Michigan Ucc Search With Id

Description

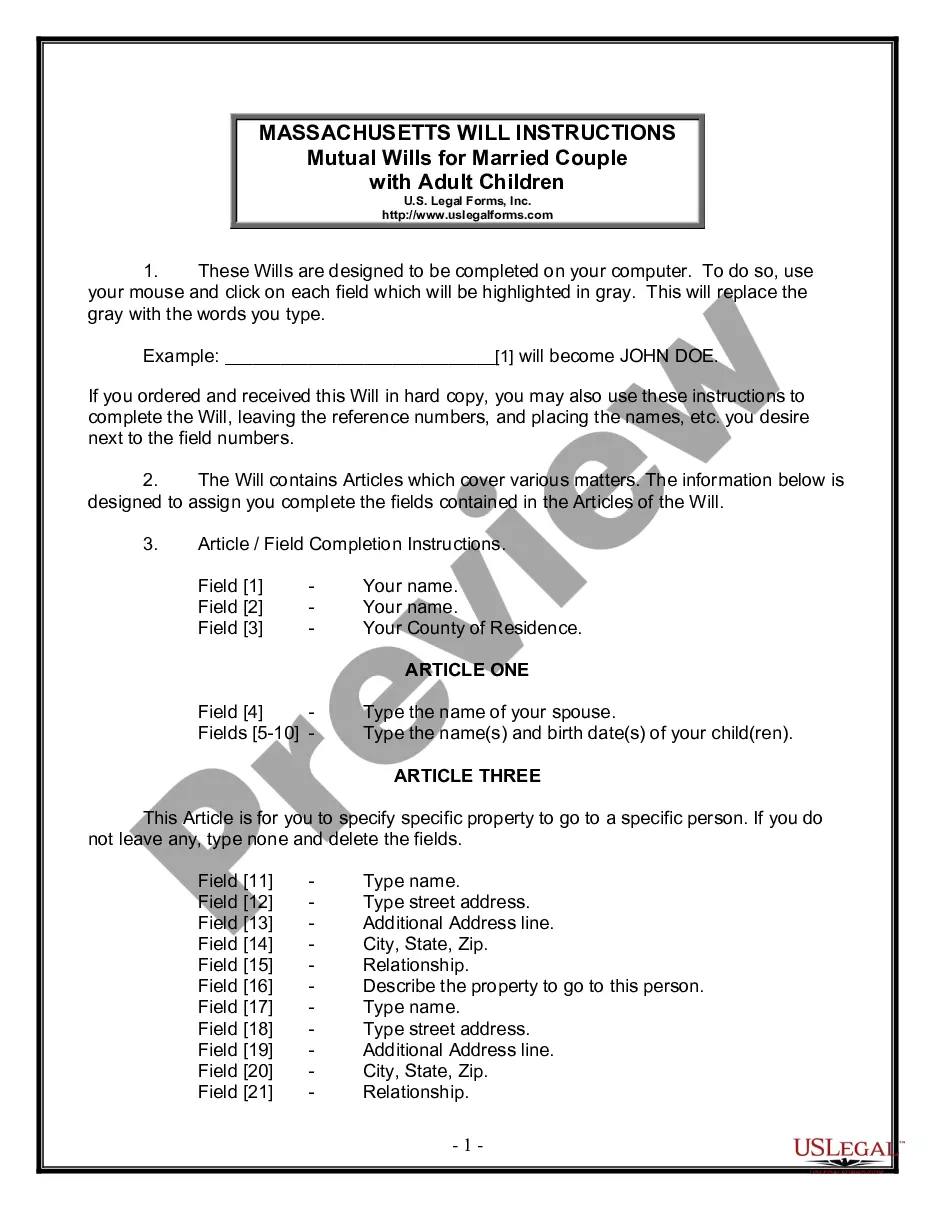

How to fill out Michigan UCC1 Financing Statement?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may entail extensive research and significant financial outlay.

If you seek a more straightforward and economical method of generating Michigan Ucc Search With Id or any other paperwork without the hassle, US Legal Forms is always at your service.

Our online repository of over 85,000 current legal documents encompasses nearly all facets of your financial, legal, and personal affairs. With just a few clicks, you can rapidly access state- and county-specific templates meticulously prepared by our legal experts.

Ensure the form you select complies with the rules and regulations of your state and county. Choose the appropriate subscription plan to acquire the Michigan Ucc Search With Id. Download the form, then complete, verify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make document completion simple and efficient!

- Utilize our platform whenever you require trustworthy and dependable services to swiftly find and download the Michigan Ucc Search With Id.

- If you are already familiar with our services and have previously registered with us, simply Log In to your account, locate the template, and download it immediately or re-download it later in the My documents section.

- Not registered yet? No worries. It requires minimal time to register and explore the catalog.

- However, before proceeding to download Michigan Ucc Search With Id, adhere to these suggestions.

- Review the form preview and descriptions to confirm you have identified the document you need.

Form popularity

FAQ

A Hawaii Resident is an individual that is domiciled in Hawaii or an individual that resides in Hawaii for other than temporary purpose. An individual domiciled outside Hawaii is considered a Hawaii resident if they spend more than 200 days in Hawaii during the tax year.

If an individual does business in Hawaii, he or she must file a return, even if no taxable income is derived from that business. (Instructions, Form N-15, Individual Income Tax Return?Nonresident and Part-Year Resident) However, a nonresident will be taxed on income from Hawaii sources only.

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to ?le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

Any person who is in Hawai?i for a temporary or transient purpose and whose permanent residence is not Hawai?i is considered a Hawai?i nonresident. Each year, a nonresident who earns income from Hawai?i sources must file a State of Hawai?i tax return and will be taxed only on income from Hawai?i sources.

A 7.25% withholding obligation is generally imposed on the transferee/buyer when a Hawaii real property interest is acquired from a nonresident person.

Individuals who spend more than 200 days in the tax year within Hawaii are presumed to be residents. Residents file Form N-11, Individual Income Tax Return (Resident Form). Part-year Residents/Nonresidents: Part-year residents or nonresidents are individuals whose permanent domicile is not Hawaii.

Verify is generally a voluntary program. However, certain employers may be required to enroll in verify: Federal contractors or subcontractors with contracts containing the Federal Acquisition Regulation (FAR) Verify clause.

Form N-15 is filed by nonresident individuals who have Hawaii tax liability and by individuals who are Hawaii residents for only part of the tax year.