Montana Affidavit Of Resale

Description

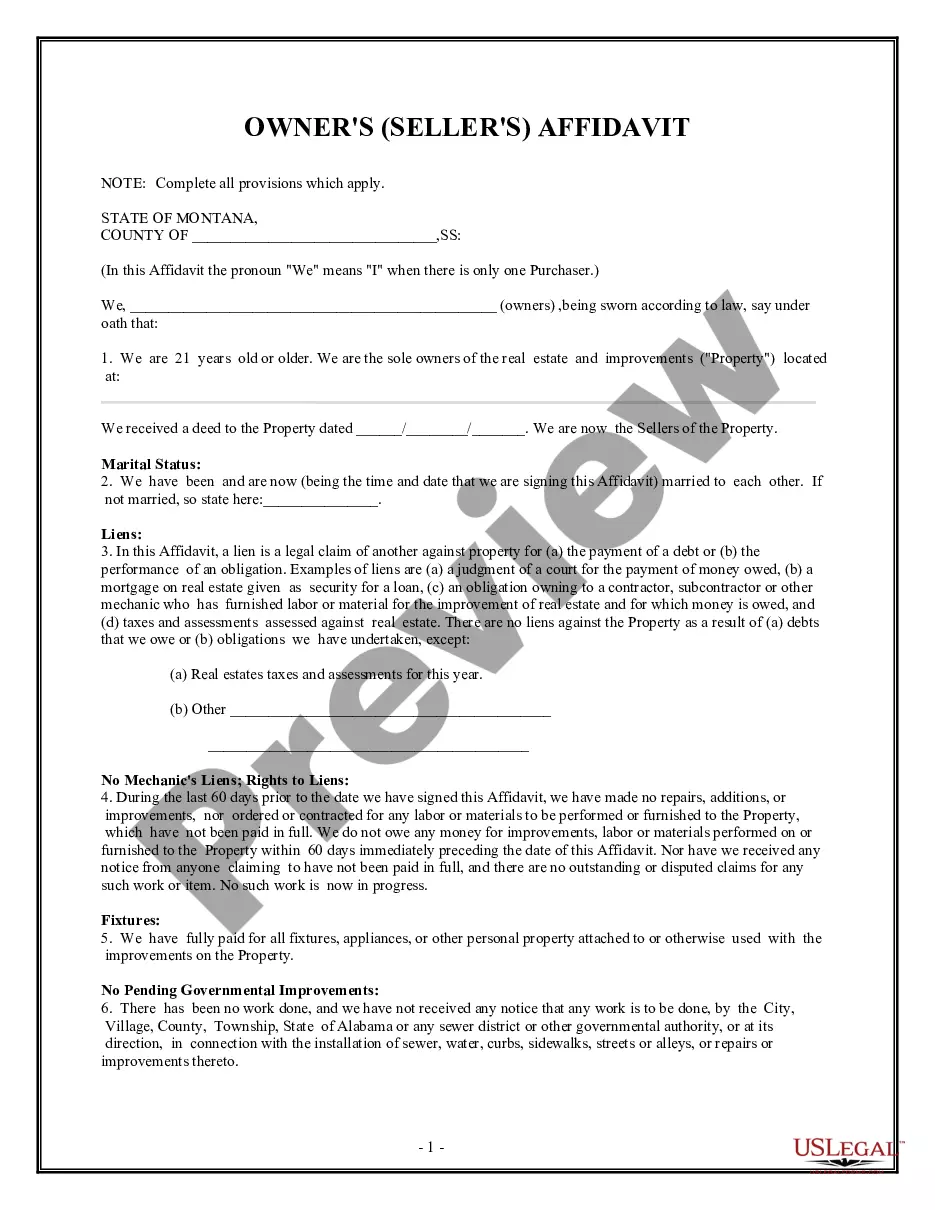

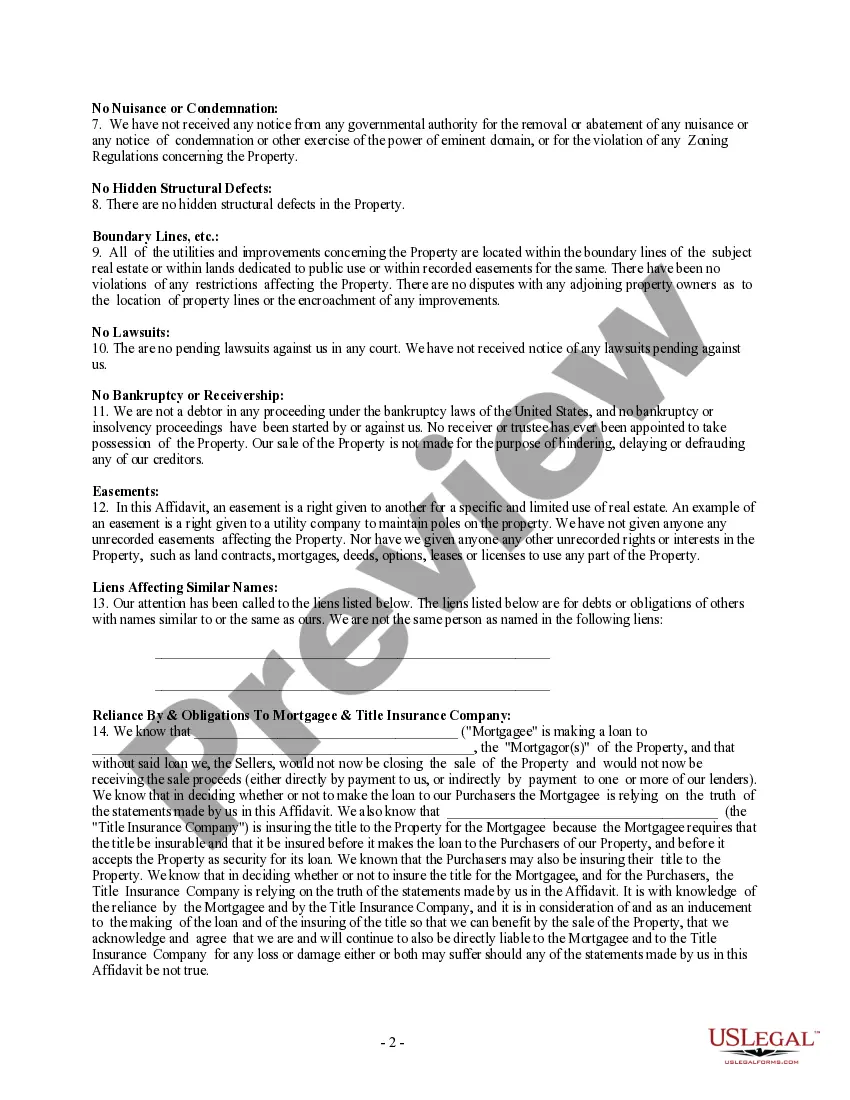

How to fill out Montana Owner's Or Seller's Affidavit Of No Liens?

When you need to present the Montana Affidavit Of Resale that adheres to your local state's laws and regulations, there may be numerous options to choose from.

There's no need to examine every document to ensure it fulfills all the legal standards if you are a US Legal Forms member.

It is a reliable resource that can assist you in acquiring a reusable and current template on any subject.

Utilizing US Legal Forms for acquiring professionally drafted formal documents is effortless. Additionally, Premium users can take advantage of robust integrated tools for online PDF editing and signing. Try it today!

- US Legal Forms is the most expansive online directory with a repository of over 85k ready-to-use documents for business and personal legal situations.

- All templates are verified to conform with each state's regulations.

- Consequently, when downloading the Montana Affidavit Of Resale from our platform, you can trust that you are obtaining a valid and current document.

- Accessing the needed sample from our platform is very straightforward.

- If you already possess an account, simply Log In to the system, confirm your subscription is active, and save the selected file.

- In the future, you can navigate to the My documents section in your profile and access the Montana Affidavit Of Resale at any time.

- If this is your first time using our website, please follow the instructions below.

- Browse the suggested page and verify it for alignment with your requirements.

Form popularity

FAQ

What if I purchase goods out of state for resale in Montana? If you are a Montana business and need to send a resale certificate to your out of state vendor, you may use the Montana Business Registry Resale Certificate.

Montana does not have a general sales, use, or transaction tax. If you need to report a sales tax exemption to your vendor, you may use this form.

Most businesses operating in or selling in the state of Montana are required to purchase a resale certificate annually. Even online based businesses shipping products to Montana residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Local sales taxes can increase the sales tax rates of some areas above their statewide level, with combined rates that can exceed 10 percent. Montana's tax rate for a statewide sales tax is limited to 4 percent in the state constitution.

A Montana buyer who purchases goods outside of Montana for resale in the ordinary course of business may provide this certificate to an out- of-state seller of property as evidence that the buyer is registered to do business in Montana. Sellers are responsible for verifying this self-certification.