Bird Deed Statement For Texas

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Finding a go-to place to take the most recent and relevant legal templates is half the struggle of handling bureaucracy. Discovering the right legal documents calls for accuracy and attention to detail, which is the reason it is important to take samples of Bird Deed Statement For Texas only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the information about the document’s use and relevance for your circumstances and in your state or region.

Take the listed steps to finish your Bird Deed Statement For Texas:

- Utilize the library navigation or search field to find your sample.

- View the form’s description to ascertain if it suits the requirements of your state and county.

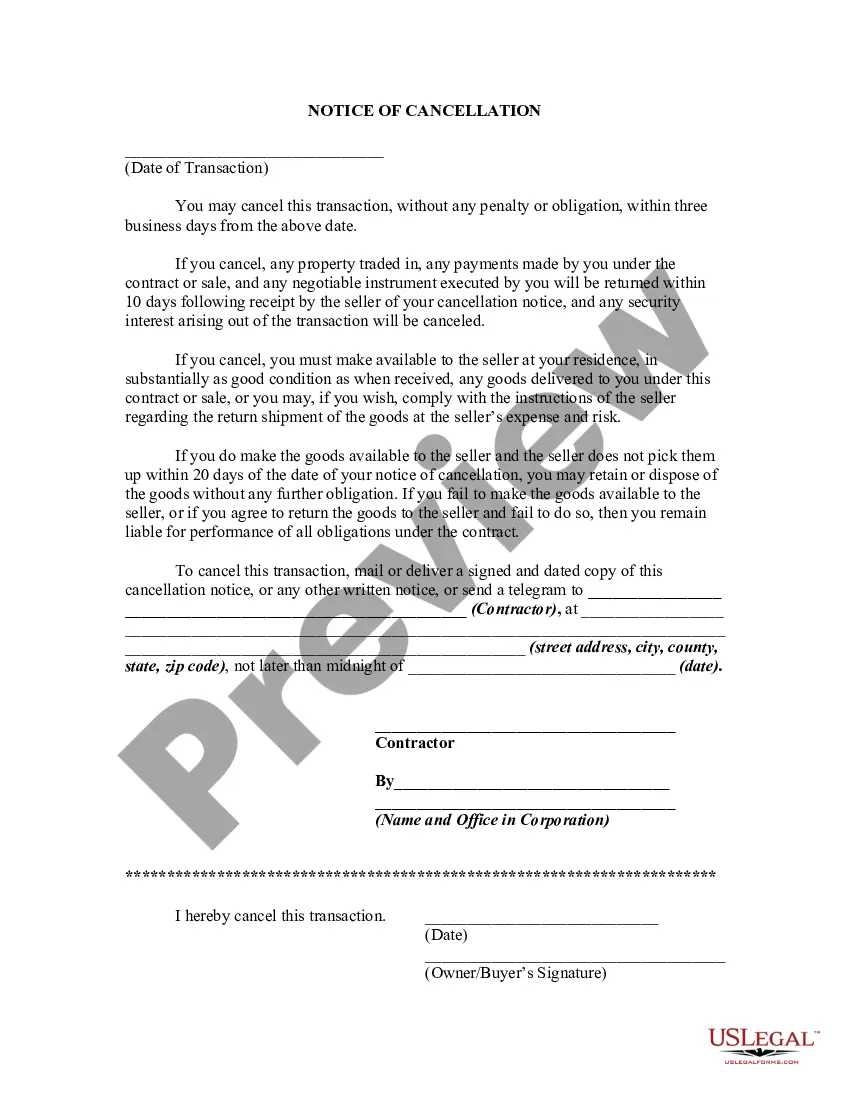

- View the form preview, if there is one, to make sure the template is definitely the one you are interested in.

- Return to the search and look for the right template if the Bird Deed Statement For Texas does not match your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the form.

- Choose the pricing plan that suits your needs.

- Go on to the registration to complete your purchase.

- Finalize your purchase by selecting a transaction method (credit card or PayPal).

- Choose the document format for downloading Bird Deed Statement For Texas.

- Once you have the form on your gadget, you can alter it using the editor or print it and finish it manually.

Get rid of the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms collection where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

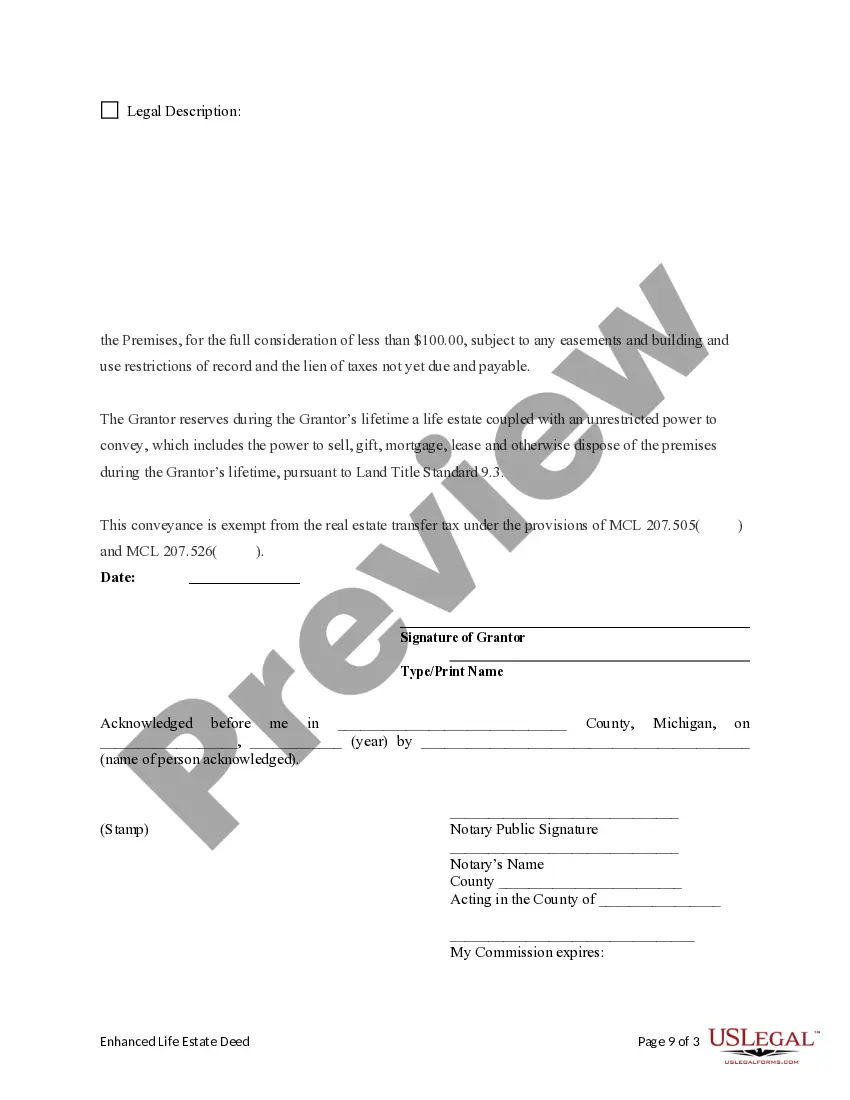

Transfer on death deeds cannot be signed by anyone other than the property owner. But as long as the Lady Bird deed form is signed in the presence of a licensed notary, Lady Bird deeds can be signed by the owner or the owner's agent under power of attorney.

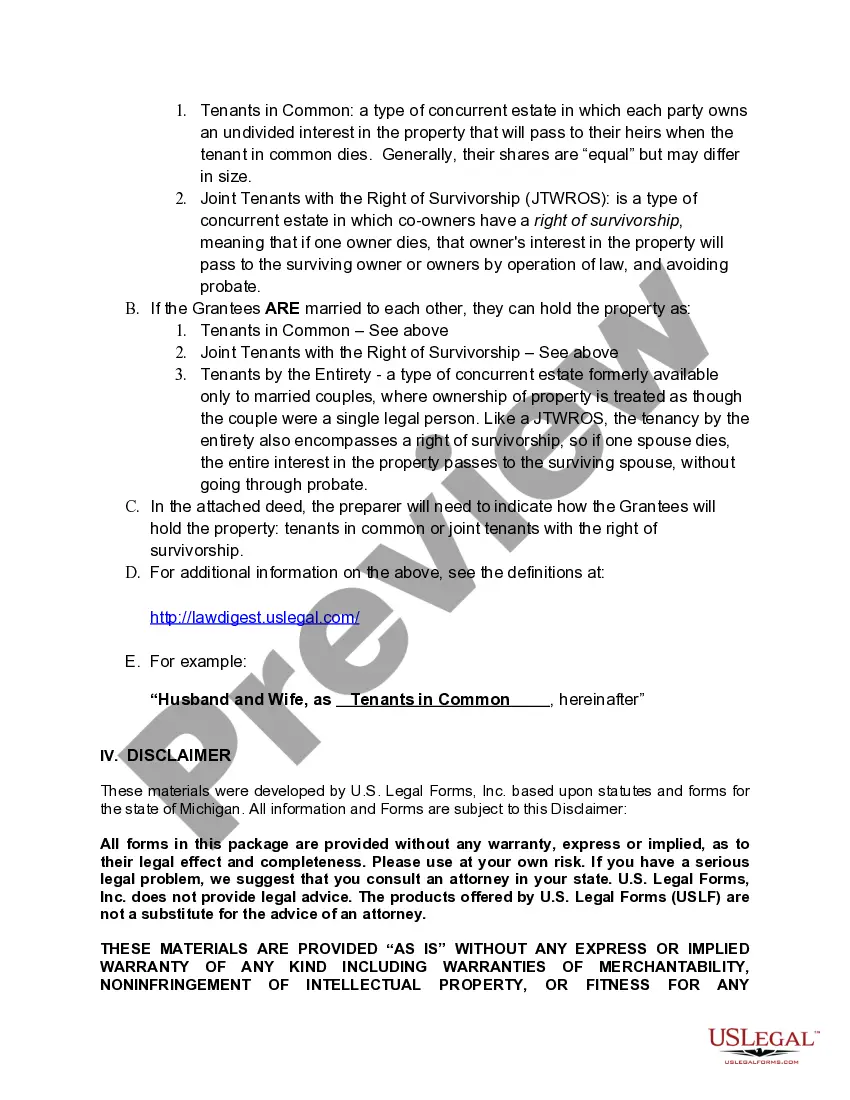

Disadvantages Not Ideal for Multiple Beneficiaries: A lady bird deed is not ideal if you want to leave the property to multiple beneficiaries. ... Title Insurance Can Be Tricky: Title insurance companies may not want to insure a property subject to a lady bird deed, especially if there are multiple beneficiaries.

Disadvantages Not Ideal for Multiple Beneficiaries: A lady bird deed is not ideal if you want to leave the property to multiple beneficiaries. ... Title Insurance Can Be Tricky: Title insurance companies may not want to insure a property subject to a lady bird deed, especially if there are multiple beneficiaries.

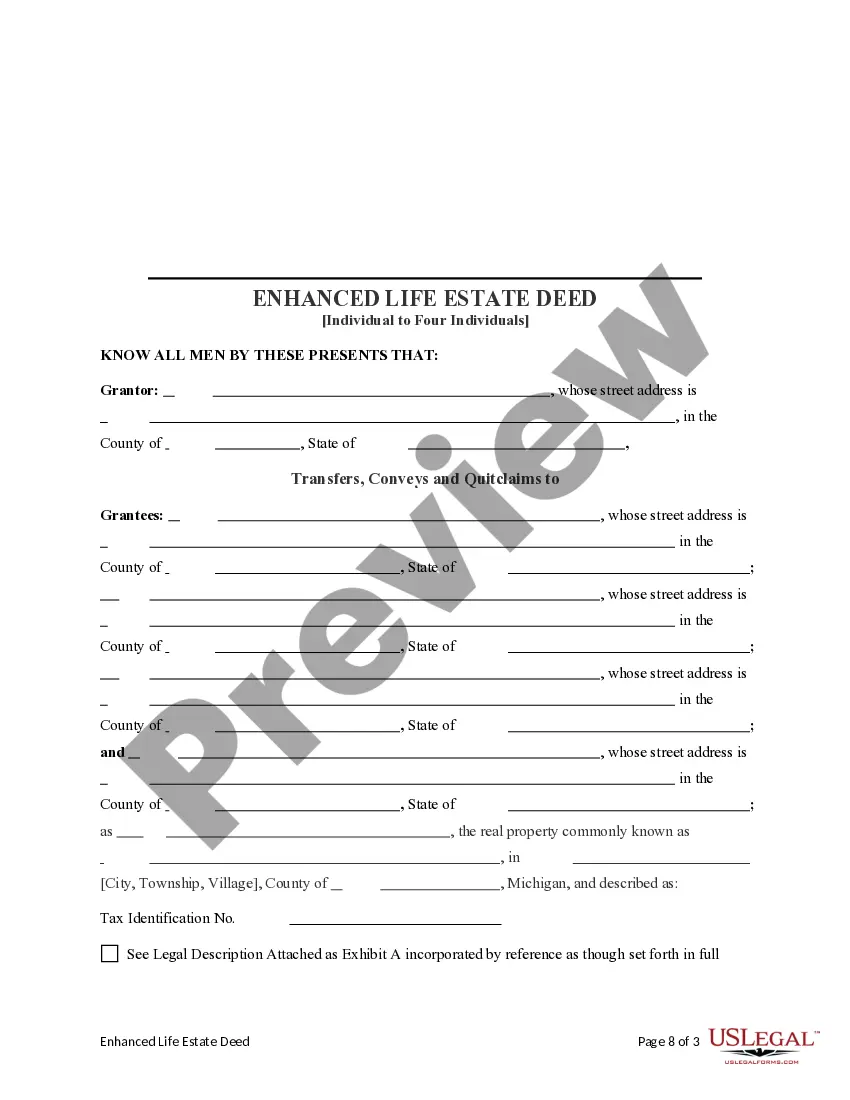

A general warranty deed must include the following to be valid: The name and address of the seller (called the grantor) The name and address of the buyer (called the grantee) A legal description of the property (found on the previous deed) A statement that the grantor is transferring the property to the grantee.

Tax Consequences of Ladybird Deeds This can allow the beneficiary to sell the property without incurring income taxes on the sale. The deeds also do not trigger Federal gift taxes. They are not completed gifts for gift tax purposes. The property does remain in the decedent's taxable estate for estate tax purposes.