Trust Account For Family

Description

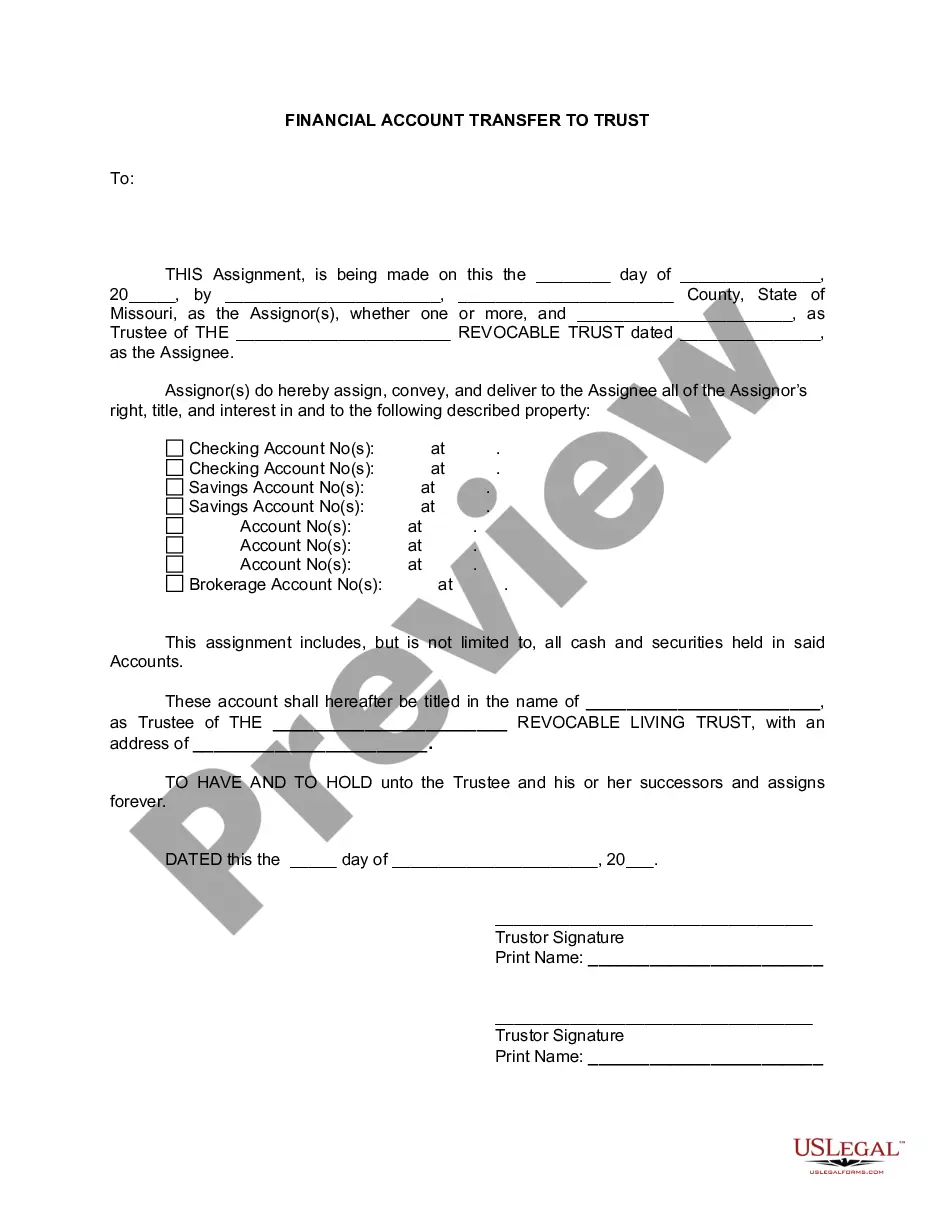

How to fill out Missouri Financial Account Transfer To Living Trust?

- Start by logging into your US Legal Forms account. If you're a new user, register for an account to access the extensive library of documents.

- Browse the available forms and use the Preview mode to ensure you select the template that fits your family trust requirements and complies with local regulations.

- If you can’t find an appropriate form, utilize the Search function to explore more options until you discover the right one.

- Choose your desired form and click the Buy Now button to select a suitable subscription plan. Make sure that your account remains active for smooth access.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Download your completed form directly to your device. You can always access it later through the My Forms section of your account.

In conclusion, US Legal Forms simplifies the process of securing legal documentation for family trust accounts. With a vast library and expert support, you can ensure your forms are compliant and effective.

Start managing your family trust account today by visiting US Legal Forms and accessing the documentation you need!

Form popularity

FAQ

Failing to file taxes for a trust account for family can lead to serious consequences. The IRS may impose penalties and interest on unpaid taxes, and trustees could face personal liability. Furthermore, not filing can complicate tax filings for beneficiaries. To avoid these issues, it is wise to seek guidance from a tax professional or use reliable resources like US Legal Forms.

The new IRS rules regarding trust accounts for family can have significant implications. Recent legislation may affect reporting requirements and eligibility for certain tax deductions. It's crucial for trustees to stay updated on these changes to maintain compliance and minimize tax liability. Consulting a tax expert can help you navigate these rules effectively.

Filing taxes for a trust account for family involves several steps. You may need to file IRS Form 1041, which is specifically for estates and trusts. Accurate record-keeping is essential, so collect all income statements and relevant documents ahead of time. You might also consider using platforms like US Legal Forms to assist you in the tax preparation process.

Yes, a trust account for family may require a 1099 form if it has generated income. This income can come from investments, interest, or other sources. The IRS requires the trustee to report this income to ensure proper tax compliance. Consulting with a tax professional can provide clarity on your specific situation.

A family trust is a legal arrangement where one party holds assets on behalf of family members. For example, a parent may establish a trust account for family children that stipulates funds will be used for education expenses. This not only helps in managing the distribution of assets but also protects family wealth for future generations. You can find helpful resources and templates on US Legal Forms to create a structured family trust.

To set up a trust account for family members, start by selecting the type of trust that meets your family’s needs. Then, gather the necessary documentation, including the names of beneficiaries and the assets to be placed in the trust. Following this, you should draft the trust agreement, clearly outlining how the trust operates. With tools from US Legal Forms, you can streamline this process to ensure all legal requirements are met.

One of the biggest mistakes parents often make when setting up a trust account for family is failing to clearly define the terms of the trust. Parents should specify how the funds can be used and set milestones for distribution. Additionally, ignoring the importance of choosing a trustworthy trustee can lead to complications later. Using a platform like US Legal Forms can help parents navigate these details effectively.

The best structure for a family trust often includes a designated trustee who manages the trust assets and distributes them according to your wishes. Incorporating specific conditions for distribution, such as educational milestones or age requirements, can ensure that it meets the family’s long-term goals. Also, opening a trust account for family with the right financial institution can streamline fund management. For assistance navigating the setup process, US Legal Forms provides valuable resources.

A spendthrift trust can effectively protect family assets by preventing beneficiaries from squandering their inheritance. This type of trust restricts access to the assets until the recipient reaches a certain age or meets specific criteria, ensuring their financial security. Additionally, establishing a trust account for family with clear guidelines can safeguard assets from creditors or divorce settlements. Consider legal resources like US Legal Forms to help you set this up correctly.

Choosing between a revocable trust and an irrevocable trust depends on your specific needs. A revocable trust allows you to retain control over the assets and change the terms as needed, offering flexibility. In contrast, an irrevocable trust provides better protection for your assets but generally cannot be altered after creation. For many families, setting up a trust account for family through a revocable trust is a practical way to manage assets while retaining some level of control.