Life Estate Deed Explained

Description

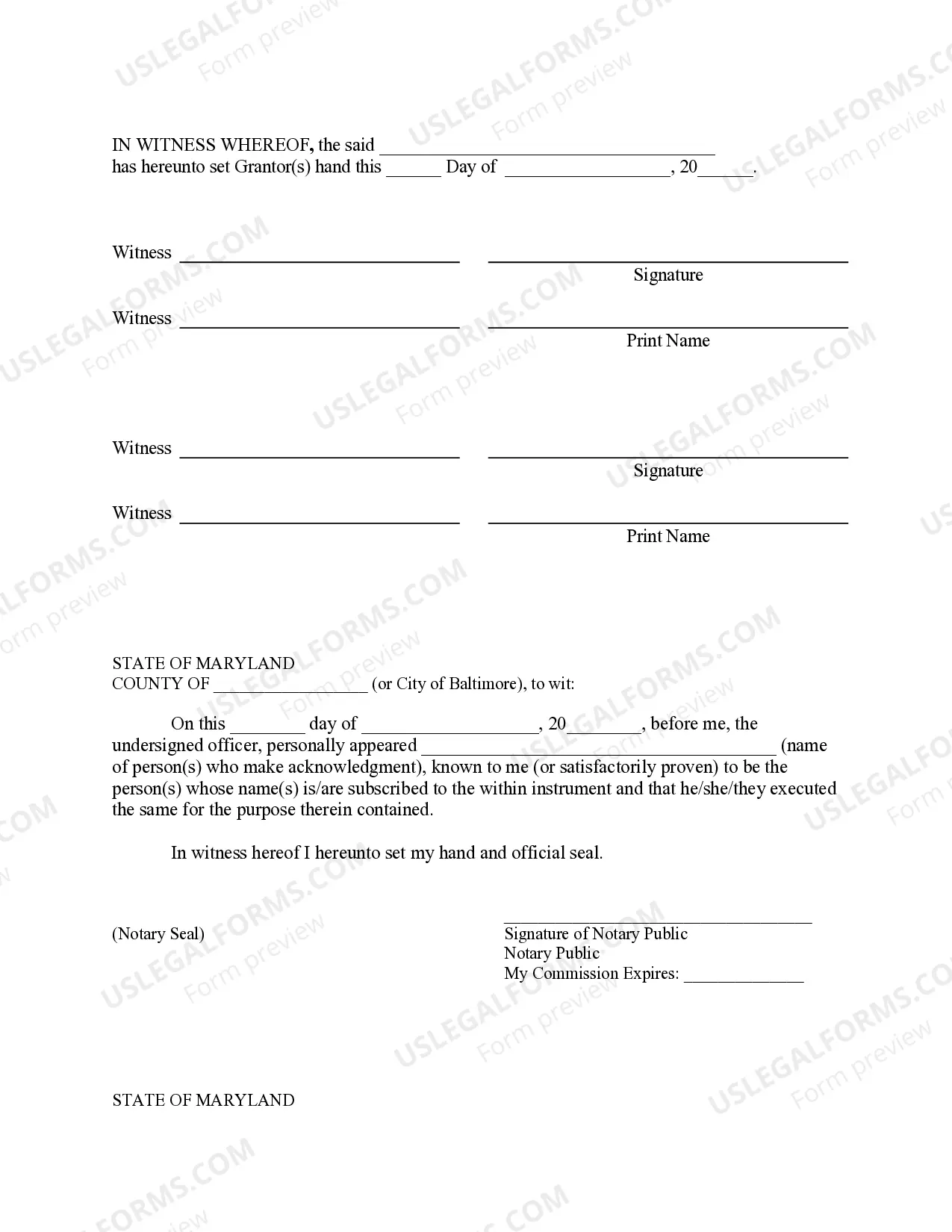

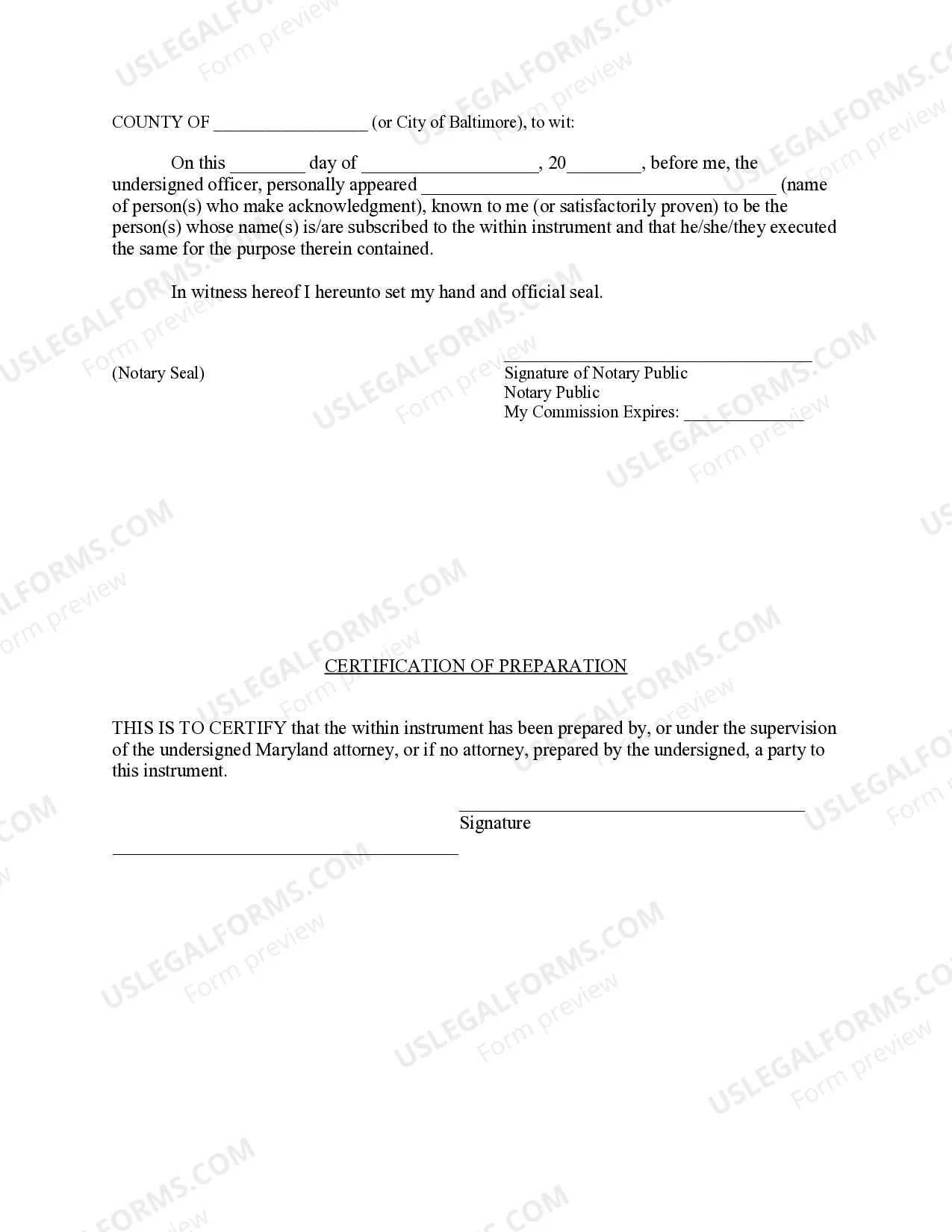

How to fill out Maryland Warranty Deed For Parents To Child With Reservation Of Life Estate?

Utilizing legal templates that adhere to federal and local regulations is essential, and the internet presents a plethora of choices to select from.

However, what is the benefit of squandering time searching for the appropriately drafted Life Estate Deed Explained sample online when the US Legal Forms online repository has already collected such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates created by attorneys for various business and personal situations.

Examine the template utilizing the Preview feature or through the textual description to confirm it satisfies your requirements.

- They are effortless to navigate with all documents arranged by jurisdiction and intended usage.

- Our experts stay updated with legislative modifications, so you can always feel assured that your documents are current and compliant when acquiring a Life Estate Deed Explained from our site.

- Obtaining a Life Estate Deed Explained is straightforward and quick for both existing and new patrons.

- If you possess an account with an active subscription, Log In and secure the document sample you need in your preferred format.

- If you are visiting our site for the first time, adhere to the guidelines below.

Form popularity

FAQ

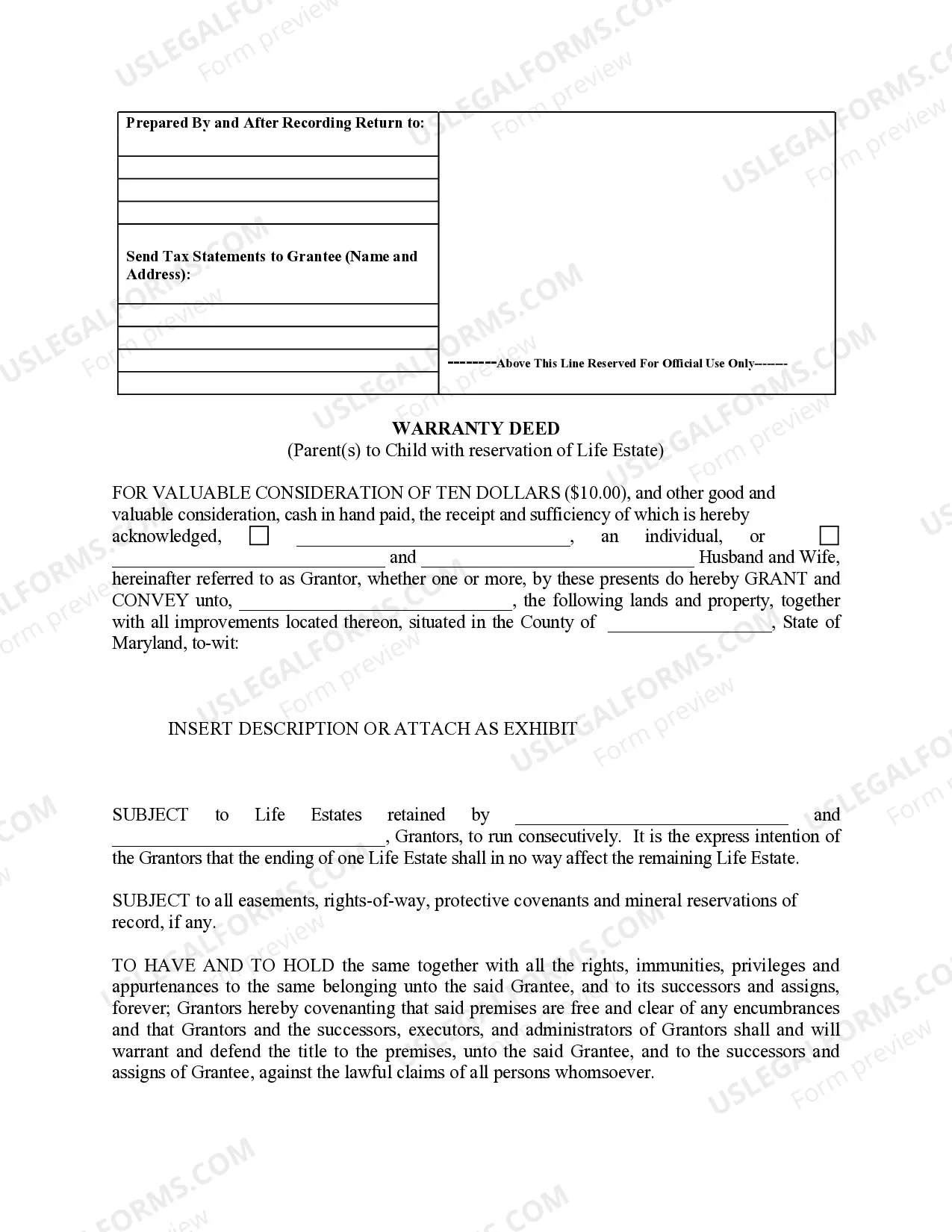

If you hold the life estate your obligated to make repairs that are essential to the preservation of the property, your obligated to pay the interest on any outstanding mortgages and Property taxes.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

In addition, life estates allow the owner to control the property in all respects, except that they cannot sell or mortgage the property without the consent of their heirs. If created in a timely manner, a life estate can even help its creator qualify for Medicaid assistance.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.