Checklist For Determining Independent Contractor Status

Description

How to fill out Determining Self-Employed Independent Contractor Status?

Well-constructed official documentation is among the crucial assurances for preventing issues and legal disputes, but acquiring it without legal assistance may require time.

Whether you need to swiftly locate an up-to-date Checklist For Determining Independent Contractor Status or any other templates for employment, family, or business situations, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the chosen file. Additionally, you can access the Checklist For Determining Independent Contractor Status at any time in the future, as all documentation acquired on the platform remains accessible within the My documents tab of your profile. Save time and money on preparing official paperwork. Try US Legal Forms today!

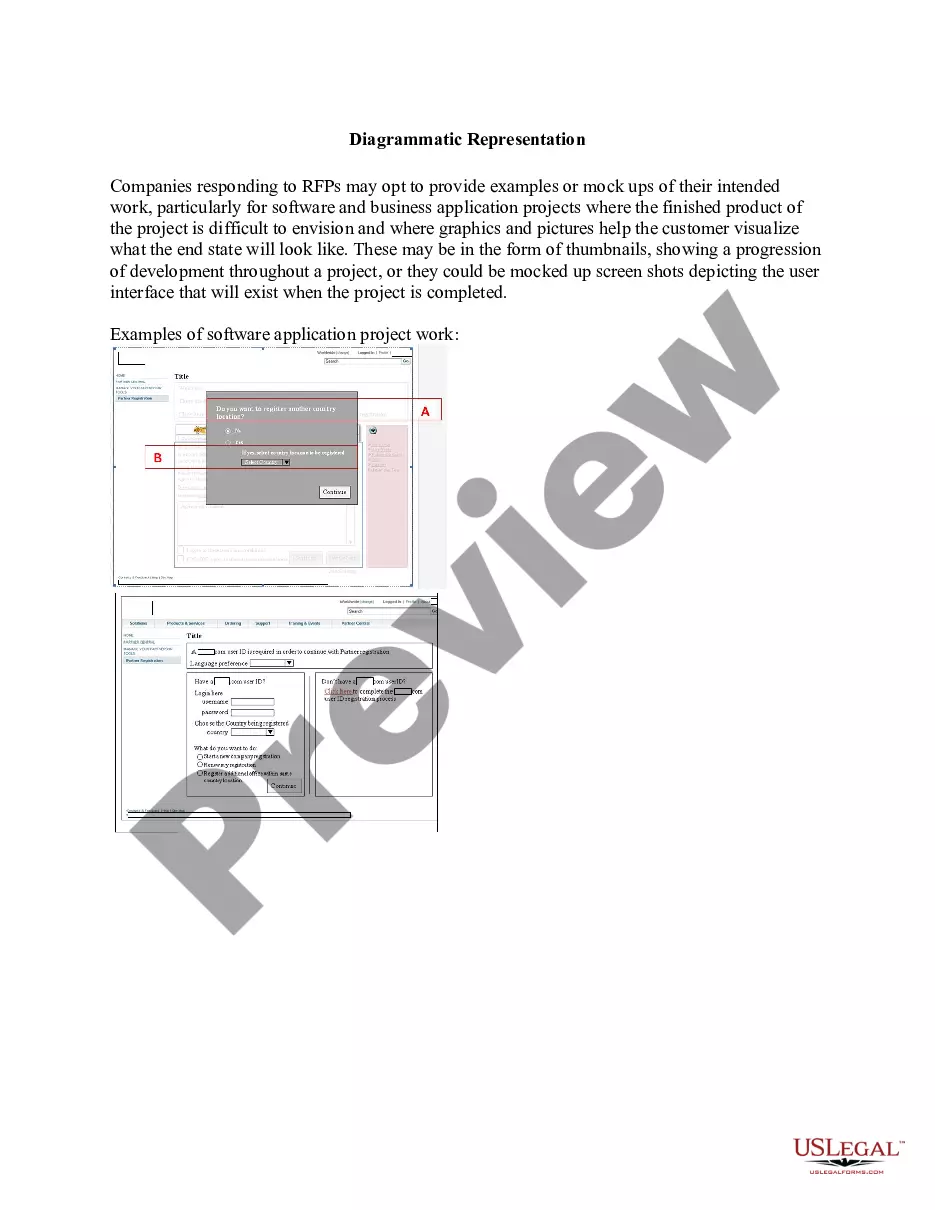

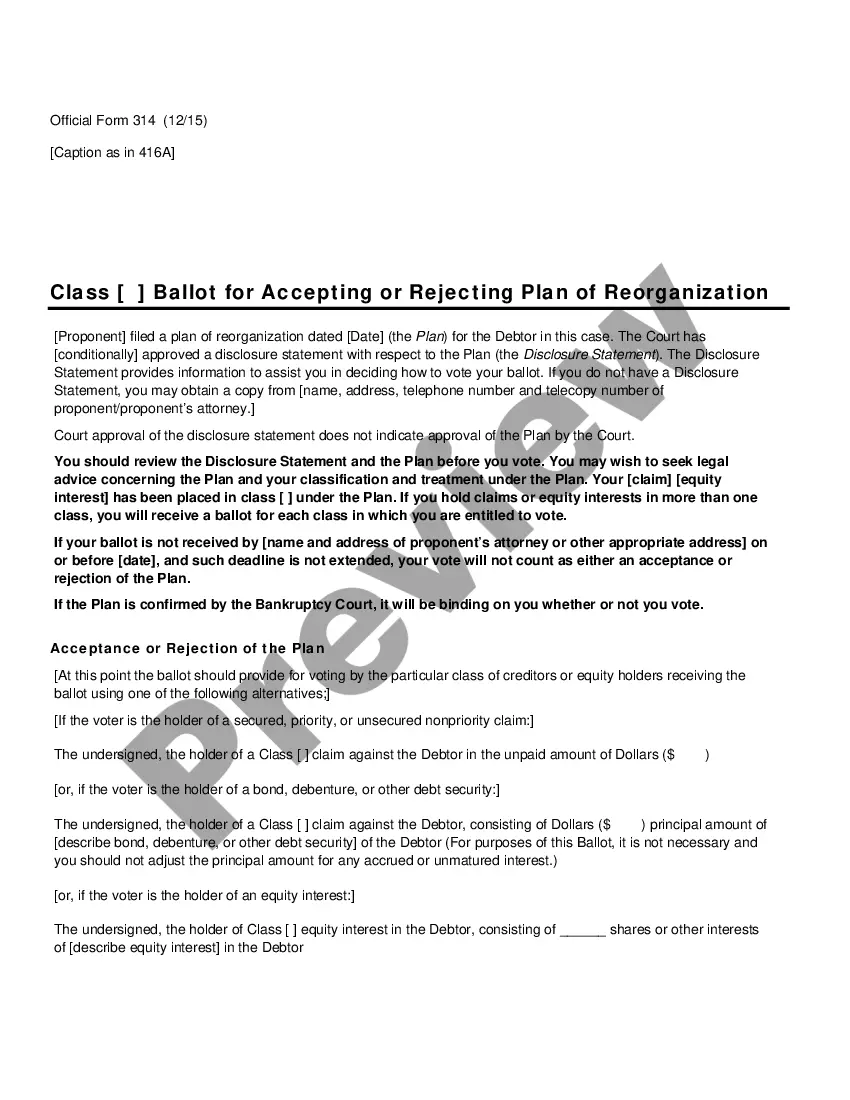

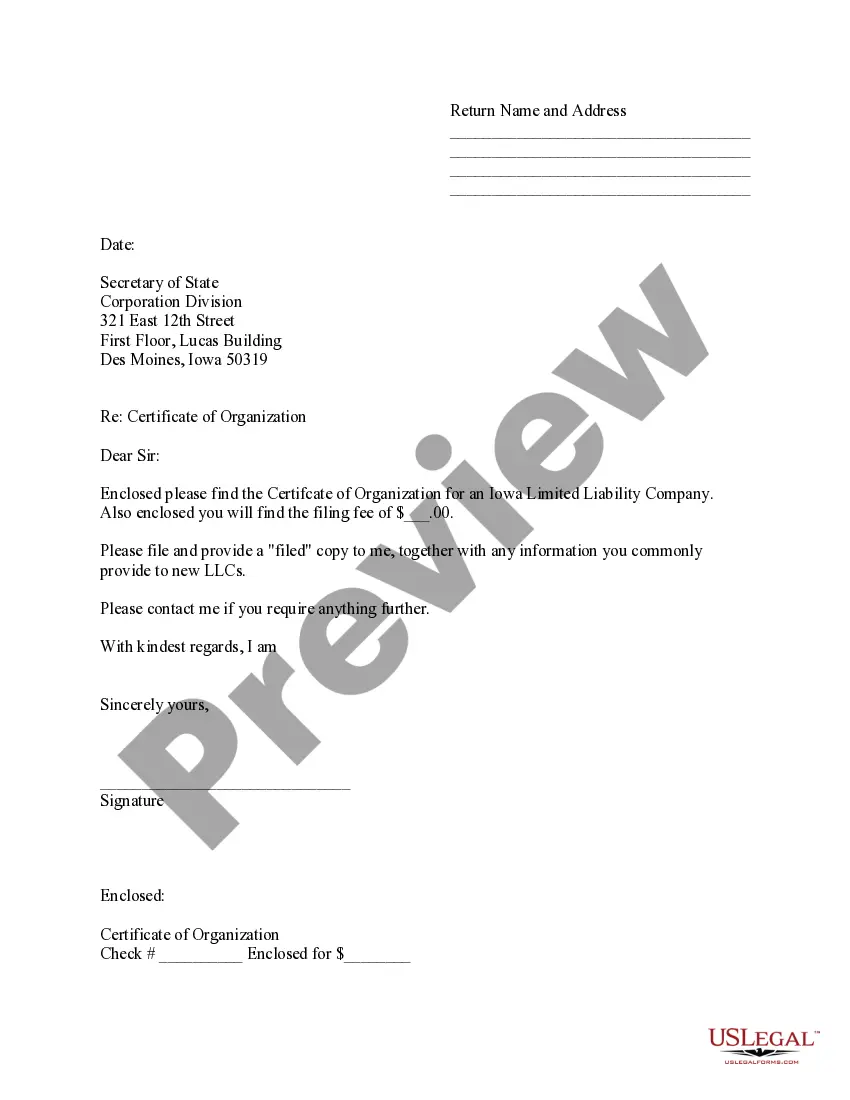

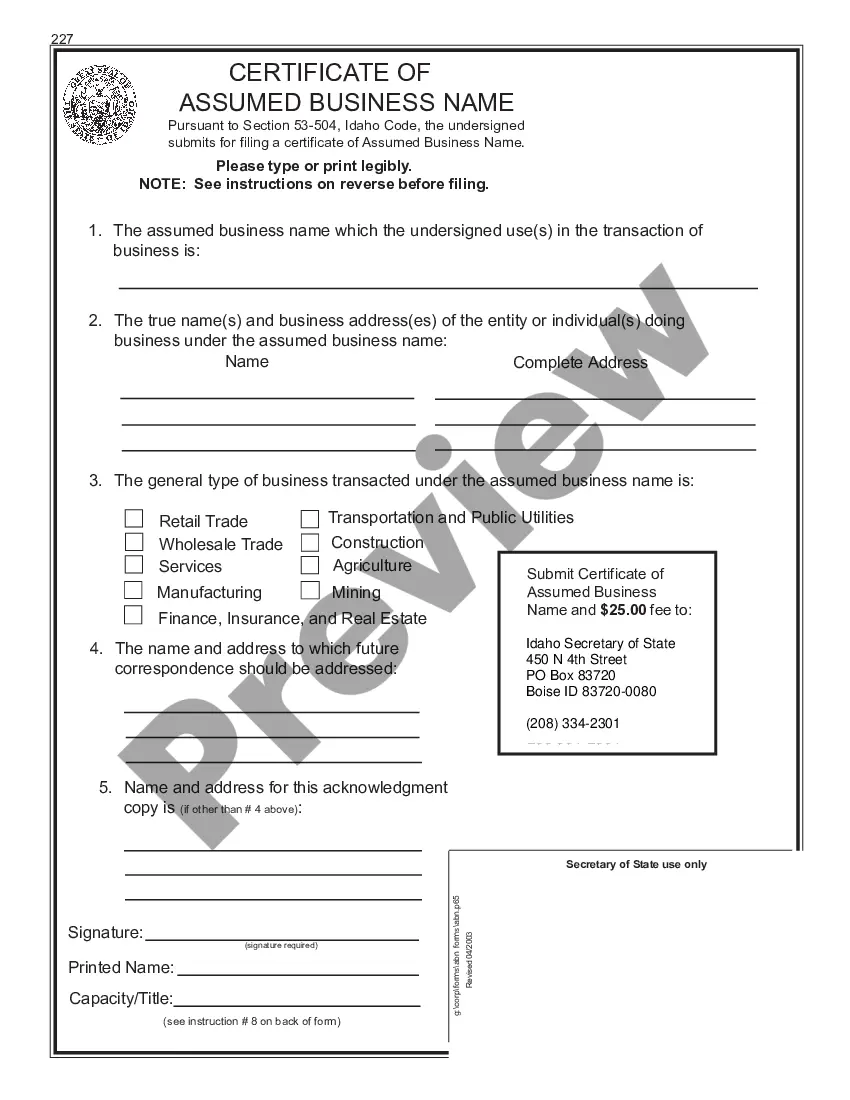

- Ensure that the form fits your case and region by reviewing the description and preview.

- Search for another sample (if necessary) using the Search bar in the page header.

- Click on Buy Now once you find the relevant template.

- Select your pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Checklist For Determining Independent Contractor Status.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

A worker does not have to meet all 20 criteria to qualify as an employee or independent contractor, and no single factor is decisive in determining a worker's status.

Pursuant to California labor law, the basic test for determining whether a worker is an independent contractor versus an employee is whether the employer has the right to direct and control the manner and means by which the work is performed.

What is the IRS 20-Factor Test? The IRS 20-Factor Test, commonly referred to as the Right-to-Control Test, is designed to evaluate who controls how the work is performed. According to the IRS's Common-Law Rules, a worker's status corresponds to the level of control and independence they have over their work.

The 5 personality traits that make a successful contractorConfidence. To become a successful contractor - it's important to have confidence in your own abilities.Personable.Flexibility.Problem Solving.Honesty.07-Mar-2018