Estate Life

Description

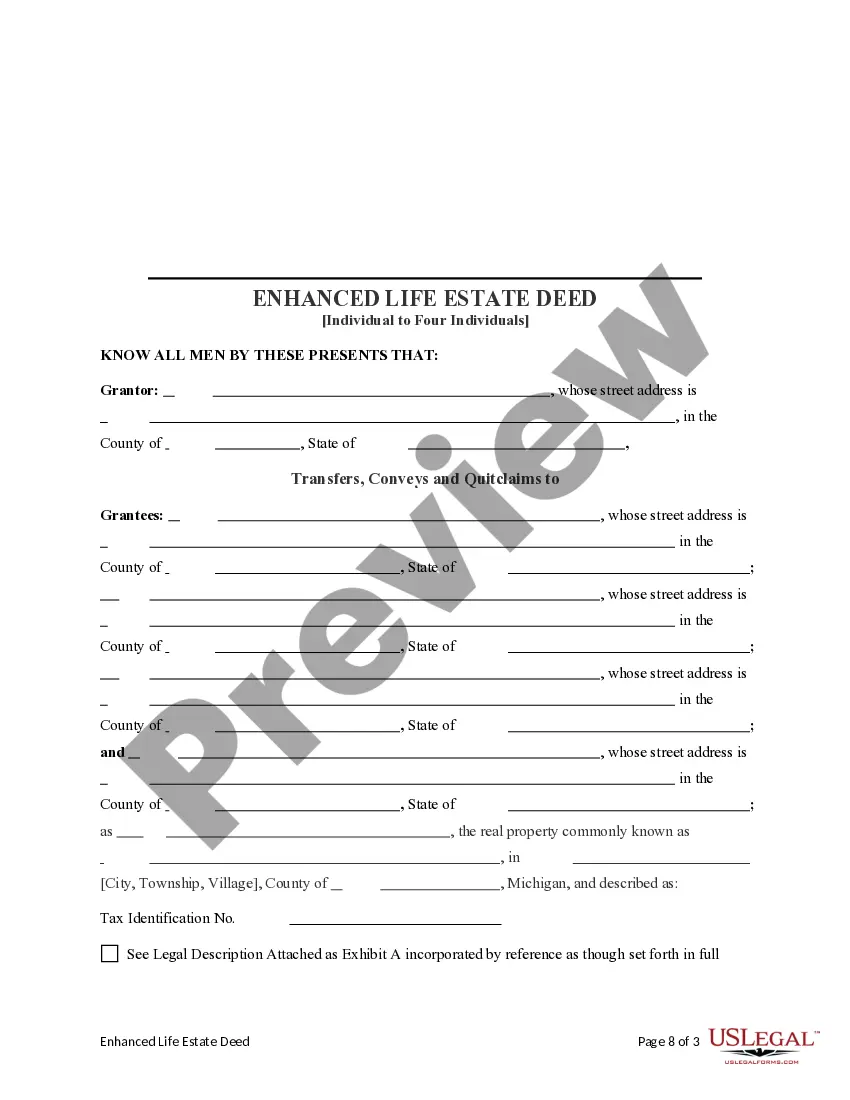

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

- Log in to your account if you are a returning user. Ensure your subscription is active; renew if necessary.

- Preview the legal form you need by checking its description to verify it meets your local jurisdiction's requirements.

- Utilize the search function if you need a different form. Adjust your search terms until you find the right template.

- Click on the 'Buy Now' button for your selected document, and choose your preferred subscription plan.

- Complete your purchase by providing payment details, either through a credit card or PayPal.

- Download the form directly to your device. You can access it later via the 'My Forms' section of your account.

In conclusion, US Legal Forms offers an extensive collection of over 85,000 editable legal templates, making it an invaluable resource for anyone dealing with estate life. With the added benefit of accessing premium experts for assistance, you can ensure that your documents are completed accurately.

Explore the convenience of US Legal Forms today to streamline your legal needs!

Form popularity

FAQ

Preparing a final accounting involves listing all income, expenses, and distributions related to the estate. Gather documentation for all transactions to create a clear financial picture. This process ensures transparency and accuracy, which are vital in settling an estate. Tools and resources from platforms like US Legal Forms can simplify this task and enhance your estate life management.

Not all estates automatically go to probate after a person passes away. The need for probate depends on the estate's assets and how they are titled. In some cases, if assets are held in a trust or jointly owned, probate may not be necessary. Understanding this can simplify your estate life and save time and expenses.

Yes, there is usually a time limit for starting probate, which varies by state. Failing to start the probate process within this timeframe may result in complications for the estate, delaying access for beneficiaries. Therefore, understanding these deadlines is vital for a smooth estate life transition. Seeking guidance can help you navigate these time-sensitive issues successfully.

Creating an estate plan involves several key steps to protect your wishes and belongings. Start by outlining your goals, including how you want your assets distributed. Next, you can use templates from platforms like US Legal Forms to draft vital documents such as wills and trusts. This careful planning ensures your estate life is organized and clear.

You typically have a limited time to start the probate process after someone passes away. Generally, this period ranges from a few weeks to several months, depending on the state. It’s crucial to begin promptly to ensure the estate is settled properly. Knowing when to initiate this process is essential in managing estate life effectively.

In New York, a life estate operates similarly to other states, allowing a person to occupy property for life with the ownership passing upon their death to named beneficiaries. New York law also outlines how taxes and liens on properties affect the life estate. Thorough understanding of estate life in New York can guide you in managing and establishing these arrangements effectively.

A downside of establishing a life estate is the potential for complications regarding property management. Since the life tenant lacks full control, conflicts may arise with remainder beneficiaries. Furthermore, estate taxes and liabilities can still impact the life tenant, creating financial uncertainty.

Giving someone a life estate means granting them rights to live in or use the property for their lifetime. This arrangement allows you to direct the future of your property while ensuring that the life tenant has a secure place to reside. Understanding this concept is vital when planning your estate life.

Determining whether a will or a life estate is better depends on individual circumstances and objectives. A life estate offers immediate rights to occupy the property while ensuring long-term plans for its transfer. On the other hand, a will provides broader asset distribution options, making it essential to consider your overall estate life plan.

The main difference lies in the transfer of property rights. A will distributes assets after death according to the testator's wishes. In contrast, a life estate provides specific rights and obligations during the tenant's life, ensuring a reliable transfer of ownership upon death.