Fha/va Financing Addendum (form 2a4-t)

Description

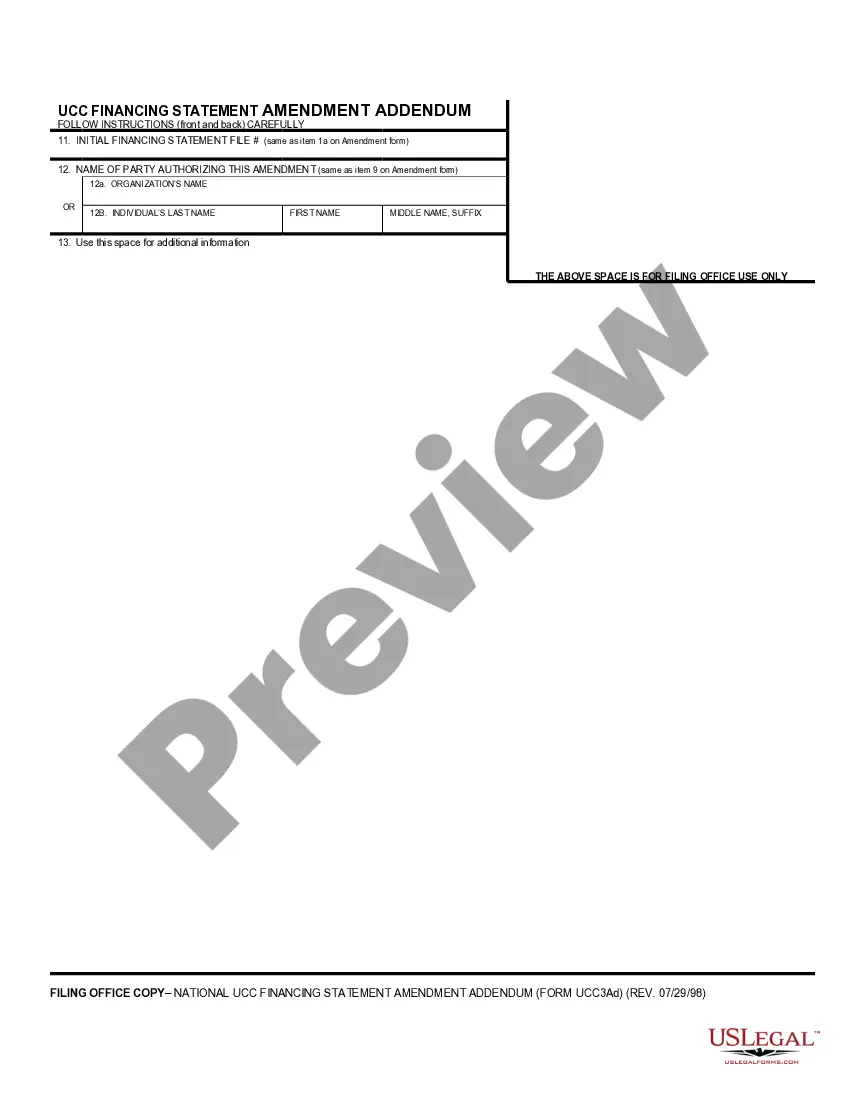

How to fill out UCC1-AD Financing Statement Addendum?

Regardless of whether for corporate objectives or personal issues, everyone must handle legal matters at some moment in their life.

Filling out legal documents necessitates meticulous consideration, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you do not have to waste time searching for the right template online. Utilize the library’s straightforward navigation to obtain the suitable form for any circumstance.

- For instance, if you choose an incorrect version of a Fha/va Financing Addendum (form 2a4-t), it will be rejected when submitted.

- It is thus essential to secure a trustworthy source for legal documents such as US Legal Forms.

- If you need to acquire a Fha/va Financing Addendum (form 2a4-t) template, follow these straightforward procedures.

- Locate the template you require using the search bar or catalog navigation.

- Review the form’s details to confirm it fits your situation, state, and county.

- Click on the form’s preview to assess it.

- If it is not the correct form, return to the search function to find the Fha/va Financing Addendum (form 2a4-t) sample you need.

- Obtain the file once it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- In case you do not yet have an account, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: either a credit card or PayPal account.

- Select the desired file format and download the Fha/va Financing Addendum (form 2a4-t).

- After downloading, you can complete the form using editing software or print it out and finish it by hand.

Form popularity

FAQ

You would use the FHA VA financing addendum (form 2a4-t) when you are purchasing a property with financing backed by the FHA or VA. This addendum ensures that all parties involved understand the specific terms and conditions related to these types of loans. By including this addendum in your real estate transaction, you protect your rights and clarify the financing terms. Using a reliable platform like US Legal Forms can help you easily access and customize the FHA VA financing addendum (form 2a4-t) for your needs.

An FHA VA financing addendum is a specialized document that combines terms for both FHA and VA loans in real estate transactions. The FHA/VA financing addendum (form 2a4-t) outlines the unique requirements and protections for buyers using these financing options. It provides clarity and peace of mind for all parties involved, ensuring that everyone understands their roles and responsibilities.

To fill out an FHA addendum, start by carefully reading the instructions provided with the FHA/VA financing addendum (form 2a4-t). Input the required information accurately, including the buyer and seller details, property description, and any specific conditions. Ensure that you review the completed document for correctness before submitting it with the main contract.

Filling out an addendum requires careful attention to detail. Start by obtaining the FHA/VA financing addendum (form 2a4-t) from a reliable source, such as USLegalForms. Then, accurately provide the necessary details, including names, addresses, and specific terms related to the transaction, ensuring that all information aligns with the main contract.

An FHA addendum is a crucial document that outlines specific terms and conditions related to Federal Housing Administration loans. It serves to protect both buyers and sellers during real estate transactions by clarifying the obligations of each party. The FHA/VA financing addendum (form 2a4-t) is specifically designed for transactions involving FHA loans, ensuring compliance with federal regulations.

The FHA amendatory clause is generally provided by lenders or real estate agents familiar with FHA and VA financing. They ensure the clause is included in the paperwork to protect the buyer's interests. You can easily access the FHA/VA financing addendum (form 2a4-t) through US Legal Forms, which simplifies the process of obtaining the necessary documents for your transaction.

If the home appraisal comes in below the agreed-upon price of a home you plan to purchase, the FHA amendatory clause enables FHA home buyers to cancel the home purchase and receive a refund of their earnest money. In short, it will allow you, the home buyer, to back out of the sale without any sort of penalty.

An FHA/VA financing addendum is attached to a purchase contract to state that a buyer with FHA/VA financing can back out of the sale if the appraised property value is less than the asking price.

A Federal Housing Administration (FHA) loan is a home mortgage that is insured by the government and issued by a bank or other lender that is approved by the agency. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores than is usually required.

The amendatory clause applies to FHA homebuyers and eligible military borrowers buying a home with a loan guaranteed by the U.S. Department of Veterans Affairs (VA). The amendatory clause does not apply to conventional loans or mortgages backed by the U.S. Department of Agriculture (USDA).