Security Deposit For Credit Card

Description

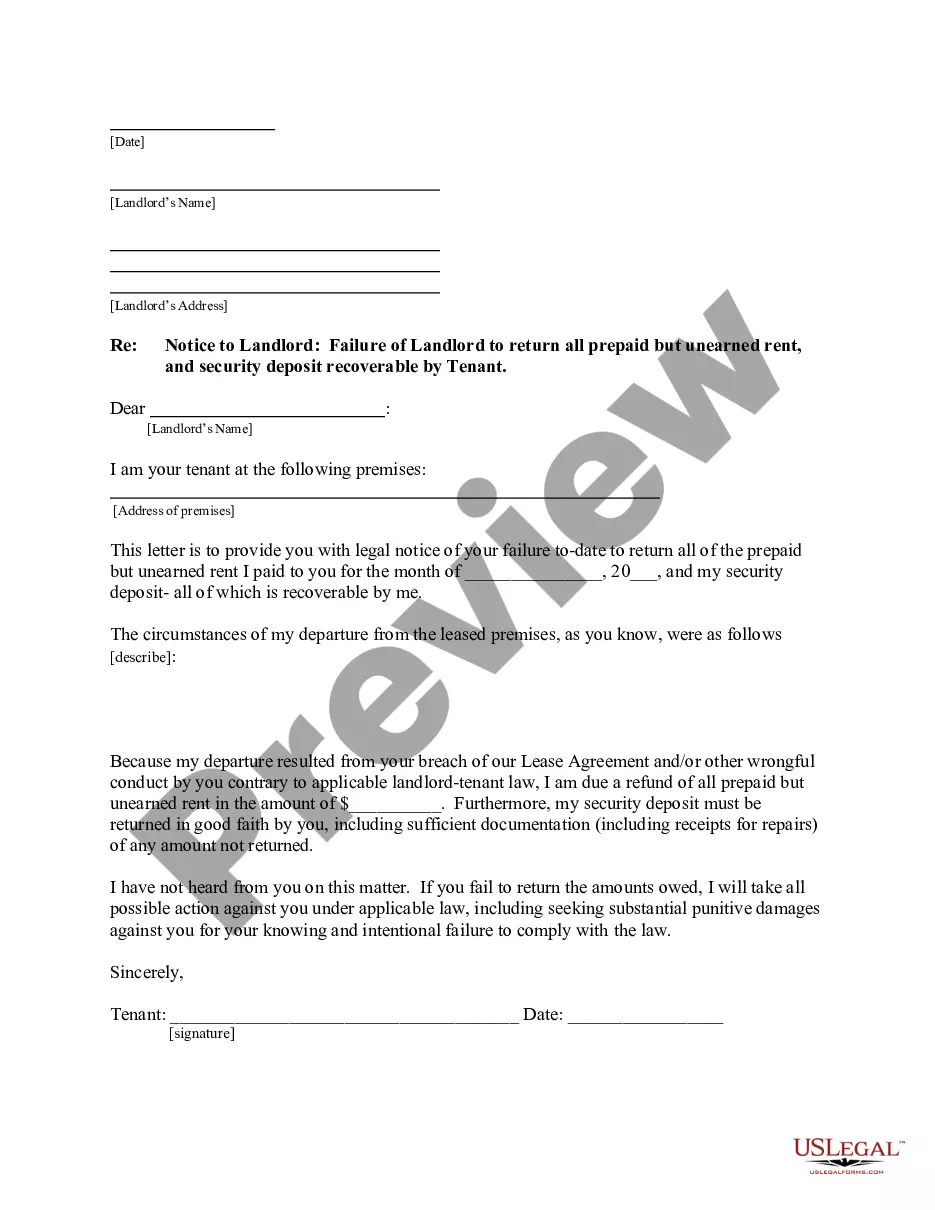

How to fill out North Carolina Letter From Tenant To Landlord For Failure Of Landlord To Return All Prepaid And Unearned Rent And Security Recoverable By Tenant?

Individuals frequently connect legal documents with something complex that solely an expert can handle.

In a certain sense, this is accurate, as formulating Security Deposit For Credit Card necessitates comprehensive understanding of subject criteria, inclusive of state and municipal regulations.

However, thanks to US Legal Forms, tasks have become easier: pre-prepared legal documents for various life and business circumstances tailored to state laws are gathered in a unified online catalog and are now accessible to all.

Select the format for your document and click Download. Print your paper or upload it to an online editor for speedy completion. All templates in our inventory are reusable: once purchased, they remain saved in your profile. You can access them whenever necessary through the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and use area, so searching for Security Deposit For Credit Card or any specific template only requires a few minutes.

- Former registered users with an active subscription must Log In to their account and select Download to acquire the form.

- New users of the platform will initially need to establish an account and subscribe before they can download any legal documents.

- Follow these instructions step-by-step to secure the Security Deposit For Credit Card.

- Examine the page content thoroughly to confirm it meets your requirements.

- Review the form description or check it through the Preview option.

- If the previous sample does not fit your needs, use the Search field in the header to find another one.

- When you identify the suitable Security Deposit For Credit Card, click Buy Now.

- Select the subscription plan that aligns with your needs and financial plan.

- Create an account or Log In to move forward to the payment page.

- Complete your payment for your subscription via PayPal or by using your credit card.

Form popularity

FAQ

A good security deposit for a credit card is generally between $200 and $500, depending on the card issuer's requirements. This range allows you to open a secured credit account while keeping your financial situation manageable. Choosing an appropriate amount helps you build credit without unnecessary stress. Ensuring you're comfortable with your deposit amount is key to successful credit management.

When considering how much to put down on a secured credit card, it's wise to start with at least $200. This amount strikes a balance between security for the issuer and manageable risk for you. Depending on your financial capacity, you may choose to deposit more, which can increase your credit limit. Remember, the goal is to establish credit while staying within your means.

A good security deposit for a credit card often ranges between $200 and $500. This amount is usually enough to secure a credit line while allowing you to manage your finances efficiently. It ultimately helps you build your credit score without overwhelming your budget. Always choose a deposit you feel comfortable committing to.

Yes, you can typically put $2000 as a security deposit for a credit card, provided the card issuer allows a higher deposit. A larger deposit may lead to a higher credit limit, which benefits your credit utilization ratio. Consider checking the specific terms of the credit card you're interested in, as they may vary. Always approach this option with the goal of managing your credit wisely.

A $200 security deposit for a credit card serves as collateral for lenders. This amount helps reduce their risk if you fail to make payments. Furthermore, this deposit allows you to establish or rebuild your credit history. Ultimately, it helps you gain access to unsecured credit in the future.

Not all credit cards require a security deposit, but secured credit cards do. These cards need a security deposit for credit card issuance, which acts as a safeguard for the lender. If you're unsure about which card suits your needs, US Legal Forms can guide you in selecting a card that offers clear terms and benefits.

Yes, it is common for certain credit cards, especially secured cards, to require a security deposit for credit card approval. This deposit minimizes the risk for the lender and helps those with limited or poor credit history establish or rebuild their credit score. Always check the card's terms to fully understand the deposit requirements.

The typical security deposit for a credit card usually ranges from $200 to $2,500, depending on the card issuer and your creditworthiness. This amount serves as collateral and will often determine your spending limit on the card. It's essential to review various secured credit card options to find one that fits your financial situation.

Using a credit card for a security deposit can be a convenient option, especially if you want to build your credit. By making timely payments on your card, you enhance your credit score while managing your apartment's initial costs. However, ensure the landlord accepts credit cards for deposits, as not all do. It’s wise to consider other options as well, depending on your situation.

Yes, you can get your security deposit back, but it depends on the terms of the card issuer. Once you prove responsible credit behavior, such as making on-time payments, your issuer may return your deposit. Additionally, some cards allow for upgrades to unsecured credit, which means you can reclaim your deposit after a set period. Always check your specific card’s policies for details.