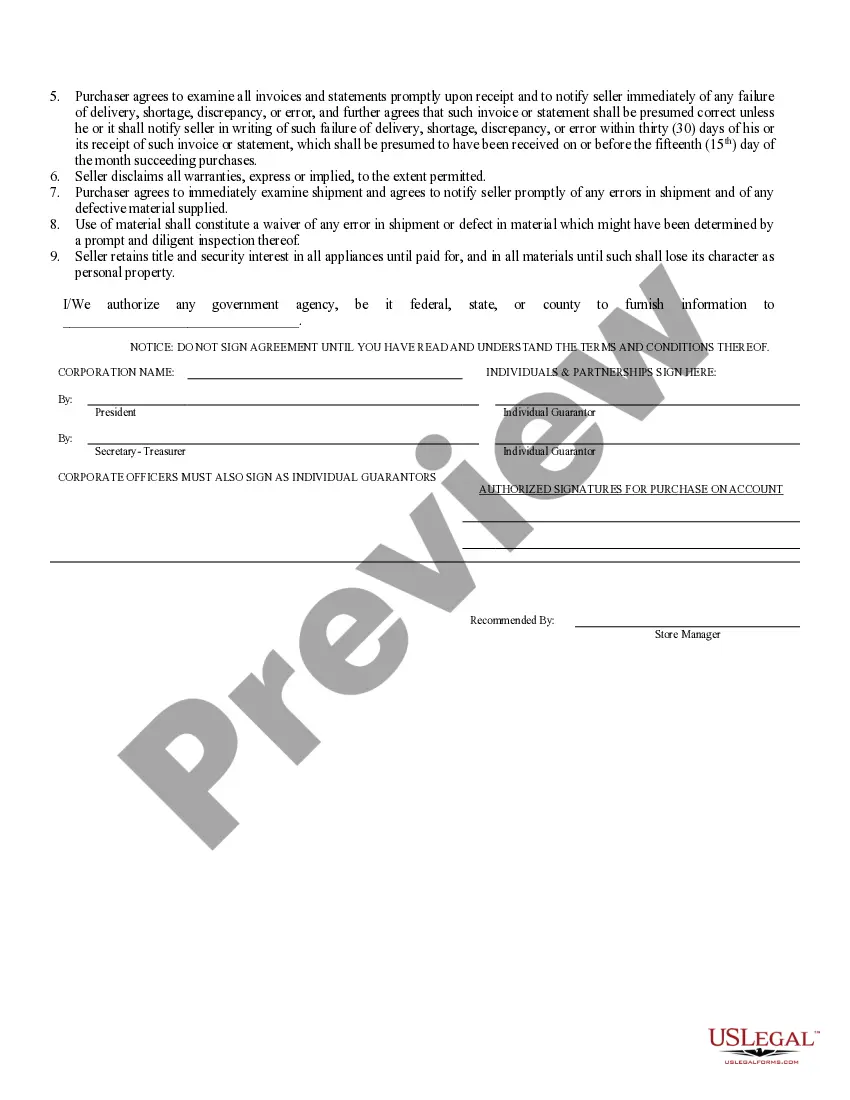

Credit Application Form For Customers

Description

How to fill out Credit Application Form For Customers?

Individuals typically link legal documentation with complexity that solely an expert can manage.

In some respects, this is accurate, as creating a Credit Application Form For Customers demands considerable knowledge of subject specifications, incorporating state and municipal laws.

Nonetheless, with US Legal Forms, matters have become simpler: pre-prepared legal templates for any personal and business situations tailored to state regulations are gathered in a singular online repository and are now accessible to everyone.

Print your document or upload it to an online editor for a quicker completion. All templates in our library are reusable: once obtained, they remain stored in your profile. You can access them whenever required via the My documents tab. Explore all the benefits of utilizing the US Legal Forms platform. Register today!

- US Legal Forms presents over 85,000 current forms categorized by state and type of use, allowing for quick searches for the Credit Application Form For Customers or any other specific template in just a few minutes.

- Previously registered members with an active subscription must Log Into their account and click Download to receive the form.

- New users of the service will first have to create an account and subscribe before being able to save any paperwork documentation.

- Here’s a step-by-step guide to obtaining the Credit Application Form For Customers.

- Carefully review the page's content to ensure it meets your requirements.

- Examine the form description or view it through the Preview option.

- If the initial form is not suitable, find another sample using the Search field in the header.

- When you locate the appropriate Credit Application Form For Customers, click Buy Now.

- Select a pricing plan that aligns with your requirements and financial limits.

- Create an account or Log In to move forward to the payment page.

- Complete your subscription payment using PayPal or your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

A credit application is a standardized form that a customer or borrower uses to request credit. The form contains requests for such information as: The amount of credit requested. The identification of the applicant. The financial status of the applicant.

A business credit application form is used by businesses to request funding or lines of credit with a bank through the business's website.

A credit application is a request for a loan or line of credit. The information included in a credit report helps the lender determine whether the borrower is a good candidate for a loan. You can usually fill out a credit application either online or in person.

The credit application (Application) is the. initial document used by Vendors to collect. information and establish contractual terms. with the Applicant.

In the credit application, you should request:bank details including account name, BSB and bank location;accountant's details;permission to do credit checks; and.trade references from at least three other suppliers, including full business name, ABN, mobile number and email address.