Personal Representative Form Montana For Estate

Description

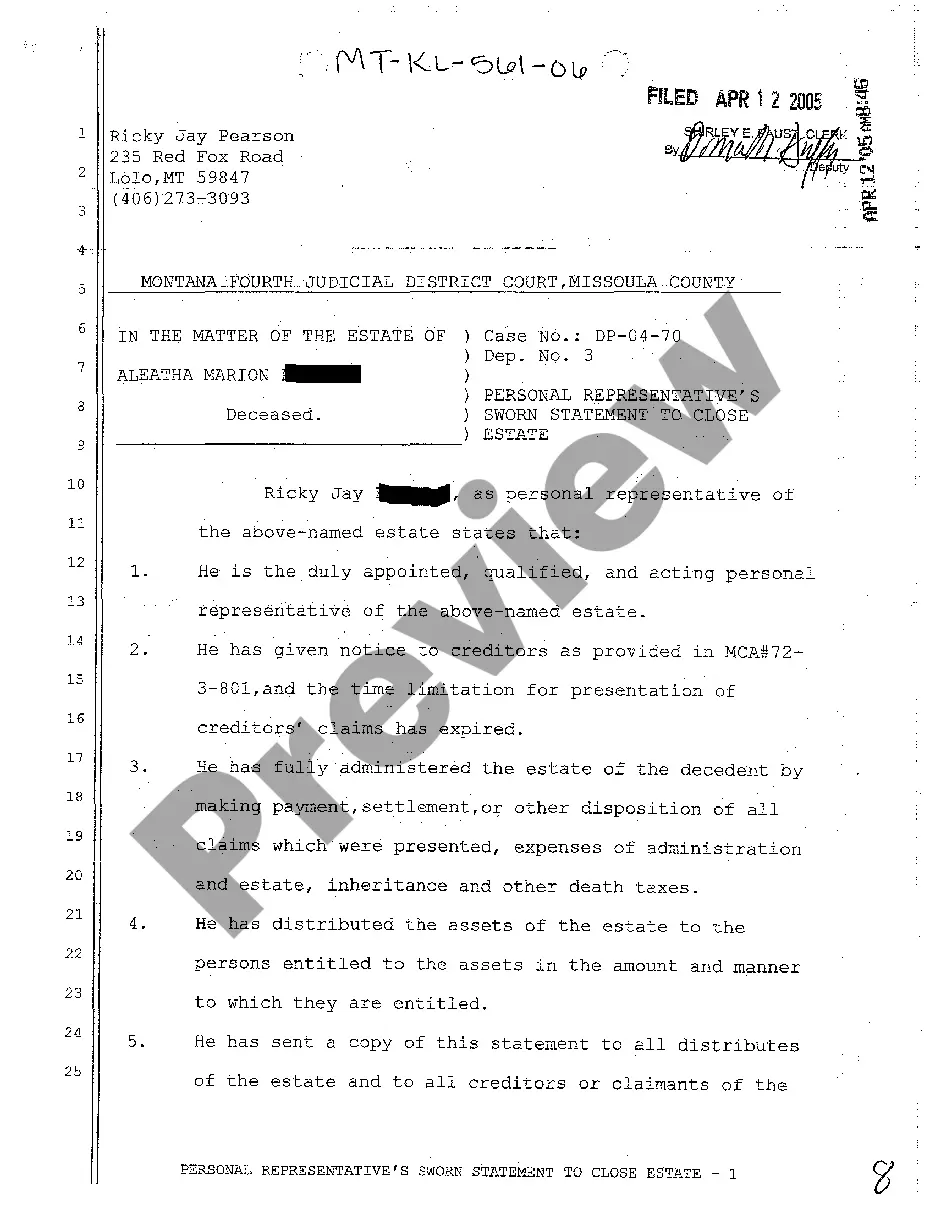

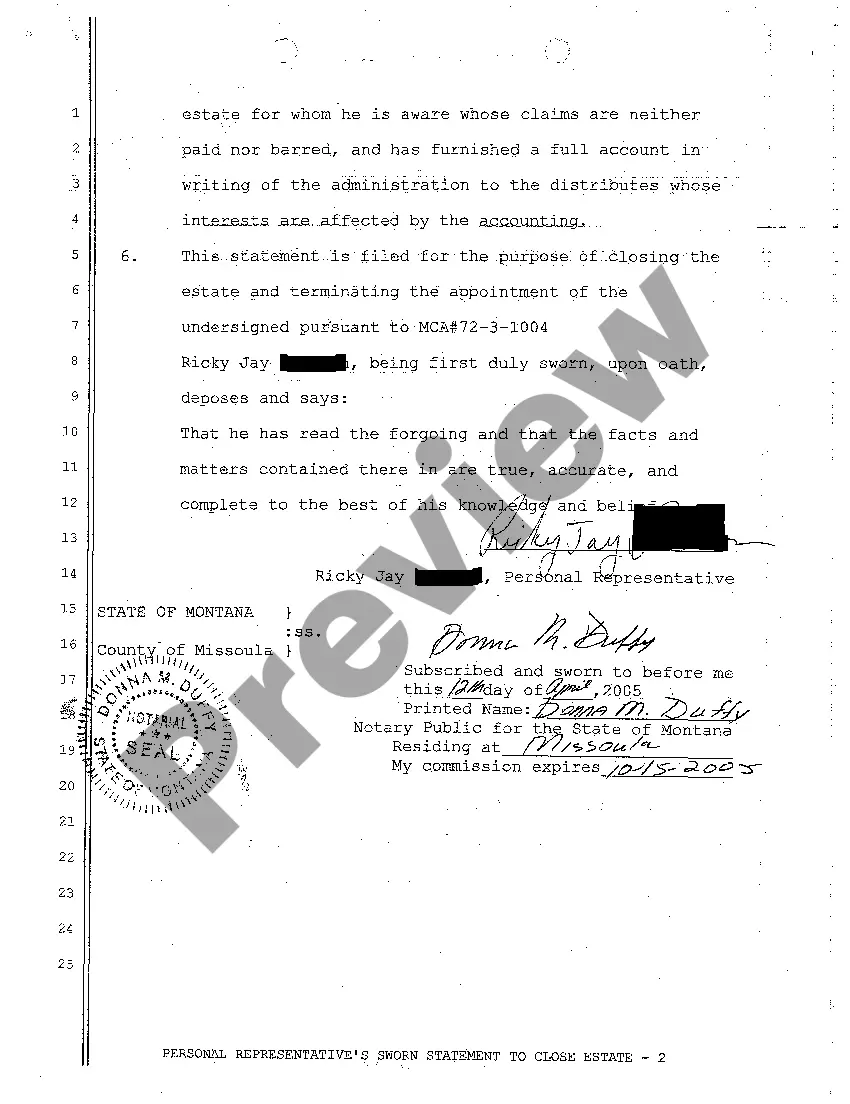

How to fill out Montana Personal Representative's Sworn Statement To Close Estate?

How to locate professional legal documents that adhere to your state laws and create the Personal Representative Form Montana For Estate without hiring a lawyer.

Numerous online services provide templates to address various legal scenarios and formal requirements. Nonetheless, it may require time to determine which of the available samples meet both the intended purpose and legal standards for you.

US Legal Forms is a trustworthy platform that aids you in locating official documents formulated in line with the latest state law revisions, saving you money on legal assistance.

Download the Personal Representative Form Montana For Estate using the relevant button adjacent to the file name. If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you've accessed and confirm if the form meets your requirements. To achieve this, use the form description and preview options if they are available. Search for an alternate template in the header corresponding to your state if needed. Click the Buy Now button once you find the appropriate document. Choose the most suitable pricing plan, then Log In or create an account. Select your preferred payment method (by credit card or via PayPal). Choose the file format for your Personal Representative Form Montana For Estate and click Download. The downloaded templates remain yours; you can always access them in the My documents tab of your profile. Register on our platform and prepare legal documents independently like a seasoned legal expert!

- US Legal Forms is not a typical online directory.

- It comprises over 85,000 verified templates for multiple business and personal circumstances.

- All documents are organized by region and state to expedite your search process.

- It also features integration with efficient tools for PDF editing and eSignature.

- This allows users with a Premium subscription to quickly complete their forms online.

- Minimal time and effort are required to obtain the necessary documents.

- If you already possess an account, Log In and verify your subscription's active status.

Form popularity

FAQ

Form 1310, which is used to claim tax refund for a decedent's estate, may be necessary in some situations. If the estate has a refund due, the personal representative should file this form to ensure proper handling of tax matters. It's important to familiarize yourself with this form alongside the personal representative form montana for estate. This ensures that all aspects of the estate administration are covered.

As an executor, your first steps include gathering important documents like the will and the personal representative form montana for estate. Next, you should secure the estate's assets and notify beneficiaries about their rights. Understanding the legal obligations is vital for effective estate management. Taking these initial steps ensures that you set a solid foundation for carrying out the deceased’s wishes.

To file for the role of executor, you need several key documents, including the deceased's will, a completed personal representative form montana for estate, and identification documents. You may also need to provide an inventory of the estate’s assets and any other documentation that the probate court requires. Having these documents organized will facilitate a smoother filing process.

The best person to serve as an executor is someone responsible, organized, and trustworthy. Ideal candidates often include close family members, friends, or professional advisors who understand the deceased’s wishes. Importantly, the chosen individual should be willing to take on the duties associated with the personal representative form montana for estate. This ensures that the estate management process is handled efficiently and compassionately.

To file as an executor, you must first be appointed by the probate court in Montana. This involves submitting the will and the personal representative form montana for estate along with relevant documentation to the court. After the court approves your appointment, you can begin managing the estate according to the deceased's wishes. It’s a structured process, but ensuring you have the right forms will help you navigate it smoothly.

A personal representative of the deceased is an individual designated to oversee the distribution of the deceased's estate. This person ensures that the wishes outlined in the will are respected and manages necessary legal processes. They play a vital role in facilitating a smooth transition of assets. It’s important for them to utilize the personal representative form montana for estate to formalize this process correctly.

In Montana, the personal representative of the estate is the individual appointed to administer the estate of a deceased person. This role involves gathering assets, settling debts, and distributing the remaining assets to beneficiaries. It's typically preferable for family members or trusted friends to take on this responsibility. Completing the personal representative form montana for estate is an essential step in this appointment.

Being an executor of a will can bring various challenges. Executors have a legal duty to manage the estate's assets, which can be time-consuming and stressful. Additionally, they may face disputes among beneficiaries, which can complicate the process. Therefore, understanding the responsibilities tied to the personal representative form montana for estate is crucial before accepting this role.

To obtain the executor of estate paperwork, you can start by completing the necessary Personal representative form montana for estate. This form is essential for establishing your authority to act on behalf of the deceased. After filling it out, you will need to file it with the appropriate probate court in Montana. Consider using USLegalForms for a streamlined process, as they provide easy-to-follow templates and guidance to help you every step of the way.

One significant disadvantage of being an executor is the potential for personal liability. If an executor fails to manage the estate properly, they could be held responsible for any financial losses. Additionally, the role requires considerable time and effort, which can be stressful. When considering the personal representative form Montana for estate, be aware of these challenges so you can prepare accordingly.