Llc Company Form For Company Registration

Description

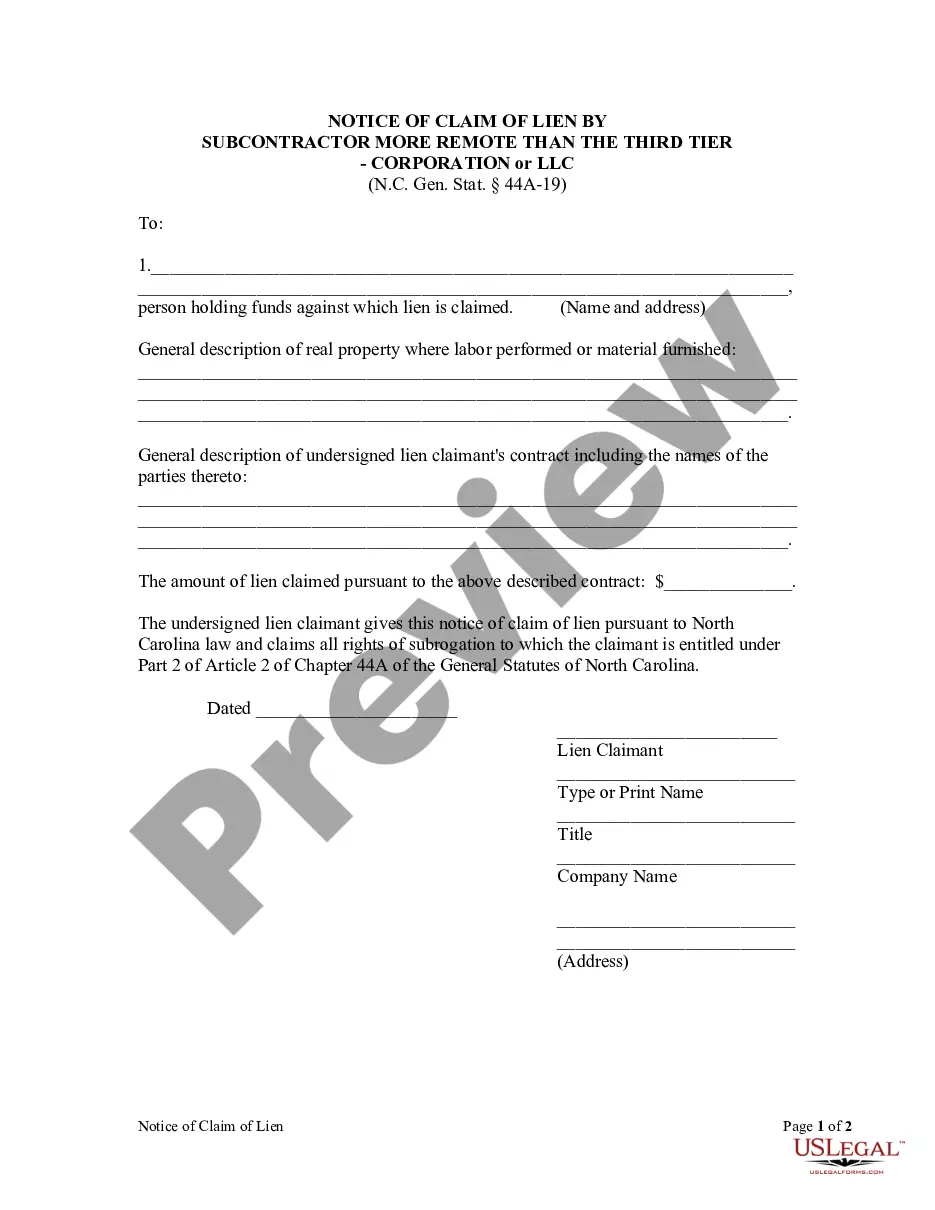

How to fill out North Carolina Notice Of Claim - More Remote Than 3rd Tier - Corporation?

- Begin by logging into your US Legal Forms account. If you're a new user, create an account to access the library of legal forms.

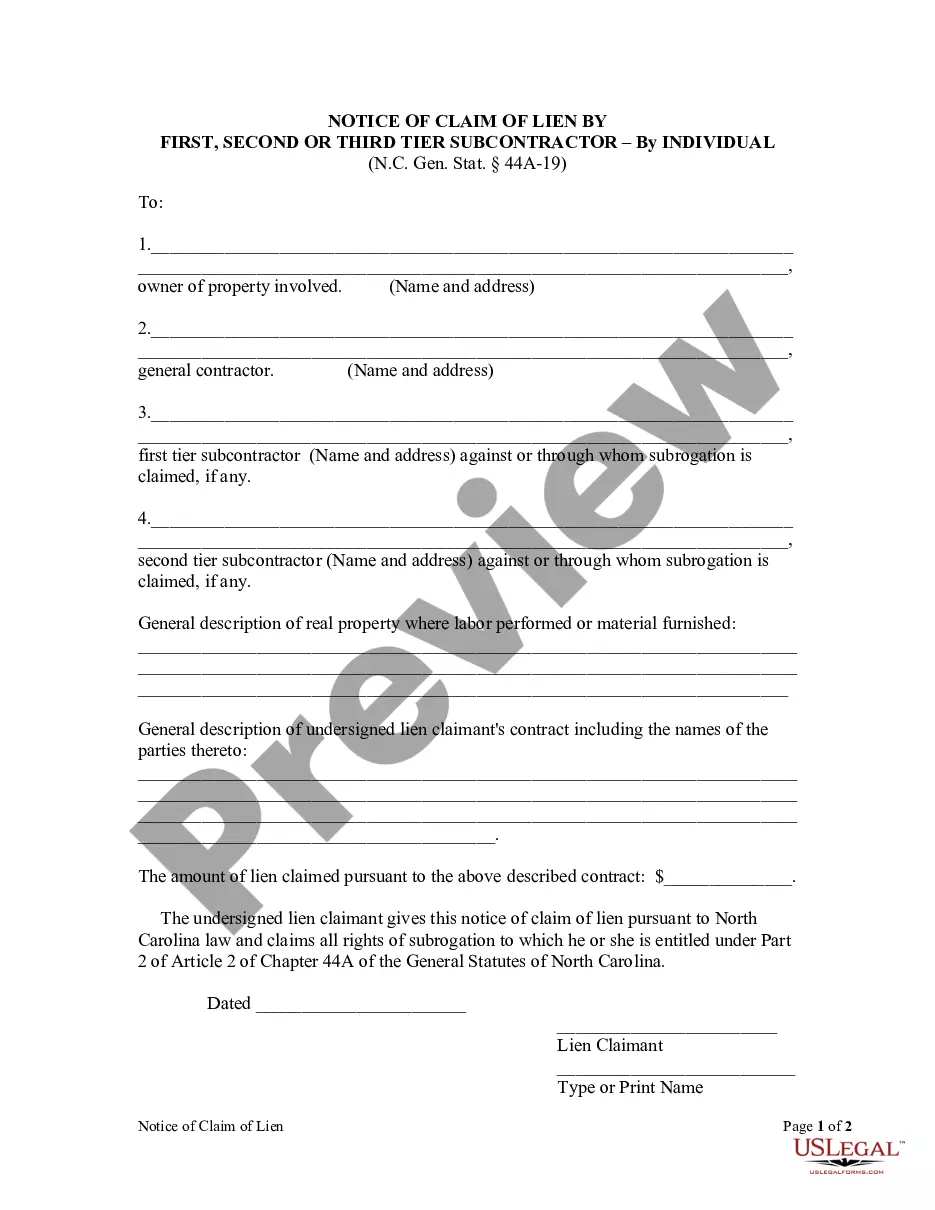

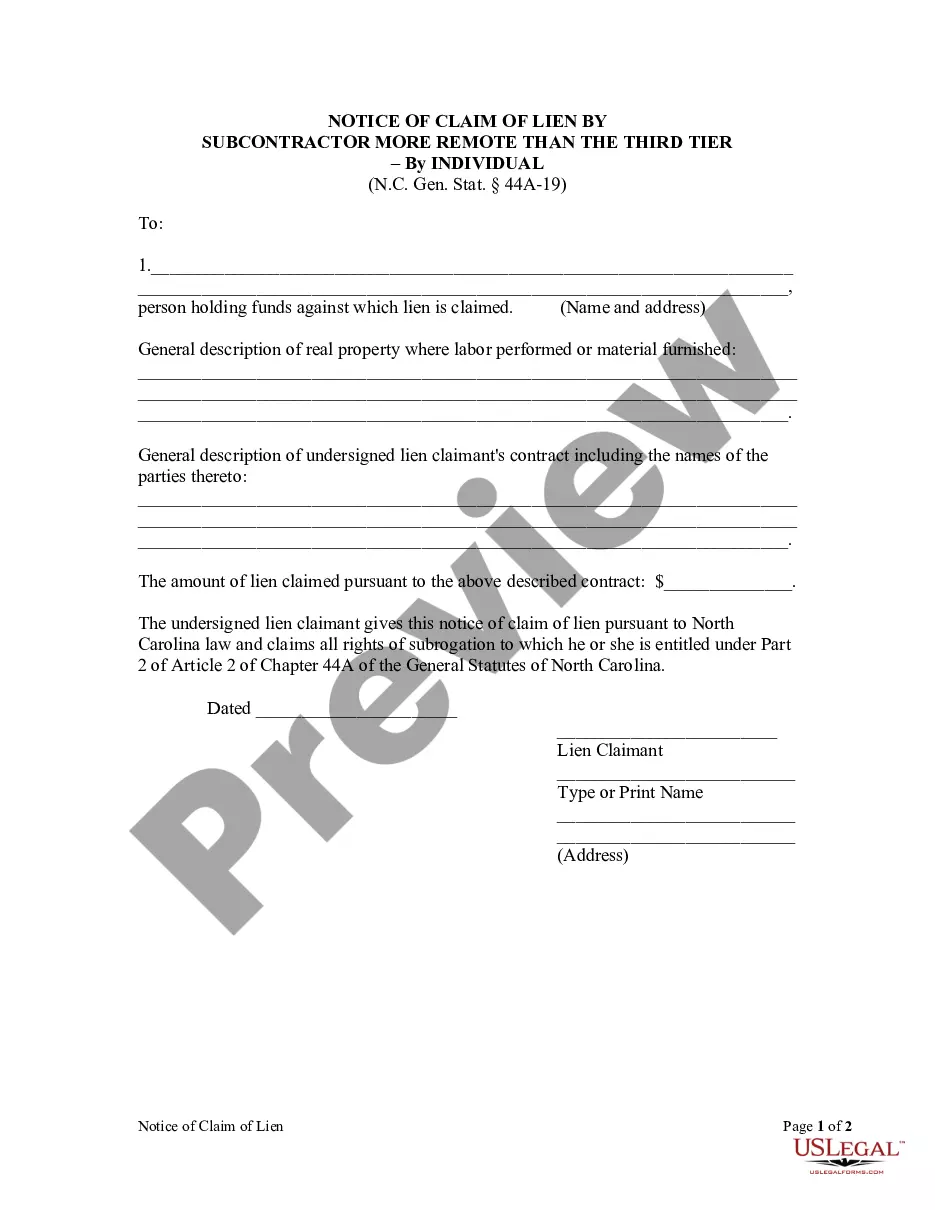

- Review the preview mode and form descriptions. Ensure you select the LLC company form that aligns with your specific requirements and jurisdiction.

- If you need a different template, utilize the Search feature to find the right one.

- Once you've found the appropriate form, click 'Buy Now' and select your preferred subscription plan.

- Proceed to payment by entering your credit card information or selecting PayPal.

- Download the completed form to your device. You can also access it anytime via the 'My Forms' section in your profile.

US Legal Forms not only provides a robust collection of legal document templates but also gives users the support of premium experts for assistance in completing forms accurately. This empowers both individuals and attorneys to execute legal documents with confidence.

Take control of your LLC registration process today! Visit US Legal Forms to explore your options and get started.

Form popularity

FAQ

To determine if your LLC is classified as an S or C Corporation, you should check your IRS tax filings. If you have made a valid election to treat your LLC as an S corp, you'll notice this classification on your tax documents. If not, your LLC may default to C corp status, which you can verify through your company's tax structure and filings.

A company registration form is a legal document that you submit to your state to officially establish your business entity. This form typically includes basic information about your business, such as its name, type, and management structure. The proper completion of this form ensures your LLC is recognized by the state and complies with local regulations.

To start an LLC in Nebraska, you need to choose a unique name, designate a registered agent, and file the required formation documents with the state. Additionally, you may need to obtain an Employer Identification Number (EIN) from the IRS for tax purposes. This all forms part of the LLC company form for company registration in Nebraska.

If you have formed a company under state regulations and filed as an LLC, you are an LLC by structure. However, your tax classification may vary. To confirm if you are treated as an S corp, check your IRS filings or consult a tax advisor who can help clarify your situation.

To classify your LLC as an S corp, you need to file Form 2553 with the IRS. This form must be completed in a timely manner, typically during the first 75 days of the tax year for which you want the classification. Upon approval, your LLC will benefit from the taxation advantages that S corporations offer.

You can identify the type of LLC you have based on how you filed your company registration documents. Check your original formation documents and any tax filings with the IRS. If you filed for pass-through taxation, you might have designated your LLC as an S corp; otherwise, it is typically treated as a C corp.

To determine if your LLC is a C corp or S corp, you should first check your filing status with the IRS. If you filed Form 2553, your LLC is taxed as an S corporation. If you did not file this form, your LLC defaults to a C corporation status, unless you have chosen a different tax classification.

Yes, you can file your LLC by yourself using the LLC company form for company registration. However, it's important to understand that the process involves various steps, including selecting a business name, preparing the articles of organization, and paying the necessary fees. If you are unsure about how to complete these steps, consider using platforms like US Legal Forms for guidance. They provide resources to make the filing process easier and ensure you meet all legal requirements.

The time it takes to register an LLC in Mississippi varies, but generally, you can expect a processing time of around two to three weeks if filed by mail. If you choose to file online, the process may be quicker, sometimes taking just a few days. It's important to ensure that all paperwork is completed accurately to avoid delays. Consider using US Legal Forms, which provides a streamlined service for obtaining the LLC company form for company registration.

To form an LLC in Mississippi, you need to file the appropriate documents, specifically the LLC formation paperwork, with the Secretary of State. You may also require a unique name for your LLC that adheres to state guidelines. Additionally, appointing a registered agent who can receive legal documents on behalf of the company is essential. Utilizing a reliable platform like US Legal Forms can simplify the process of acquiring the LLC company form for company registration.