Leased

Description

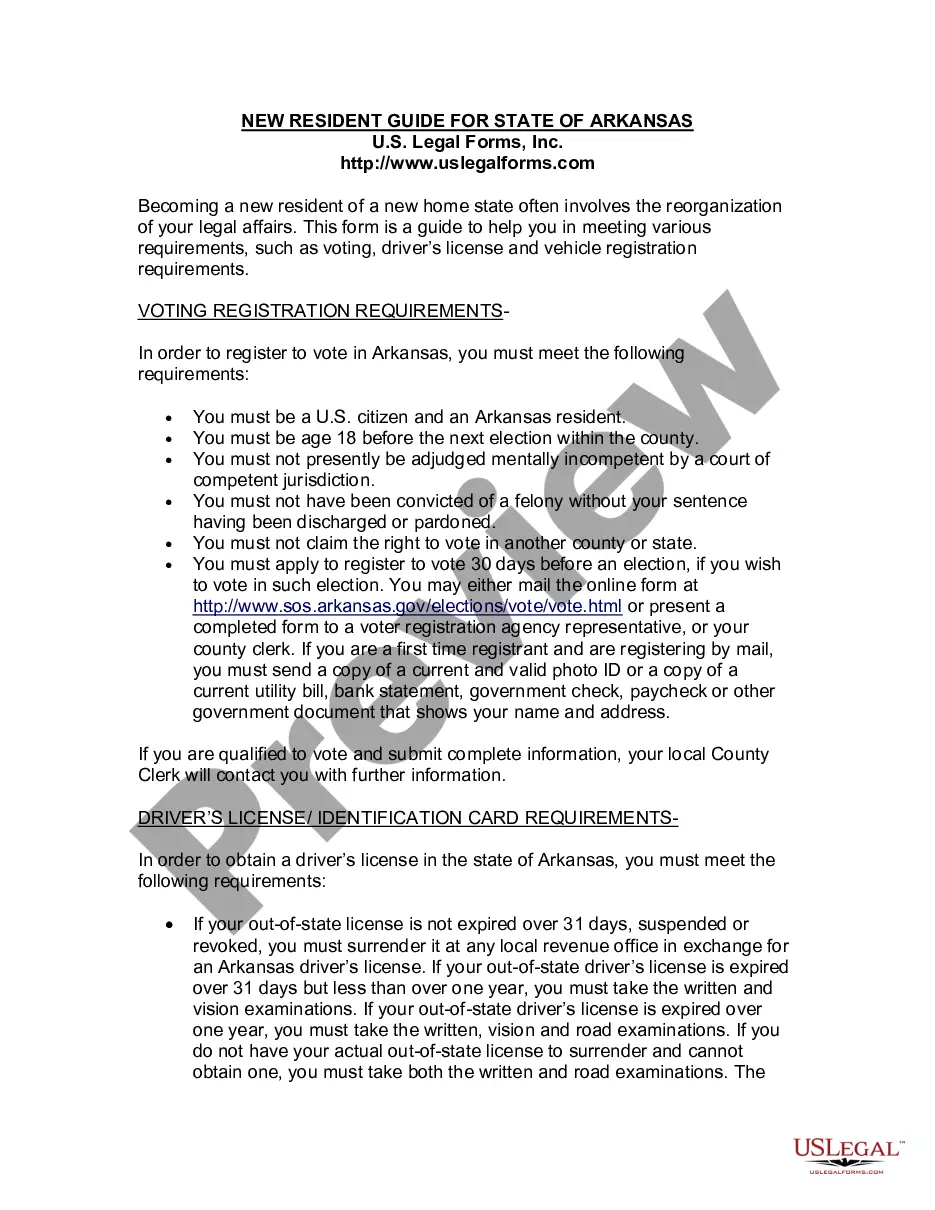

How to fill out Michigan Residential Lease Renewal Agreement?

- If you're a returning user, log in to your account and ensure your subscription is current. Click the Download button to save your chosen form template.

- For first-time users, begin by exploring the Preview mode and description of the leased forms available. Make sure it meets your requirements and complies with local laws.

- If the form you choose isn't right, utilize the Search feature to find the correct template for your specific needs.

- Once you find the appropriate form, click on the 'Buy Now' button and select a subscription plan that suits you. Remember to create an account for full access to the form library.

- Proceed to make your purchase by entering your payment details or using PayPal. Ensure that the transaction is completed successfully.

- Finally, download your chosen form. It will be saved on your device and accessible in the My Forms section of your profile for future use.

By following these steps, you can ensure that you acquire the exact legal forms you need swiftly and effectively. US Legal Forms not only offers a vast collection but also grants access to experts who assist in form completion, providing peace of mind.

Get started today and simplify your legal documentation process with US Legal Forms!

Form popularity

FAQ

To report rental income to the IRS, you'll typically use Schedule E on your Form 1040. This includes income from all leased properties, ensuring you accurately present any expenses related to the properties that can reduce your taxable income. By maintaining a clear record, you streamline your reporting and ensure compliance.

To claim a leased vehicle on your taxes, you can deduct the business-use percentage of your lease payments, maintenance costs, and certain other expenses. Keep detailed logs to track business versus personal use of the leased vehicle. This helps ensure you maximize your deductions while staying compliant.

The IRS may become aware of your rental income through various channels, such as reported income on tax returns or rental information reported by tenants on 1099 forms. They may also conduct audits based on discrepancies in reported income for leased properties. Keeping thorough records of all income and expenses offers transparency in your tax filings.

Possibly, depending on your state’s tax regulations. Some states allow individuals to deduct a portion of their rent on their state taxes, while others do not. Always review your state’s tax laws or consult a tax professional to determine what's possible with the leased expenses.

The IRS requires that you report all rental income, regardless of the amount. This includes income from any leased properties, no matter how small. For accurate tax reporting, a comprehensive record ensures you meet all federal obligations and remain in good standing with the IRS.

Even without a 1099 form, you still have to report all rental income, including funds received from leased properties. Utilize Schedule E on your tax return to declare this income. Providing detailed records of payments received will also support your reported income during tax filing.

To report your rental income to the IRS, use Schedule E (Supplemental Income and Loss) attached to your Form 1040. Report all leased properties you generate income from, ensuring you include necessary expenses like repairs and management fees. This documentation helps to demonstrate your complete financial picture and can reduce your taxable income.

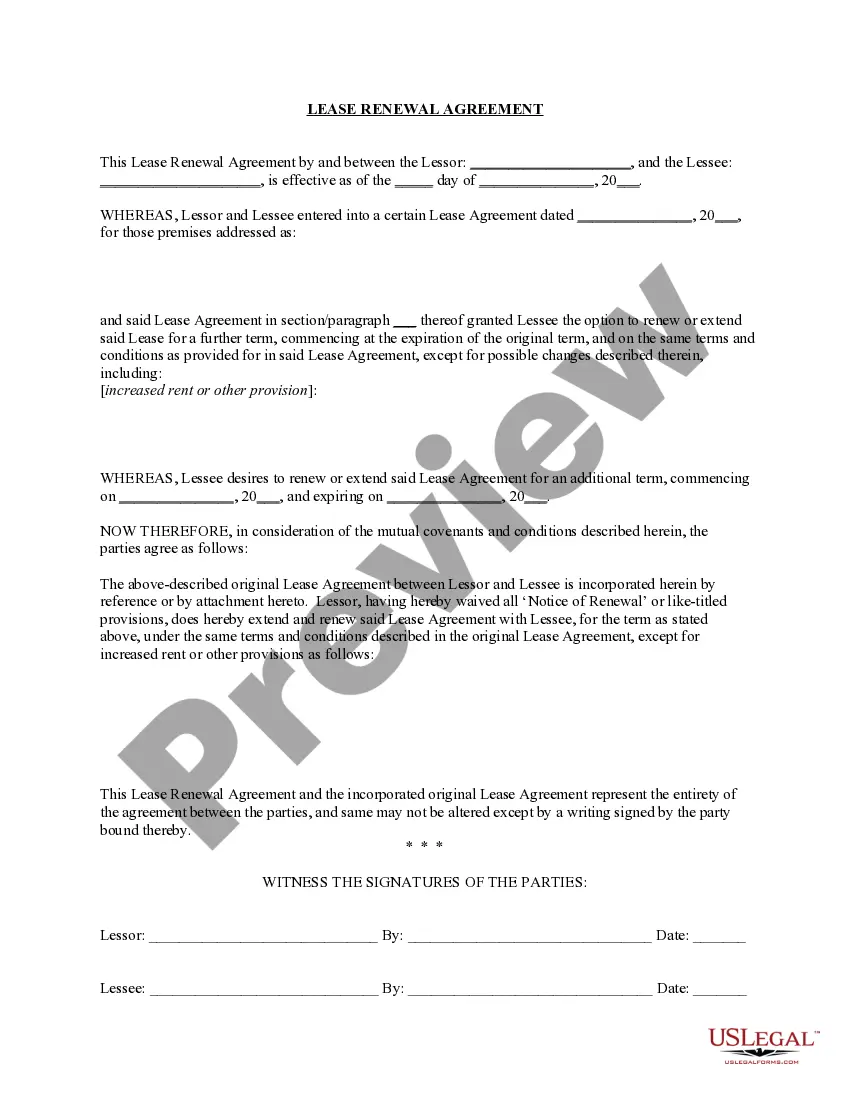

Filling a lease agreement involves understanding key elements such as parties involved, duration, and payment terms. Ensure you clearly state the lease amount, monthly payments, and any additional conditions. Using platforms like US Legal Forms can simplify this process, providing templates and guidelines to create a comprehensive lease agreement tailored to your needs.

Yes, you can write off a leased vehicle on taxes if you use it primarily for business. The IRS allows deductions for lease payments proportional to the business use of the vehicle. It’s crucial to keep thorough records to support your deductions and ensure compliance with tax regulations.

The amount you receive for writing off a car depends on how you use the vehicle for business purposes. You can deduct either the standard mileage rate or actual expenses incurred while using the vehicle. If you lease the car, understanding your lease costs and the percentage of business use will help determine your write-off on taxes.