Maryland Warranty Deed for Parents to Child with Reservation of Life Estate

What this document covers

This Warranty Deed for Parents to Child with Reservation of Life Estate is a legal document that allows parents to transfer property to their child while retaining the right to live on and use the property for the rest of their lives. This deed is important for families wanting to manage property inheritance and maintain control over their real estate during their lifetime, distinguishing it from other types of deeds that do not provide such reservations.

What’s included in this form

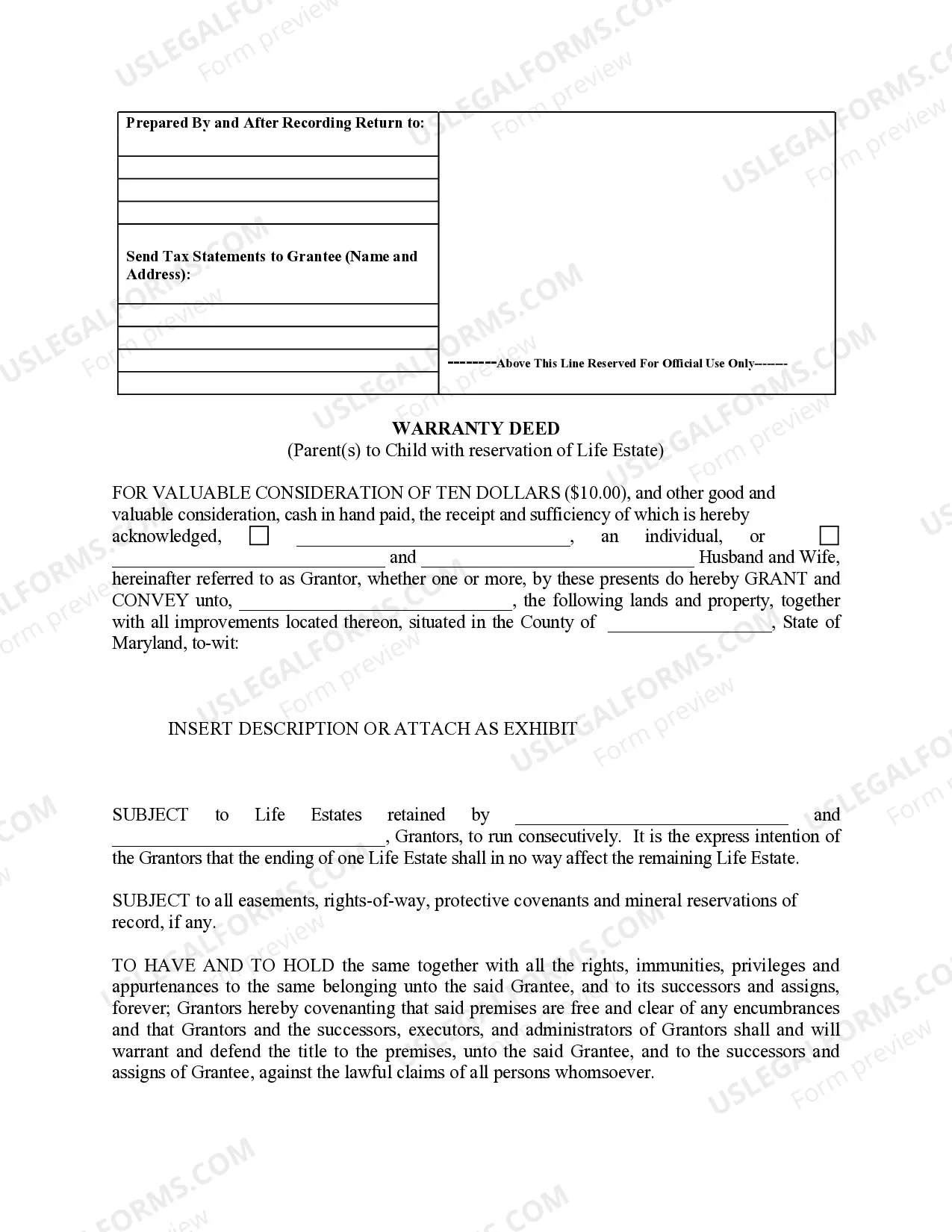

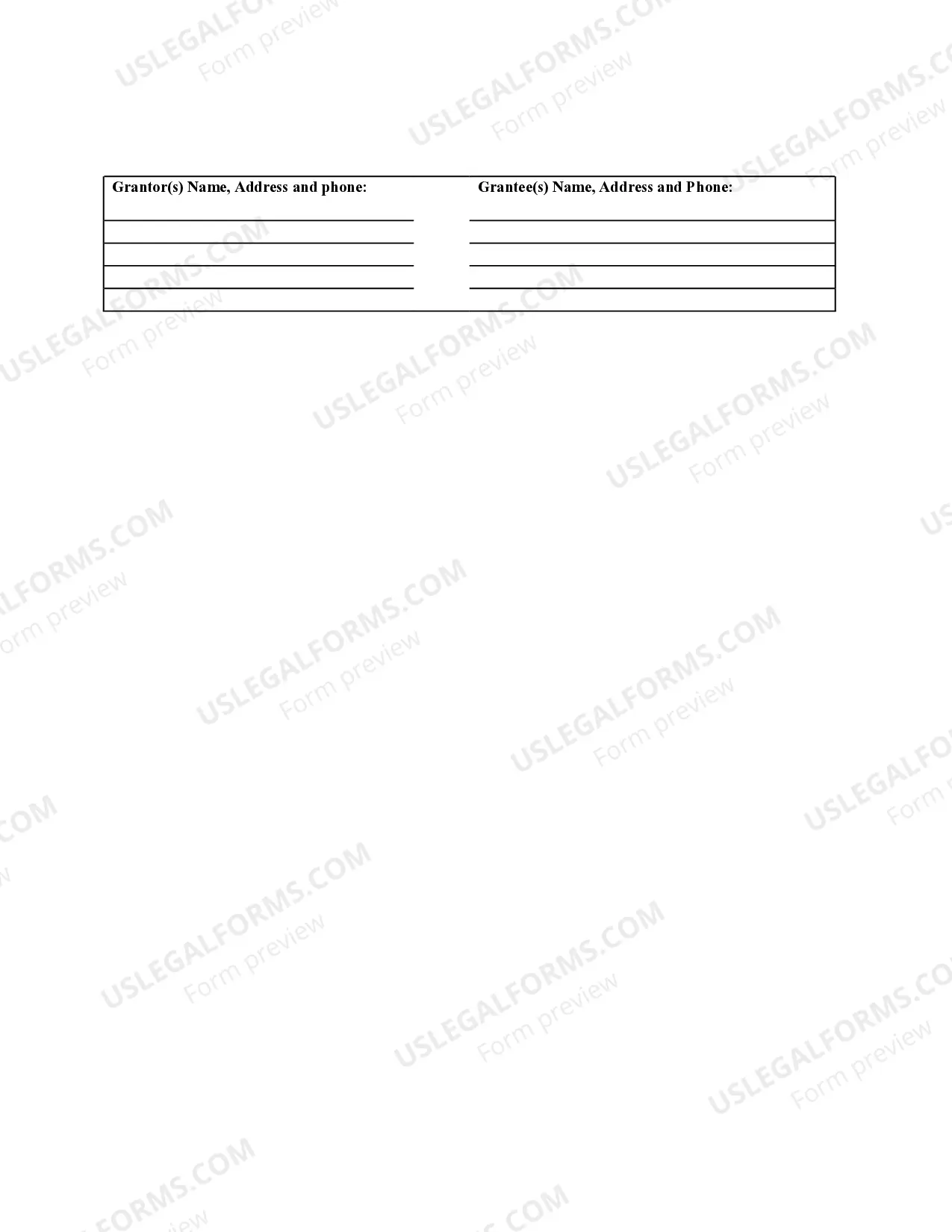

- Grantor details: Information about the parents transferring the property.

- Grantee details: Information about the child receiving the property.

- Description of the property: A detailed description of the property being transferred, including its location.

- Reservation of life estate: Explicit statement allowing the grantors to retain the right to live on the property during their lifetimes.

- Signatures and notarization: Space for grantors' signatures and notary acknowledgment to validate the deed.

When to use this document

This form should be used when parents wish to legally transfer ownership of a property to their child while ensuring that they can continue to reside in the property for as long as they are alive. It is commonly utilized in estate planning, especially when parents want to simplify the transfer of property to their heirs and avoid probate issues later on.

Who should use this form

- Parents wishing to transfer real estate to their children.

- Families looking to preserve property for future generations while maintaining occupancy rights.

- Individuals involved in estate planning who want to avoid probate complications.

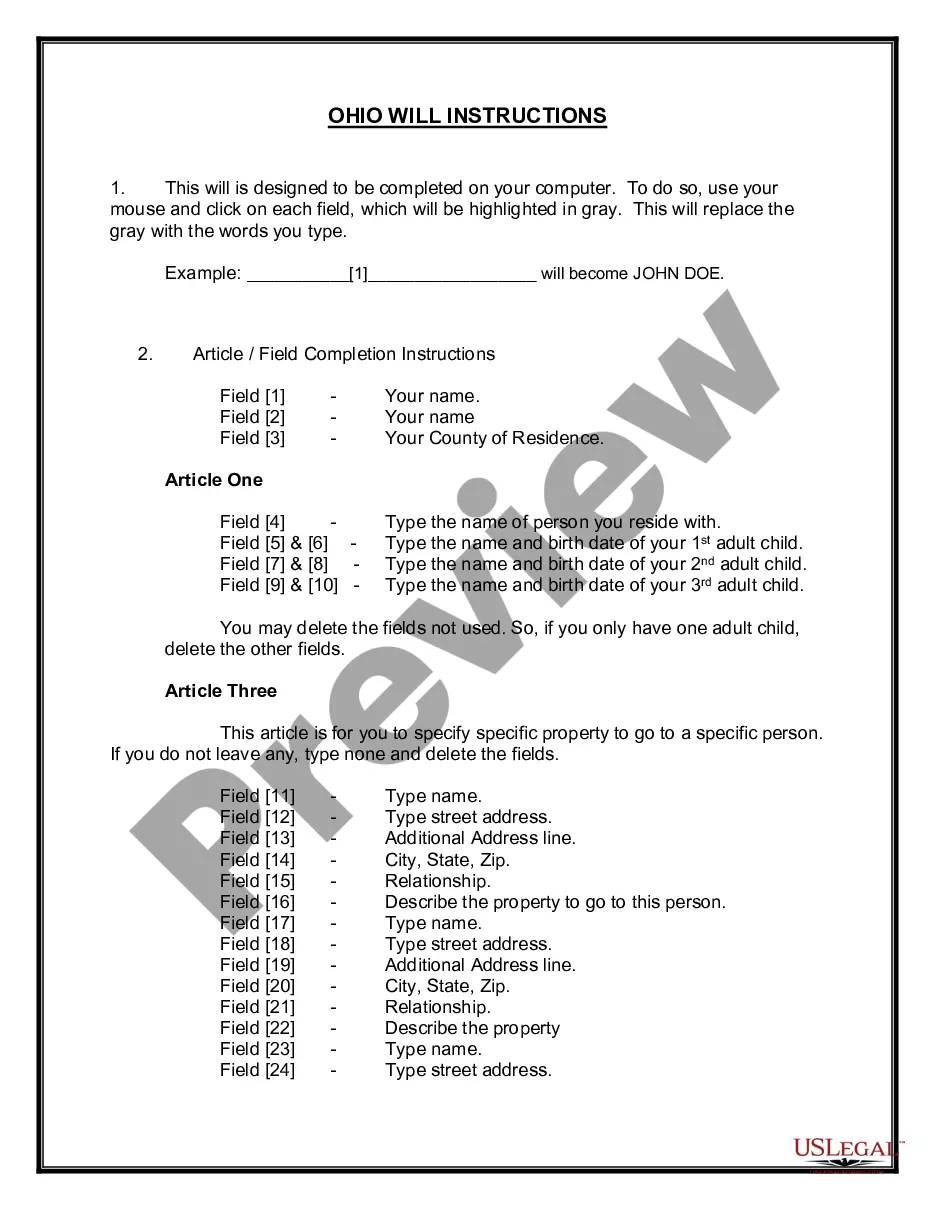

Completing this form step by step

- Identify the parties: Fill in the names and addresses of the parents (grantors) and the child (grantee).

- Specify the property: Provide a detailed description of the property being transferred.

- Enter the terms: Clearly state the reservation of life estate retained by the grantors.

- Complete the signature block: Have all parties sign the document in the presence of a notary public.

- File with local authorities: Ensure the completed deed is submitted along with any required forms to the appropriate county office.

Does this document require notarization?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Mistakes to watch out for

- Not including a complete property description, which can lead to legal disputes.

- Failing to sign the document in front of a notary public, making the deed invalid.

- Ignoring local filing requirements, which can result in non-compliance issues.

Benefits of completing this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows you to customize fields easily.

- Reliability of forms drafted by licensed attorneys, ensuring legal compliance.

Legal use & context

- This deed provides a clear legal framework for transferring property with a retained life estate.

- Enforceable in Maryland courts, subject to adherence to local laws.

- Helps avoid probate, facilitating smoother property transfer upon the death of the grantors.

Quick recap

- This Warranty Deed allows parents to transfer property while retaining occupancy rights.

- It is specifically designed for use in Maryland and requires notarization.

- Proper completion and filing are essential for legal validity and proper property transfer.

Form popularity

FAQ

A life estate deed is a type of deed. You give yourself a life estate interest in your home 1 and retain the right to live in, use, and enjoy the property during your lifetime.There are two different types of life estate deeds used in Maryland. The first is called a life estate deed with full powers.

A California Revocable Transfer-On-Death Deed does not take effect until the property owner dies.As long as the original owner is alive, he can revoke the transfer, sell the property, add or remove beneficiaries, and otherwise maintain complete control over the property.

The life tenant cannot change the remainder beneficiary without their consent. If the life tenant applies for any loans, they cannot use the life estate property as collateral. There's no creditor protection for the remainderman. You can't minimize estate tax.

When the life tenant dies, the house will not go through probate, since at the life tenant's death the ownership will pass automatically to the holders of the remainder interest.The life tenant cannot sell or mortgage the property without the agreement of the remaindermen.

The IRS treats the life estate transfer as a sale, and the fair market value of the house is included in your estate. If your estate exceeds the exclusion amount, you could owe estates taxes on the difference.If your estate is $100,000 to $150,000 over the exclusion maximum, the amount is taxed at 30 percent.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner.Remainder Owners have no right to use the property or collect income generated by the property, and are not responsible for taxes, insurance or maintenance, as long as the Life Tenant is still alive.

Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.