Lien Waivr

Description

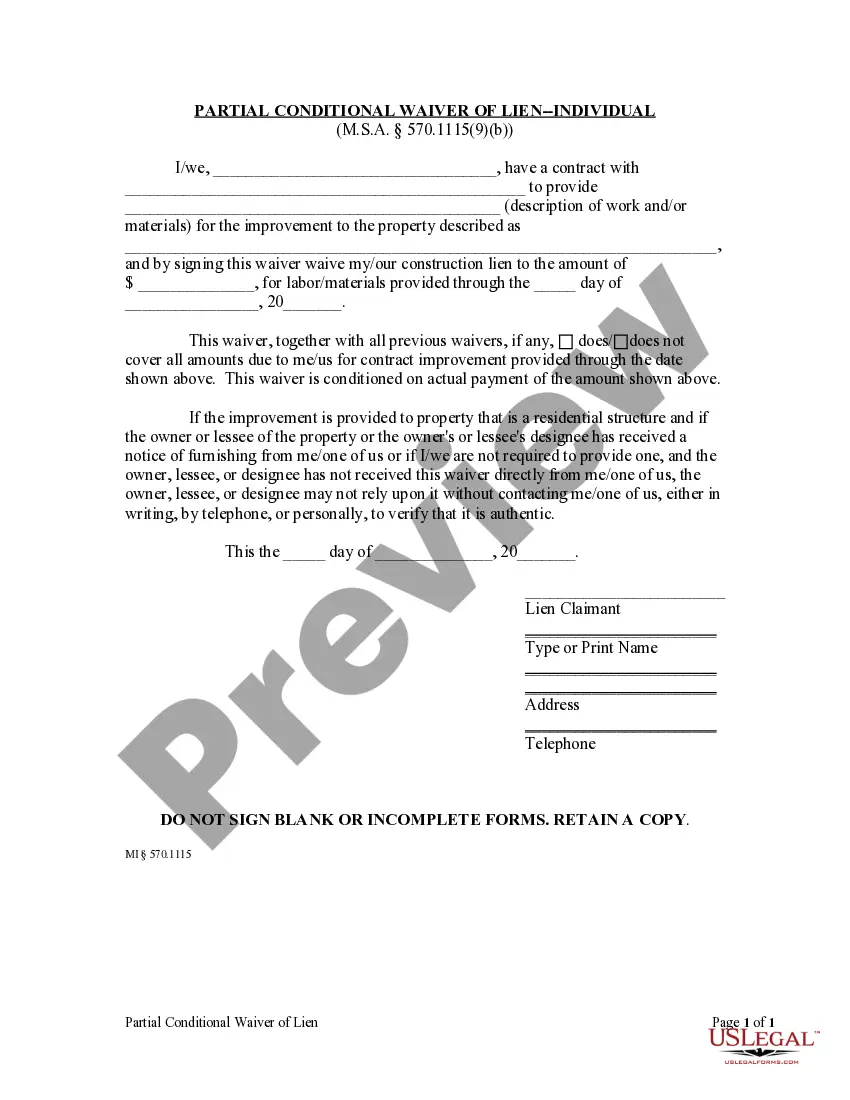

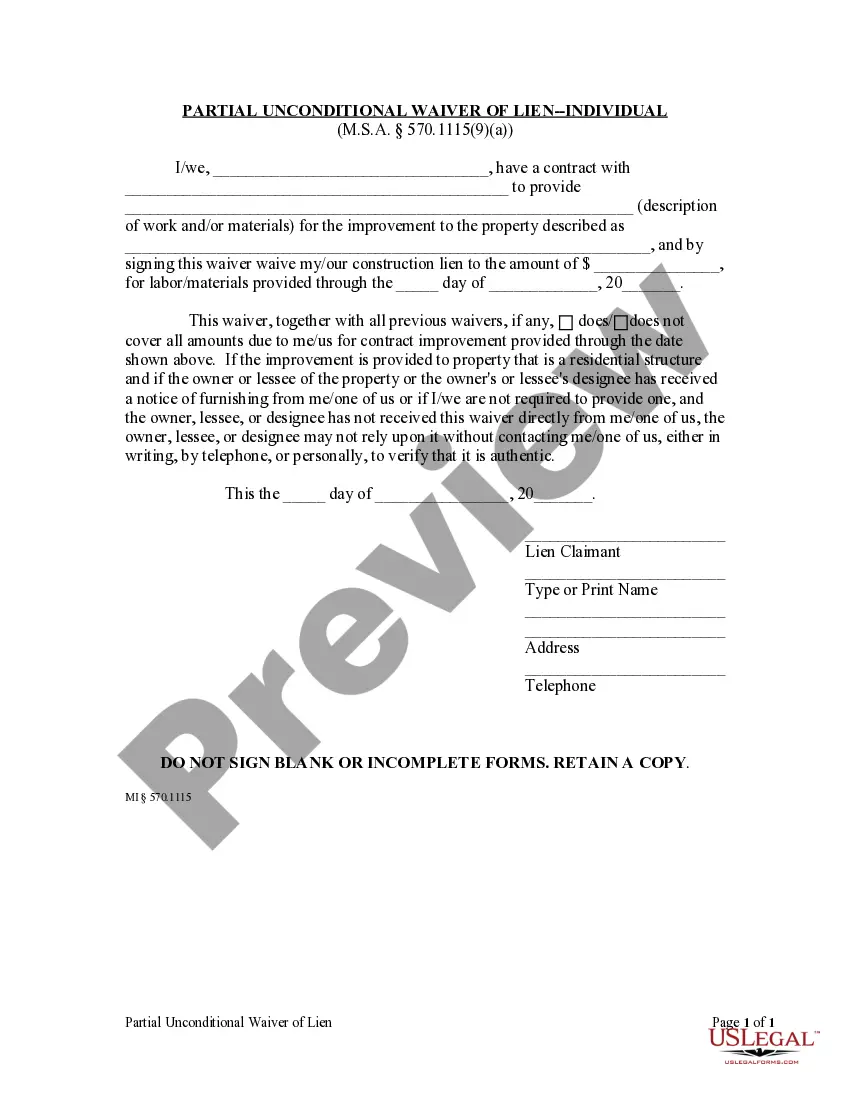

How to fill out Michigan Partial Unconditional Waiver Of Lien - Individual?

- Log in to your US Legal Forms account or create one if you're a new user.

- Browse the extensive library by entering 'lien waivr' in the search bar to find relevant forms.

- Review the previews and descriptions of the forms to ensure they comply with your needs.

- Select the form that suits you, then click the 'Buy Now' button to choose your subscription plan.

- Complete the purchase by entering your payment information via credit card or PayPal.

- Once your payment is confirmed, download the form directly to your device from the 'My Forms' section.

By following these steps, you can easily obtain the legal forms you need while benefiting from the robust collection and expert assistance available through US Legal Forms.

Get started today and ensure your legal documents are accurate and tailored to your requirements!

Form popularity

FAQ

In Texas, a lien typically requires a written agreement between the creditor and debtor, detailing the debt amount and the property involved. Additionally, the lien must be filed with the county clerk in the appropriate jurisdiction. Understanding these requirements can help ensure your lien is valid and enforceable.

To complete a waiver of lien, start by filling out all necessary details, including the names of the parties and the property description. Next, ensure all conditions and terms of the waiver are correct and understood by both parties. Finally, have the waiver signed by the appropriate individuals to finalize the process.

Writing a lien waiver involves clearly stating the agreement between the parties regarding the release of lien rights. Begin by including relevant details such as the parties' names, the property description, and the terms of the waiver. Platforms like USLegalForms provide templates that can guide you in drafting an effective lien waiver.

In Texas, lien waivers do not require notarization unless specified by the contract. However, having a notarized lien waiver can provide an extra layer of security and validity. Always check the specifics of your contract to ensure you meet any legal requirements regarding lien waivers.

Yes, lien waivers can be signed electronically, which simplifies the process for all parties involved. Most jurisdictions recognize electronic signatures as legally binding, making it easier to manage transactions. Using an online platform like USLegalForms can streamline the electronic signing of lien waivers, ensuring compliance and efficiency.

In Texas, a lien waiver generally requires the identification of the parties involved, a description of the property, and any specific amounts involved. It is important to ensure that the waiver is signed by all necessary parties to be valid. Consulting resources like US Legal Forms can guide you through the requirements and ensure compliance with state laws.

A lien waiver is a legal document that signifies a party's relinquishment of any claim over another's property. This means that the party cannot impose a lien for debts owed, which can provide peace of mind in business transactions. Understanding the implications of a lien waiver can help protect your assets and foster positive relations.

To fill out a waiver of lien, you must provide essential details such as the parties involved, the property address, and the amount being waived. Accurately completing this document ensures that anyone involved understands the terms. Using a professional platform like US Legal Forms can simplify this process with templates and guidance.

Yes, Pennsylvania does recognize statutory lien waivers, which provide specific guidelines for how these documents must be used. A statutory lien waiver in Pennsylvania protects property owners from unexpected claims against their property. It’s essential to understand these laws to ensure all parties involved are aware of their rights and obligations.

The primary purpose of a lien waiver is to protect homeowners and tenants from being held liable for excessive claims related to unpaid debts or services. By signing a lien waiver, a party can prevent creditors from asserting a legal claim against their property. This ensures a smoother transaction and fosters trust in business and contractual relationships.