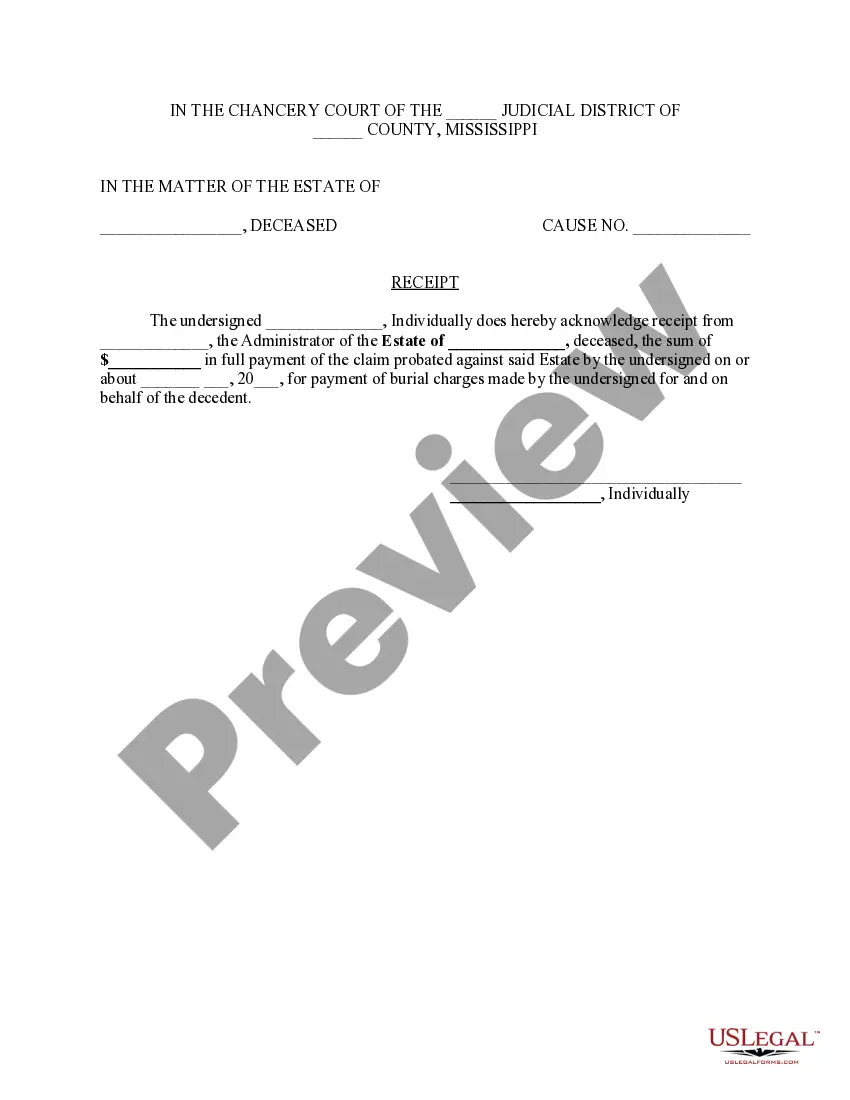

Receipt Form For Estate Distribution

Description

How to fill out Mississippi Receipt For Distribution From Estate?

Individuals frequently connect legal documentation with a daunting task that solely a professional can manage.

In some respects, this is accurate, as composing a Receipt Form For Estate Distribution necessitates considerable knowledge of subject matters, including state and municipal laws.

However, with US Legal Forms, everything has become more attainable: pre-designed legal templates for any personal and business needs aligned with state regulations are gathered in one online repository and are now accessible to all.

All templates in our repository are reusable: once acquired, they remain stored in your profile, allowing access anytime needed via the My documents tab. Experience all the advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and purpose, making the search for Receipt Form For Estate Distribution or any specific template a matter of minutes.

- Previously registered users with an active membership must Log In to their account and click Download to retrieve the form.

- New users of the service need to register for an account and subscribe before they can download any documentation.

- Here's the detailed process on how to obtain the Receipt Form For Estate Distribution.

- Examine the page content thoroughly to confirm it meets your requirements.

- Read the form description or view it using the Preview option.

- If the previous option is unsuitable, search for another sample using the Search field in the header.

- Once you find the appropriate Receipt Form For Estate Distribution, click Buy Now.

- Choose a pricing plan that corresponds to your needs and financial capacity.

- Register an account or Log In to proceed to the payment interface.

- Complete your subscription payment via PayPal or with a credit card.

- Select your desired file format and click Download.

- You can either print your document or upload it to an online editor for a faster fill-in.

Form popularity

FAQ

In the context of a will, distribution refers to how the deceased's assets are allocated among the beneficiaries. This process ensures that each person receives their intended share according to the will's terms. To facilitate this process, utilizing a receipt form for estate distribution can help document each allocation, ensuring transparency and compliance.

A disbursement receipt is a document that records the payment of funds from an estate to a beneficiary. It serves as proof of the distribution and helps maintain clear financial records. Using a receipt form for estate distribution simplifies tracking these transactions, offering clarity and accountability.

You can obtain proof of the executor's authority through a court document known as 'Letters Testamentary.' This document officially appoints the executor to handle the estate. For your records, it’s advisable to keep a receipt form for estate distribution, which validates the transactions made on behalf of the estate.

A distribution refers to the transfer of assets from an estate to beneficiaries. When handling taxes, distributions can affect the taxable income of the estate or the beneficiaries. It's essential to keep accurate records, such as a receipt form for estate distribution, to ensure compliance with tax obligations.

You can show proof of inheritance using several documents, including a will, a death certificate, and a receipt of inheritance. These documents demonstrate your connection to the deceased and your entitlement to their assets. Organizing and maintaining these records is essential for a smooth transition of assets. A well-prepared receipt form for estate distribution can facilitate this process and serve as solid proof of your claims.

A receipt and release serves as a legal document that confirms you have received your inherited assets and releases the estate from any further claims. This document is crucial for protecting both the recipient and the estate, as it minimizes the risk of future disputes. Utilizing this document is an effective way to manage any potential misunderstandings regarding asset distribution. Incorporating a receipt form for estate distribution ensures clarity in these transactions.

To obtain a certificate of inheritance, you typically need to request it from the probate court overseeing the estate. You may need to provide a copy of the will and any supporting documents to prove your claim to the inheritance. Simply submitting this request with all required documents will initiate the process. Integrating a receipt form for estate distribution can simplify tracking your inheritance claims.

A receipt of inheritance is a document that acknowledges the receipt of a bequest from an estate. This form provides proof that you have received your designated assets, helping to resolve any future disputes over the estate. It is an essential part of estate planning and asset transfer. Always ensure to create a valid receipt form for estate distribution to formalize this process.

Filling out an estate document involves gathering all necessary information regarding assets, debts, and beneficiaries. You should clearly list all assets, their values, and any debts owed by the deceased. Utilizing the right tools, like ulegalforms, can provide you the necessary templates and guidance when crafting your receipt form for estate distribution.

Income for an estate may include interest earned from investments, dividends, rental income, and any revenue generated by estate-owned businesses. This income may affect the overall value of the estate and the distribution to beneficiaries. It's crucial to capture this income accurately with the appropriate receipt form for estate distribution.