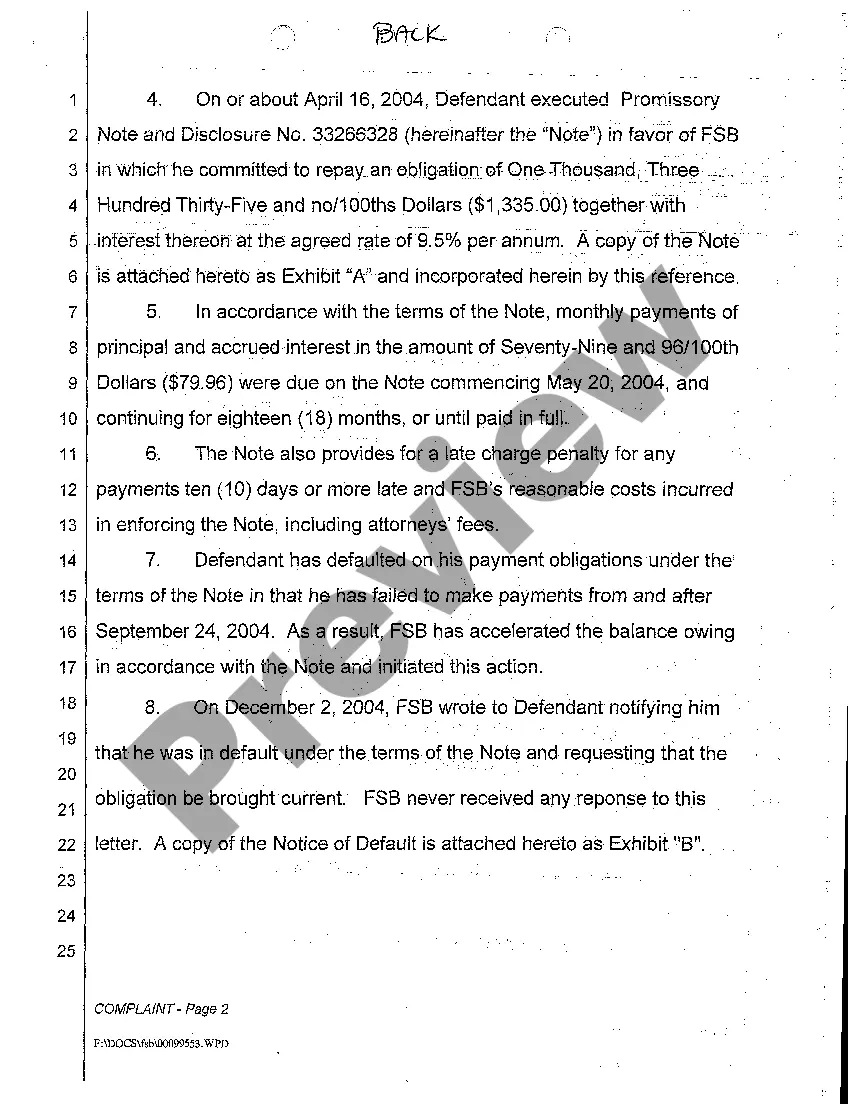

Breach Of Promissory Note With Collateral Template

Description

How to fill out Montana Complaint For Breach Of Promissory Note?

Bureaucracy requires meticulousness and correctness.

If you don't regularly handle documents like the Breach Of Promissory Note With Collateral Template, it might create some misunderstandings.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avert any hassles of re-submitting a file or repeating the same task from scratch.

If you are not a registered user, locating the needed template will require a few extra steps: Find the template using the search bar, confirm the Breach Of Promissory Note With Collateral Template you’ve located is suitable for your state or county, review the preview or browse the description containing details on how to use the template, and if the result aligns with your query, click the Buy Now button. Choose the appropriate option from the available subscription plans, Log In to your account or create a new one, complete the purchase using a credit card or PayPal, and save the form in your preferred format. Securing the correct and current templates for your documents takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your efficiency with forms.

- You can always locate the suitable template for your paperwork in US Legal Forms.

- US Legal Forms is the largest online collection of forms, housing over 85 thousand templates across various fields.

- You can acquire the latest and most relevant version of the Breach Of Promissory Note With Collateral Template simply by searching for it on the site.

- Find, save, and download templates in your account, or consult the description to verify that you have the correct one available.

- With an account at US Legal Forms, you can gather, keep in one location, and access the templates you save within a few clicks.

- When visiting the website, click the Log In button to sign in.

- Then, navigate to the My documents page, where your document history is stored.

- Examine the description of the forms and download what you need whenever you wish.

Form popularity

FAQ

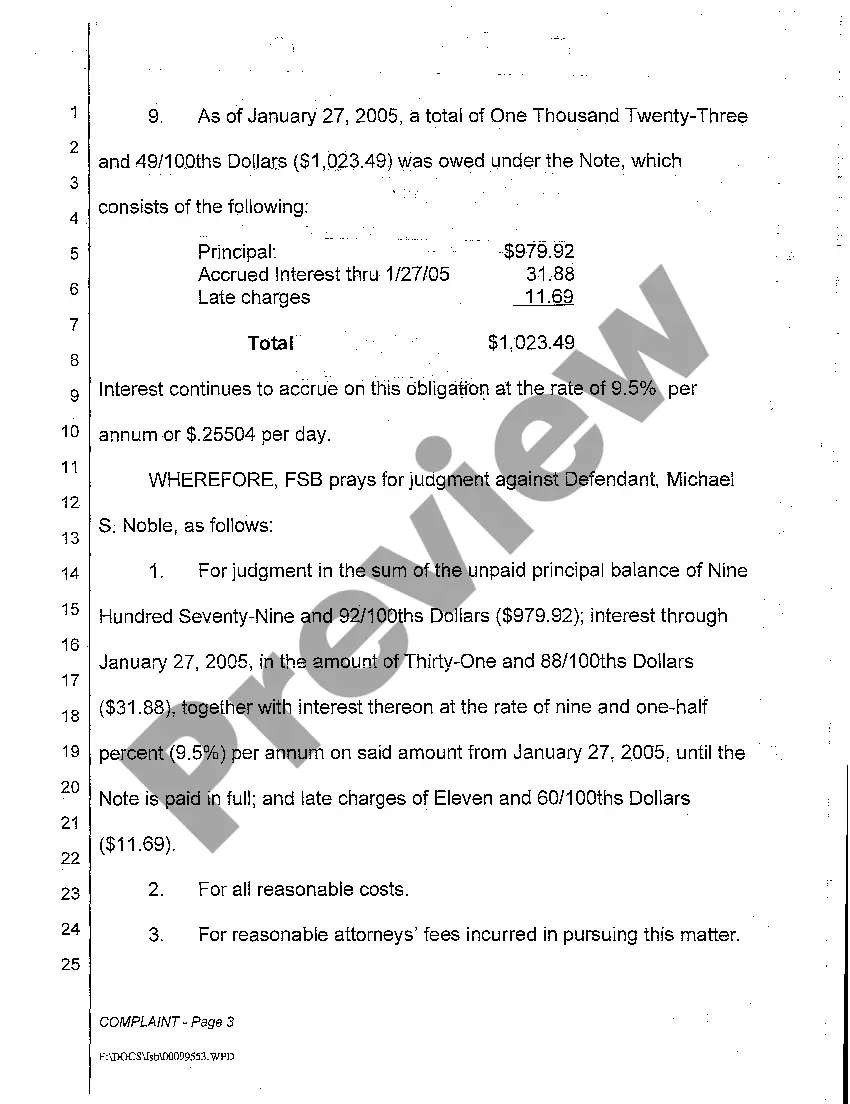

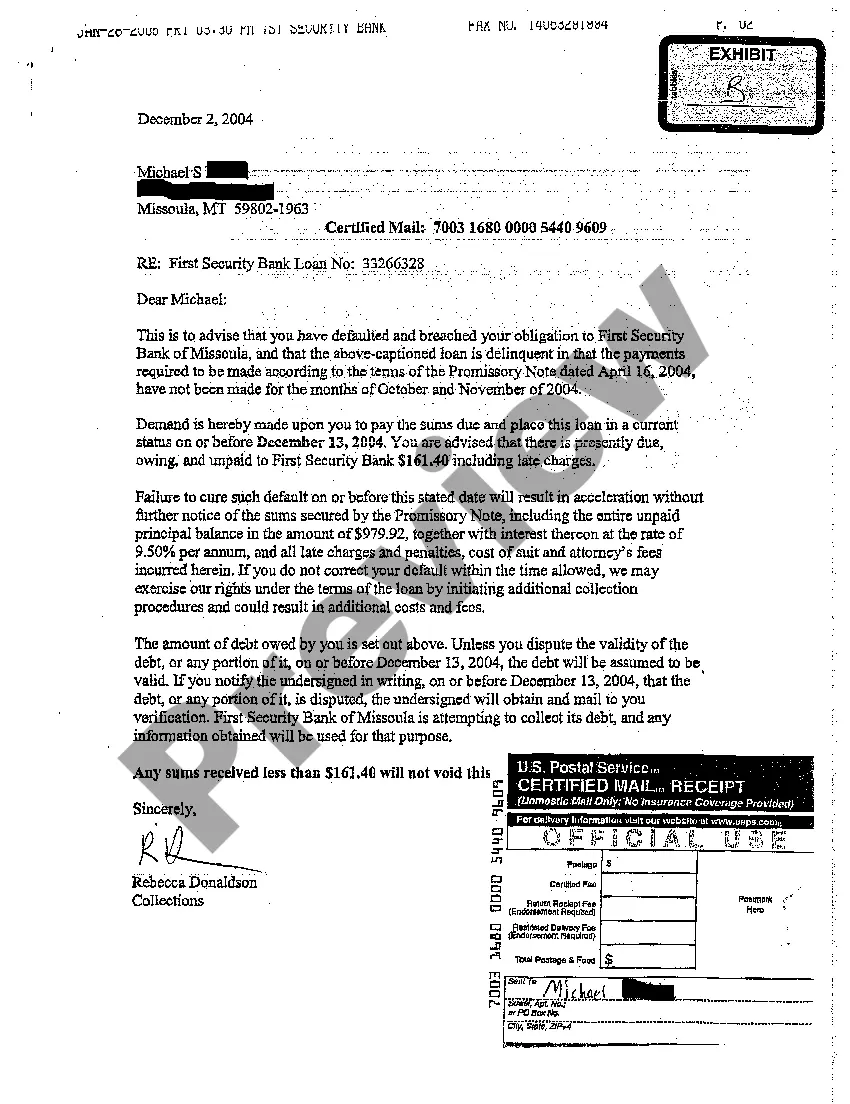

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

How to Enforce a Promissory NoteTypes of Property that can be used as collateral.Speak to them in person.Draft a Demand / Notice Letter.Write and send a Follow Up Letter.Enlisting a Professional Collection Agency.Filing a petition or complaint in court.Selling the Promissory Note.Final Tips.More items...?

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

What invalidates promissory notes?Incomplete signatures. Both parties must sign the promissory note.Missing payment amount or schedule.Missing interest rate.Lost original copy.Unclear clauses.Unreasonable terms.Past the statute of limitations.Changes made without a new agreement.