Breach Of Promissory Note With Payment Schedule

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

How to locate official legal documents adhering to your state's regulations and draft the Breach Of Promissory Note With Payment Schedule without hiring an attorney.

Numerous online services offer templates to address a variety of legal situations and requirements. However, it might require some effort to determine which available samples fulfill both your usage needs and legal specifications.

US Legal Forms is a reputable resource that assists you in finding legal documents created in accordance with the latest updates to state laws, helping you save on legal fees.

If you lack an account with US Legal Forms, adhere to the following steps: Review the webpage you've accessed and ascertain whether the form meets your requirements. Utilize the form description and preview options, if provided. Search for another template by using the header that lists your state if needed. When you identify the correct form, click the Buy Now button. Choose the most suitable pricing plan, followed by signing in or registering for an account. Select your payment option (credit card or PayPal). Opt for the file format for your Breach Of Promissory Note With Payment Schedule and click Download. The downloaded templates remain yours: you can always access them in the My documents section of your profile. Subscribe to our platform and produce legal documents independently like a seasoned legal expert!

- US Legal Forms is more than just a typical online library.

- It boasts a compilation of over 85,000 validated templates for diverse business and personal situations.

- All documents are categorized by area and state for a more efficient and user-friendly search experience.

- Moreover, it connects with advanced solutions for PDF modification and electronic signatures, allowing users with a Premium subscription to easily complete their documents online.

- The process to obtain the required documentation requires minimal time and effort.

- If you already possess an account, Log In and confirm your subscription is active.

- Download the Breach Of Promissory Note With Payment Schedule using the appropriate button adjacent to the file name.

Form popularity

FAQ

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.

Unsecured Promissory Note If the borrower does not make the payment, the lender must instead file in small claims court or go through other legal processes to enforce the note.

Circumstances for Release of a Promissory NoteThe debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

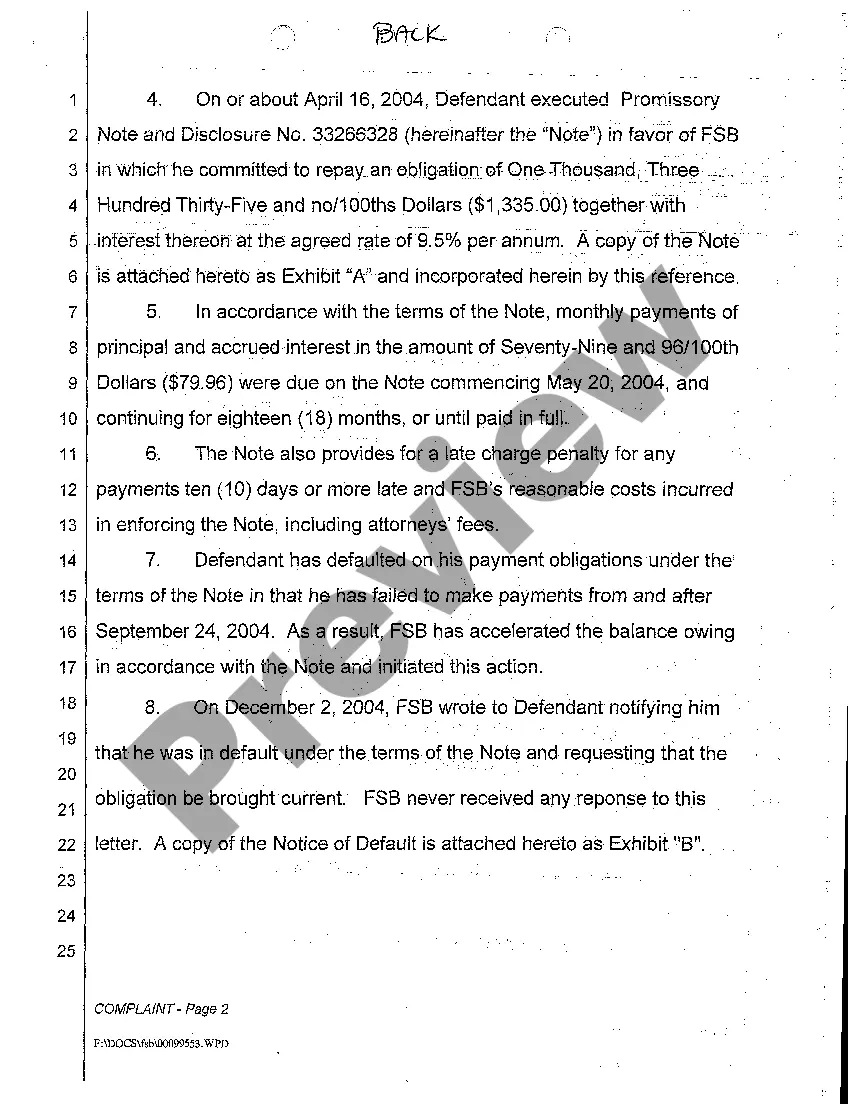

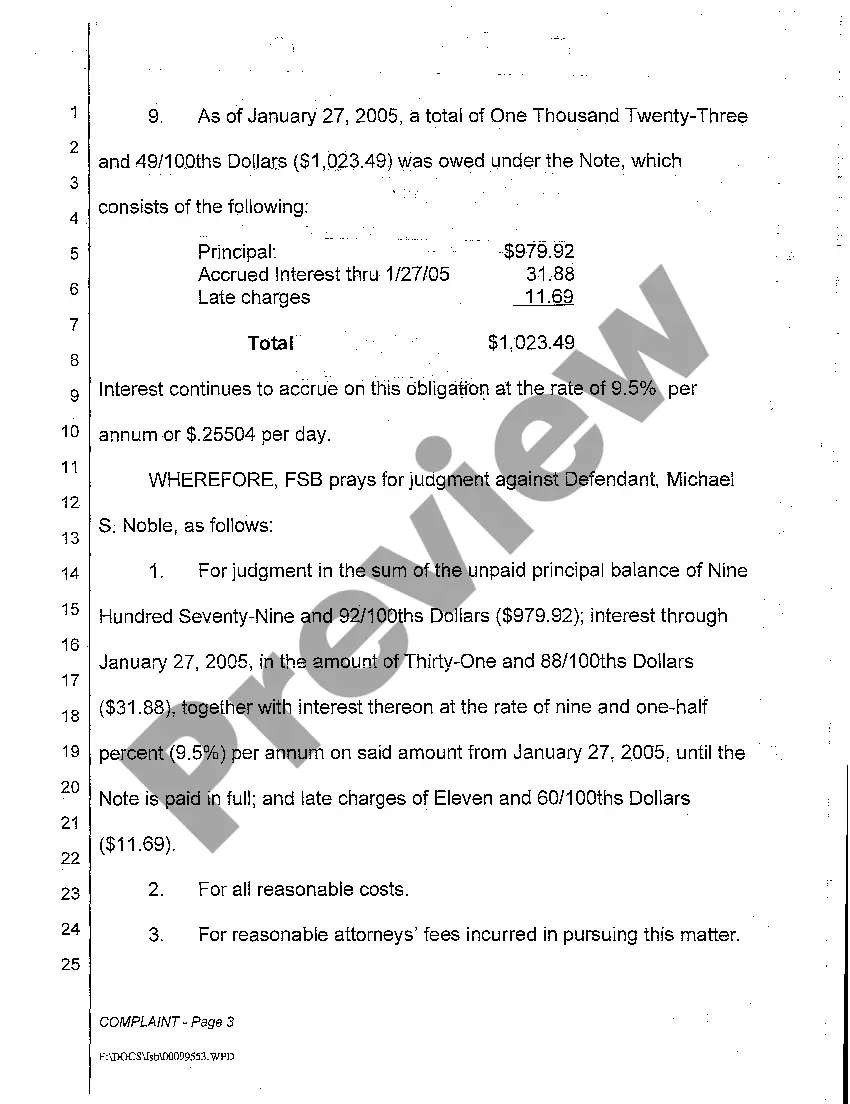

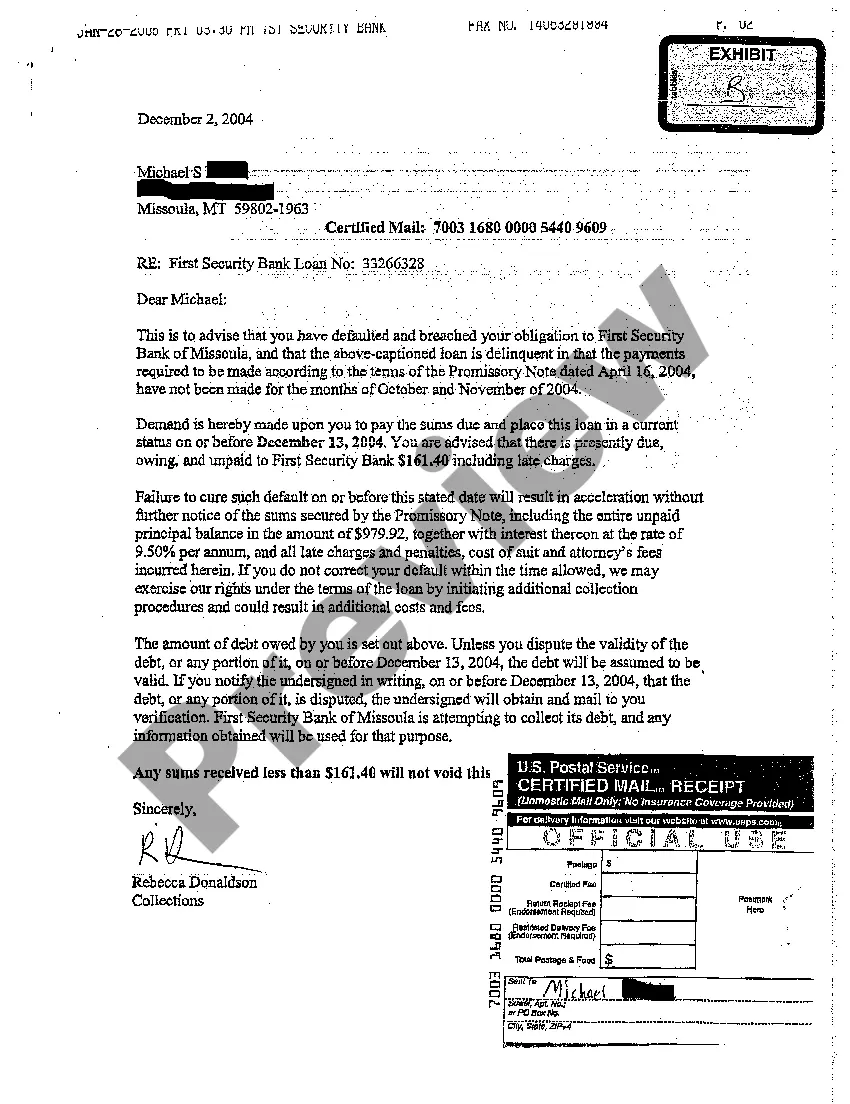

A promissory note is breached when payment due, or properly demanded as per the terms of the note, is not received. If you want to enforce a breached promissory note, you must follow the terms agreed upon when making demands for payment.