A finding of emancipation requires that the child place himself or herself beyond the control, custody, and care of the parents. Unless otherwise provided for in an underlying child support judgment, automatic emancipation shall occur if:

" The age of majority (21) is attained, unless the child support order specifies differently;

" The child marries;

" The child joins the military and serves on a full-time basis; or

" The child is convicted of a felony and is sentenced to incarceration of two (2) or more years for committing such felony.

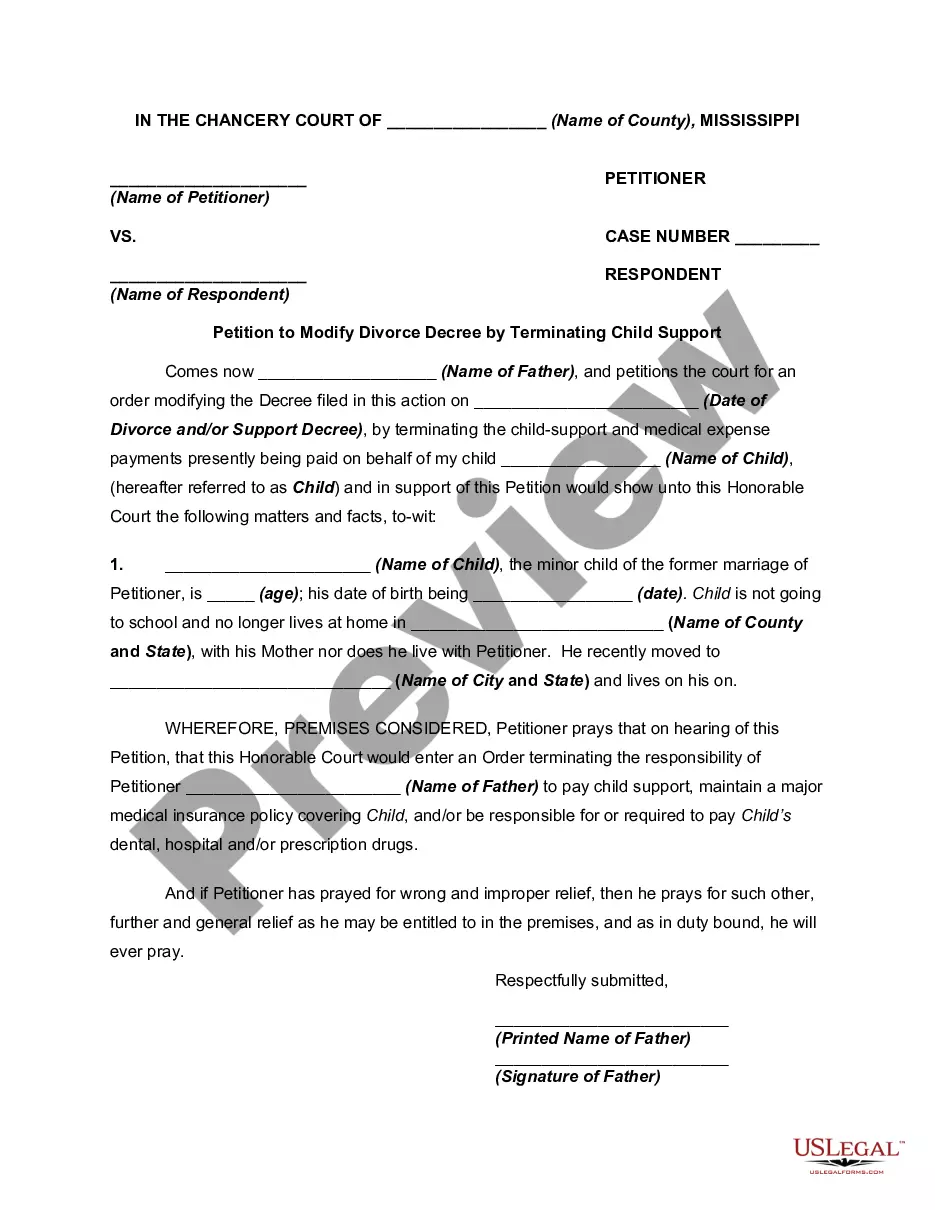

The following does not emancipate automatically and requires a court order for emancipation to eliminate or decrease the amount of child support:

" Discontinues full-time enrollment in school having attained the age of eighteen (18) years, unless the child is disabled;

" Voluntarily moves from the home of the custodial parent or guardian, and establishes independent living arrangements, obtains full-time employment and discontinues educational endeavors prior to attaining the age of twenty-one (21); or

" Cohabits with another person without the approval of the parent obligated to pay support; cohabits generally means living together as if husband and wife. (See Rennie v. Rennie, 718 So. 2d 1091 (Miss. 1998).