Lease Property For Hunting

Description

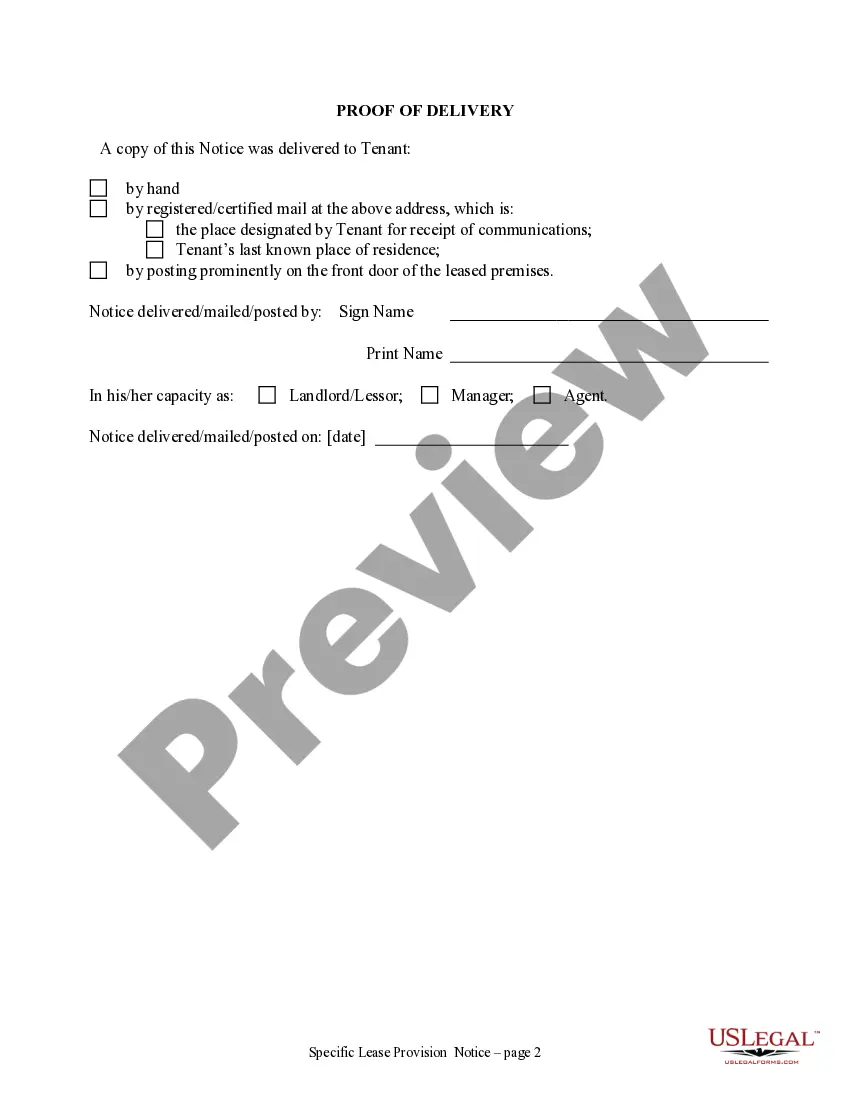

How to fill out North Carolina Notice Of Breach Of Written Lease For Violating Specific Provisions Of Lease With Right To Cure For Nonresidential Property From Landlord To Tenant?

- Log in to your US Legal Forms account if you're already a user. Ensure your subscription is active, or renew it as needed.

- Browse the available forms in the Hunting category. Use the Preview mode to confirm the document meets your requirements and adheres to local jurisdiction laws.

- If you don’t find a suitable template, utilize the Search feature at the top to find the right one.

- Once the correct document is identified, click on the Buy Now button and select your desired subscription plan. Create an account if you haven't already.

- Complete your purchase by providing payment information, either via credit card or PayPal.

- Download your completed form to your device and access it anytime through the My Forms section in your account.

Using US Legal Forms provides you with access to an extensive collection of over 85,000 fillable legal forms and packages. This ensures you have the robust support needed for your hunting lease agreements.

Don't hesitate to leverage the expertise available to ensure your documents are accurate. Start your journey to lease property for hunting today with US Legal Forms' comprehensive library!

Form popularity

FAQ

Income from a ground lease, including leasing property for hunting, is typically taxed as ordinary income. You must report this income on your federal tax return. Deductible expenses may include property management costs and maintenance, so it’s advisable to keep thorough records.

To effectively hunt on your own property, having at least 20 to 40 acres is often recommended. This size ensures enough space for deer and other game to thrive while providing a safe distance from neighboring properties. Ultimately, the ideal size may vary based on your hunting goals and local regulations.

The income from leasing property for hunting can vary widely based on location, game availability, and land quality. In some areas, leases can range from a few hundred to several thousand dollars per year. Conducting research in your region will give you a clearer idea of potential earnings.

Yes, income from leasing property for hunting is often considered passive income. This means that you may not actively participate in management decisions or operations of the hunting activity. However, some exceptions can apply based on your involvement, so it's wise to consult with a tax advisor.

When you lease property for hunting, you typically report that income on Schedule E (Supplemental Income and Loss) of your tax return. This schedule allows you to detail income and expenses related to rental real estate. Always ensure you have proper documentation for all transactions.

Yes, if you lease property for hunting and receive payment, that income is generally taxable. You'll need to report it on your income tax return. It's important to keep accurate records and consult a tax professional for guidance on how to report it correctly.

A land lease agreement offers several advantages, such as access to exclusive hunting areas and the ability to avoid long-term financial commitments. However, it may come with restrictions and limits on how you can use the land. Understanding these pros and cons helps you make an informed decision when you choose to lease property for hunting. USLegalForms can provide the necessary legal resources to guide you through this process.

Leasing land for hunting can be a wise investment if you enjoy the outdoors and participate frequently in hunting activities. It provides access to exclusive areas while spreading out your costs over time. Additionally, many find leasing hunting land allows for better management of wildlife, leading to improved hunting quality. This investment can enhance your recreational experience significantly.

Deciding whether to buy or lease hunting land depends on your goals and budget. Leasing property for hunting often requires a lower initial investment than purchasing land. It allows flexibility, enabling you to change locations or adapt your hunting strategy easily. In contrast, buying may be a long-term commitment but can provide permanent access to desired hunting grounds.

Leasing hunting land can be a valuable option for many outdoor enthusiasts. It provides access to private property, ensuring a more controlled hunting environment. By leasing property for hunting, you often gain exclusive rights that public lands cannot offer. This can enhance your overall hunting experience and increase the chances of a successful outing.