Missouri Foreign Llc Registration Withholding

Description

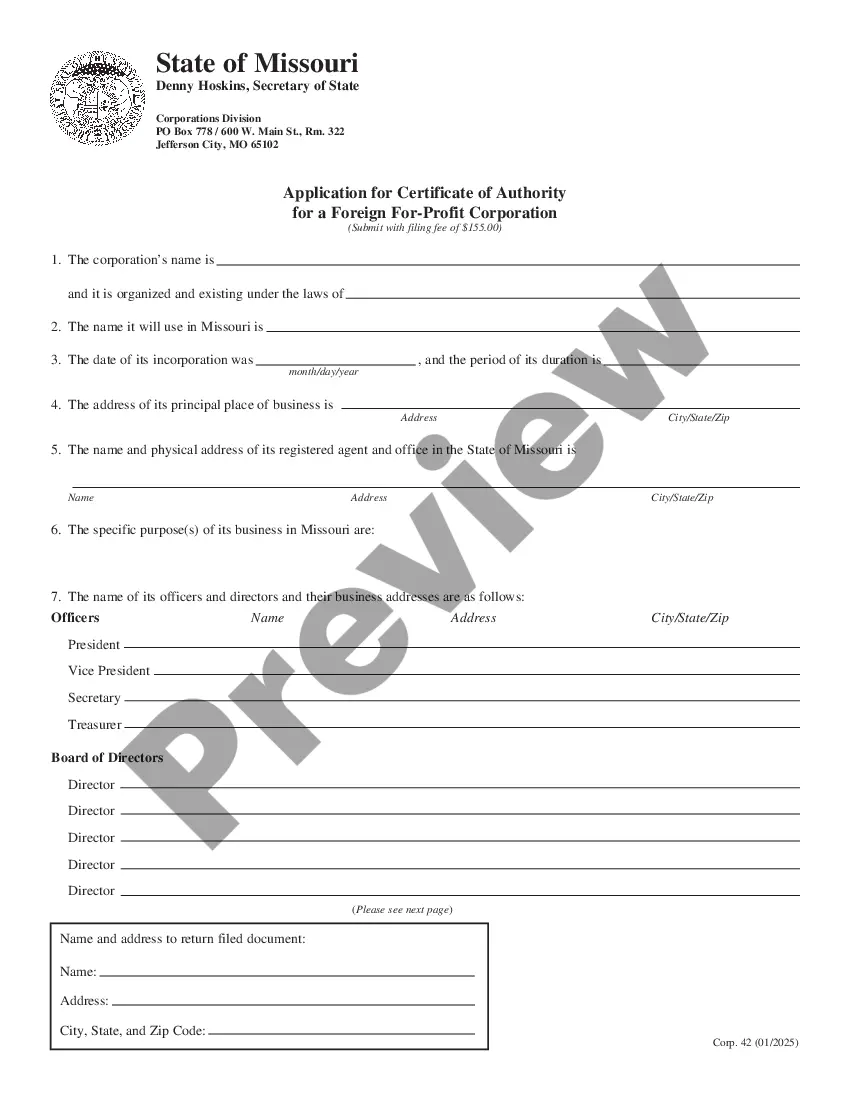

How to fill out Missouri Registration Of Foreign Corporation?

Creating legal documents from the beginning can occasionally be somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of preparing Missouri Foreign Llc Registration Withholding or any other documentation without unnecessary complications, US Legal Forms is always available for you.

Our online repository of over 85,000 current legal forms covers nearly every area of your financial, legal, and personal matters.

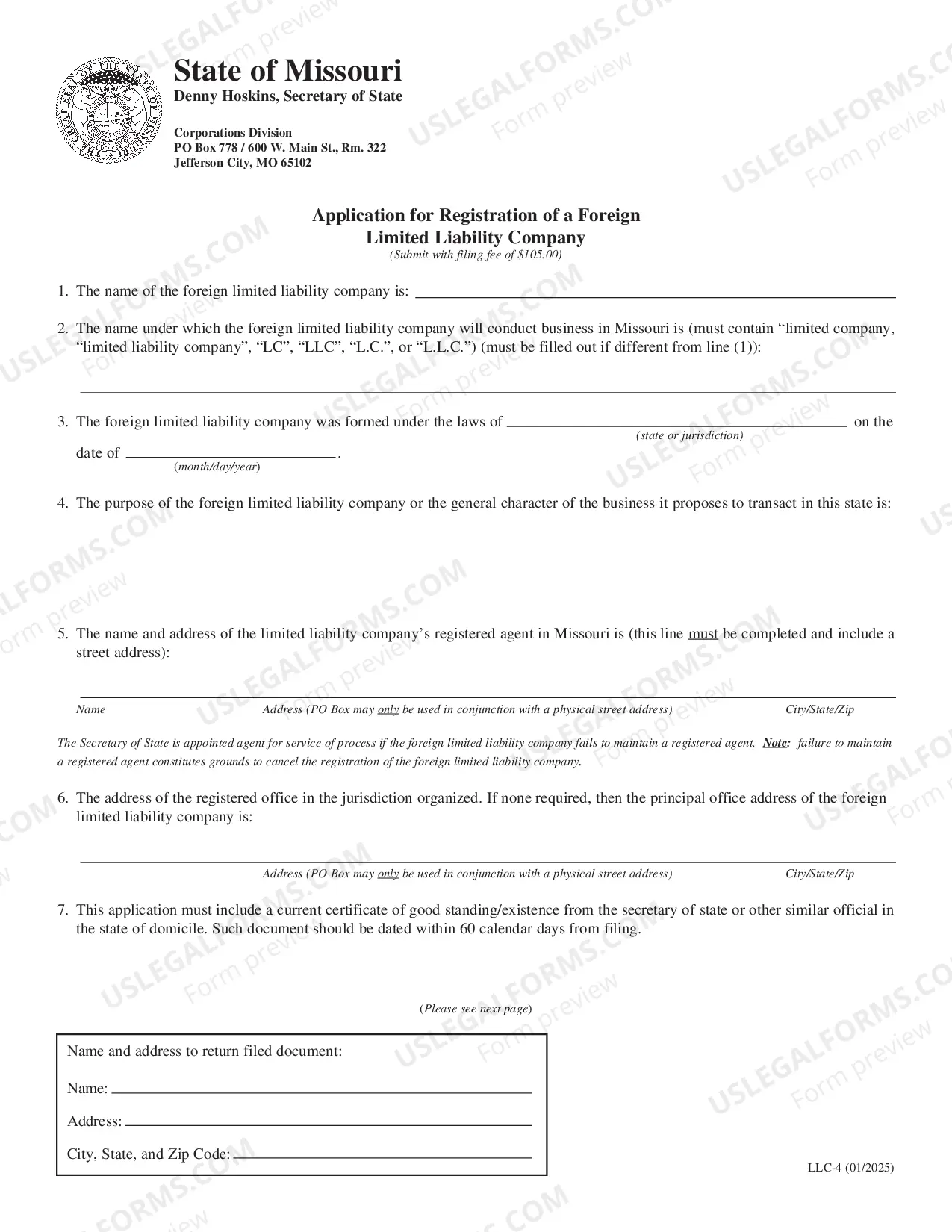

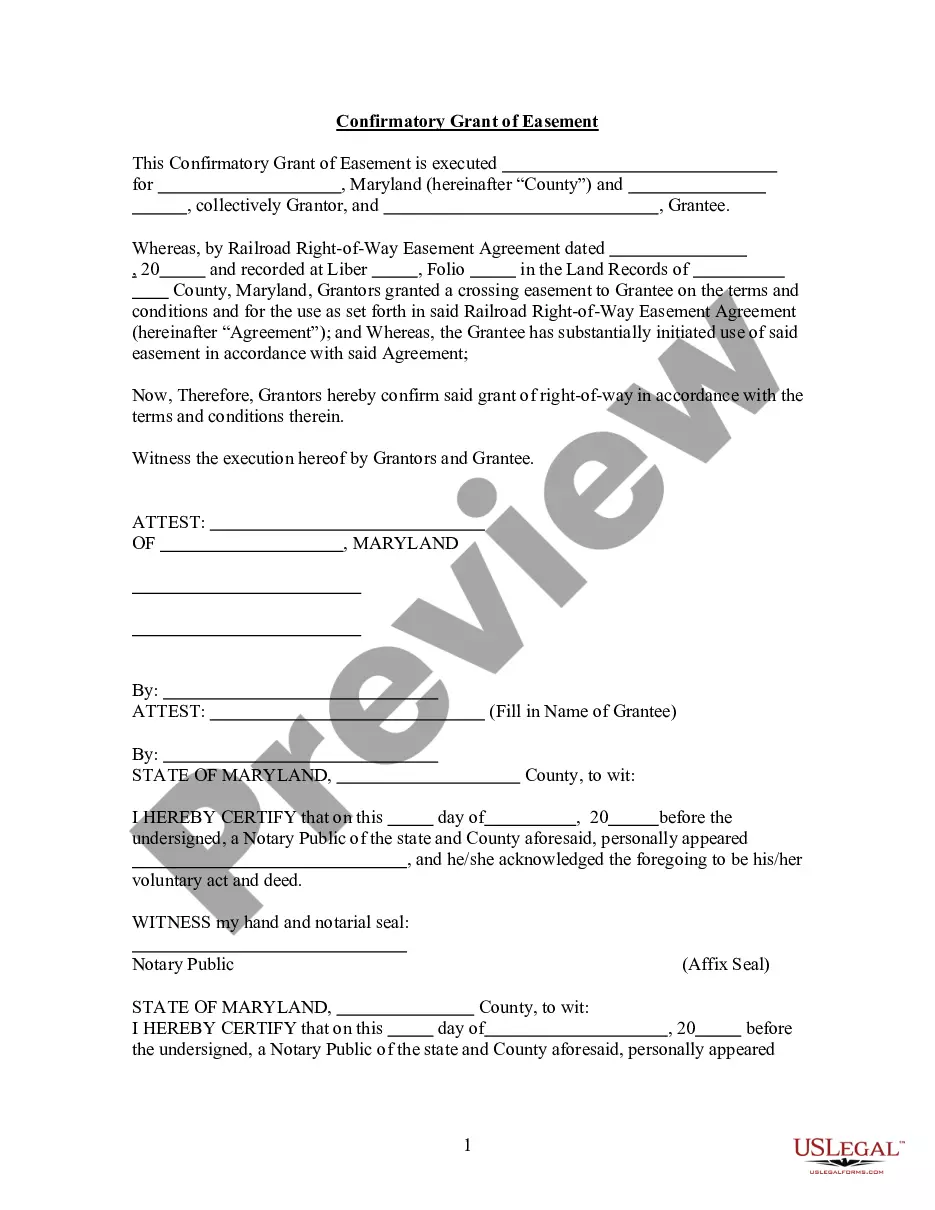

Examine the form preview and descriptions to ensure you are selecting the correct form. Ensure the form you choose meets the standards of your state and county. Select the most appropriate subscription plan to obtain the Missouri Foreign Llc Registration Withholding. Download the document. Then fill it out, sign it, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and simplify the document preparation process!

- With just a few clicks, you can quickly access state- and county-compliant templates carefully crafted for you by our legal experts.

- Utilize our site whenever you need a dependable and trustworthy service through which you can effortlessly locate and download the Missouri Foreign Llc Registration Withholding.

- If you’re familiar with our services and have previously registered with us, simply Log In to your account, choose the template, and download it or re-download it anytime later in the My documents section.

- Not signed up yet? No problem. It takes minimal time to register and explore the library.

- However, before proceeding to download Missouri Foreign Llc Registration Withholding, consider these recommendations.

Form popularity

FAQ

Yes, an employer is required to withhold Missouri tax from all wages paid to an employee in exchange for services the employee performs for the employer in Missouri.

Missouri Withholding Account Number & Employer Account Number. Register online as a new business. You will receive both your Withholding Account Number and Employer Account Number within 2 weeks.

Exemption from withholding. You may claim exemption from withholding for 2023 if you meet both of the following conditions: you had no federal income tax liability in 2022 and you expect to have no federal income tax liability in 2023.

Limited Liability Company (LLC) taxed as a partnership income is passed directly through to the members ing to the amount of stock held. Generally no income tax is paid by the LLC.

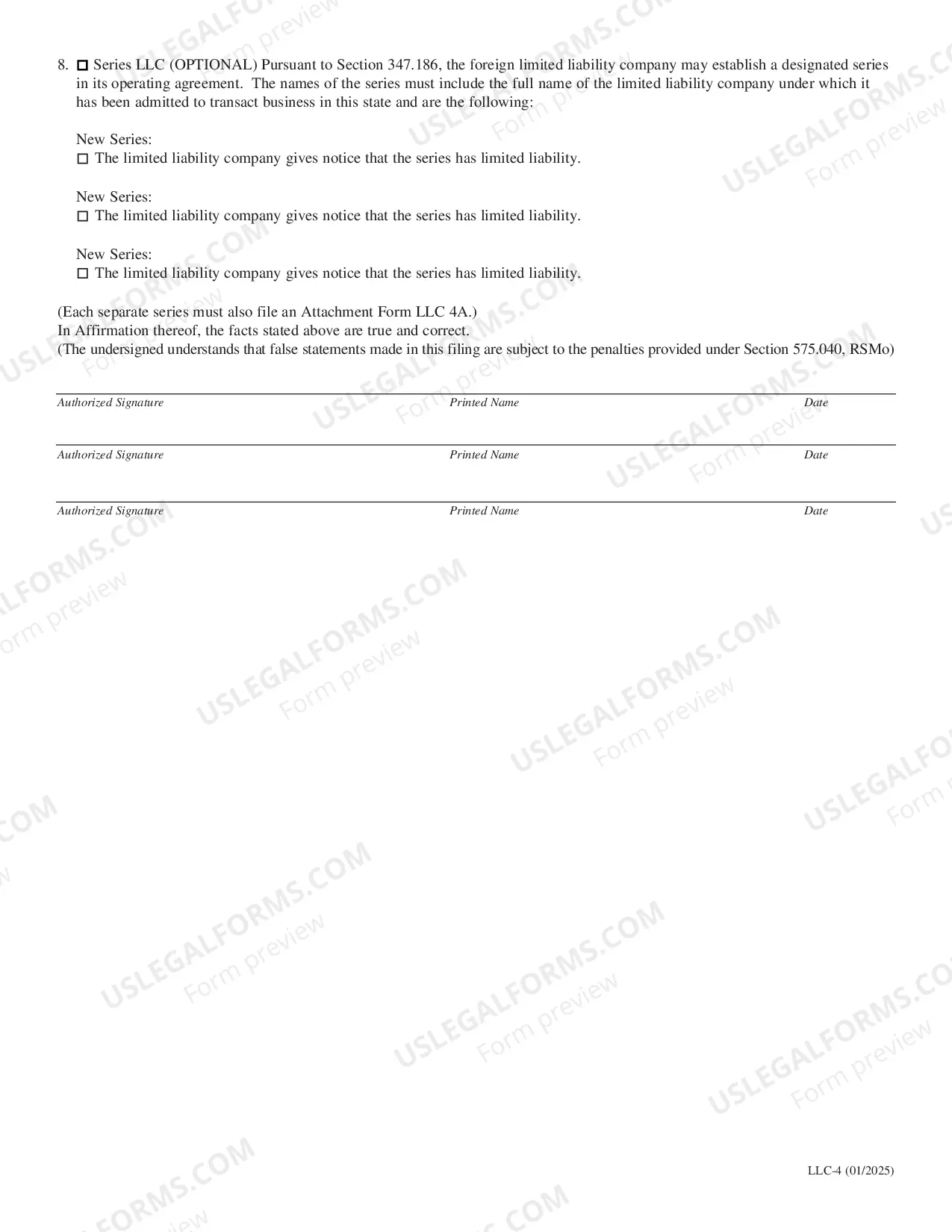

To do business as a foreign LLC in Missouri, you'll need to appoint a local registered agent, file an Application for Registration of a Foreign Limited Liability Company with the Missouri Secretary of State, and pay the state filing fee of $105 (plus a 2.15% added fee if paying by credit card).