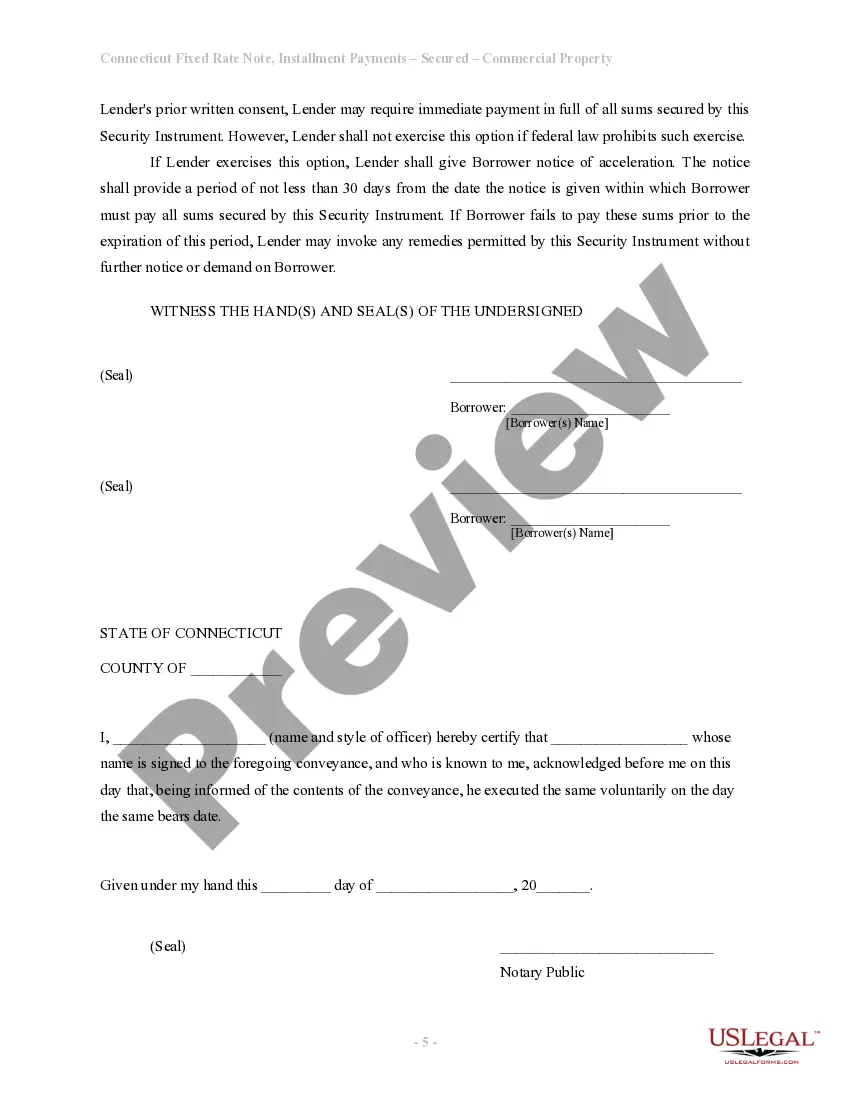

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Connecticut Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

The greater number of documents you need to produce - the more anxious you become.

You can discover numerous Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate templates online; however, you are uncertain which ones to trust.

Eliminate the inconvenience to simplify obtaining samples with US Legal Forms. Receive expertly crafted documents designed to meet state regulations.

Enter the required information to set up your profile and pay for the order using your PayPal or credit card. Choose a convenient document format and obtain your copy. Access every template you acquire in the My documents section. Simply visit there to generate a new copy of the Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Even when preparing professionally drafted documents, it remains essential to consult with a local attorney to verify that your document is accurately completed. Get more for less with US Legal Forms!

- If you are already a subscriber to US Legal Forms, Log In to your account, and you will find the Download button on the webpage for the Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If you have not previously used our website, follow these steps to complete the registration process.

- Verify that the Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is valid in your state.

- Double-check your selection by reviewing the description or by utilizing the Preview feature, if available for the selected document.

- Click on Buy Now to initiate the registration process and select a pricing plan that fits your requirements.

Form popularity

FAQ

Yes, a promissory note secured by land is generally categorized as a mortgage note. This type of note gives the lender a legal claim to the property if the borrower defaults. In the context of a Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this means that the property serves as collateral, offering both parties a clear understanding of their rights and responsibilities.

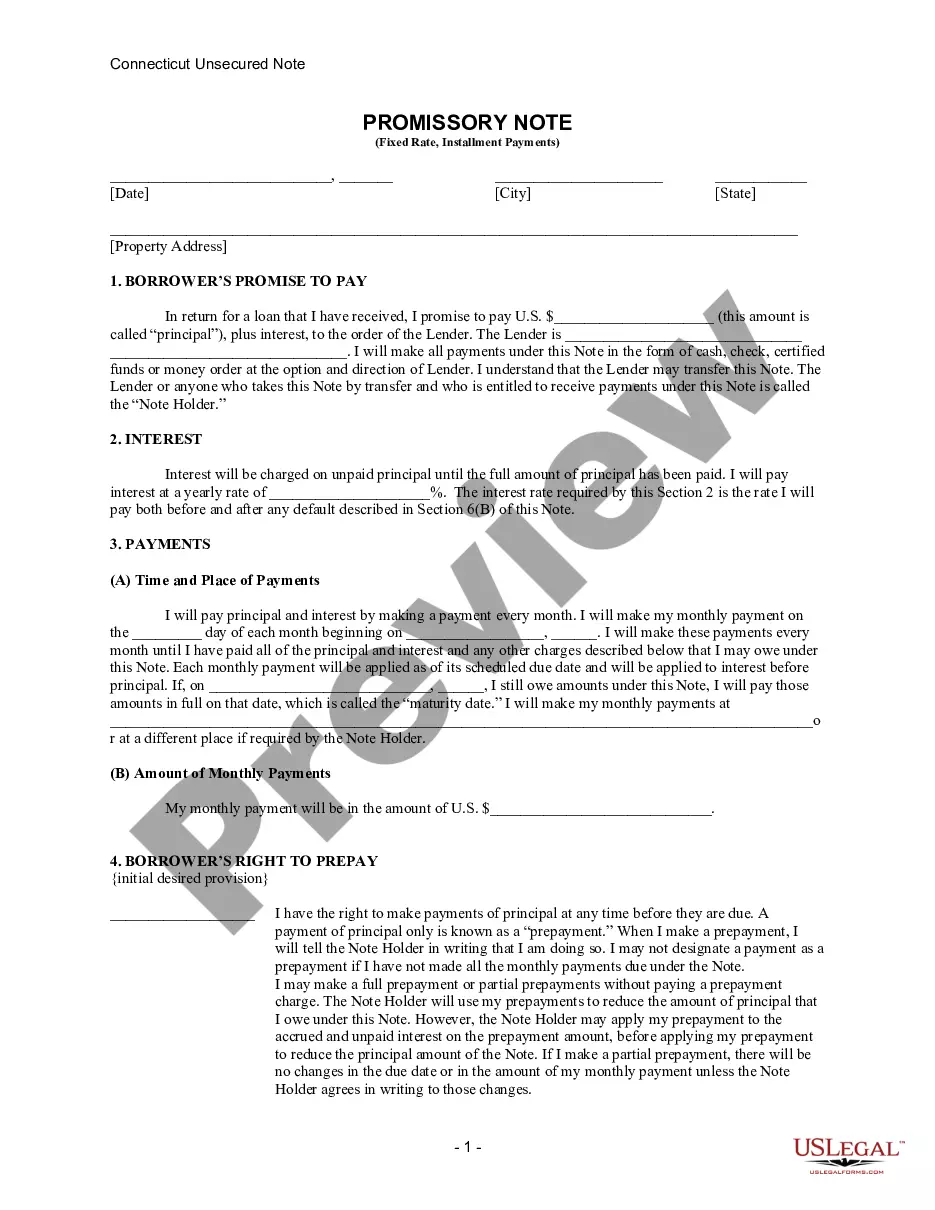

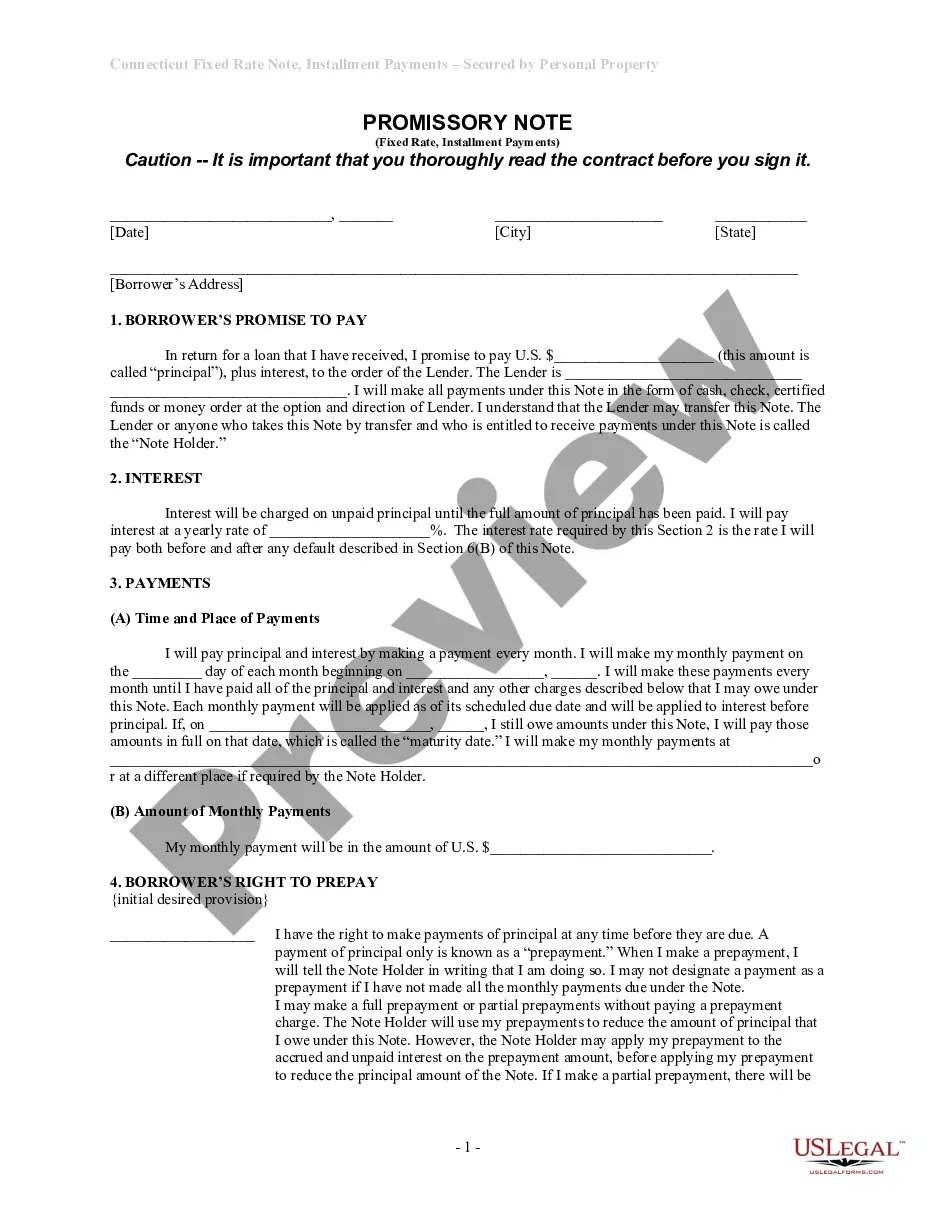

A commercial promissory note is a financial instrument used in business transactions to confirm borrowing for commercial purposes. It specifies the amount borrowed, the repayment schedule, and any collateral involved. When considering a Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is essential to understand that these notes often encompass terms that cater to the unique needs of commercial investment, ensuring a beneficial arrangement for businesses.

One potential disadvantage of a promissory note is that it may impose a financial obligation on the borrower that can become overwhelming. If the borrower fails to make payments, they risk losing the collateral tied to the note, such as commercial real estate. Additionally, understanding the specific terms of a Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is crucial, as any misunderstanding can lead to financial difficulties.

An installment note is a type of promissory note that requires the borrower to make regular payments over time, including both principal and interest. In contrast, a standard promissory note might involve a single repayment at maturity or different payback terms. When dealing with a Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you can expect predictable payment amounts, which simplifies your budgeting process.

To properly record a Connecticut Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you typically must file it with the county clerk or recorder's office where the property is located. This filing creates a public record, ensuring that your interests are protected should any disputes arise. It is essential to follow this step to uphold the integrity of your transaction. For more support on filing, visit the US Legal Forms platform for numerous templates and insights.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

Writing the Promissory Note Terms You don't have to write a promissory note from scratch. You can use a template or create a promissory note online.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.