Limited Liability Company With One Member

Description

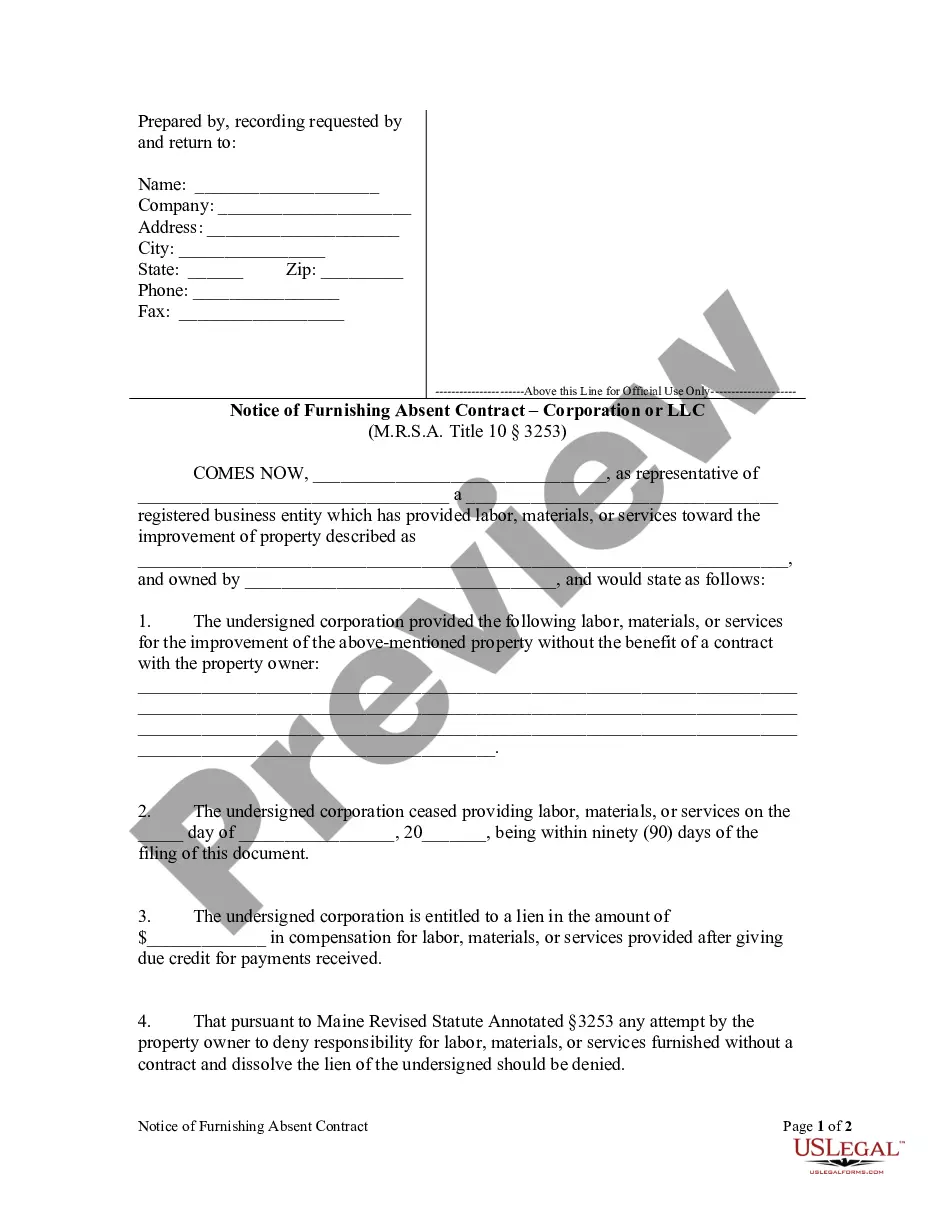

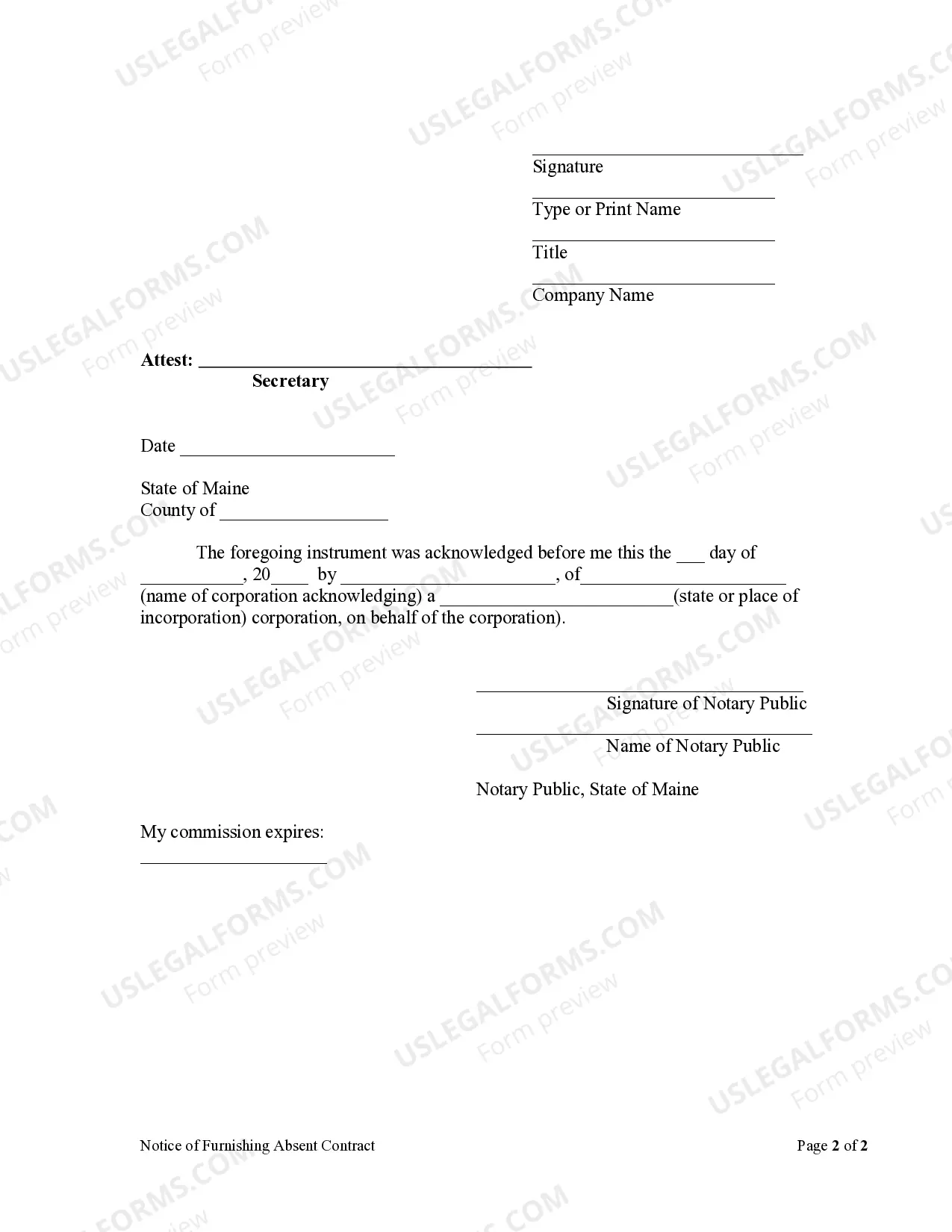

How to fill out Maine Notice Of Furnishing Absent Contract - Corporation Or LLC?

- Log into your US Legal Forms account and navigate to the document library. Ensure your subscription is active, or renew it according to your chosen payment plan.

- Browse the extensive library and use the Preview mode to verify that you have selected the correct form for creating a single-member LLC that meets your local jurisdiction requirements.

- If you're unable to find the appropriate template, utilize the Search tab to locate alternative forms that suit your needs.

- Select your desired document by clicking the Buy Now button and pick the subscription plan that best fits your requirements. You will need to create an account to access the full library.

- Complete the payment using your credit card or PayPal account to finalize your purchase.

- Download your LLC formation template to your device and access it later through the My Forms section of your profile.

With US Legal Forms, users benefit from an extensive collection of over 85,000 legal forms, making it easier than ever to find exactly what you need. The service also provides access to premium experts should you require assistance with form completion.

By following these steps, you can quickly set up your limited liability company with one member. Start creating your LLC today with US Legal Forms and enjoy peace of mind knowing that your legal documents are accurate and compliant.

Form popularity

FAQ

Yes, a limited liability company with one member can be owned by another company. This means a corporation or another LLC can be the sole member of your single-member LLC. This structure may provide additional layers of liability protection and can be advantageous for tax purposes. However, it’s crucial to understand the implications and consult with legal or tax professionals to navigate this setup properly.

To start a limited liability company with one member, you need to choose a unique business name and check its availability. Next, you will file the necessary paperwork with your state, which typically includes Articles of Organization. Once your application is approved, you may need to create an operating agreement to clarify roles and responsibilities. Platforms like USLegalForms can simplify this process by providing the required documents and guidance.

Being a limited liability company with one member can be beneficial for many entrepreneurs. It combines liability protection with simpler management requirements compared to other business structures. Additionally, you maintain full control over your business decisions and profits. It's essential to weigh these advantages against your business goals and financial situation.

A limited liability company with one member can generally deduct ordinary and necessary business expenses on its tax return. This means you can write off expenses like office supplies, travel, and utilities. However, there are limits and specific rules on what qualifies for a write-off, so it's wise to consult a tax professional to maximize your deductions effectively.

While a limited liability company with one member offers personal asset protection, it does have some disadvantages. One major concern is that it may lack the same credibility as a multi-member LLC, which could affect business relationships. Additionally, a single-member LLC could face stricter tax scrutiny from the IRS. These factors make it important to carefully consider your specific situation.

When filling out a W-9, a single-member LLC can use either a Social Security Number or an Employer Identification Number. If your limited liability company with one member has an EIN, it's best to use it to separate your personal and business finances. However, if you don't have an EIN, your SSN is an acceptable alternative.

To fill out a W-9 as a single-member LLC, enter your business name in the first line and your name as the owner in the second. Select 'Limited liability company' as the entity type, and specify that you are a single-member by entering '1.' Be sure to include your EIN if you have one, or your Social Security Number if not.

Generally, a single-member LLC owner enjoys protection from personal liability for business debts, meaning your personal assets are typically safe. However, it's crucial to maintain good business practices to uphold this protection. If you fail to separate your personal and business finances, you may risk losing that liability shield.

An LLC with one person is commonly referred to as a 'single-member LLC.' This business structure offers the same limited liability protection as a multi-member LLC while allowing for simpler tax reporting. If you're a sole owner, this might be the ideal choice for protecting your personal assets.

A single individual filling out a W-9 should indicate their name as the owner of the limited liability company with one member. Make sure to check the 'Individual/Sole Proprietor' box and provide your Social Security Number. This clarification helps avoid any confusion regarding the ownership structure of your business.