Beneficiary Distribution Rules

Description

How to fill out Receipt Of Beneficiary For Early Distribution From Estate And Indemnity Agreement?

Managing legal documents and processes can be a lengthy addition to your schedule.

Beneficiary Distribution Guidelines and similar forms generally require you to search for them and figure out the most efficient way to fill them out properly.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and functional online directory of forms readily available will be extremely beneficial.

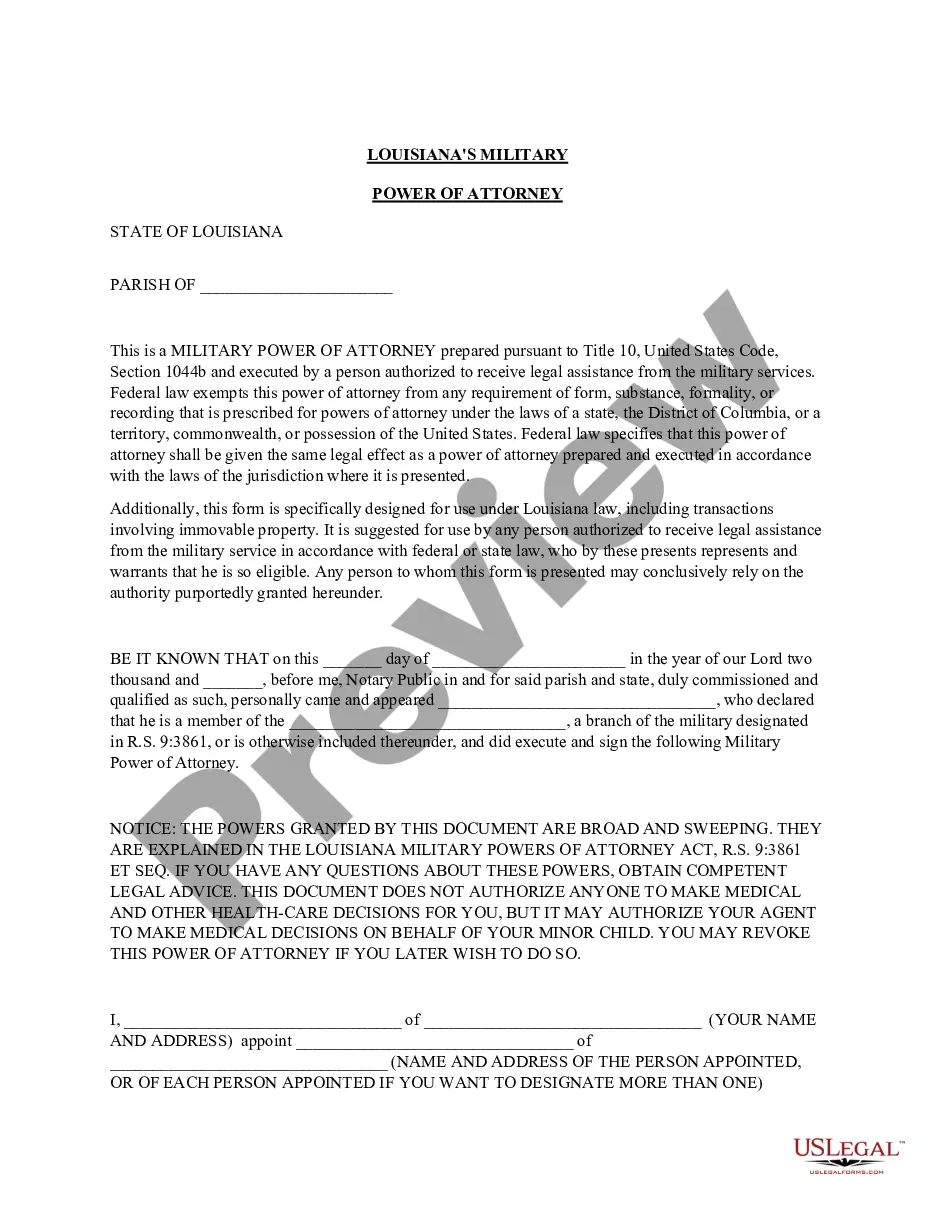

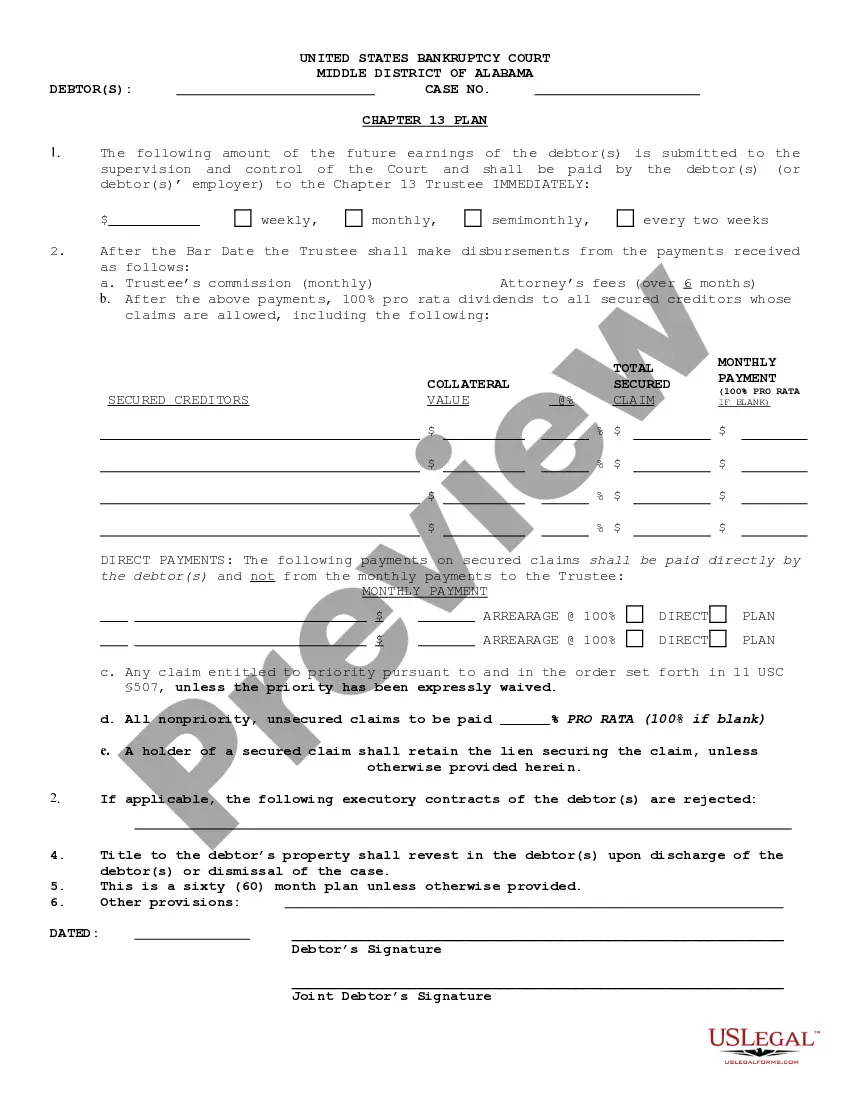

US Legal Forms is the premier online resource for legal templates, boasting over 85,000 state-specific documents and various tools that will assist you in completing your paperwork swiftly.

Is this your first experience with US Legal Forms? Register and create your account in a few minutes, granting you access to the form catalog and Beneficiary Distribution Guidelines. Then, follow the instructions below to complete your form: Ensure you have selected the appropriate form by using the Review feature and examining the form description. Choose Buy Now once ready, and pick the monthly subscription plan that suits you best. Click Download then fill out, sign, and print the form. US Legal Forms has twenty-five years of expertise assisting users in managing their legal documents. Acquire the form you require right now and streamline any process effortlessly.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific documents available for download at any time.

- Protect your document management processes with a top-notch service that enables you to create any form within moments without any additional or concealed charges.

- Simply Log In to your account, locate Beneficiary Distribution Guidelines and obtain it immediately from the My documents section.

- You can also access forms you have previously downloaded.

Form popularity

FAQ

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

If you need to send money across to another account, you need to add the account as a beneficiary. Keep the beneficiary's account details handy. These include the bank account number, the IFSC code, the branch details, the beneficiary's name as mentioned in the bank account, and phone number.

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.