Mississippi Commitment For Title Insurance

Description

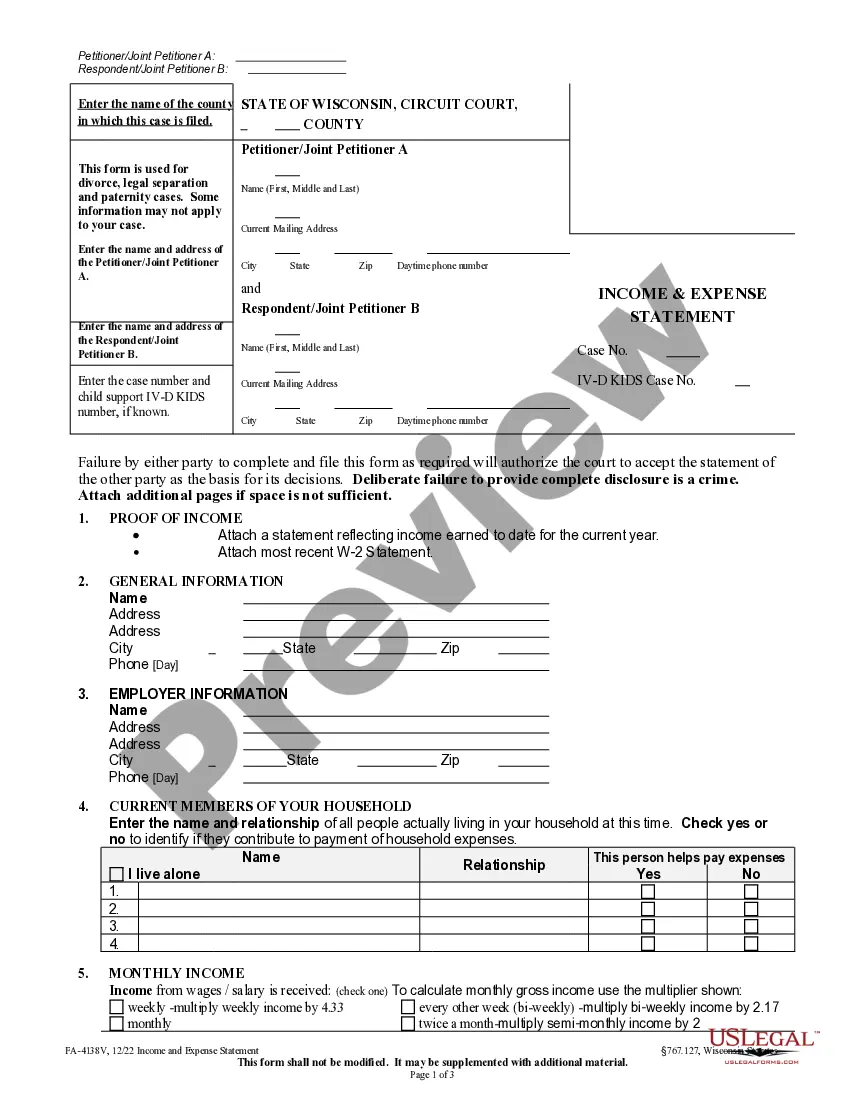

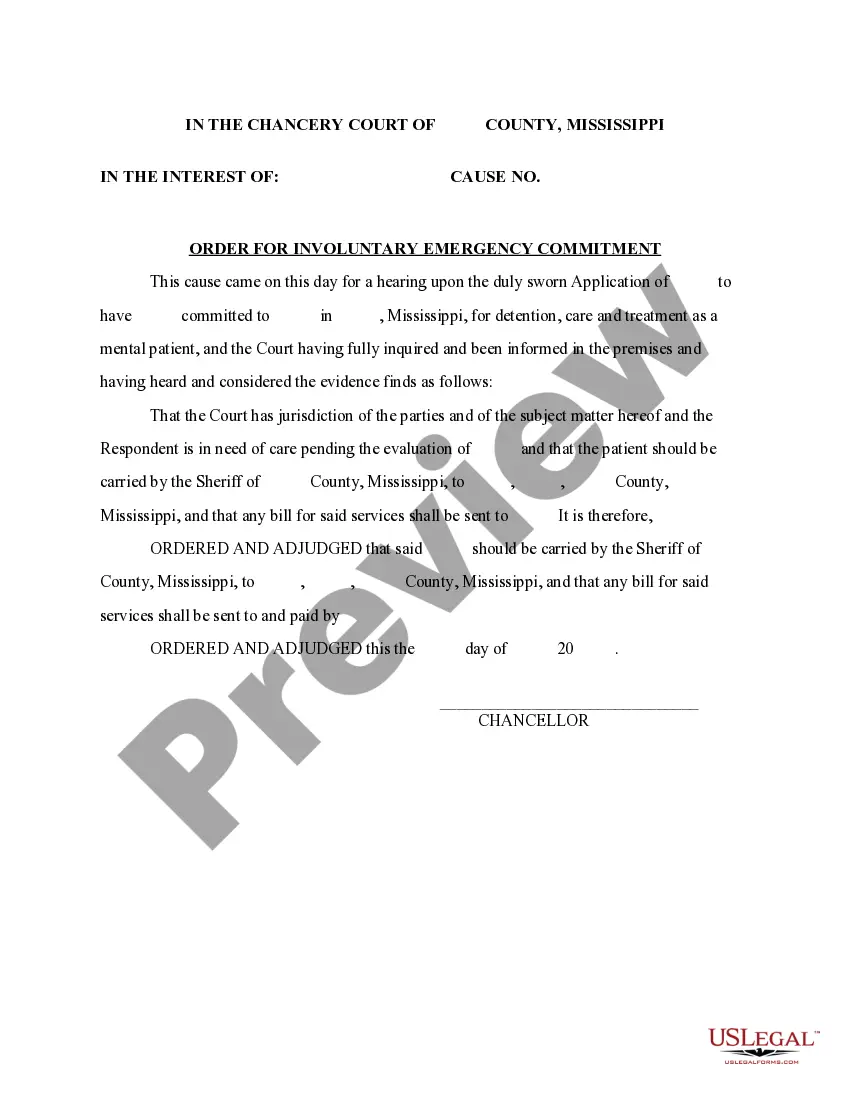

How to fill out Mississippi Order For Involuntary Emergency Commitment?

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more cost-effective way of preparing Mississippi Commitment For Title Insurance or any other paperwork without jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of more than 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly access state- and county-specific forms carefully prepared for you by our legal specialists.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Mississippi Commitment For Title Insurance. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and explore the catalog. But before jumping straight to downloading Mississippi Commitment For Title Insurance, follow these tips:

- Check the form preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the form you select complies with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Mississippi Commitment For Title Insurance.

- Download the form. Then fill out, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us today and transform document completion into something simple and streamlined!

Form popularity

FAQ

How to read a title commitment report? To read a title commitment report, beginning with Schedule A, you should check the names of the buyer and seller, their marital status, the property description and address, the amount of coverage and premium, the effective date and commitment number.

The title commitment is a proposal submitted by the title company to the parties, agreeing to insure the property if specific, named requirements are met. The commitment also includes information about the parties, the property, the terms of the policy, what is not covered, and other essential matters.

To read a title commitment report, beginning with Schedule A, you should check the names of the buyer and seller, their marital status, the property description and address, the amount of coverage and premium, the effective date and commitment number.

A title commitment is the document by which a title insurer discloses to all parties connected with a particular real estate transaction all the liens, defects, and burdens and obligations that affect the subject property.

The Requirements section lists all the things that must be addressed prior to or at the closing, such as: Paying off taxes. Paying off seller's existing mortgages. Releasing liens on the title.