Noticenol

Description

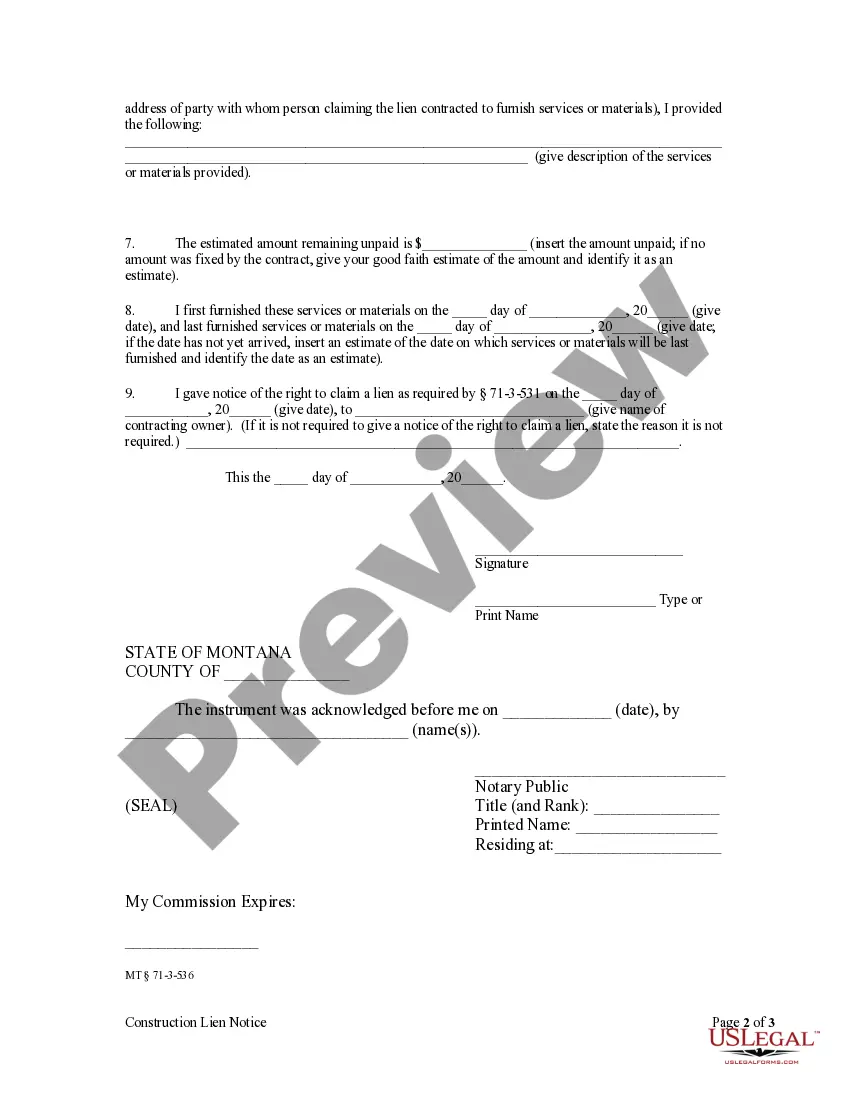

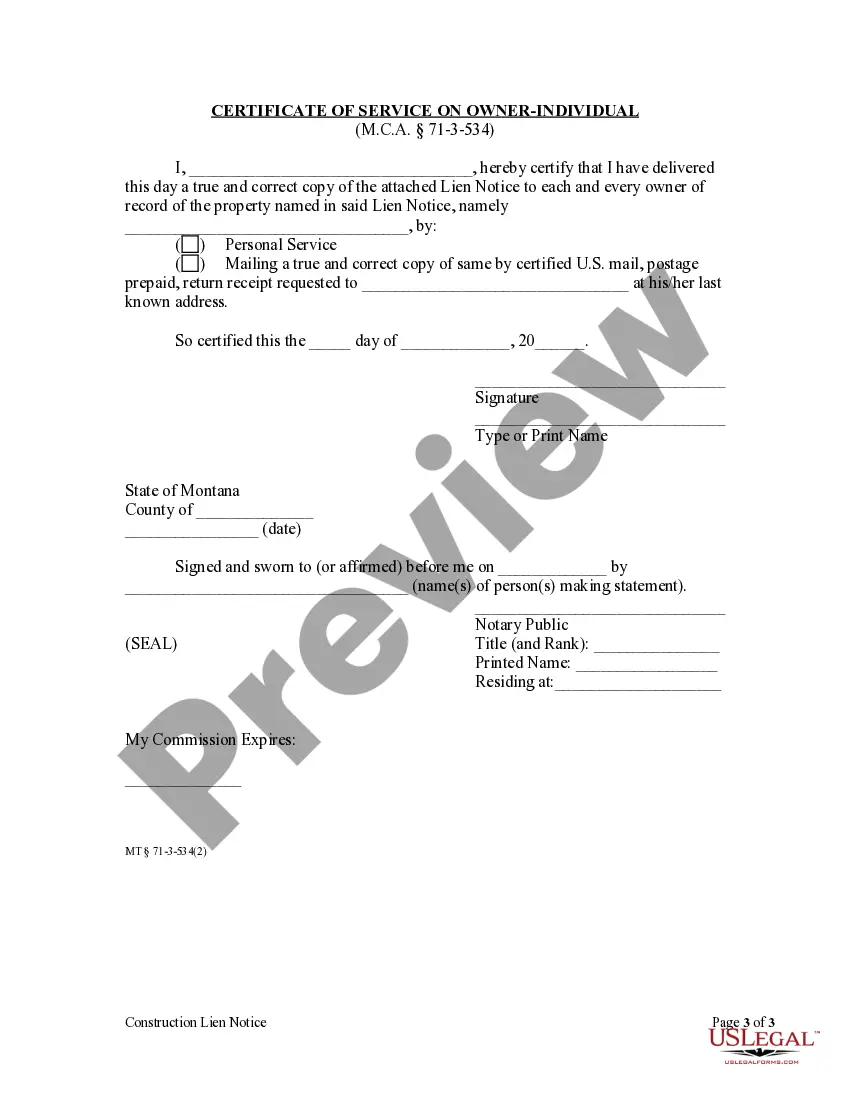

How to fill out Montana Construction Lien Notice - Individual?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription remains active.

- For first-time users, start by searching for the form in the Preview mode. Verify it fits your local jurisdiction and requirements.

- If necessary, refine your search using the Search tab to locate the appropriate template that matches your needs.

- Once you find a suitable document, click on the 'Buy Now' button. Choose the subscription plan that works best for you and register for an account.

- Complete your purchase by entering your payment information via credit card or PayPal.

- After the transaction, download the form to your device. Access it anytime through the 'My Forms' section in your account.

In conclusion, Noticenol simplifies your legal document needs by providing an extensive library and user-friendly interface. With the ability to access expert assistance, you can ensure your documents are completed accurately and efficiently.

Start navigating the world of legal forms with Noticenol today!

Form popularity

FAQ

When filling out Form 5695, start by entering your information in the identification section. Then, report your qualified energy expenses and any credits you may be eligible to claim. For a clear and precise completion of this form, consulting Noticenol can provide valuable insights.

Determining the amount for extra withholding depends on your financial situation and any anticipated tax liabilities. You might want to estimate your tax obligations and decide on an amount that can help you avoid a tax bill. Noticenol can aid you in calculating this figure effectively.

To fill out a US tax form, begin by gathering all necessary documents, such as W-2s and 1099s. Clearly enter your income, deductions, and credits, ensuring all calculations are accurate. The use of Noticenol can streamline this process, providing guidance as you complete your forms.

Your withholding allowance should reflect your tax situation and financial goals. Factor in your dependents and any tax credits you may be eligible for when deciding the number of allowances to claim. To navigate this process effectively, consider using Noticenol to gain a better grasp of your options.

On the W4 form, you will find a section labeled 'Personal Allowances Worksheet' where you can indicate 0 or 1. Entering 0 indicates you prefer maximum withholding, while entering 1 reflects a desire for a slightly lower withholding amount. Utilizing Noticenol can ensure you place this information correctly based on your needs.

Filling out a withholding allowance form begins with entering your details, such as name and address. After that, determine the number of allowances you wish to claim based on your personal circumstances. Keep in mind that using Noticenol can help you understand the implications of your choices on your tax situation.

To fill out a withholding exemption form, you should start by providing your personal details, including your name and Social Security number. Next, indicate your exemption status, ensuring you qualify based on your tax situation. Remember to consult Noticenol for any specific guidelines that may apply to your case.

Yes, Form 8332 can be filed electronically using TurboTax, which offers guidance throughout the process. This efficiency can save you time and reduce errors. Utilizing Noticenol in conjunction with TurboTax enhances your experience, ensuring a smoother tax season.

To file Form 8832 electronically, you will need to use a tax software system that supports this capability. Double-check that your software allows for electronic filing of this form. Noticenol can facilitate this process, providing insights and confirming correct submission.

Filing Form 433-F involves providing details about your financial situation, including income, assets, and liabilities. After accurately filling out the form, submit it to the IRS, preferably with the guidance of a professional or using tools like Noticenol for clarity.