Fort Real Estate

Description

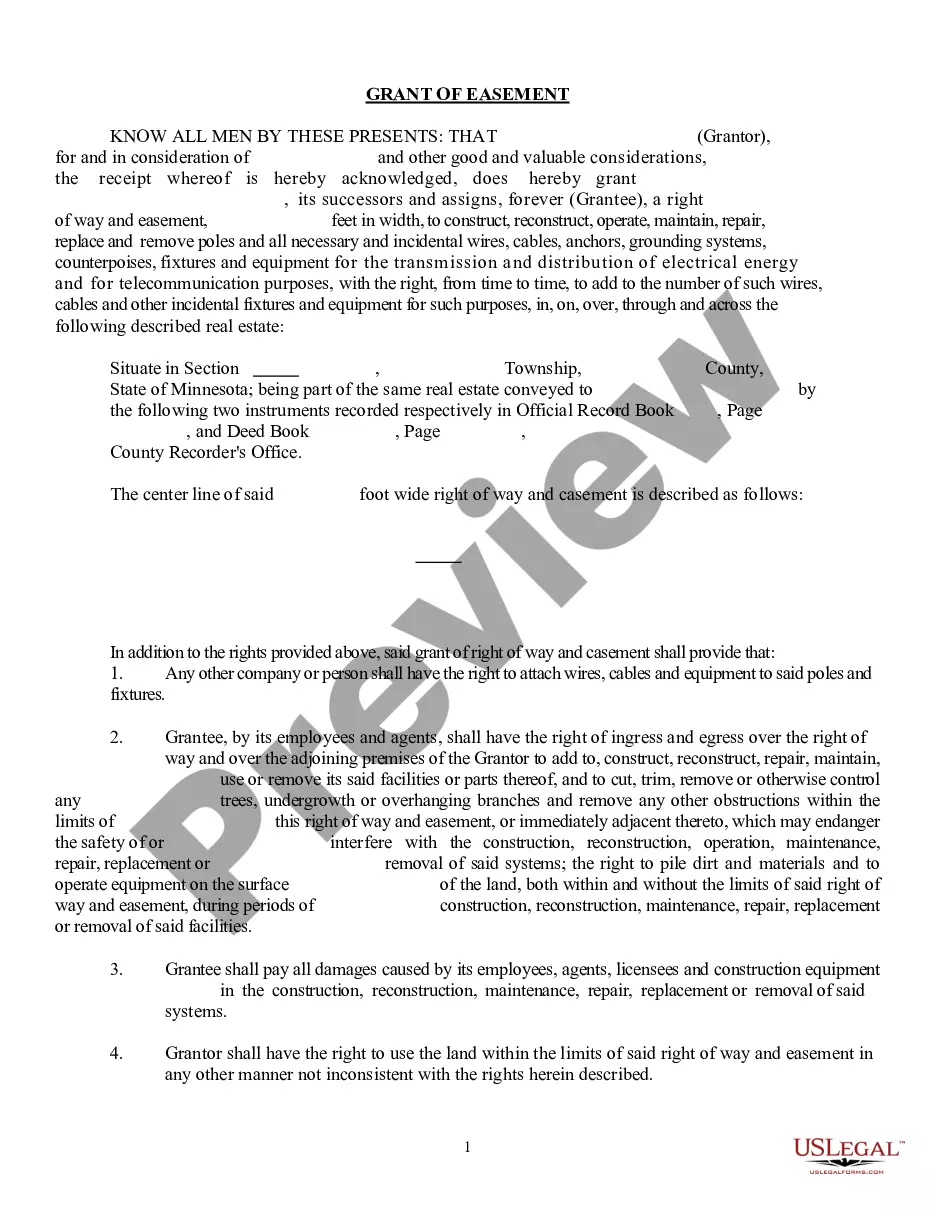

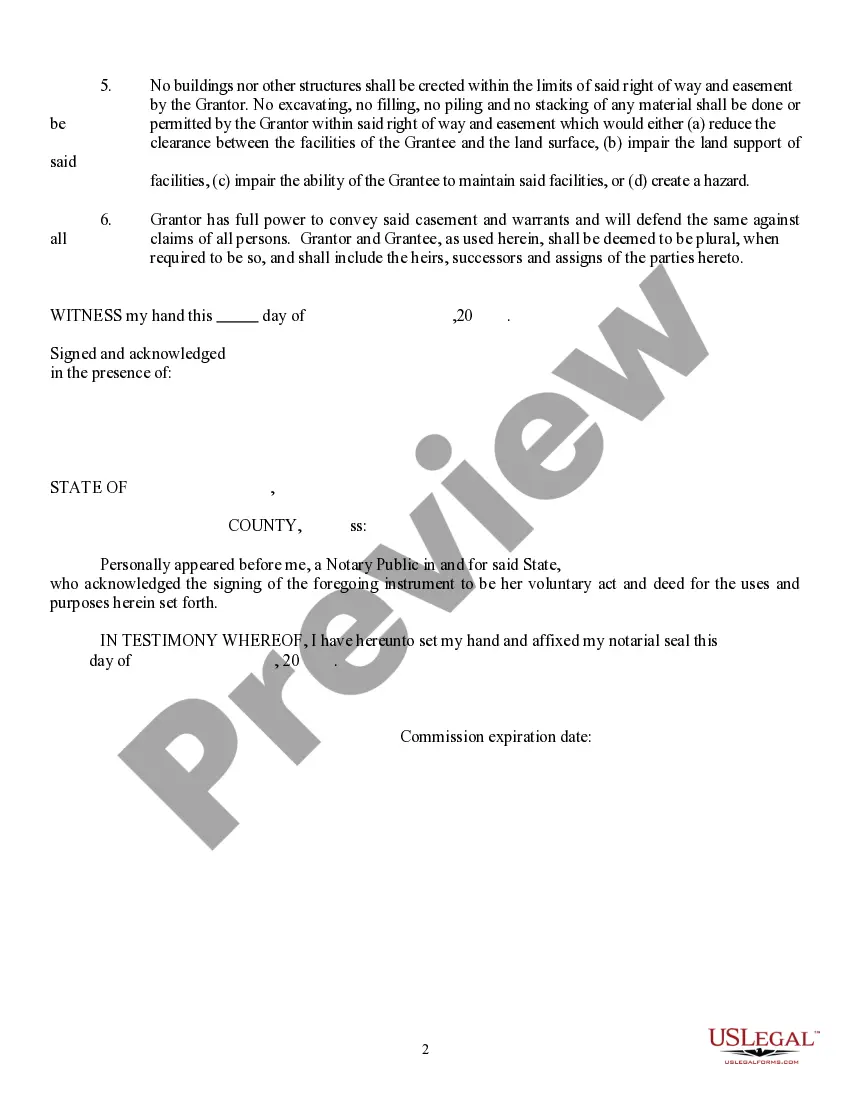

How to fill out Minnesota Grant Of Easement For The Transmission Of Electrical Energy?

- If you're a returning user, start by logging in to your account. Confirm your subscription is active, and download the desired form template from your dashboard.

- For new users, begin by exploring the Preview mode and form descriptions to identify the correct form that suits your requirements.

- If you need to search for additional templates, utilize the Search tab at the top of the page to find any other forms that might be appropriate.

- Select the document you wish to purchase. Click on the Buy Now button and choose a subscription plan that fits your needs.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your form and save it to your device. You can access it anytime via the My Forms section of your account.

In conclusion, US Legal Forms provides a robust collection of over 85,000 easily fillable and editable legal documents. With expert assistance easily accessible, you will ensure all transactions are legally sound and compliant.

Start simplifying your Fort real estate transactions today by exploring US Legal Forms!

Form popularity

FAQ

A real estate professional is someone who participates in real estate activities on a regular basis and meets the IRS criteria for professional status. This includes typical activities like buying, selling, or managing properties within the Fort real estate industry. Understanding this definition is crucial for maximizing your investment and tax opportunities.

A 1099 form is used to report income received in a real estate transaction, typically by independent contractors or individuals engaged in real estate sales. During a Fort real estate closing, this form informs the IRS of payments made that may impact your tax filings. Understanding how this form works can aid in keeping your tax situation clear and compliant.

The IRS considers an individual a real estate professional if they meet the criteria of spending most of their working hours and at least 750 hours per year on real estate activities. This includes time spent on property management, development, or investment in Fort real estate. Ensuring you meet these guidelines can lead to important tax benefits.

Being designated as a real estate professional can offer substantial tax advantages, such as the ability to deduct losses against ordinary income. This classification is particularly beneficial for individuals heavily invested in Fort real estate. Consulting with a tax advisor can help clarify these benefits based on your specific situation.

Filing for real estate typically involves submitting the appropriate documents to your local government, including property deeds and tax forms. For those involved in Fort real estate, it's essential to ensure that all filings comply with local laws and regulations. Uslegalforms offers a variety of templates to simplify your filing process.

A real estate professional typically engages in property management or investment and may qualify for specific tax benefits, while a real estate agent focuses on helping clients buy or sell properties. Both roles play vital parts in the Fort real estate market, but they have distinct responsibilities and legal standings. Knowing the difference can enhance your strategies in real estate dealings.

To be classified as a real estate professional, you must meet specific criteria set by the IRS. Primarily, you need to spend more than half of your working hours in real estate activities and participate in real estate activities for at least 750 hours during the year. This classification can benefit you significantly in terms of tax deductions related to Fort real estate activities.

Making $100,000 as a realtor in Fort real estate can be challenging but achievable. It requires a solid understanding of local market dynamics, excellent communication skills, and a strategic approach to client acquisition. Staying organized and using tools like USLegalForms can help streamline your operations, making it easier to focus on sales.

Most realtors in Fort real estate earn around $40,000 to $50,000 in their first year, although this varies based on location and experience. The initial year can be challenging, as it often involves learning the ropes of the industry and establishing a client base. However, with determination and the right approach, many new agents exceed these average earnings.

Yes, it is possible to earn $100,000 in your first year in Fort real estate, but it requires hard work and dedication. You need to be proactive in finding clients, closing sales, and understanding the local market. Successful agents often combine effective marketing strategies with solid negotiation skills to boost their earnings.