Mt Lien Individual 3 Editable Withdrawal

Description

How to fill out Montana Construction Lien Notice - Individual?

Accessing legal document samples that meet the federal and state regulations is essential, and the internet offers many options to choose from. But what’s the point in wasting time searching for the appropriate Mt Lien Individual 3 Editable Withdrawal sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are simple to browse with all documents organized by state and purpose of use. Our professionals stay up with legislative changes, so you can always be confident your form is up to date and compliant when getting a Mt Lien Individual 3 Editable Withdrawal from our website.

Obtaining a Mt Lien Individual 3 Editable Withdrawal is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Take a look at the template using the Preview option or through the text description to ensure it meets your requirements.

- Locate a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Mt Lien Individual 3 Editable Withdrawal and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

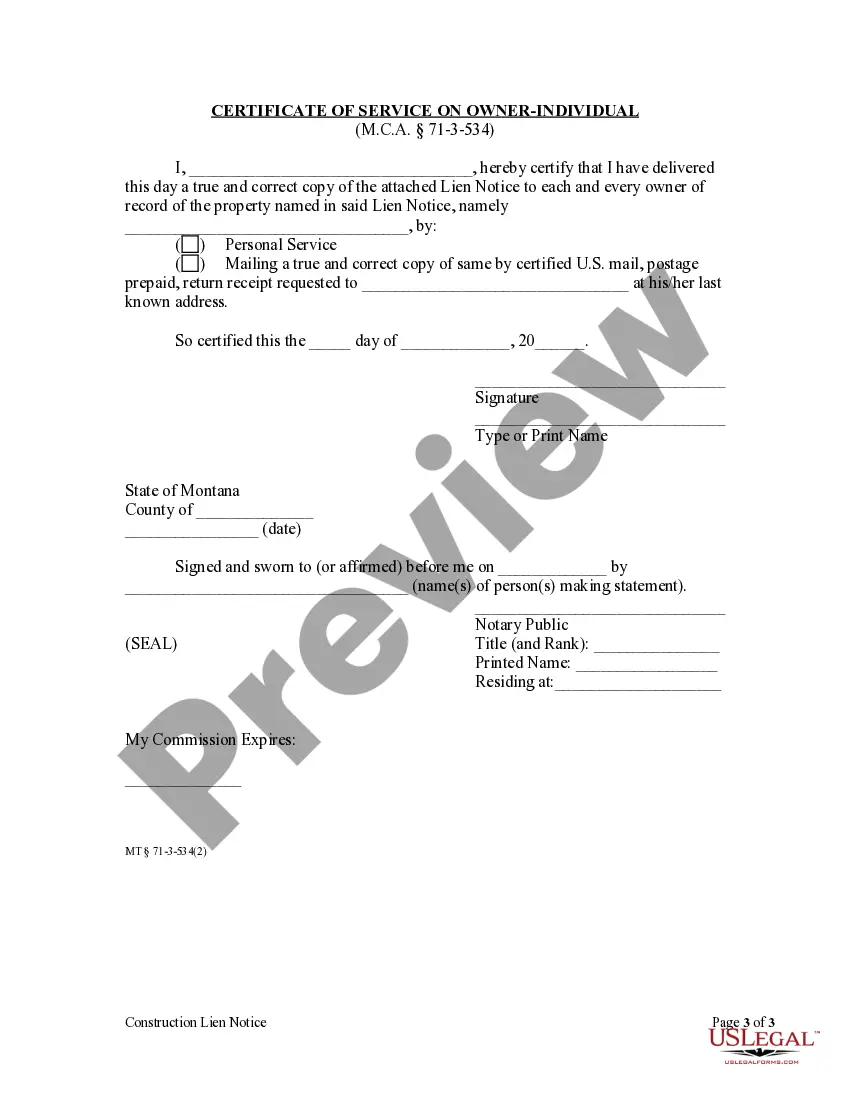

File A Lien An action to enforce a mechanics lien in Montana must be initiated within 2 years from lien's filing. Notice of Lien Rights served on owner within 20 days of first delivering materials or labor and filed with recorder within 5 days of delivery to owner.

You must send the Owner notice of your right to claim a lien within twenty (20) days of first work performed and/or materials supplied. You must file this notice of your right to claim a lien with the county recorder where the property is located within five (5) days of sending the notice to the Owner.

About Montana Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

New Filings UCC1 Lien$7.00Federal Tax Lien$7.00DPHHS Notice Of Child Support Lien$7.00Title 71 Crop Lien For Seed Or Grain$7.00Title 71 Crop Lien For Hail Insurance$7.008 more rows

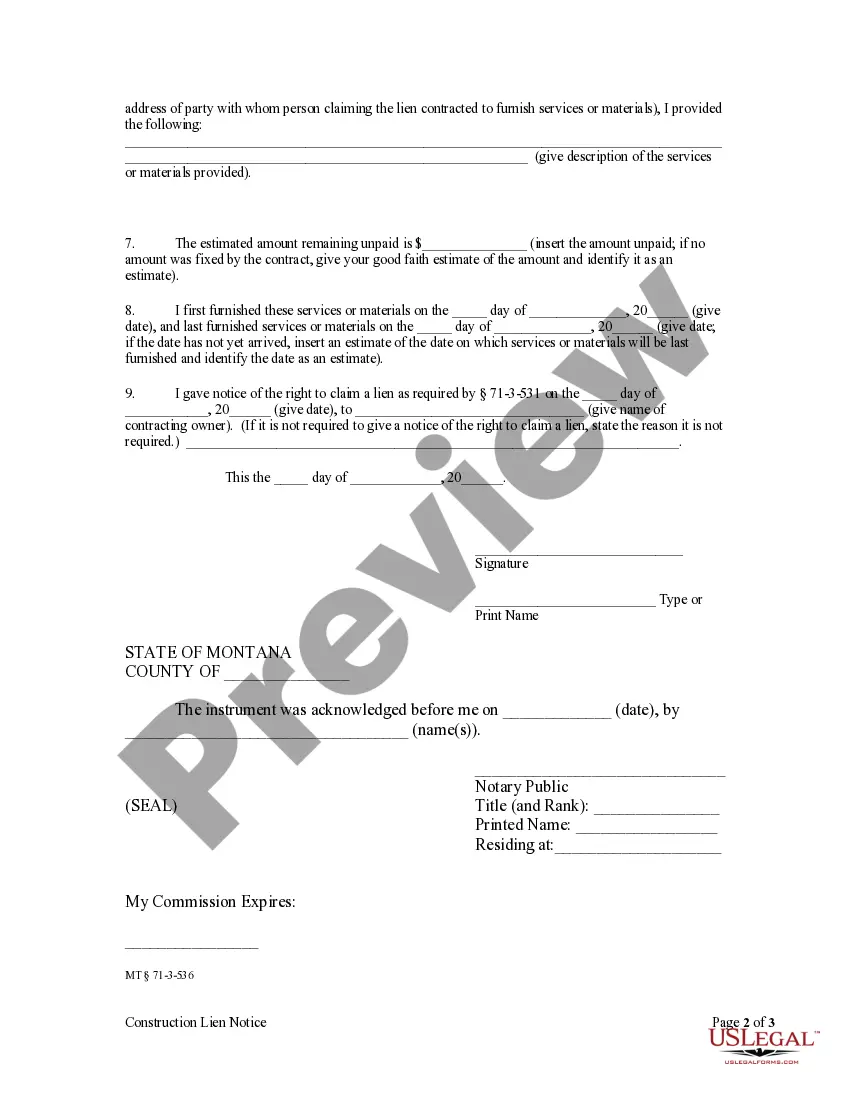

How to File a Montana Mechanics Lien | A Step-by-Step Guide to Get You Paid Properly identify yourself. Identify the property owner(s) Describe the labor or materials provided. Identify the hiring party. State the amount of the lien claim. Provide the first and last dates when labor or materials were provided.