Disburse Funds Adjudged Withholding

Description

How to fill out Mississippi Order To Disburse Funds On Motion Of The Plaintiffs?

- If you're a returning user, log in to your account and ensure your subscription is current. Click the Download button to obtain your required form template.

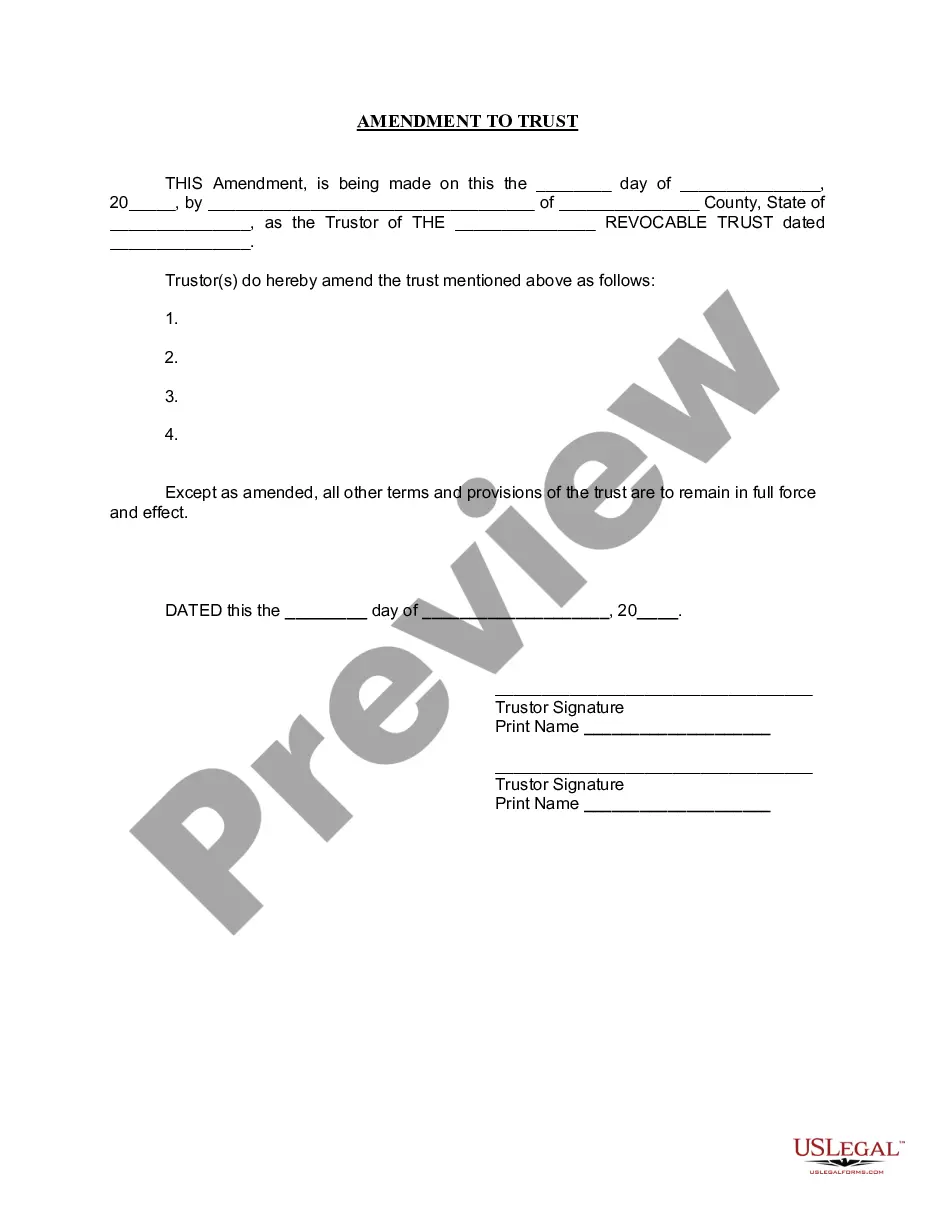

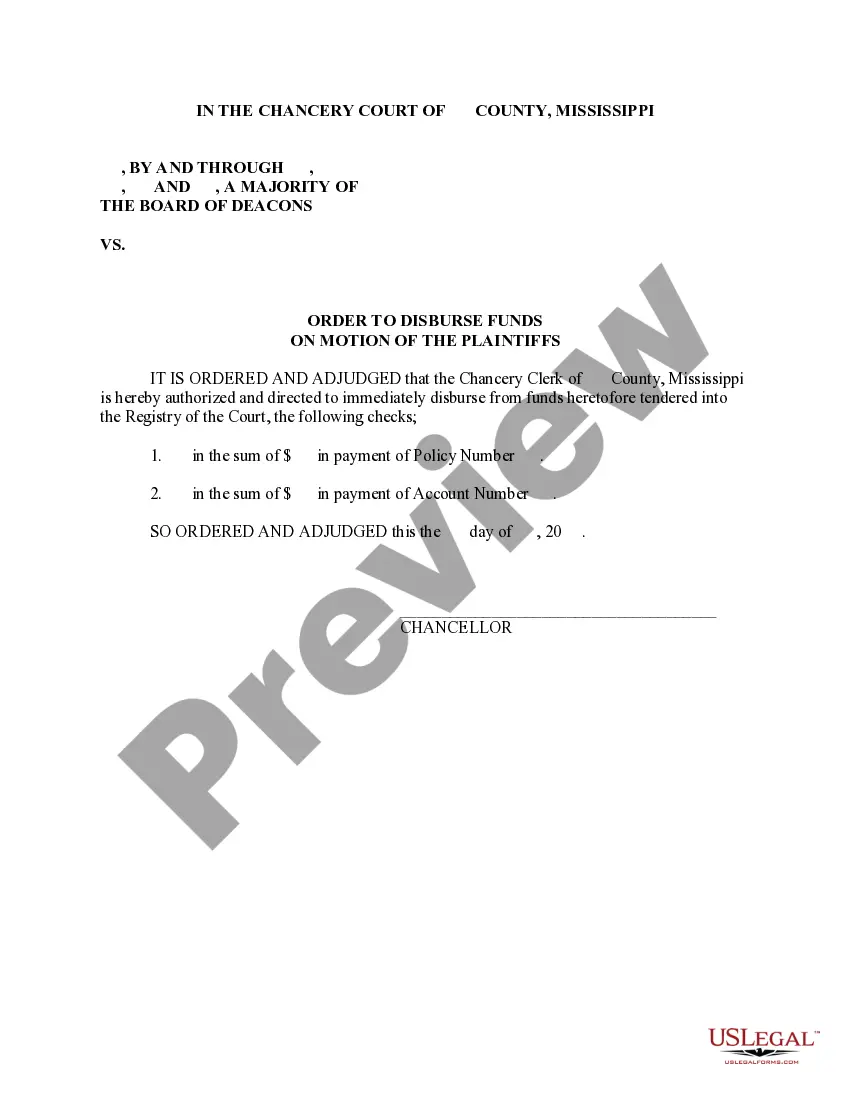

- For new users, begin by exploring the Preview mode to identify the appropriate form that aligns with your local jurisdiction's requirements.

- If the selected form doesn't fit your needs, use the Search tab to find a more suitable template. Once you confirm it meets your criteria, proceed to the next step.

- Next, click the Buy Now button for the chosen document and select a subscription plan that best fits your needs, ensuring you register an account for full access.

- Complete your purchase by entering your credit card information or PayPal credentials. This grants you access to the extensive library.

- Finally, download your form to your device. You can easily access it later in the My Forms section of your account.

By following these straightforward steps, you can swiftly handle the disbursement of funds adjudged withholding while benefiting from US Legal Forms' robust collection and user-friendly interface.

Start exploring the extensive resources available to you through US Legal Forms today and ensure your legal documents are accurate and compliant!

Form popularity

FAQ

Taxes might not have been withheld from your paycheck due to an incorrect W-4 form or your employer's payroll system malfunction. Additionally, if you met certain earning thresholds, you may qualify for exemption from withholding. It's important to verify your payroll information and communicate with your employer to make necessary adjustments. Ensuring proper withholding helps you avoid complications related to disburse funds adjudged withholding.

Your bank may inquire about backup withholding to ensure compliance with IRS regulations. When you disburse funds adjudged withholding, your bank needs to verify that any required taxes are withheld correctly. This process helps to prevent tax evasion and ensures that you do not face additional penalties in the future. It's best to provide the necessary documentation to avoid any disruption in your banking services.

Claiming 0 does not always guarantee you will receive a refund; it merely increases the amount withheld from your paychecks throughout the year. If your income increases or if you have other taxable income, you may still owe taxes. Understanding your financial landscape is crucial to avoid surprises at tax season. You can use tools from US Legal Forms to better assess your withholding strategy.

Determining an additional amount to withhold from your paycheck can help you manage tax liabilities. Consider your financial situation and expected tax obligations when deciding on this amount. An accurate estimate might include any anticipated deductions or credits, allowing you to disburse funds adjudged withholding wisely. Consulting tax experts or resources like US Legal Forms can provide valuable guidance.

Filling out a withholding exemption requires careful attention to detail. You'll need to complete IRS Form W-4 to indicate your exemption status accurately. Ensure you meet the criteria set forth by the IRS, as this will determine how much tax is withheld from your paychecks. Utilizing tools provided by US Legal Forms can simplify the process and help you navigate your options effectively.

Deciding on higher withholding requires careful thought. If you expect to owe taxes or anticipate significant deductions, agreeing to higher withholding can be beneficial. This option allows you to disburse funds adjudged withholding upfront, potentially easing your tax burden later. Always assess your financial needs and speak to a tax professional for personalized advice.

Choosing to claim 0 or 1 on your W4 affects your tax withholding amounts. If you claim 0, more funds will be withheld from your paycheck, potentially leading to a refund when you file your taxes. On the other hand, claiming 1 reduces your withholding, meaning you may owe taxes when filing. It's essential to consider your financial situation and future tax obligations when making this choice.

The processing time for form 8288 B can vary, but typically, you can expect a response within 6 to 8 weeks after the IRS receives your submission. Factors such as workload and the complexity of your submission may influence this timeline, particularly in relation to the disbursement of funds adjudged withholding. To stay informed about your submission status, consider following up with the IRS or utilize the resources available at uslegalforms for assistance.

If your employer makes an error in your tax withholding, it may affect your tax return and the disbursement of funds adjudged withholding. You could end up owing tax at the end of the year if too little was withheld, or receive a refund if too much was withheld. To address this, you should communicate with your employer and review your W-4 form. If necessary, uslegalforms can provide assistance in making corrections and ensure your withholding aligns with your financial situation.

Form 8288 should be filed with the IRS at the designated address provided in the form instructions, which may vary based on different factors. If you are uncertain, checking the IRS website can give you the most up-to-date information. Properly filing this form is crucial to ensure the correct disbursement of funds adjudged withholding. You can also rely on uslegalforms to guide you through the process and ensure you meet all requirements.