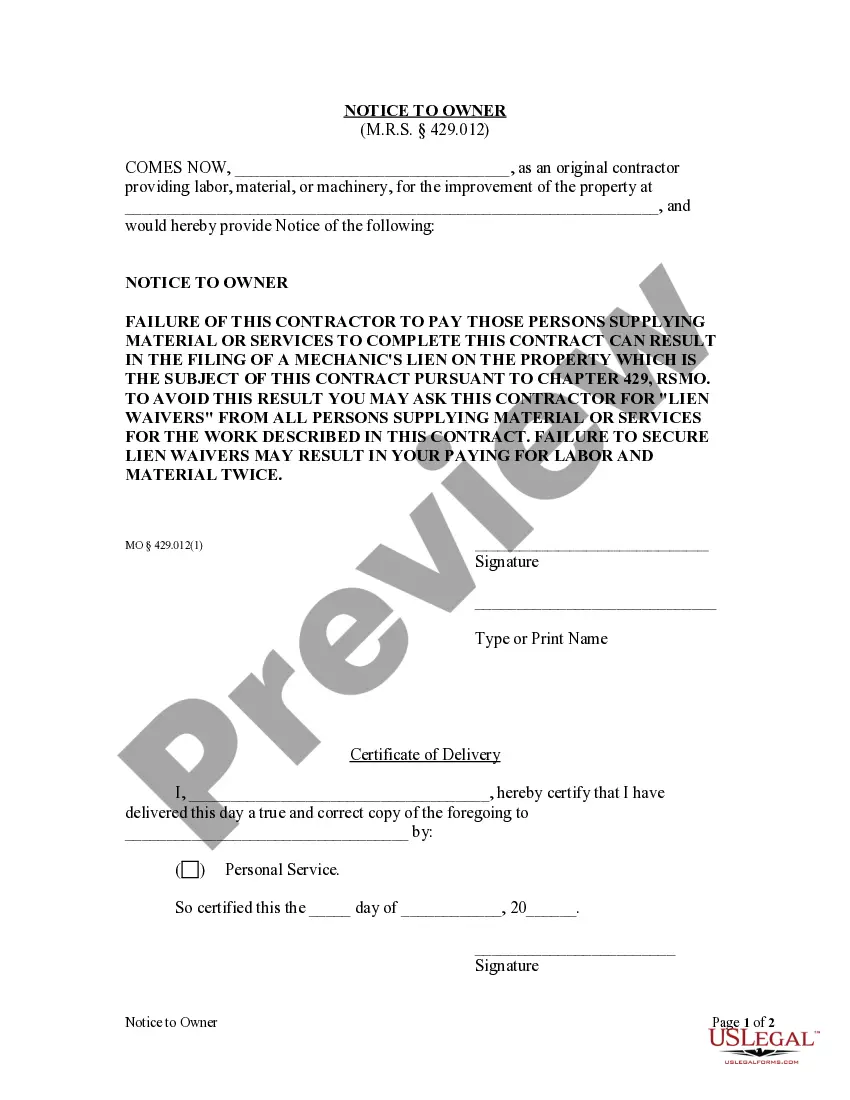

Missouri Notice Of Intent To Lien Form

Description

Form popularity

FAQ

The notice of intent to file a lien in Missouri informs the property owner that you plan to file a lien against their property. This notice is helpful in initiating communication about payment disputes before taking further legal steps. The Missouri notice of intent to lien form aids in simplifying this process and ensures you adhere to state laws.

A notice of intent is a formal declaration that indicates a party's intention to take specific actions, such as filing a lien. It serves as a warning to the property owner and allows them the opportunity to address any disputes or issues. The Missouri notice of intent to lien form is crucial in this process, ensuring all parties are informed.

In Missouri, a lien waiver is not typically required but may be used in certain situations. This document can help protect parties involved in a transaction by ensuring that liens will not be enforced after payment. Even so, using the Missouri notice of intent to lien form properly can offer protection for those wanting to secure their financial interests.

In Missouri, to create a lien, you must follow specific legal requirements. First, a written contract or agreement is often necessary. Additionally, you need to provide proper documentation and filing of the Missouri notice of intent to lien form to establish the lien effectively.

Form 4809 in Missouri pertains to the Tax Exempt Lien Notice. This form notifies purchasers of outstanding property taxes that may affect the title. By leveraging the Missouri notice of intent to lien form, you can better understand your rights and obligations concerning liens related to property taxes.

A lien waiver in Missouri is a document that relinquishes the lien rights on a property. This often occurs once payment has been made to the contractor or service provider. Using the Missouri notice of intent to lien form can clarify the process and help prevent lien issues when managing construction or repair projects.

To remove a lien from a title in Missouri, you must obtain a lien release from the lienholder. Once you have the completed lien release document, submit it, along with the appropriate application and fees, to your local Department of Revenue office. The Missouri notice of intent to lien form can guide your understanding of lien processes in Missouri.

Yes, a bill of sale is required to transfer title in Missouri. This document acts as proof of the transaction and includes essential information about the buyer, seller, and the vehicle. Utilizing the Missouri notice of intent to lien form can also be beneficial if a lien exists on the title during this transfer.

Yes, Missouri requires a notarized lien release to ensure the proper and legal removal of a lien. This process helps protect both the lienholder and the property owner. You can find the Missouri notice of intent to lien form to initiate the lien process, but remember, the release must be properly notarized to be valid.

In Missouri, a lien is generally valid for five years from the date it is filed. After this period, if the lienholder has not taken action to enforce the lien, it may become invalid. To keep your lien active, it is important to stay aware of renewal options and deadlines.