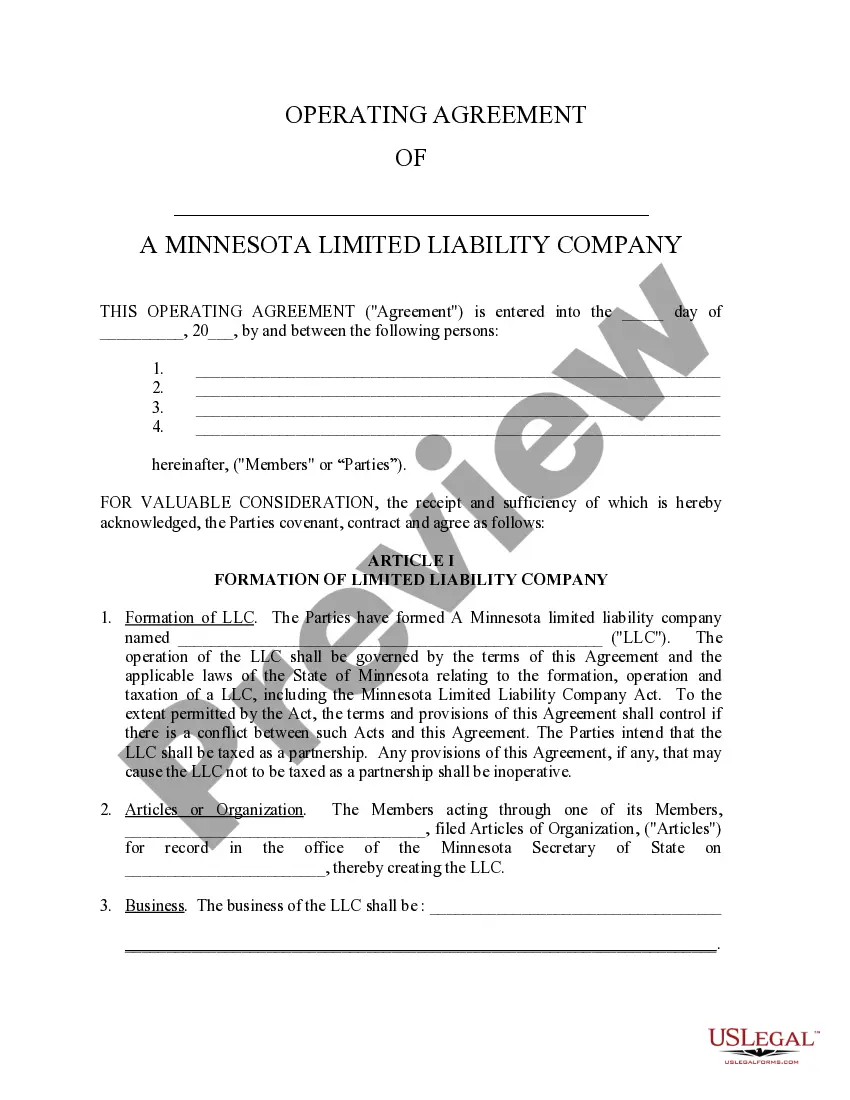

Llc Operating Agreement Minnesota With Preferred Return

Description

How to fill out Minnesota Limited Liability Company LLC Operating Agreement?

Obtaining legal documents that comply with federal and state regulations is essential, and the internet provides numerous options to select from.

However, what’s the use of spending time searching for the suitable Llc Operating Agreement Minnesota With Preferred Return template online when the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms stands as the largest online legal repository with more than 85,000 customizable templates created by lawyers for any professional or personal situation.

Review the template using the Preview feature or through the text summary to confirm it fulfills your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring that your form is current and compliant when you obtain a Llc Operating Agreement Minnesota With Preferred Return from our platform.

- Acquiring a Llc Operating Agreement Minnesota With Preferred Return is straightforward and fast for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document template you need in your desired format.

- For new visitors to our site, follow the instructions below.

Form popularity

FAQ

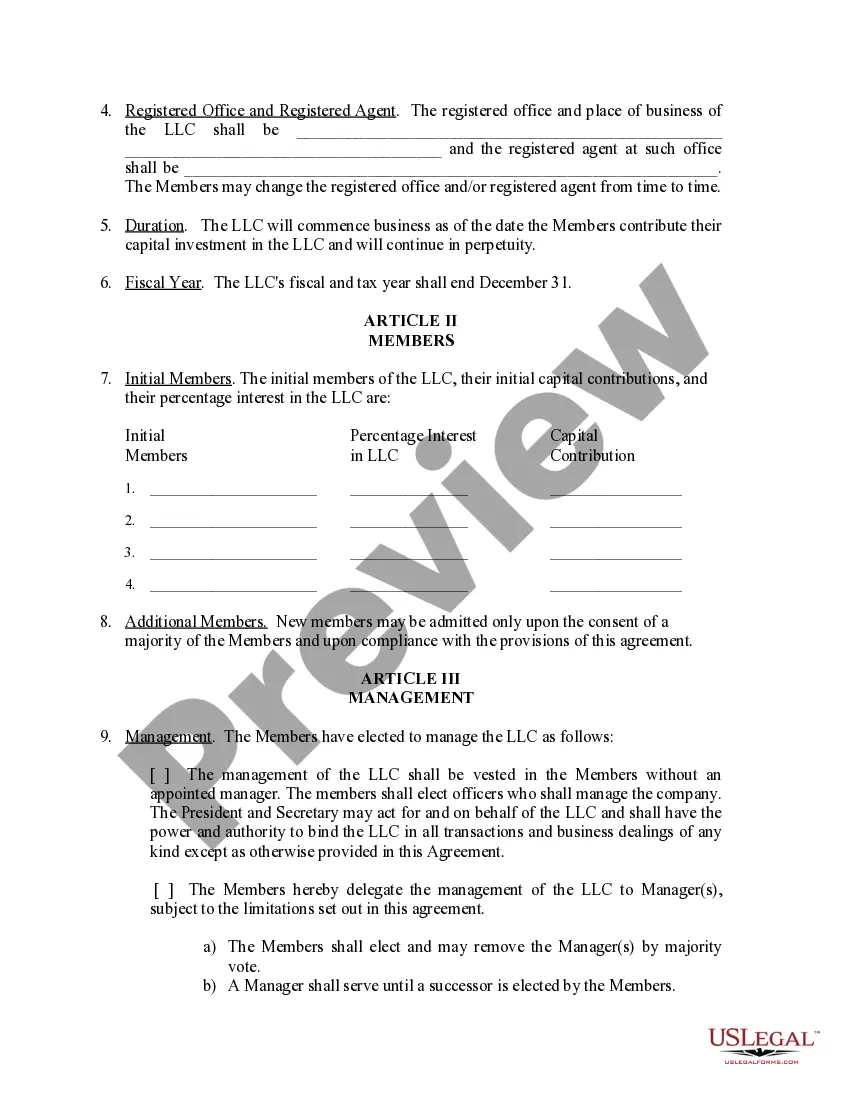

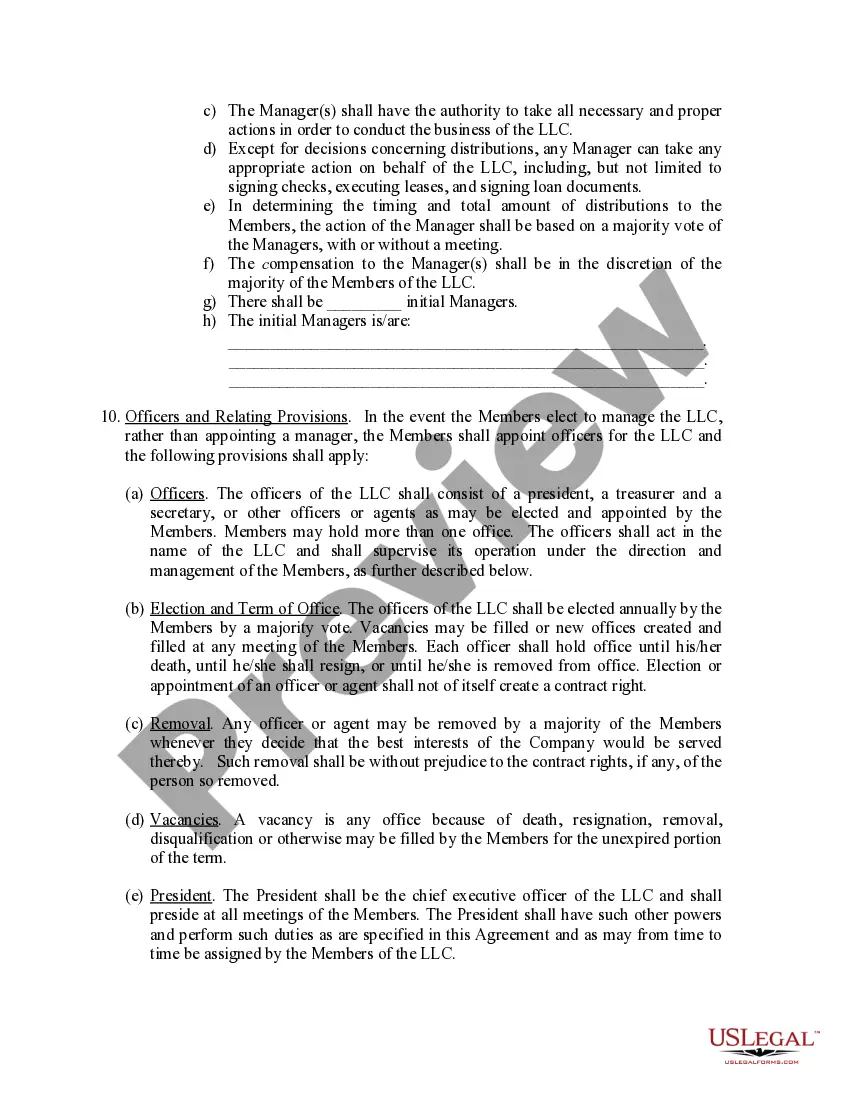

Although not required by Minnesota law, an operating agreement further protects those with an interest in an LLC by pre-determining how the LLC will conduct business. A Bloomington LLC operating agreements lawyer could help you form an operations structure optimized for your business.

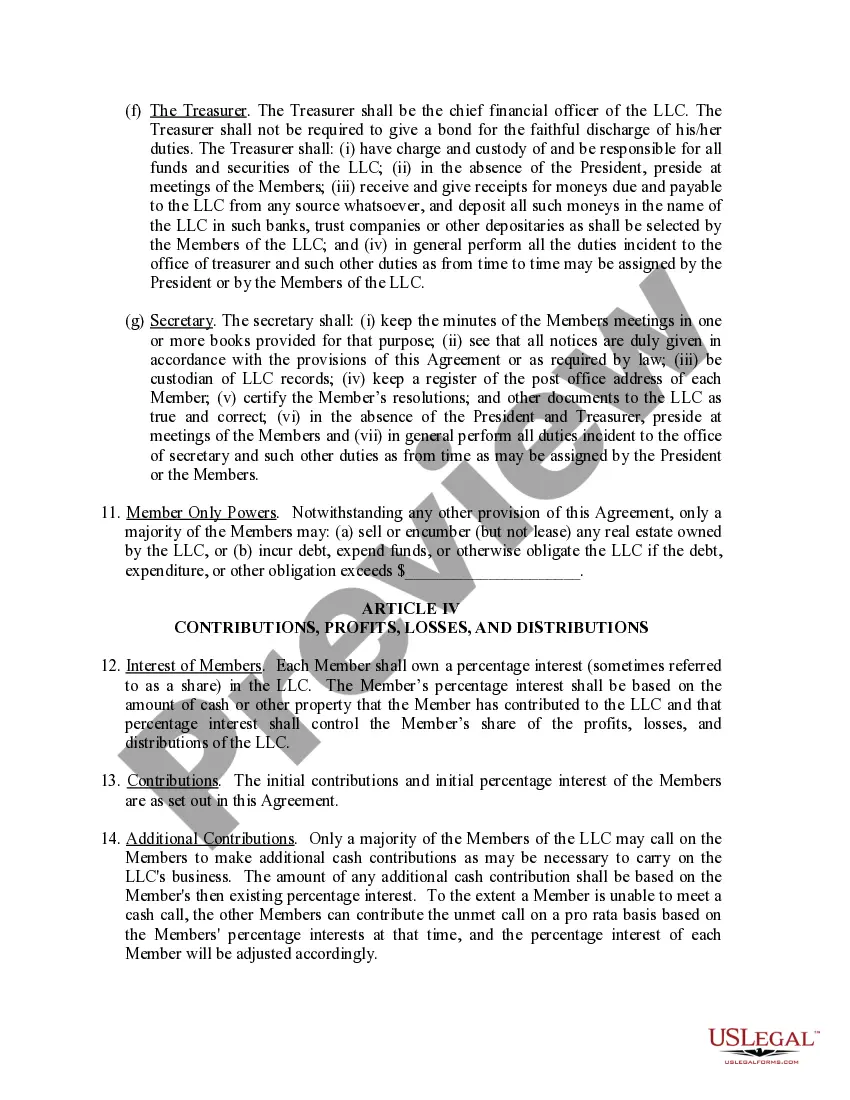

Benefits of forming a Limited Liability Company (LLC) Separate legal identity. ... Limited liability. ... Perpetual existence. ... Flexible management structure. ... Free transferability of financial interests. ... Pass-through taxation.

It costs $155 to form an LLC in Minnesota. This is a fee paid for the Articles of Organization. You'll file this form with the Minnesota Secretary of State. And once approved, your LLC will go into existence.

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Iowa state law doesn't require you to have a written operating agreement. Iowa statute § 489.110 lists common provisions an operating agreement can include, but the law doesn't state that you must have one.

A Minnesota LLC isn't legally obligated to have an operating agreement. Minnesota Statute § 322C. 0110 outlines what an operating agreement may cover but doesn't state that LLCs must have one. Still, we at Northwest strongly recommend adopting a written operating agreement.