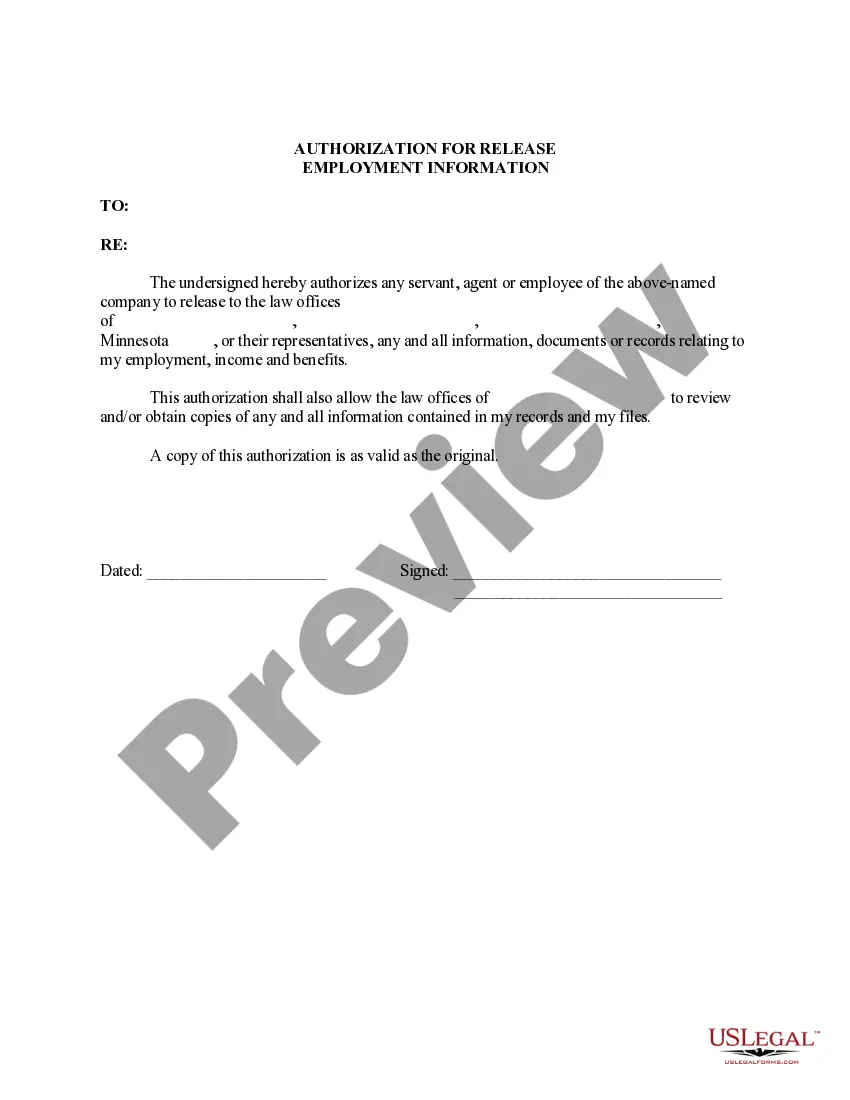

Authorization For Release Of Employment Information With Credit Bureau Records

Description

How to fill out Minnesota Authorization To Release Employment Information?

What is the most reliable service to obtain the Authorization For Release Of Employment Information With Credit Bureau Records and other current forms of legal documents? US Legal Forms is the answer!

It's the largest assortment of legal papers for any situation. Each template is expertly created and confirmed for adherence to federal and local laws and regulations. They are organized by region and state of application, making it simple to find the one you require.

US Legal Forms is an excellent choice for anyone needing to handle legal documents. Premium members can access even more features, allowing them to complete and approve previously saved files electronically at any time using the built-in PDF editing tool. Explore it today!

- Experienced users of the site only need to Log In to their account, verify their subscription status, and select the Download button next to the Authorization For Release Of Employment Information With Credit Bureau Records to obtain it.

- Once saved, the template is accessible for future use in the My documents section of your account.

- If you have not yet created an account with us, follow these steps to do so.

- Form compliance verification. Before you obtain any template, ensure it aligns with your usage requirements and the laws of your state or county. Review the form description and utilize the Preview option if provided.

Form popularity

FAQ

If you file a dispute to correct what you believe is an inaccuracy on your credit report, the credit bureau you notify must complete an investigation within 30 days (or 45 days in certain circumstances), according to the U.S. Fair Credit Reporting Act.

The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A credit report authorization form is a document used to give permission to an individual or organization to perform a credit report only. This form provides broad language that allows a credit report to be generated for any type of legal reason in compliance with the Fair Credit Reporting Act (FCRA) (15 U.S.C.

Section 604(g) of the FCRA prohibits consumer reporting agencies from providing consumer reports that contain medical information for employment purposes, or in connection with credit or insurance transactions, without the specific prior consent of the consumer who is the subject of the report.