This Registration of Foreign Corporation form includes Step by Step Instructions. Required to register your non-Missouri corporation in Missouri.

Missouri Registration of Foreign Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Registration Of Foreign Corporation?

Obtain any document from 85,000 legal templates including Missouri Registration of Foreign Corporation online with US Legal Forms. Each template is crafted and revised by state-certified lawyers.

If you already possess a subscription, Log In. Once you’re on the document’s page, click the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the steps outlined below.

With US Legal Forms, you’ll always have quick access to the appropriate downloadable template. The platform provides access to forms and categorizes them to ease your search. Utilize US Legal Forms to acquire your Missouri Registration of Foreign Corporation quickly and effortlessly.

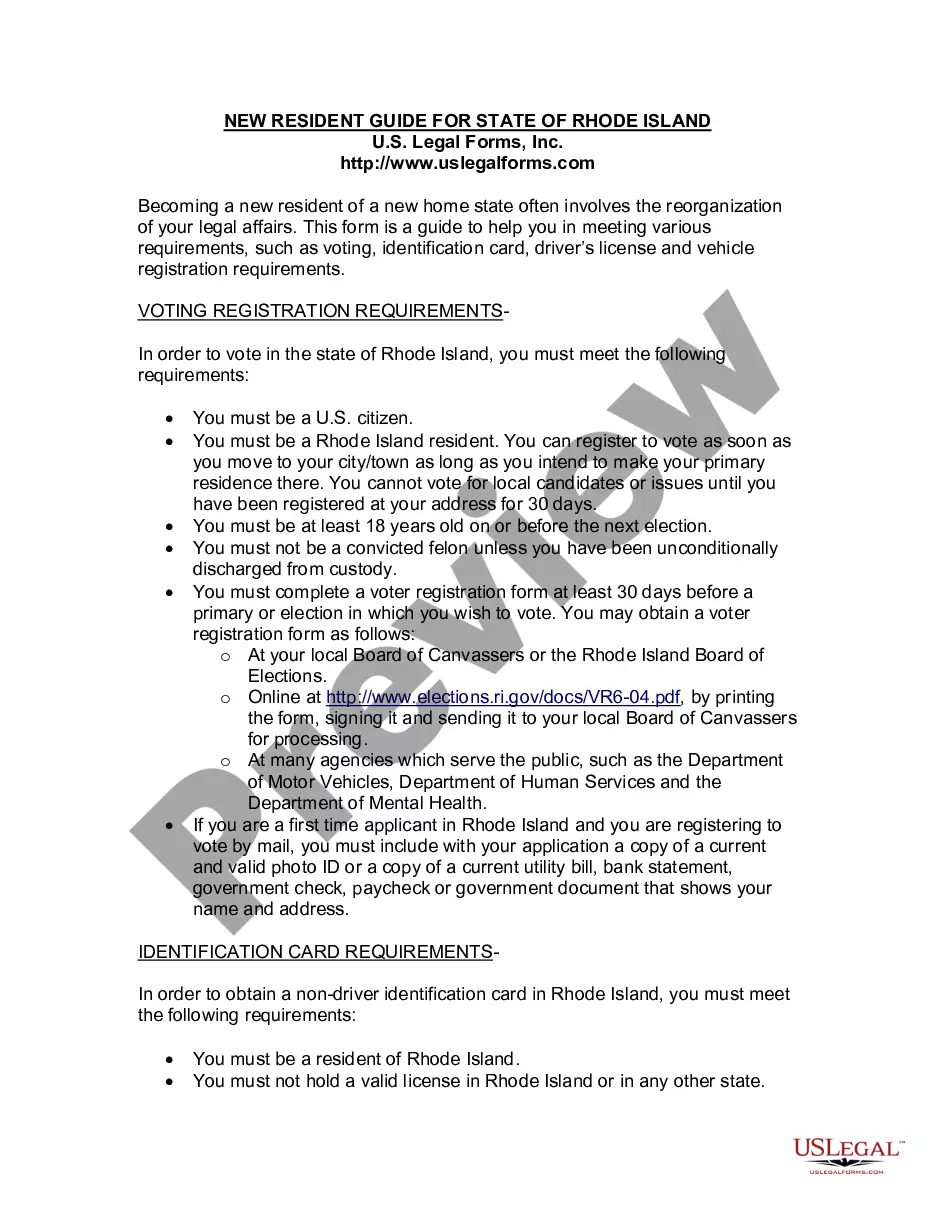

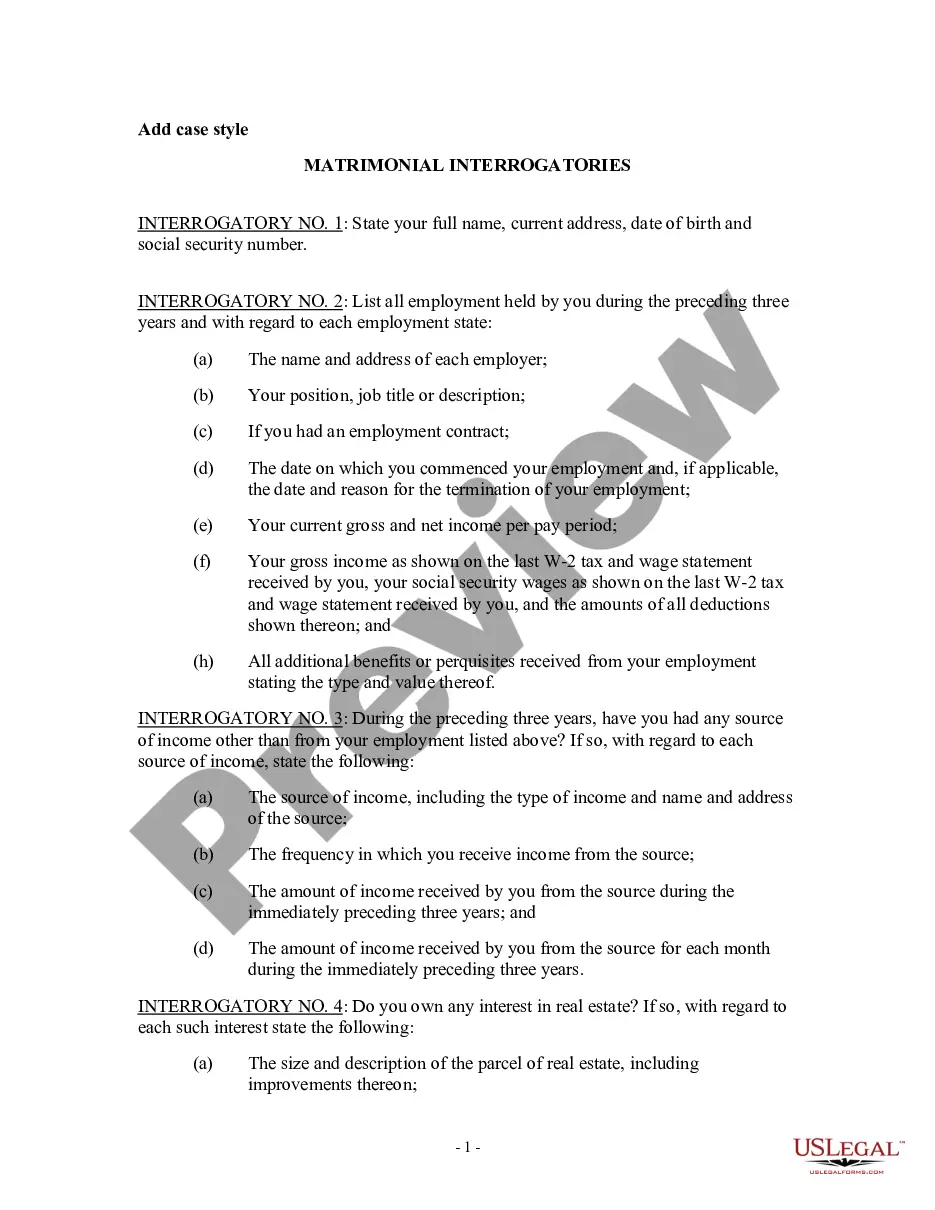

- Verify the state-specific criteria for the Missouri Registration of Foreign Corporation you wish to utilize.

- Browse through the description and preview the example.

- When you’re confident that the example meets your needs, click Buy Now.

- Choose a subscription plan that fits your budget.

- Create a personal account.

- Make a payment in one of two convenient methods: by credit card or through PayPal.

- Select a format to download the document; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is prepared, print it or save it to your device.

Form popularity

FAQ

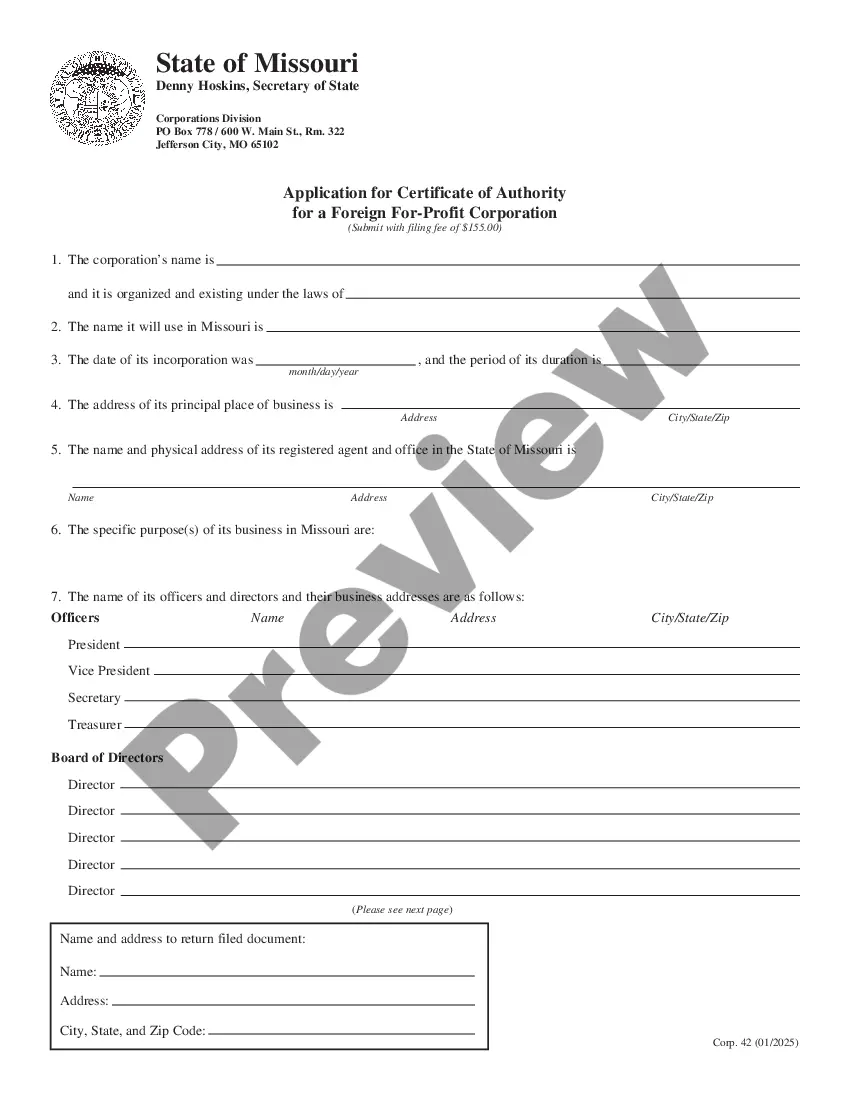

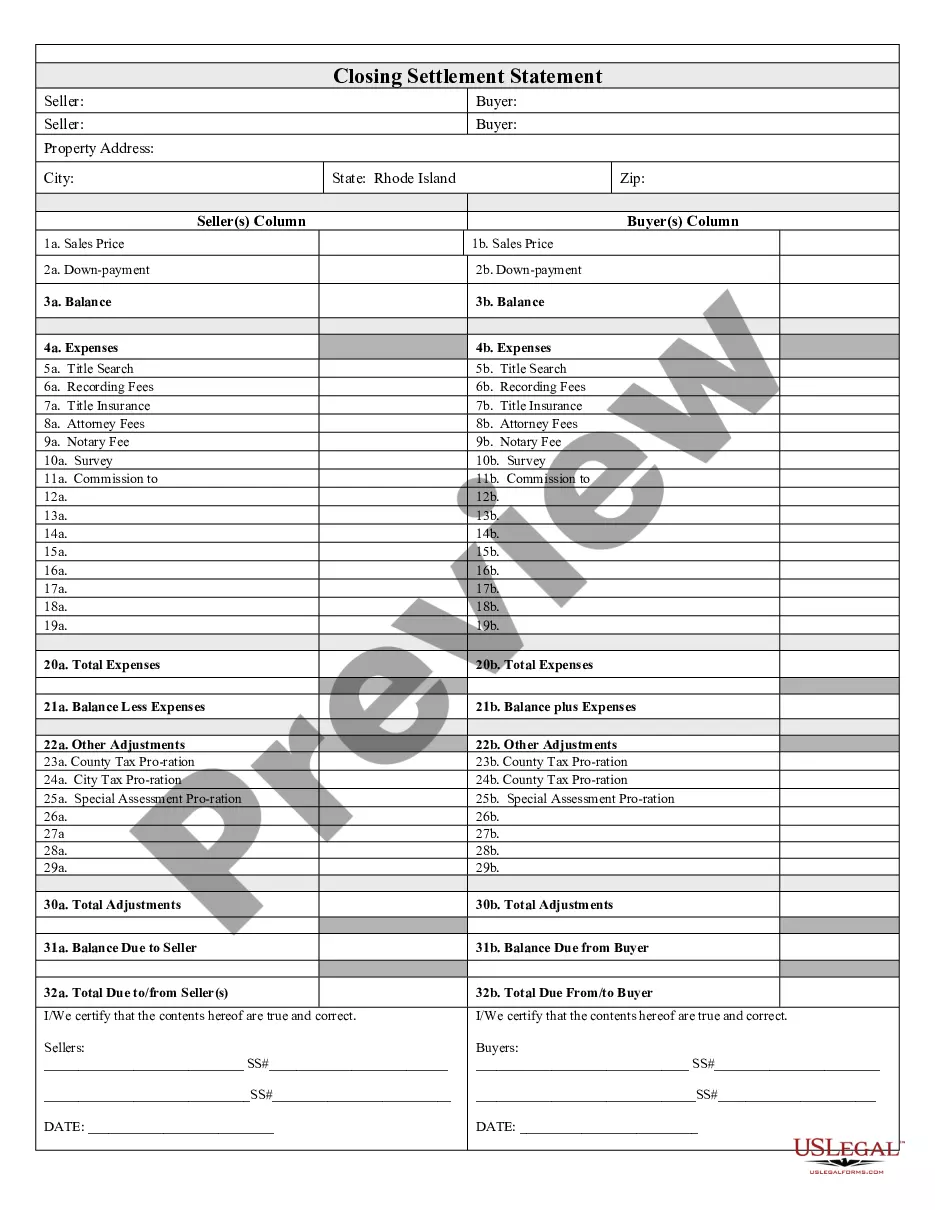

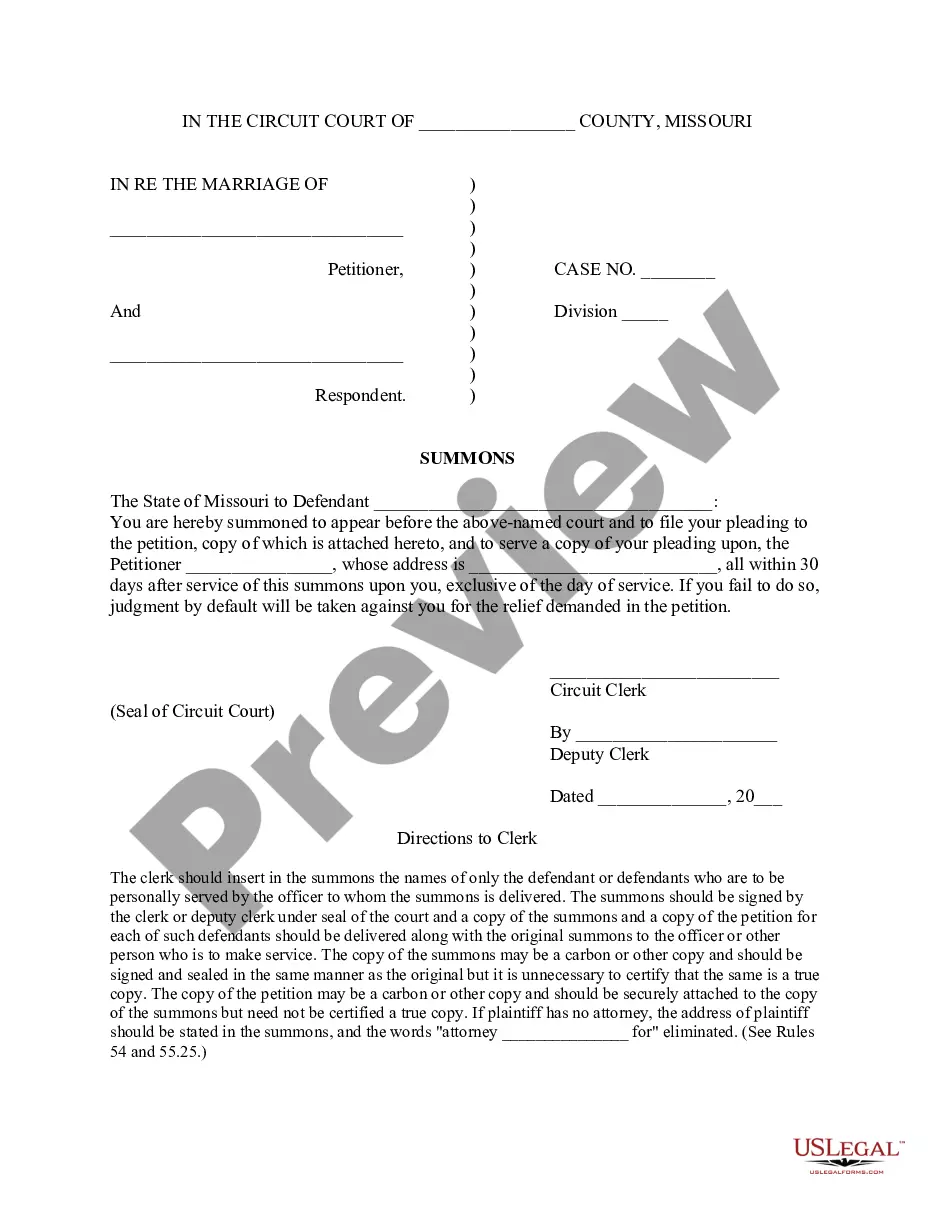

Registering a foreign corporation in Missouri involves submitting an application for a Certificate of Authority to the Secretary of State. You will need to provide information about your corporation, including its original state of incorporation and a Certificate of Good Standing. Additionally, you must designate a registered agent in Missouri. Utilizing USLegalForms simplifies the Missouri Registration of Foreign Corporation process by providing templates and expert advice.

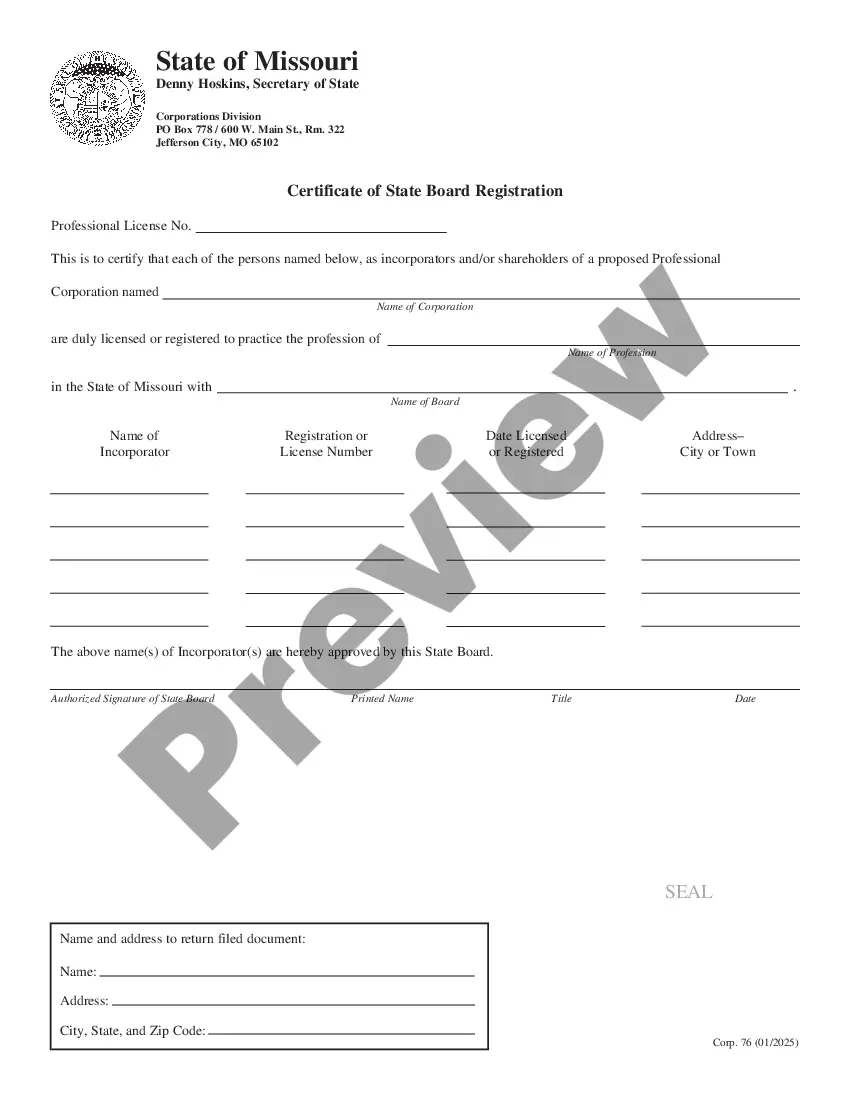

To register a corporation in Missouri, you must file Articles of Incorporation with the Secretary of State. This document includes essential details about your corporation, such as its name, purpose, and registered agent. It's important to ensure compliance with Missouri’s regulations to avoid delays. If you are a foreign entity, the Missouri Registration of Foreign Corporation process will apply, and USLegalForms can guide you through the necessary steps.

Obtain a Certificate of Existence. Choose a Registered Agent. Complete the Application. Submit the Necessary Documents and Fees. File an Annual Report.

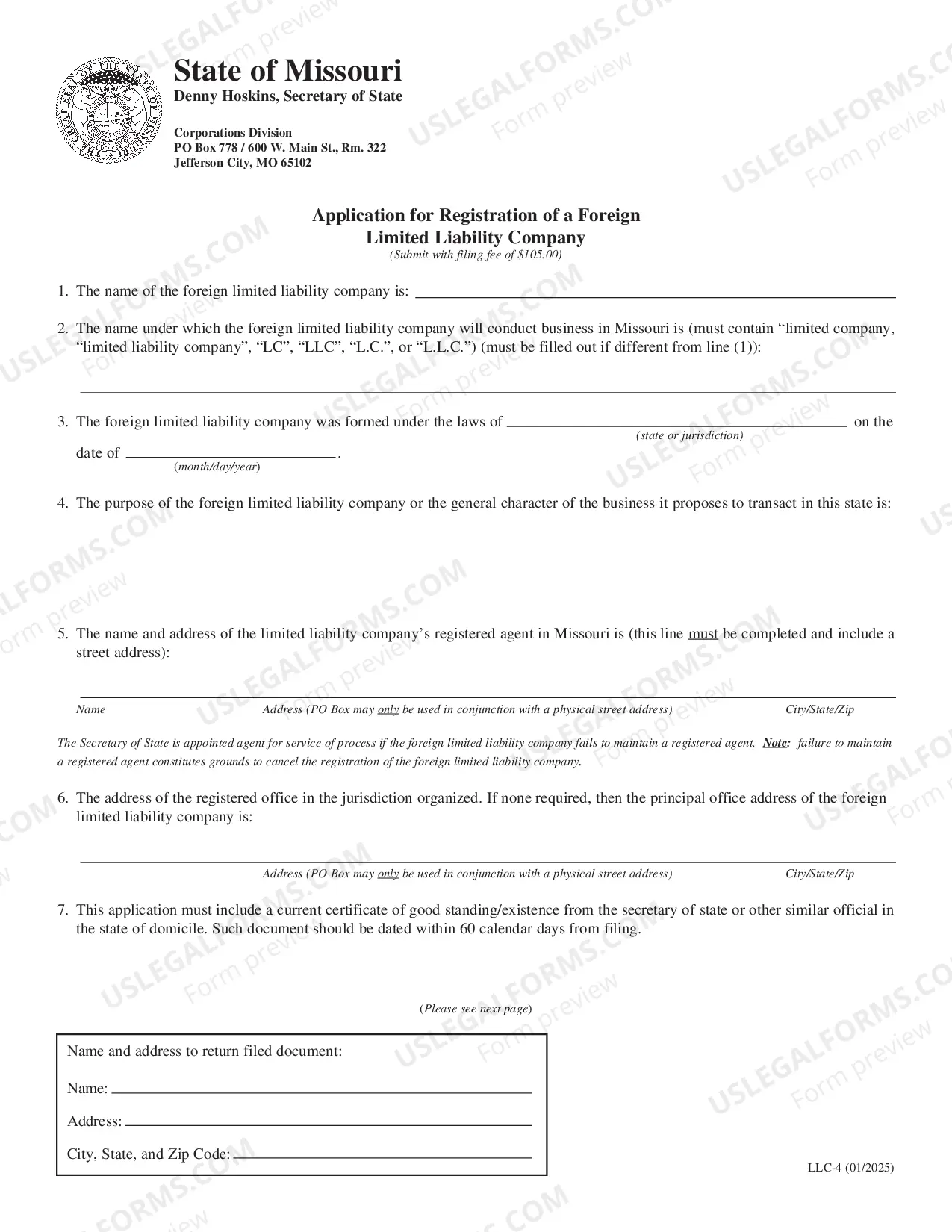

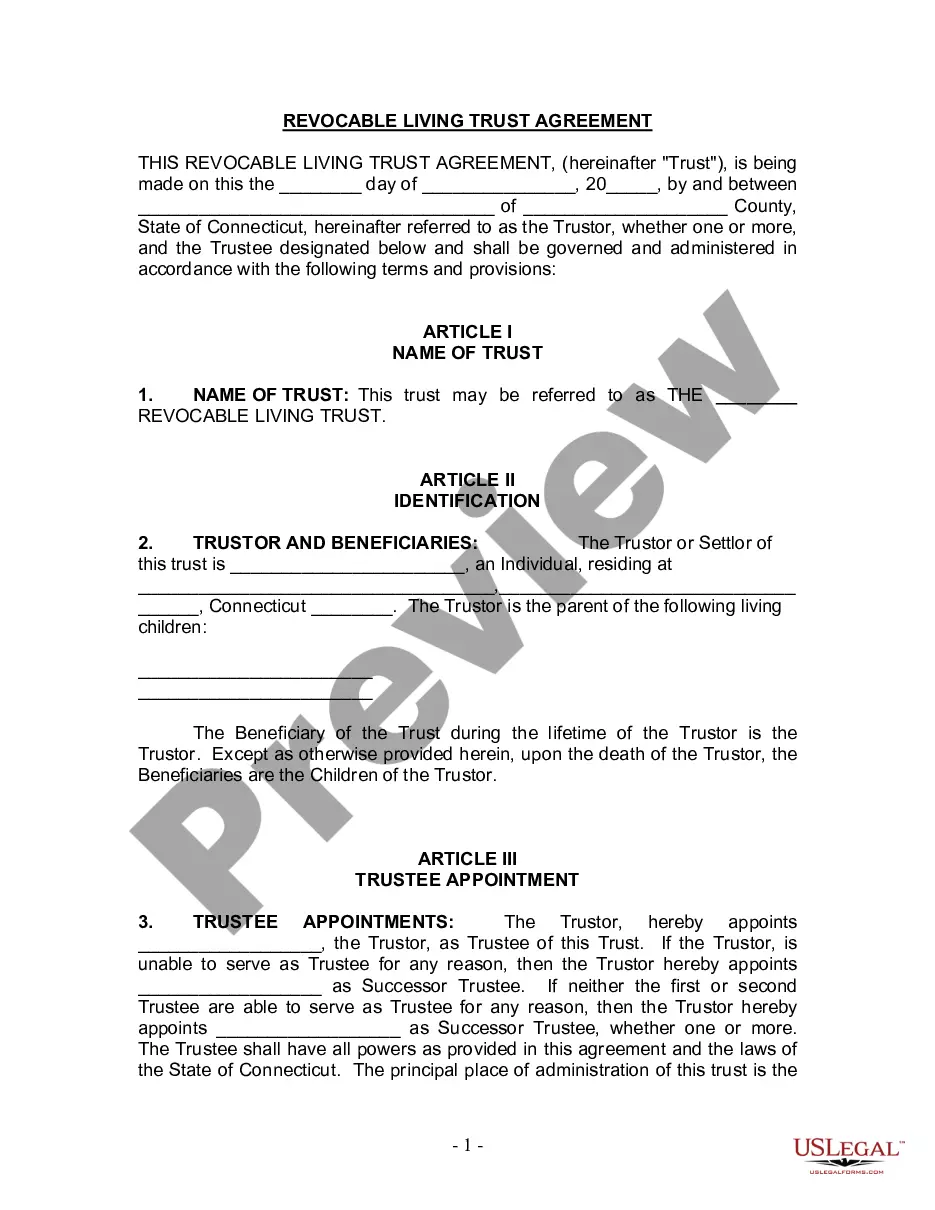

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

To register a foreign corporation in Missouri, you must file an Application for Certificate of Authority. This document is submitted to the Missouri Corporations Division. There is a $155 qualification fee. The form can be filed online.

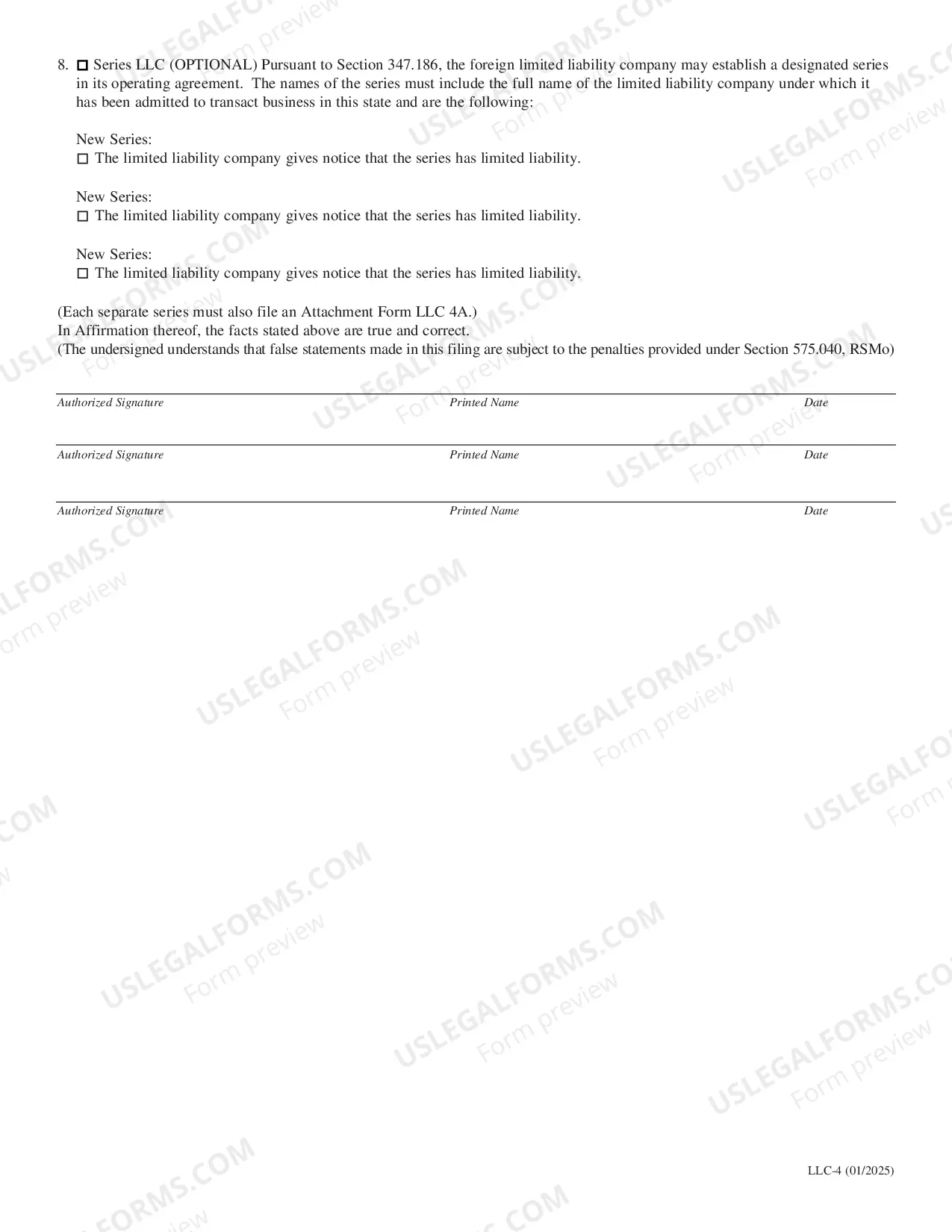

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Florida business laws require all corporations -- foreign or otherwise -- to have a registered agent and a registered office. This person is responsible for receiving important information on behalf of the business.

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

How do you change your registered agent in Missouri? File a completed Statement of Change of Registered Agent and/or Registered Office by mail or in person with a $10 filing fee. This form works for all corporations and LLCs. LPs and LLPs use their specific forms with the same $10 fee.