Own Residence

Description

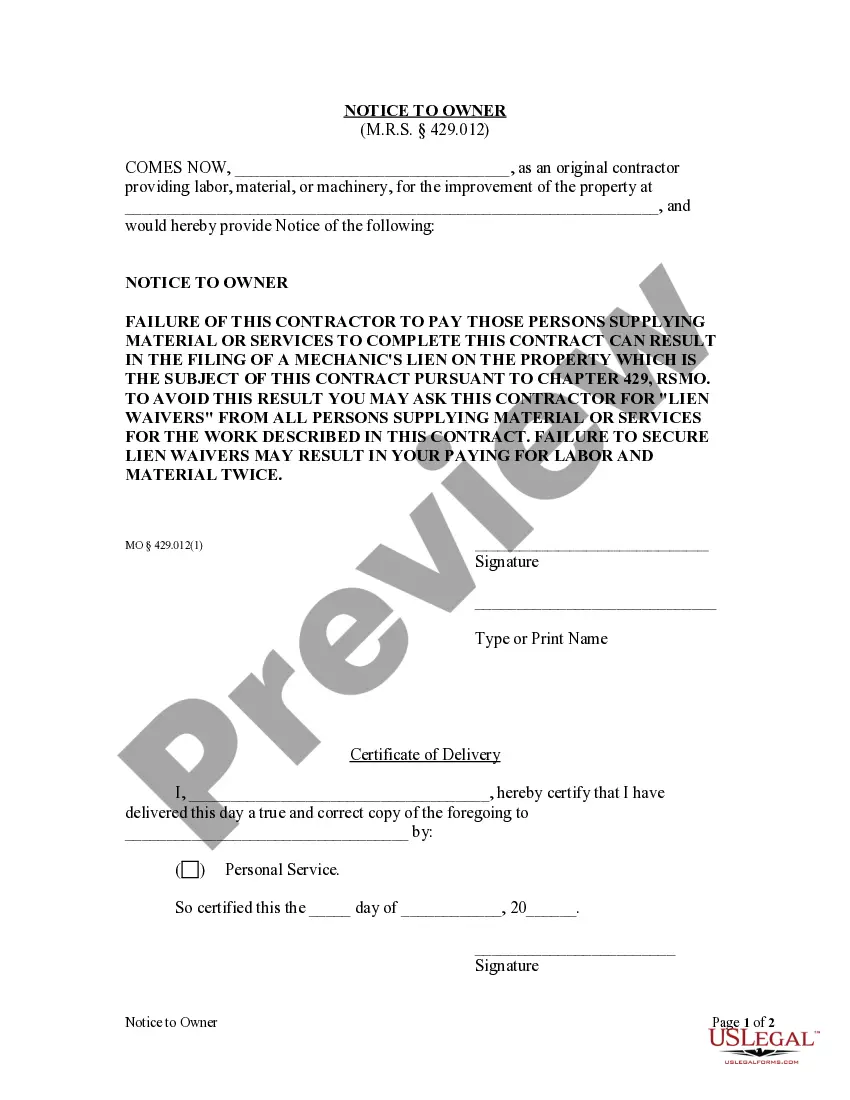

How to fill out Missouri Consent Of Owner - Residential - Individual?

- Begin by logging into your US Legal Forms account if you're a returning user; ensure your subscription is active before proceeding to download any documents.

- If you're new to the service, start by exploring the library and reviewing form previews for descriptions that match your requirements for owning a residence.

- Utilize the search feature to find any additional templates you may need. If the current choice doesn't fit, explore until you find the right one.

- Purchase your desired document by clicking the Buy Now button and selecting your preferred subscription plan. An account registration may be necessary.

- Complete your payment via credit card or PayPal for instant access to the documentation.

- Once purchased, download and save your document for easy access, which can also be retrieved later in the My Forms section of your profile.

In summary, US Legal Forms simplifies the process of obtaining legal documents related to owning a residence. Its vast library and user-friendly features allow for quick and accurate form completion, ensuring you're well-prepared for your real estate journey.

Take the first step towards securing your property by visiting US Legal Forms today!

Form popularity

FAQ

Proving your primary state of residence involves showing documentation that confirms you live in that state. Use documents such as a state-issued driver's license, tax returns, or property records. These documents collectively help assert your claim of owning a residence in that state.

The IRS identifies your primary residence through the information provided on your tax returns and the addresses used on official documents. When you file your taxes, you indicate where you reside, which the IRS keeps on record. Consistency in the documents you provide helps confirm your claim of primary residence.

A personal residence generally qualifies as any property where you live and intend to stay for a significant period. This could include single-family homes, condos, or townhouses. It's important to show that you treat the property as your own residence through activities like filing taxes or registering to vote from that address.

Owning a home often allows you to claim deductions that can increase your tax return. Mortgage interest, property taxes, and certain home-related expenses may be deductible and can significantly affect your tax situation. If you want to maximize your deductions related to your own residence, consider consulting a tax professional.

To prove your primary residence to the IRS, you should gather documents that clearly display your name and address. Common documents include tax returns, utility bills, or any government-issued identification. Keeping these documents organized will help you easily provide proof of your own residence when needed.

The IRS accepts several documents as proof of residency, including your driver's license, state ID, or utility bills showing your name and address. Additionally, bank statements and tax documents can also serve as evidence of your primary residence. Ensuring these documents reflect your current address is essential to meet IRS requirements.

Proving someone's primary residence can be done using various documents that list their name and address. Items such as utility bills, lease agreements, or government correspondence can act as solid evidence of residency. Additionally, witness statements from neighbors or friends can also help to support their claim of primary residence.

To make your house your primary residence, you need to establish it as your main home where you live most of the time. This can be done by changing your address on important documents, such as your driver's license and voter registration. Additionally, consider using utility bills in your name at that address to strengthen your claim to own residence.

A qualified residence includes a primary home and one additional dwelling, such as a vacation home. It must be a property where you live for a minimum part of the year, providing both comfort and lasting memories. The IRS allows you to deduct mortgage interest on qualified residences, making it an attractive option for homeowners. Ensuring your property meets these criteria can enhance the financial benefits you receive related to your own residence.

Lenders verify that your property is your primary residence through documentation and home inspections. They often request proof of residency, such as utility bills, tax returns, or a driver's license showing the address. Additionally, lenders may ask you to establish a consistent pattern of living at the property. By confirming your own residence status, lenders can assess your financial situation accurately.