Trust Account For Law Firm

Description

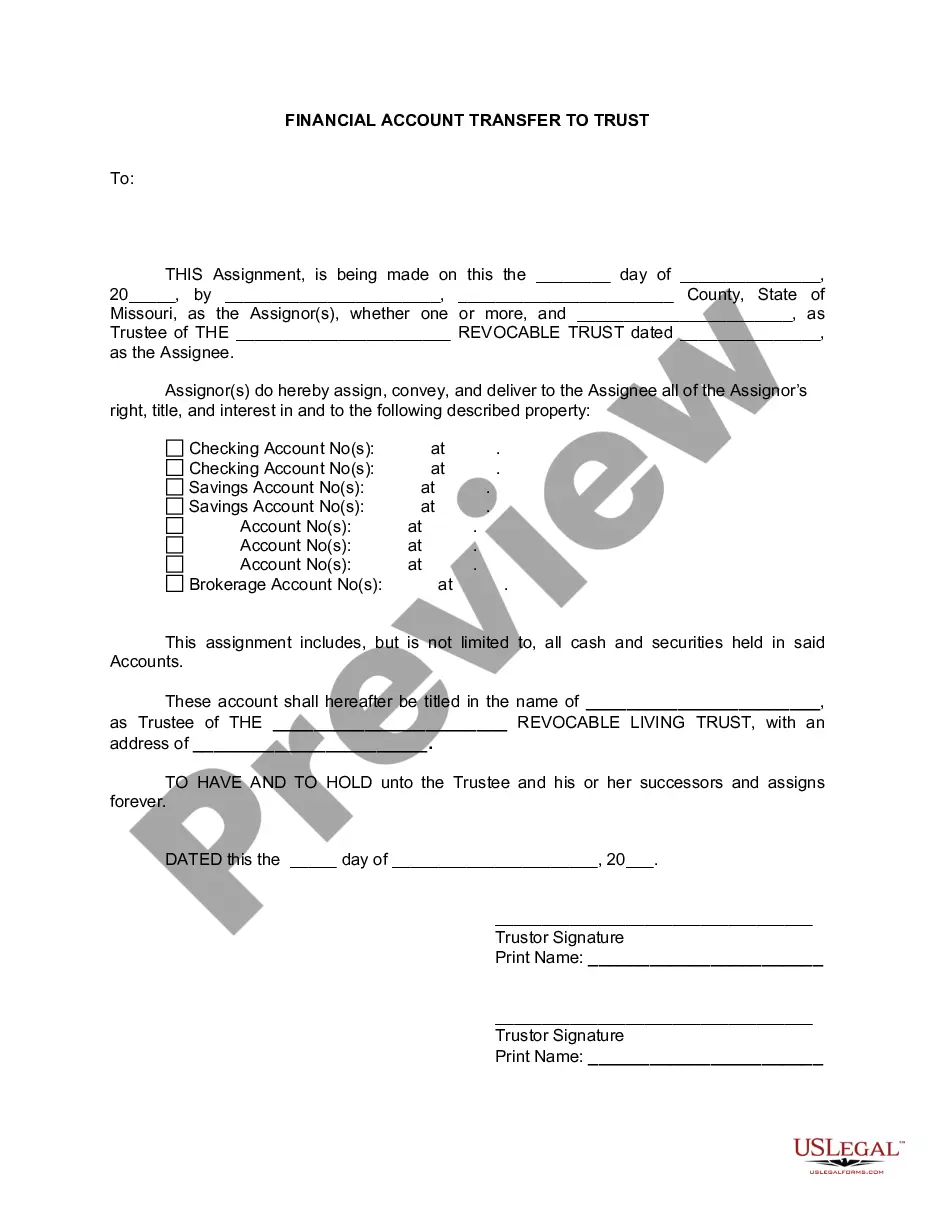

How to fill out Missouri Financial Account Transfer To Living Trust?

- Access US Legal Forms and log into your account. Ensure your subscription is active before proceeding.

- Preview the desired document and read its description to confirm it meets your specific requirements and aligns with your jurisdiction.

- Search for additional templates if you don't find the right fit by using the search functionality.

- Purchase the document by selecting your preferred subscription plan and ensuring you register for an account.

- Complete your purchase by providing payment details through credit card or PayPal.

- Download the legal form and store it securely on your device for easy access under the 'My Forms' section of your profile.

US Legal Forms not only empowers individuals and attorneys to easily navigate legal documentation but also enhances the efficiency of managing trust accounts and other forms with its extensive library.

Don't compromise on the quality of your legal documents. Visit US Legal Forms today to streamline your law firm's document needs!

Form popularity

FAQ

To fill out a trust fund for a law firm, start by identifying the client’s name and the amount deposited. Next, record the purpose of the funds, ensuring each detail aligns with your bookkeeping standards. Document every transaction accurately to uphold the integrity of the trust account for law firm operations. Additionally, consider using tools from US Legal Forms to help you manage this process more efficiently.

The basic bookkeeping of a trust account for a law firm involves accurate tracking of deposits and withdrawals. This includes maintaining records of every transaction related to client funds. Law firms must keep detailed statements to ensure transparency and to comply with legal requirements. Employing a reliable accounting system can streamline this process, making it easier to manage your trust account effectively.

To obtain a trust account for law firm operations, begin by selecting a bank or financial institution that offers legal trust account services. After completing the necessary application and compliance with specific regulations, you can set up an account that meets your firm's needs. Ensure that your trust account for law firm use adheres to state bar association rules and guidelines. Using platforms like USLegalForms can help streamline the process by providing templates and resources to manage your trust account effectively.

To fund a law firm, you can start with personal investments, client retainers, and lines of credit. Many attorneys also consider establishing a trust account for law firm needs, which helps manage client funds securely and efficiently. Additionally, obtaining loans or seeking venture capital can provide the necessary capital to kickstart your practice. It's essential to have a solid financial plan that considers both operational costs and growth opportunities.

Trust accounting for law firms involves accurately tracking and managing client funds within trust accounts. Law firms must maintain detailed records of all transactions to ensure compliance with state regulations and client agreements. Regular reconciliations of these accounts safeguard against errors and mismanagement. Using professional accounting software can enhance the efficiency of trust account management.

A trust payment to a lawyer refers to the funds that clients deposit into a trust account for the lawyer's future services. This payment ensures that clients' funds are secure until they are formally earned by the lawyer. It also simplifies billing for ongoing services, allowing clients to manage payments transparently. A trust account for law firm can make this entire process smoother and more organized.

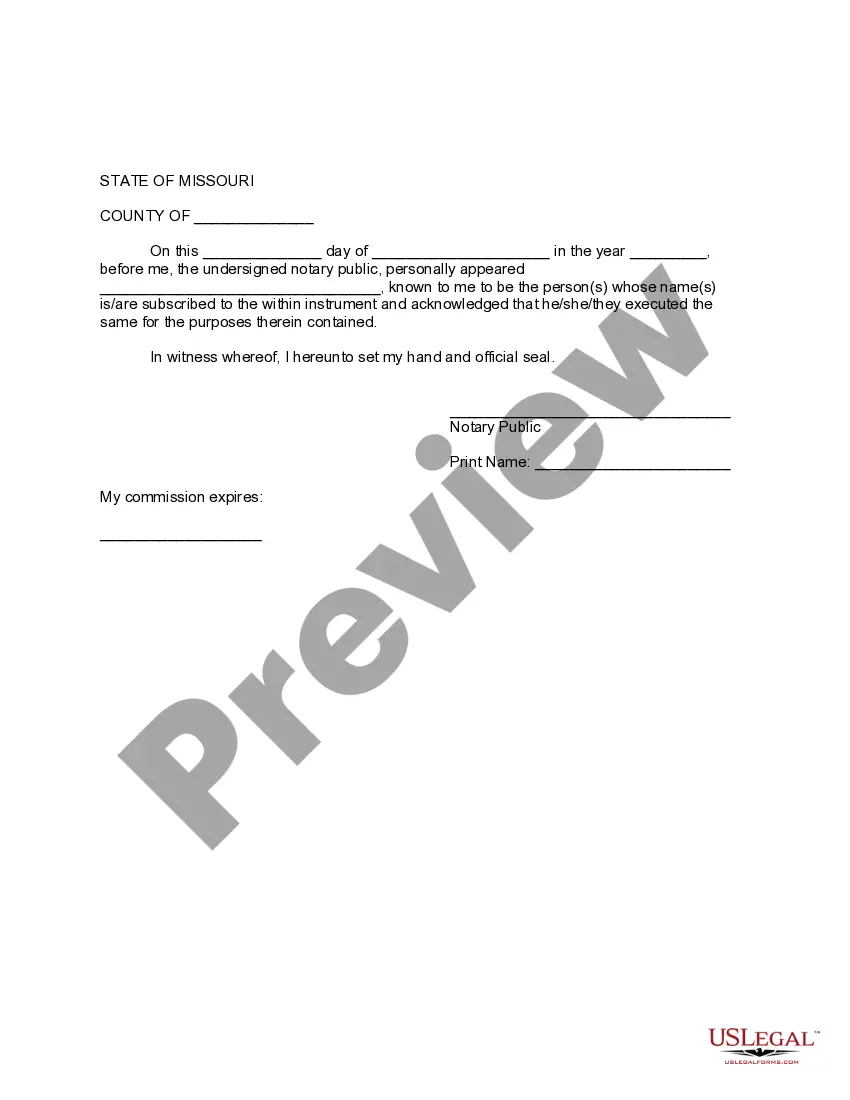

To file a trust fund, you generally need to draft a trust agreement and ensure that all necessary documentation is complete. After preparing the documents, you'll need to open a trust account for law firm purposes at your bank. Filing may also involve notifying relevant authorities or beneficiaries about the trust's existence. Seek assistance from a legal professional to ensure all steps are correctly followed.

A trust account for a lawyer is a special bank account used to hold funds on behalf of clients. These accounts must be handled with care to prevent co-mingling of personal and client funds. Proper management of a trust account for law firm not only fulfills legal obligations but also enhances the firm's reputation. You can consider using technology platforms to simplify the management of these accounts.

Yes, a law firm can serve as a trustee. This can be beneficial for clients who need a neutral party to manage their trust assets. As a trustee, the law firm ensures that the trust account for the law firm operates in compliance with legal standards and best practices. You can rely on professional legal guidance to handle these responsibilities effectively.

Trust accounting involves monitoring all transactions related to clients' funds held in trust accounts. This process requires documenting every deposit, withdrawal, and interest earned, ensuring accuracy and transparency. For a trust account for law firm, it's crucial to reconcile these records regularly to prevent discrepancies. Using reliable accounting software can help streamline this process, making it easier for lawyers to manage their client finances efficiently.