Notice Of Right To Lien

Description

How to fill out Montana Construction Lien Notice - Individual?

- Log into your account if you're a returning user, ensuring your subscription is active. If it's expired, update it as per your payment plan.

- For first-time users, begin by reviewing the available forms. Check the preview and description to confirm it meets your needs and complies with local requirements.

- If the right form isn't available, utilize the search function to explore more options. Only proceed when you find a suitable document.

- Once you've found the appropriate form, select the 'Buy Now' option and choose your preferred subscription plan to gain access to the extensive library.

- Complete your purchase by entering your payment details, either using a credit card or your PayPal account.

- Download the form and save it to your device. You can also access it later in the 'My Forms' section of your account.

In conclusion, US Legal Forms provides a powerful tool for those needing legal documents like the 'Notice of right to lien.' Its user-friendly platform and comprehensive library reduce the hassle of legal work, allowing quick execution of necessary forms.

Start your journey to hassle-free legal documentation today by visiting US Legal Forms!

Form popularity

FAQ

A letter of lien is a document that notifies you of a claim a creditor has on your property due to an existing debt. This letter outlines the debt amount, the property affected, and the lender's rights. Your notice of right to lien should guide your understanding of the letter, emphasizing the importance of addressing the debt promptly to avoid further complications.

When a lien is placed on you, it signifies that a creditor has made a legal claim on your property due to unpaid debts. This can prevent you from selling the property or obtaining additional credit until the lien is resolved. Knowing your notice of right to lien enables you to understand what steps you need to take next, whether that involves paying the debt or negotiating with the creditor.

The term 'right lien' refers to a legal claim a creditor has over a debtor's property as security for an obligation. This means that the creditor can potentially take the property if the debtor fails to fulfill their obligation. Understanding your notice of right to lien is crucial, as it outlines your responsibilities and the repercussions of not addressing any outstanding debts.

In Florida, the notice of right to lien must be filed within 90 days of the final furnishing of labor or materials. This timeframe is important for protecting your rights. Failing to file within this period can lead to losing your right to seek payment. To ensure that you navigate this process correctly, consider using platforms like USLegalForms for assistance.

In Indiana, you must file a lien within 60 days after the completion of the work or the delivery of materials. In some cases, the timeline can change based on the type of lien. It’s crucial to send a notice of right to lien well in advance to ensure that you meet all legal requirements. For specific guidelines, resources like USLegalForms can provide tailored support.

Filing a lien can have several disadvantages, such as affecting your credit score and limiting your ability to sell the property. A notice of right to lien can also lead to legal disputes if not handled properly. Additionally, property owners may have to deal with the complexities of resolving the lien before they can access funds from a sale or refinance. It’s essential to be aware of these risks when considering a lien.

Yes, it is possible for someone to file a lien on your house without your knowledge. Typically, a notice of right to lien may not be delivered directly to you before the filing occurs. However, once a lien is filed, it becomes part of the public record, which means you can discover it through property records. To protect yourself, consider using services that keep track of any new filings against your property.

In Florida, the rules for liens require that a notice of right to lien be served to the property owner before filing a lien. This notice must be sent at least 45 days prior to the filing of the lien. Additionally, when the work has been completed or materials provided, the lien must be filed within a specific timeframe, generally within 1 year. It's important to consult local regulations or platforms like USLegalForms to ensure compliance.

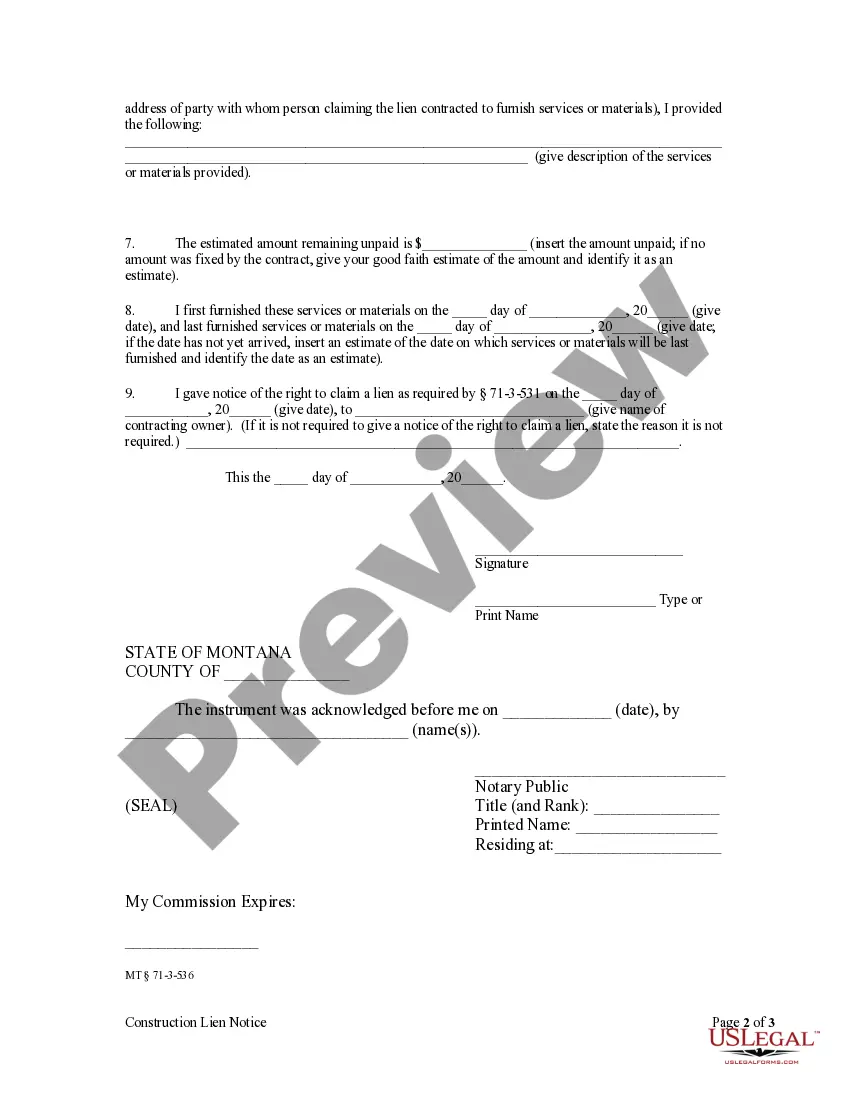

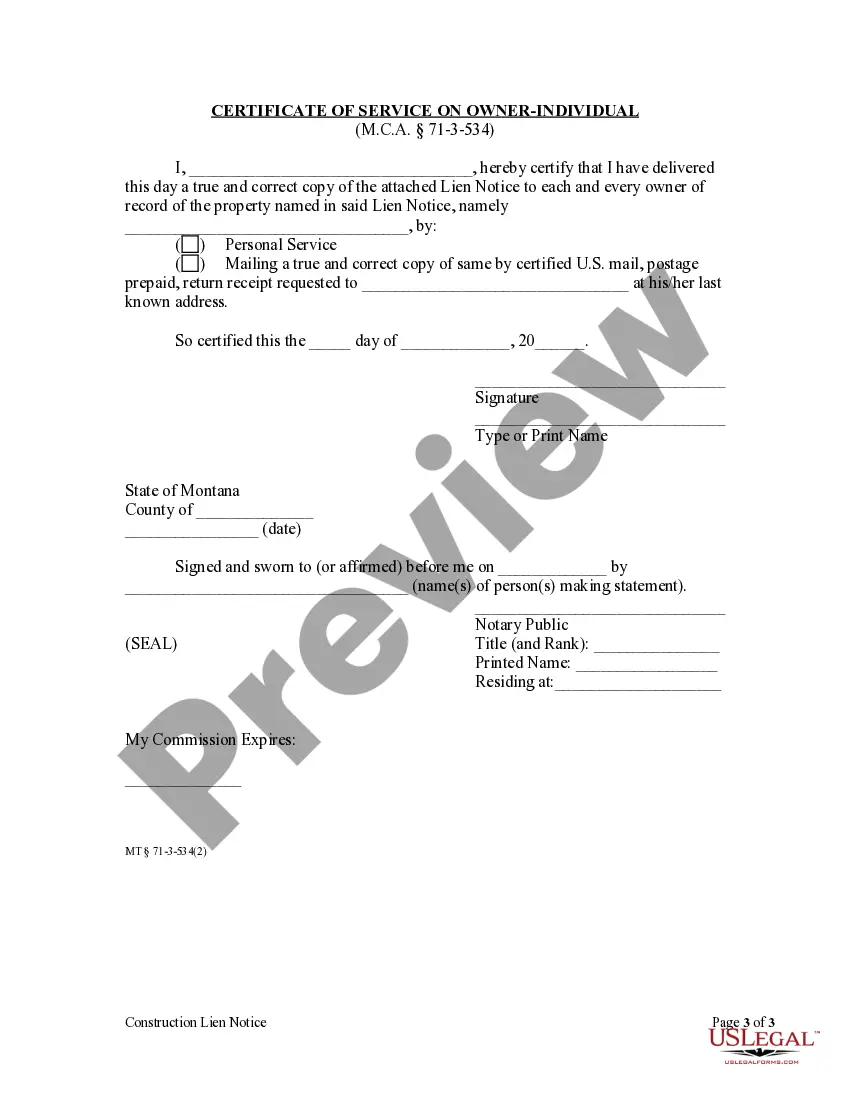

To fill out a lien affidavit, start by writing down your personal details and the specifics of the lien. Clearly document the nature of the debt and how it pertains to the property in question, ensuring to cite the notice of right to lien if relevant. Finish with your signature and a notary's acknowledgment to validate the document.

The notice of lien is a legal document that informs interested parties about an encumbrance on a property due to unpaid debts. This notice serves as a safeguard for creditors, ensuring they have an official claim on the property if debts remain unpaid. Understanding this concept is crucial for both property owners and creditors who need to protect their interests.