Maryland Affidavit Of Refinancing Exemption

Description

How to fill out Maryland Affidavit Of Refinancing Exemption?

Properly composed official documents are among the essential safeguards to prevent complications and legal disputes, but obtaining them without an attorney's assistance might require time.

Whether you need to swiftly locate a current Maryland Affidavit Of Refinancing Exemption or other templates for employment, family, or business scenarios, US Legal Forms is always ready to assist.

The procedure is even simpler for current users of the US Legal Forms library. If your subscription is active, you merely need to Log In to your account and click the Download button next to the selected document. Furthermore, you can retrieve the Maryland Affidavit Of Refinancing Exemption at any time, as all the forms previously acquired on the platform are accessible within the My documents section of your profile. Save time and money on preparing official paperwork. Try US Legal Forms today!

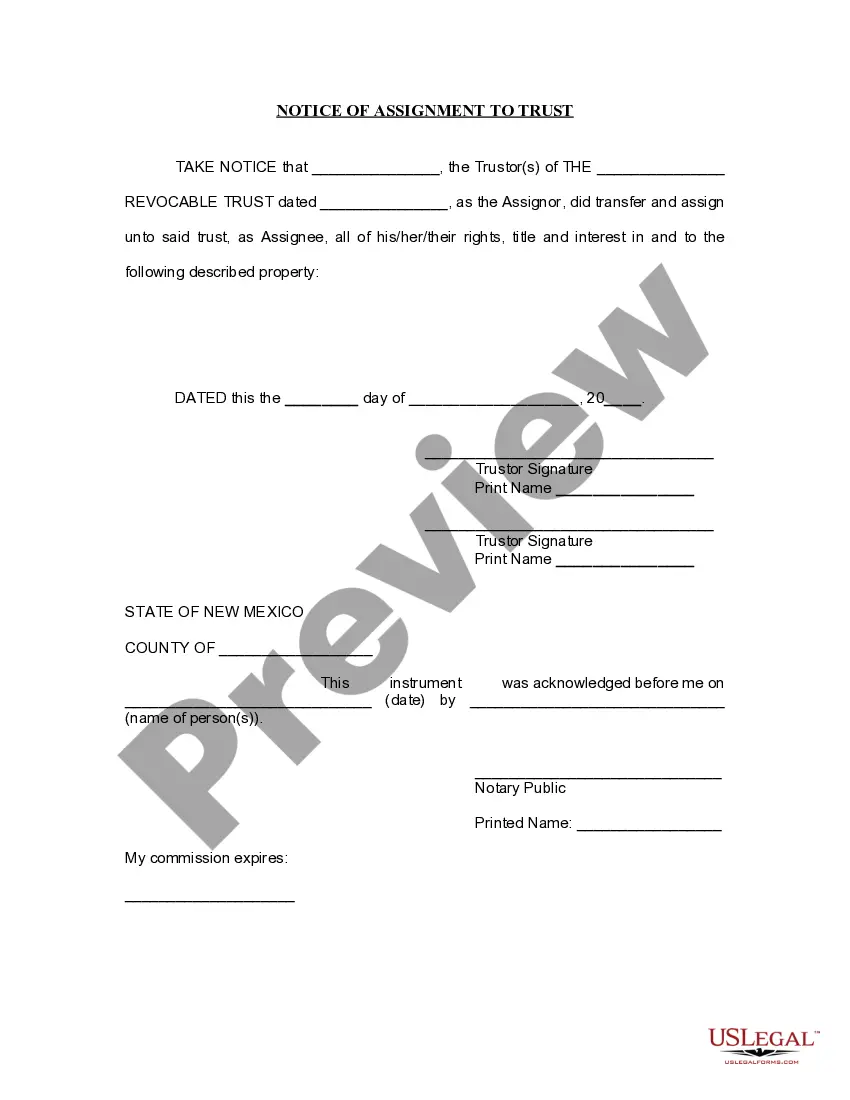

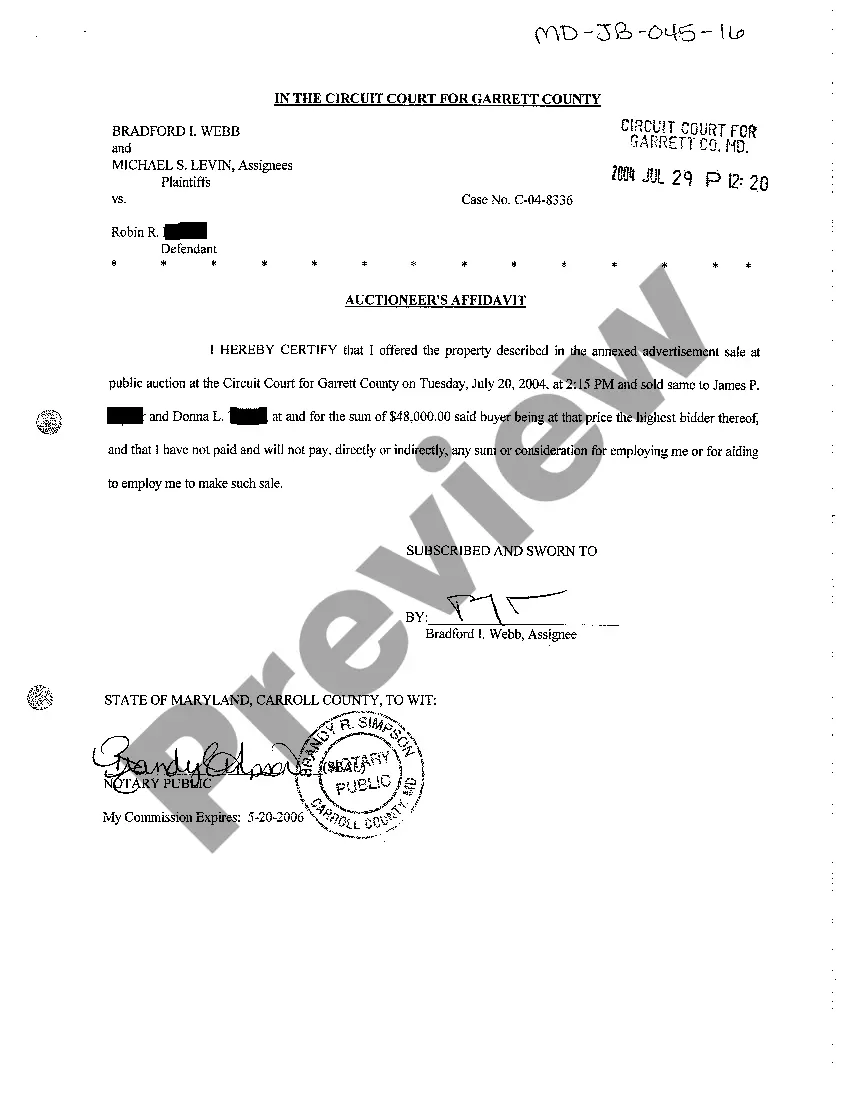

- Ensure that the form aligns with your situation and location by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Press Buy Now once you find the appropriate template.

- Choose the pricing option, Log Into your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (through credit card or PayPal).

- Choose PDF or DOCX file format for your Maryland Affidavit Of Refinancing Exemption.

- Hit Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.

Recordation Tax is applied to any instrument that transfers an interest in real property or that creates a security interest in real or personal property. The recordation tax rate for Wicomico County is $3.50 for every $500 or fraction of $500 of consideration.

The Refinance Exemption allows that, in the event the amount secured by a refinance deed of trust is greater than the unpaid principal balance of the loan secured by the existing deed of trust, State Recordation Tax is calculated on the amount of the increase, as opposed to on the entire new principal amount.

Recordation Tax is applied to any instrument that transfers an interest in real property or that creates a security interest in real or personal property. The recordation tax rate for Wicomico County is $3.50 for every $500 or fraction of $500 of consideration.

Neither Maryland State law nor Montgomery County require that property taxes be paid when refinancing a mortgage. However, often mortgage lenders will require that property taxes be current before the new mortgage is issued to the taxpayer.