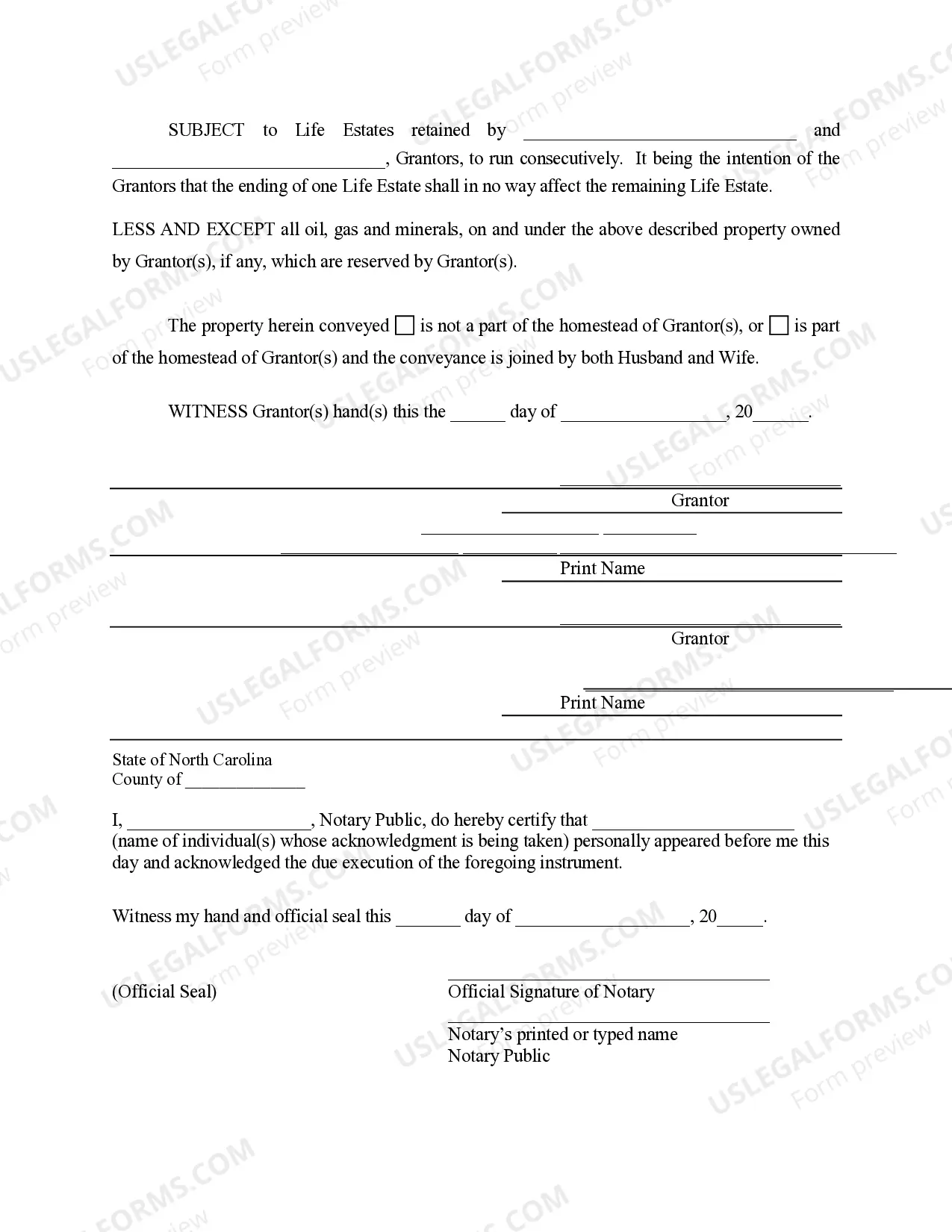

North Carolina Life Estate Deed Form With Example

Description

How to fill out North Carolina Warranty Deed To Child Reserving A Life Estate In The Parents - Husband And Wife Grantors?

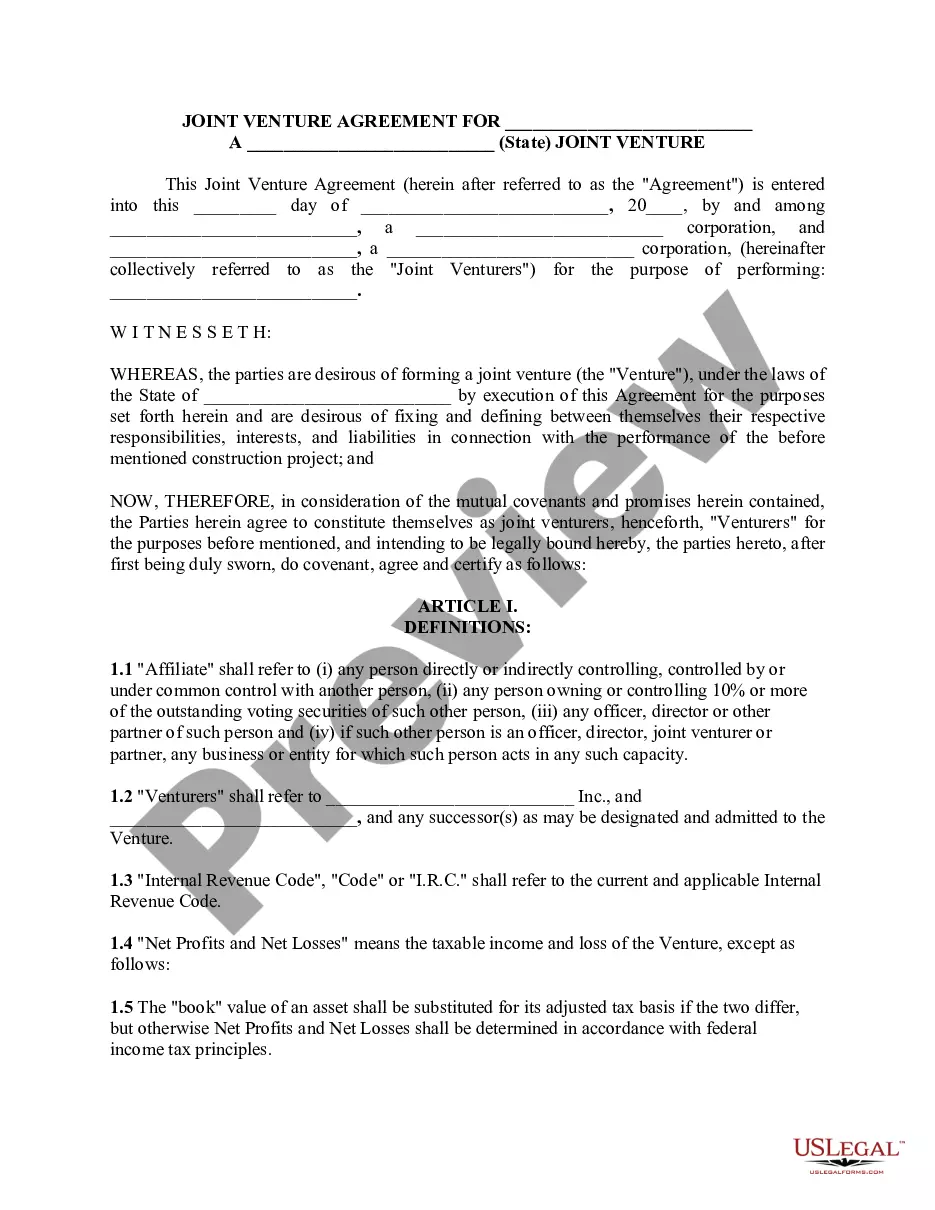

The North Carolina Life Estate Deed Template With Example displayed here is a versatile legal model crafted by experienced attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 validated, state-specific documents for various personal and business needs. It’s the fastest, most direct, and most trustworthy method to acquire the necessary paperwork, as the service ensures bank-level information security and anti-malware safeguards.

Register with US Legal Forms to have verified legal templates for all of life’s situations readily available.

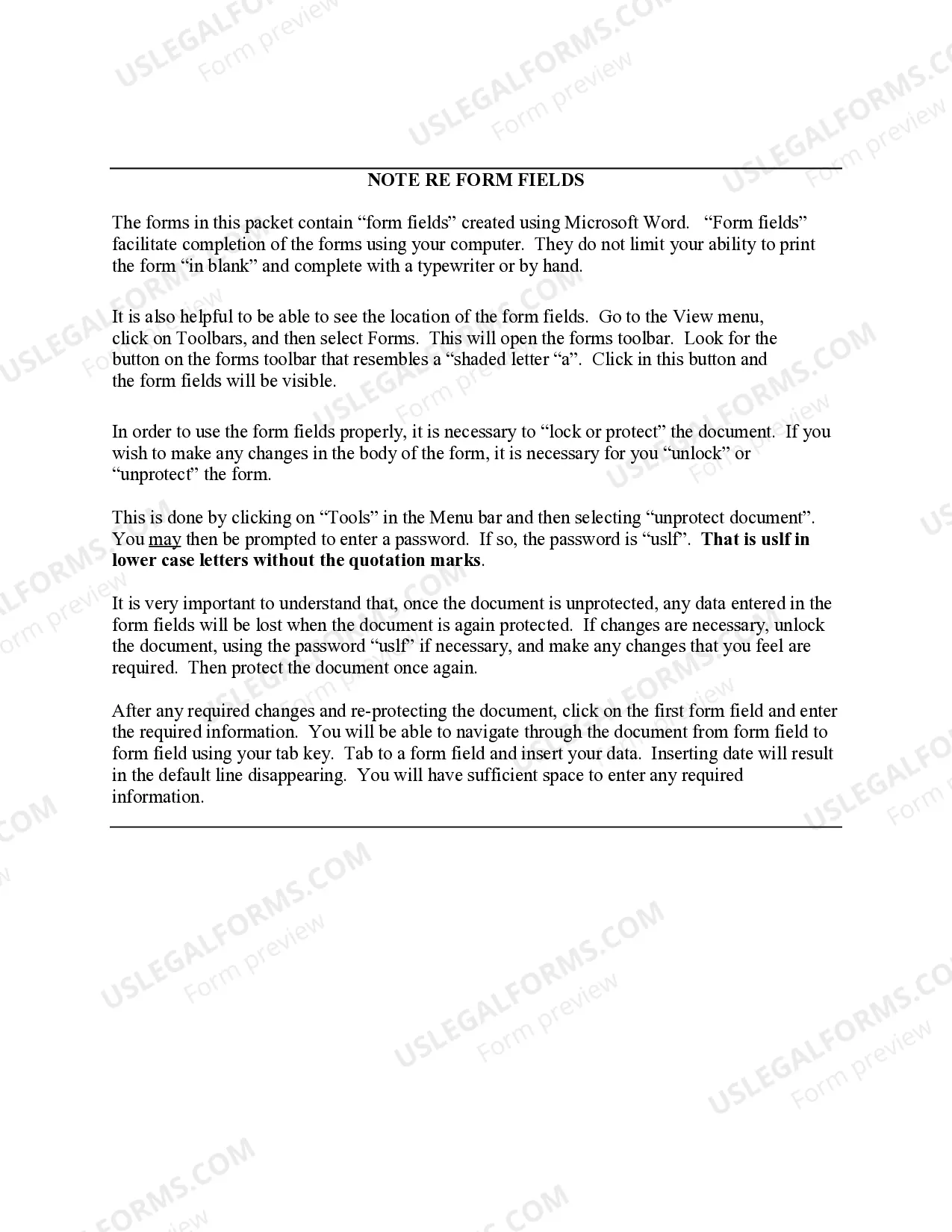

- Explore the document you require and analyze it. Browse through the file you searched and preview it or examine the form description to verify it meets your requirements. If it doesn’t, use the search function to find the right one. Hit Buy Now when you have discovered the template you need.

- Register and sign in. Select a pricing plan that suits your needs and establish an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and review your subscription to proceed.

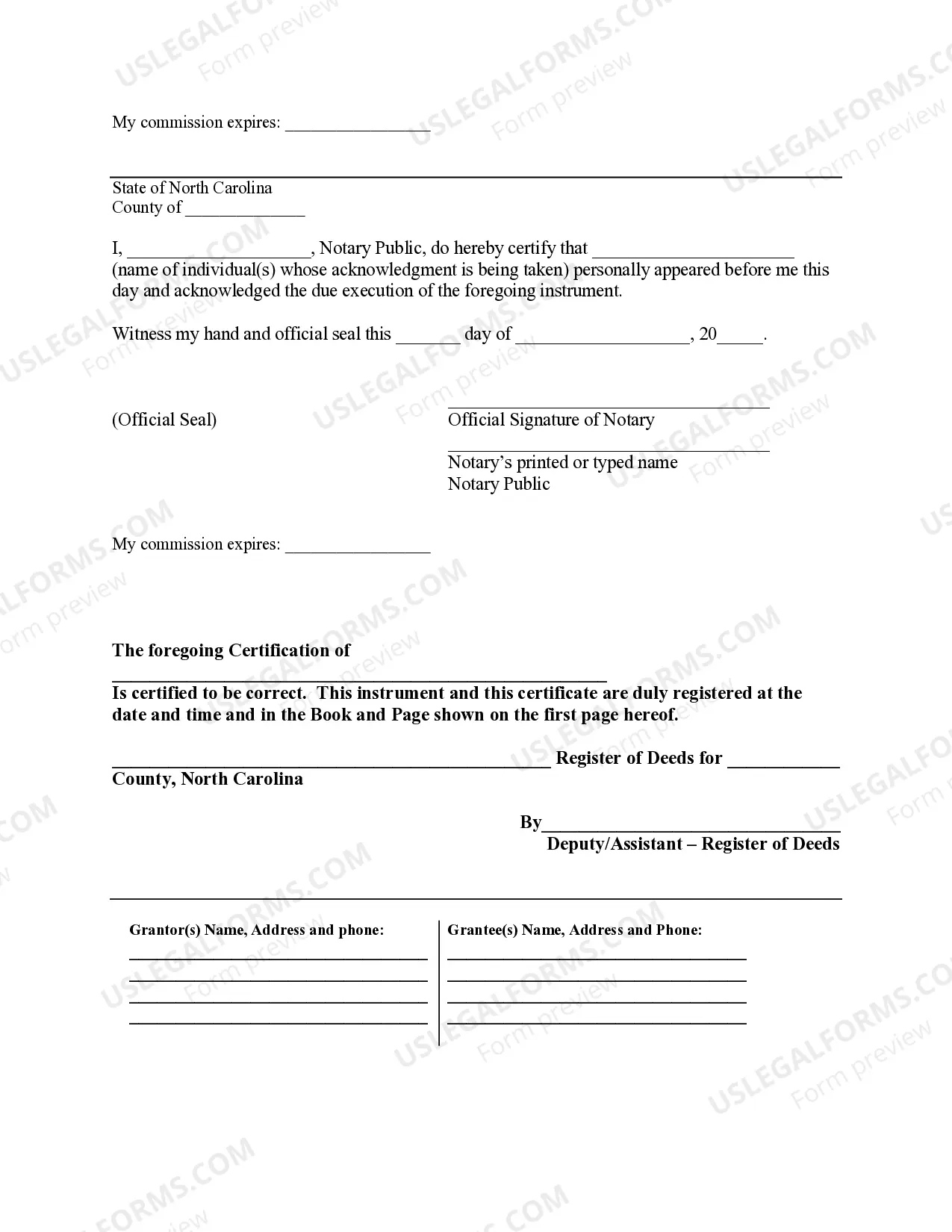

- Obtain the editable template. Choose the format you desire for your North Carolina Life Estate Deed Template With Example (PDF, DOCX, RTF) and store the file on your device.

- Complete and authenticate the document. Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your documents again. Reuse the same document whenever required. Access the My documents tab in your profile to redownload any previously purchased documents.

Form popularity

FAQ

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

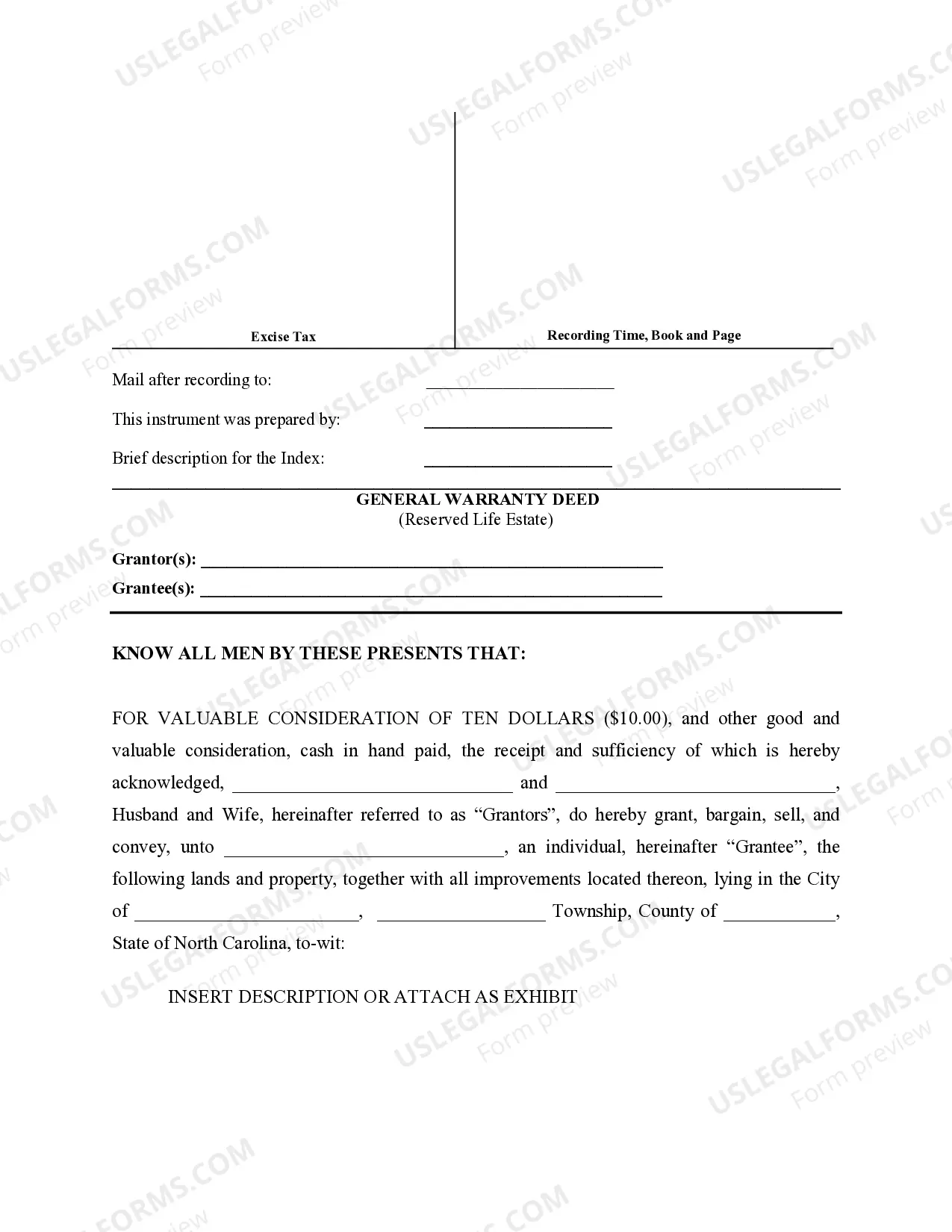

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Life Estate Deed to Avoid MERP in North Carolina You can work with an estate planning attorney to set life estate deeds up and avoid paying MERP by conveying 1% of the home to an adult child. However, this deed must include the owner designation JTWROS or ?joint tenants with a right of survivorship.?

Rights of a remainderman A remainderman has an interest in assuring that the life tenant does not destroy, damage, or otherwise diminish the value of the property. The life tenant must maintain the property, make any existing mortgage payments, pay property taxes, and keep the property adequately insured.