Irrevocable Trust With Grantor As Beneficiary

Description

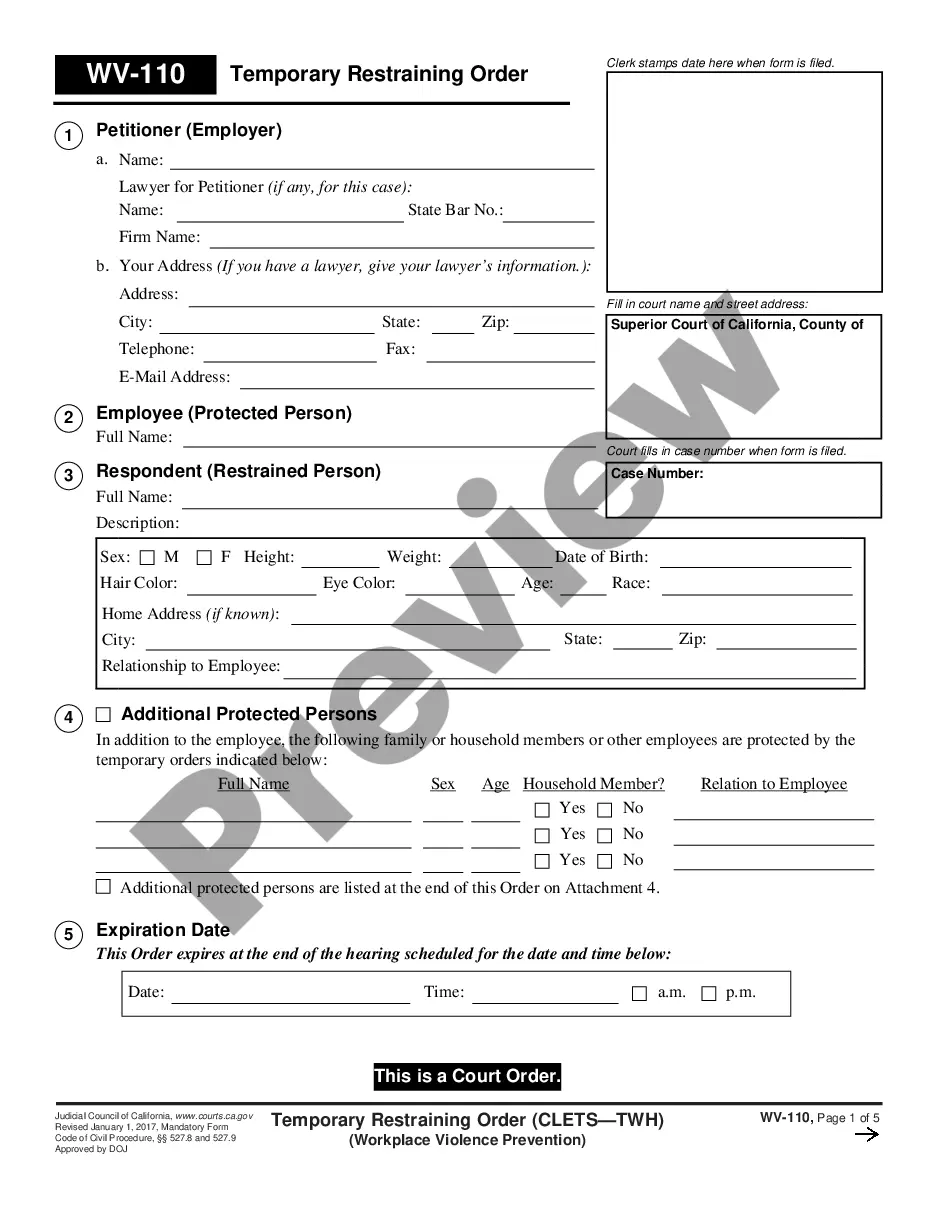

How to fill out Missouri Self-Settled Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

- Log in to your US Legal Forms account. Ensure your subscription is active; renew it if necessary.

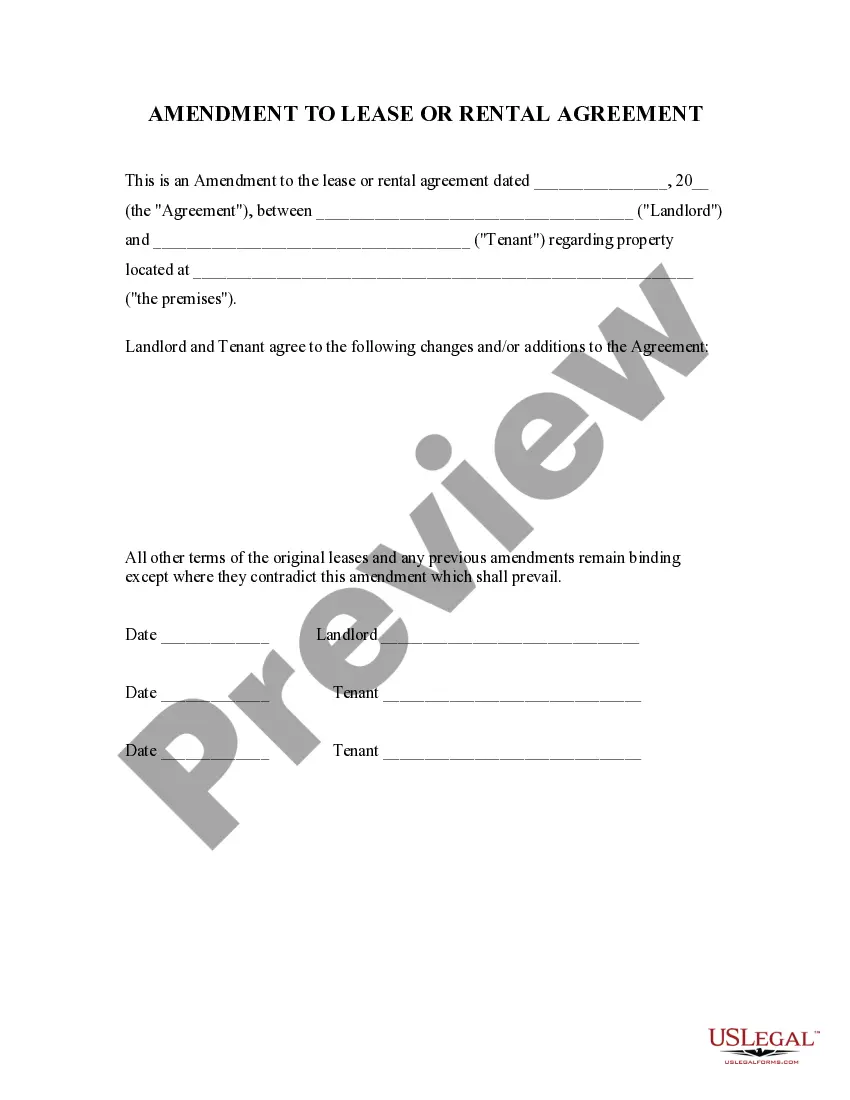

- Review the form description and use the Preview mode to confirm it's the suitable template for your circumstances.

- If adjustments are needed, utilize the Search tab to explore other options that align with your requirements.

- Select the appropriate subscription plan by clicking the Buy Now button. Create an account if this is your first purchase.

- Complete your transaction by entering your payment details through credit card or PayPal.

- Download your completed form and save it for easy access through the My Forms section in your profile.

In conclusion, utilizing US Legal Forms ensures you have access to a comprehensive library of over 85,000 legal forms, all designed to simplify your legal documentation processes.

Take action today and empower yourself with the legal resources you need by visiting US Legal Forms.

Form popularity

FAQ

One major mistake parents often make when establishing a trust fund is failing to clearly define their intentions and objectives. When creating an irrevocable trust with grantor as beneficiary, it’s essential to communicate how the funds should be used and managed. Vague instructions can lead to confusion and disputes among beneficiaries. Utilizing resources from platforms like US Legal Forms can aid in drafting clear and comprehensive legal documents.

Upon the death of the grantor, an irrevocable trust with grantor as beneficiary usually continues to exist because it is designed to be independent of the grantor. The assets in the trust will be distributed according to the terms outlined in the trust document, bypassing probate. This feature often helps in managing tax implications for the beneficiaries. It is advisable to revisit the trust's terms and consult with a legal professional to ensure everything is in order.

Yes, in an irrevocable trust with grantor as beneficiary, the grantor can also serve as the beneficiary. This arrangement allows the grantor to receive benefits from the trust while still maintaining the trust's irrevocable status. It is important to note, however, that this setup can have tax implications and may affect how assets are treated upon the grantor's passing. Always seek expert advice to navigate these complexities.

In the context of an irrevocable trust with grantor as beneficiary, the grantor can indeed be a beneficial owner. However, once the trust is established, the grantor relinquishes control over the assets within the trust. This separation is crucial, as it helps to shield those assets from creditors and estate taxes. To understand the implications fully, consider consulting with a legal expert.

To fill out an irrevocable trust with grantor as beneficiary, you should start by clearly defining the trust's purposes and terms. Include the names of the parties involved, such as the trustee and beneficiaries, and specify how the assets will be managed. It's essential to outline the conditions under which the grantor retains benefits from the trust. Consider using a platform like US Legal Forms, which provides templates and guidance to ensure you complete the document accurately and efficiently.

An irrevocable grantor trust may require the need to file a tax return, depending on the income generated by the trust assets. Generally, the grantor reports trust income on their personal tax return if they are also a beneficiary. Understanding your tax obligations ensures compliance and minimizes penalties. Utilizing resources like US Legal Forms can help clarify these requirements.

Yes, you can name yourself as a beneficiary of an irrevocable trust. This allows you to receive the benefits while simultaneously ensuring that the assets are protected from creditors or legal challenges. However, it's important to structure the trust carefully to navigate potential tax liabilities. Seeking professional guidance can prevent complications down the line.

The beneficial owner of an irrevocable trust typically refers to the beneficiaries named in the trust. If the grantor is also a beneficiary, they hold certain rights to receive benefits from the trust. However, the trust assets cannot be revoked or modified by the grantor once established. Familiarizing yourself with trust terms can enhance your understanding of ownership dynamics.

Yes, the grantor and beneficiary can be the same person in an irrevocable trust. This means you can create a trust for your own benefit, but there are tax implications that arise with this setup. Understanding these implications is key to maximizing your trust’s effectiveness. Getting legal advice can clarify how this arrangement works.

You file an irrevocable trust with your state’s governing authority, typically the probate court. This process helps to establish the trust legally and ensures compliance with state laws. Additionally, keeping documentation detailing the trust's creation and terms is important. For efficient management, consider platforms like US Legal Forms that provide guidance and forms.