Mississippi Exemption Application For Homestead

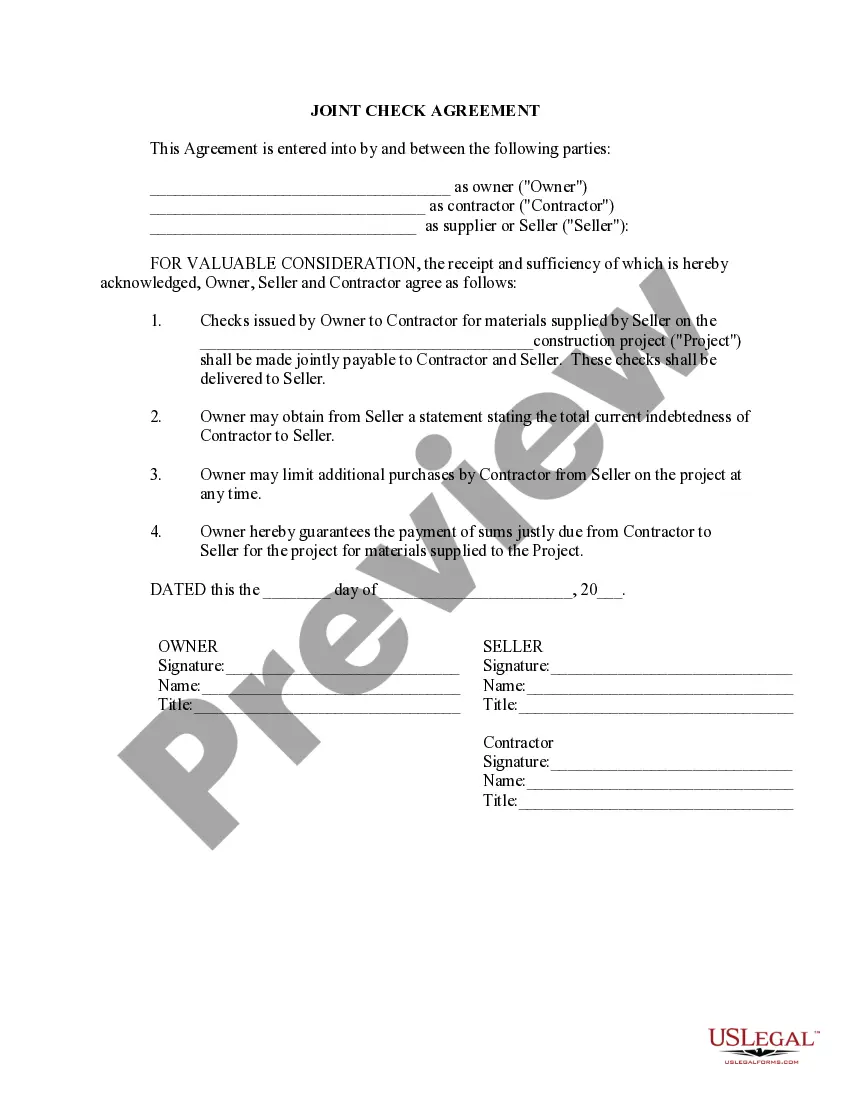

Description

How to fill out Mississippi Application For Exemption From Ad Valorem Taxes For Certain Manufactured Products Held For Sale Or Shipment To Other Than Final Consumer For A Period Of 10 Years?

It’s well-known that you can’t become a legal authority overnight, nor can you discover how to swiftly create the Mississippi Exemption Application For Homestead without a specialized skill set.

Assembling legal documents is a lengthy process that demands specific education and expertise.

So why not entrust the development of the Mississippi Exemption Application For Homestead to the professionals.

Preview it (if this option is available) and read the accompanying description to determine if the Mississippi Exemption Application For Homestead is what you’re looking for.

Register for a free account and select a subscription option to purchase the form.

- With US Legal Forms, one of the largest legal template libraries, you can locate everything from court documents to templates for internal business communication.

- We understand how crucial compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how you can begin with our website and obtain the document you need in just minutes.

- Find the form you require by using the search bar at the top of the page.

Form popularity

FAQ

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead. Your closing or settlement statement.

Application Requirements A copy of your recorded Warranty Deed. Your Mississippi car and/or truck tag numbers. Social Security Numbers for You and Your Spouse if You Are Married. Birth dates for you and your spouse or all parties applying for homestead. Your closing or settlement statement.

Homeowners may also be eligible for the Mississippi homestead exemption. This exempts the first $7,500 in assessed value from taxation, up to a maximum of $300 off your tax bill. Seniors who are 65 or older receive a full exemption on the first $7,500 of their property's assessed value.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.

The applicant must come in person to the Tax Assessor's office the first time to file for homestead exemption benefits. Each year after that the homestead exemption benefits are automatically renewed unless there is a change in the filing status.