Sample Subpoena To Accountant For Irs

Description

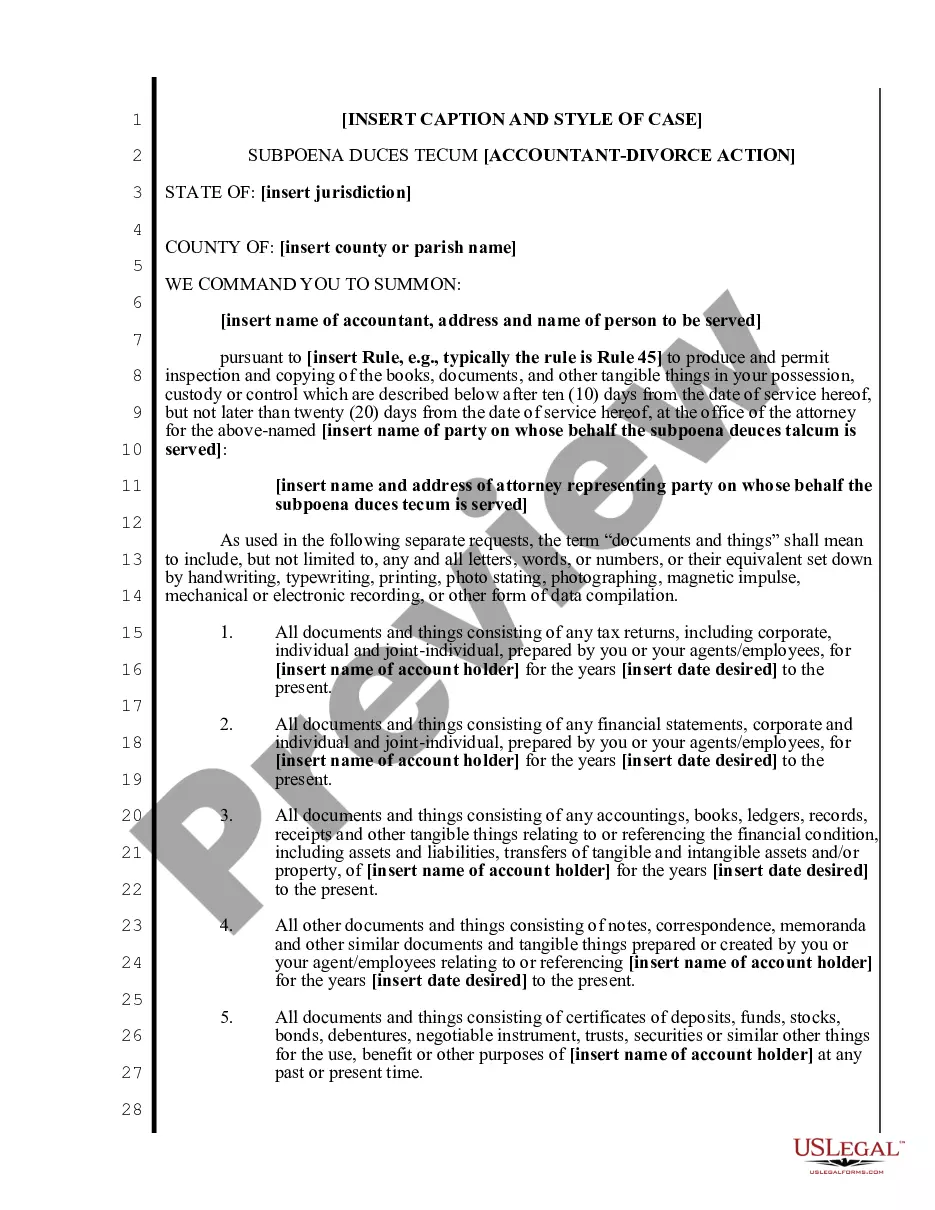

How to fill out Mississippi Subpoena Duces Tecum - Accountant - Divorce Action?

Managing legal documents can be exasperating, even for the most proficient experts.

If you are looking for a Sample Subpoena To Accountant For Irs and can't find the time to devote to locating the accurate and current version, the experience can be overwhelming.

Obtain location-specific legal and business documents. US Legal Forms accommodates all requirements you may have, from personal to business paperwork, all in one spot.

Leverage innovative tools to complete and manage your Sample Subpoena To Accountant For Irs.

Here are the steps to take after finding the form you need: Validate that this is the correct form by previewing it and reviewing its details. Ensure the sample is acceptable in your jurisdiction. Click Buy Now when you are prepared. Choose a subscription option. Select the file format you desire, and Download, fill out, sign, print, and send your document. Experience the US Legal Forms online catalogue, supported by 25 years of experience and reliability. Transform your daily document management into a simple and user-friendly experience today.

- Access a repository of articles, guides, and resources pertinent to your context and requirements.

- Conserve effort and time in locating the forms you require, utilizing US Legal Forms’ advanced search and Review feature to find the Sample Subpoena To Accountant For Irs and download it.

- If you hold a monthly subscription, Log In to the US Legal Forms account, find the form, and download it.

- Check the My documents section to view the documents you've previously saved and to organize your folders as needed.

- If this is your first experience with US Legal Forms, create an account for unlimited access to all the platform's advantages.

- A comprehensive online form directory can transform the way anyone handles these circumstances.

- US Legal Forms is a leader in web-based legal documentation, featuring over 85,000 state-specific forms accessible at your convenience.

- With US Legal Forms, you have the opportunity to.

Form popularity

FAQ

Yes, an accountant can testify against you in certain circumstances, especially if subpoenaed. If a sample subpoena to accountant for IRS is involved, the accountant may be legally obligated to provide information in court. It’s crucial to understand the limits of confidentiality in these situations and discuss potential outcomes with your accountant.

To make a FOIA request to the IRS, first, you need to prepare a written request outlining the information you wish to access. Include as much detail as possible to assist the IRS in locating the records. A sample subpoena to accountant for IRS might include relevant details to facilitate the request process. You can submit your request via mail or electronically, depending on your preference.

Accountants can be held accountable for their actions, especially if they violate legal or ethical standards. If an accountant mishandles your financial information or misrepresents your data in a sample subpoena to accountant for IRS, they may face disciplinary measures. Clients have rights and protections that can be enforced through legal channels.

Yes, legal action can be taken against an accountant if they breach their professional duties or act negligently. It’s important to document any issues thoroughly, especially when dealing with a sample subpoena to accountant for IRS. Each case will depend on the specifics, but legal recourse is available when a client feels wronged.

Yes, accountants are generally required to protect client confidentiality. This duty ensures that any personal or financial information shared remains private. However, if a sample subpoena to accountant for IRS is issued, the accountant may need to disclose certain information, which can create complexities in maintaining client confidentiality.

A variety of evidence can be subpoenaed, including documents, emails, records, and testimonies from witnesses. In cases involving tax matters, a sample subpoena to accountant for IRS can specifically target financial records or transactional documents. Understanding what can be requested helps streamline the legal process and ensures that you gather accurate information.

To subpoena the IRS for tax records, you must file a request with the appropriate court that outlines the specific documents you need. A sample subpoena to accountant for IRS may serve as a useful reference during this process, demonstrating how to appropriately structure your request and provide necessary details. This formal approach helps ensure that your inquiry is taken seriously.

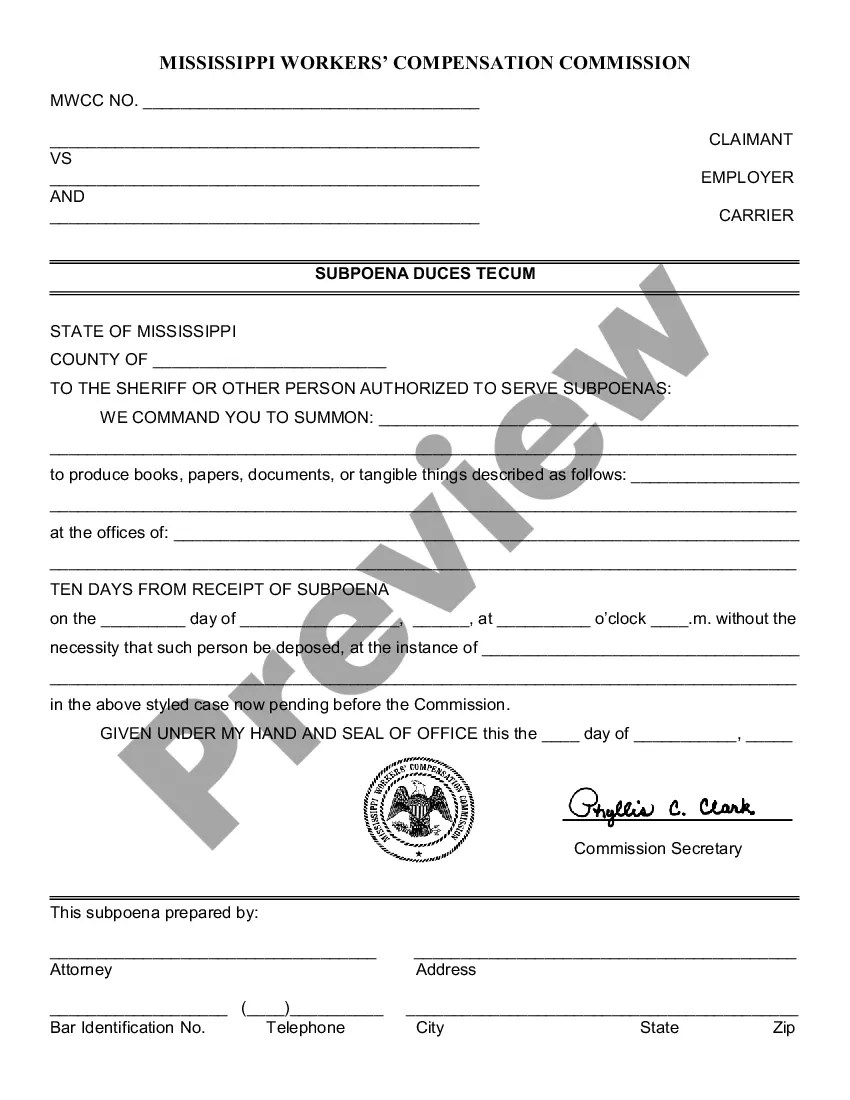

A valid subpoena typically must contain the issuing court's information, specify the required documents or testimony, and provide clear instructions on where and when to comply. These elements are critical to ensure the subpoena is enforceable and recognized in legal proceedings. When creating a sample subpoena to accountant for IRS purposes, attention to these details is essential.

A subpoena is an official order to appear in court or produce evidence. An example would be a sample subpoena to accountant for IRS documentation, where the IRS requests an accountant to submit financial records that support a particular taxpayer's claims. This type of subpoena ensures transparency and accountability in tax matters.

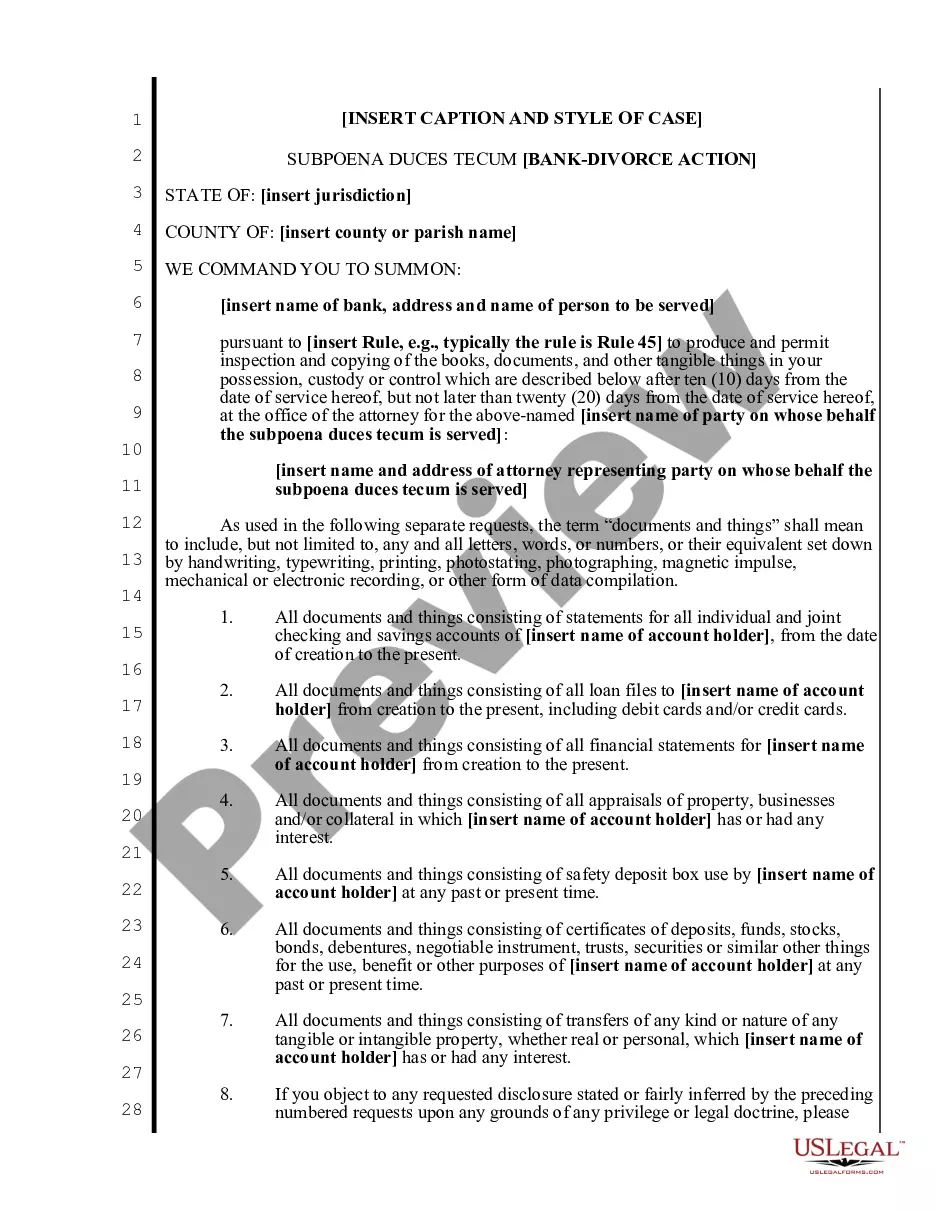

There are three main types of subpoenas: a subpoena ad testificandum, which orders a witness to testify; a subpoena duces tecum, which requires the production of documents; and a deposition subpoena, which compels a person to appear for a deposition. Each type serves a distinct purpose in legal proceedings, including those involving a sample subpoena to accountant for IRS inquiries.