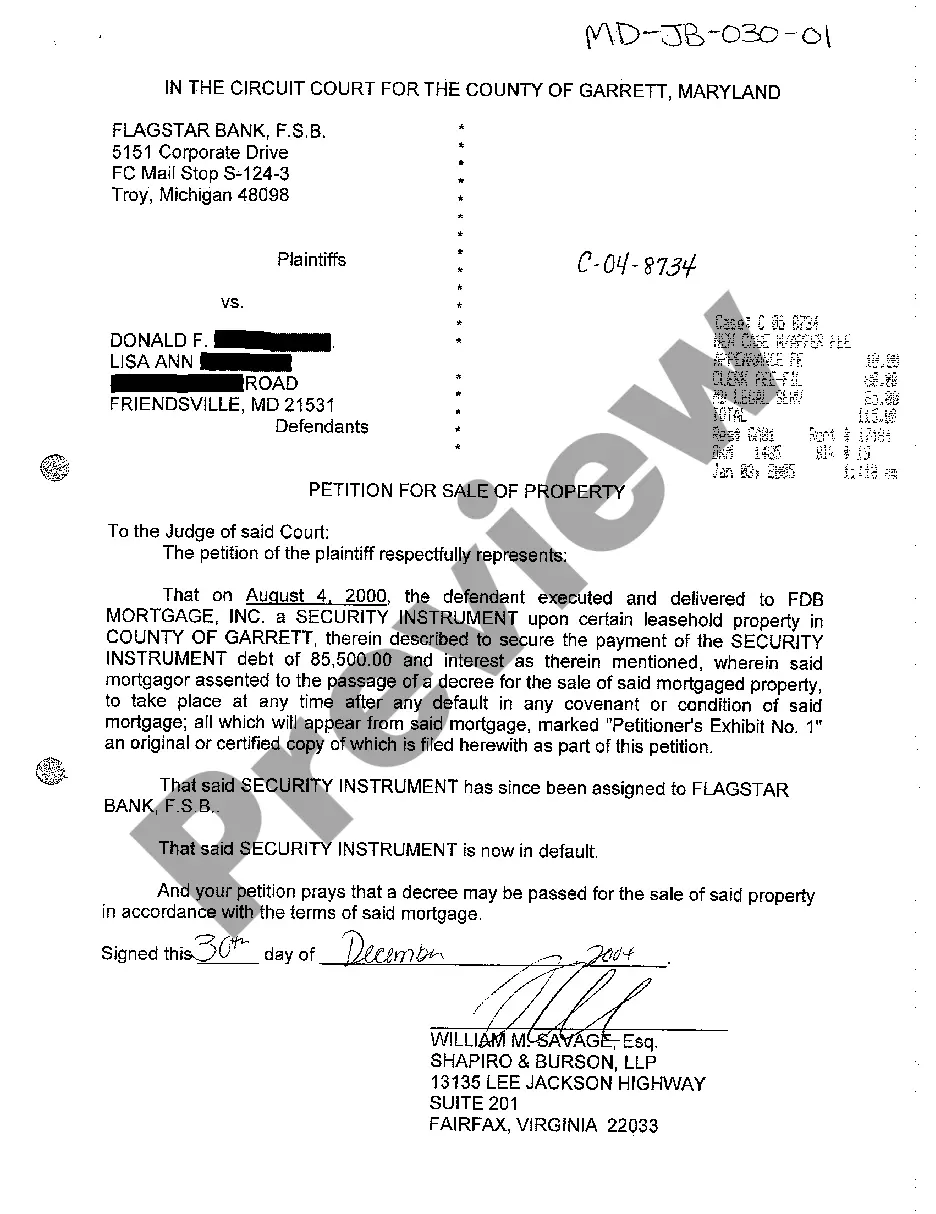

Maryland Petition For Sale Of Property With Pool

Description

How to fill out Maryland Petition For Sale Of Property With Pool?

What is the most trustworthy service to obtain the Maryland Petition For Sale Of Property With Pool and other recent iterations of legal paperwork.

US Legal Forms is the solution! It's the most comprehensive assortment of legal documents for every occasion.

If you do not yet have an account with us, here are the steps you need to follow to create one: Compliance review of the form. Before acquiring any template, you must ensure it aligns with your requirements and your state or county's regulations. Review the form description and utilize the Preview feature if available.

- Each template is professionally composed and verified for adherence to federal and state laws and regulations.

- They are organized by category and jurisdiction, making it easy to find what you require.

- Experienced users of the platform only need to Log In to their account, confirm if their subscription is active, and click the Download button next to the Maryland Petition For Sale Of Property With Pool to acquire it.

- Once downloaded, the template remains accessible for future use in the My documents section of your profile.

Form popularity

FAQ

In Maryland, a landlord must give tenants at least 60 days' notice if they intend to sell the property. This notice period ensures tenants have ample time to find new housing. If the property has a monthly lease, the landlord must also comply with local regulations regarding notice for property showings. It’s essential to communicate openly with tenants during your Maryland petition for sale of property with pool, as transparency can lead to smoother transitions.

To avoid capital gains tax on real estate in Maryland, consider living in your property for at least two of the last five years. Utilizing the primary residence exclusion allows you to exclude up to $250,000 of gains, or $500,000 for married couples. Another approach includes reinvesting the profits into another property through a 1031 exchange, which can defer the tax liability. If you're planning a sale, noting the special circumstances of your Maryland petition for sale of property with pool can help you leverage other tax benefits.

To file the Maryland Form 510, you should submit it to the local circuit court where the property is located. This can often be done online through the Maryland Judiciary Case Search website, ensuring you have the appropriate documentation ready. Filing this form is crucial for initiating your Maryland petition for sale of property with pool, as it formalizes your request to the court. Additionally, be sure to check for any local requirements or filing fees that may apply.

Section 10-702 covers the procedures for selling property in Maryland under specific legal conditions, particularly concerning the sale of property at a public auction. This section outlines the obligations of sellers and the rights of buyers. If you are in the process of a Maryland petition for sale of property with pool, understanding this section can ensure compliance with state laws. Consulting uLegalForms can provide you with the necessary legal insights to guide your transaction smoothly.

A common strategy for avoiding capital gains tax on real estate investments involves holding the property for more than a year. Long-term investments are generally taxed at lower rates than short-term gains. Moreover, leveraging a 1031 exchange could defer taxes when you reinvest in another property. If you're preparing a Maryland petition for sale of property with pool, consider these strategies to enhance your financial outcome.

In Maryland, sales tax typically does not apply to the sale of real estate. However, it is important to be aware of other fees and taxes that might come into play during the sale. Utilizing the Maryland petition for sale of property with pool might streamline certain processes, ensuring you focus only on relevant taxes and fees. Consulting with a legal expert will clarify any specifics and help you avoid unexpected costs.

To avoid capital gains tax in Maryland, you may consider utilizing exemptions such as the primary residence exclusion. If you meet certain criteria, you can exclude up to $250,000, or $500,000 for married couples, from the sale of your home. Additionally, reinvesting your profits into another qualifying property may defer these taxes. When selling property with a pool, it is wise to consult a professional to navigate the Maryland petition for sale of property with pool efficiently.

When you are forced to sell your property, it is typically referred to as a forced sale or involuntary sale. This situation may arise due to legal actions like partition actions among co-owners or foreclosure processes. If you find yourself facing such a circumstance, it's beneficial to understand the options available, including a Maryland petition for sale of property with pool, which can streamline the process.

Yes, jointly owned property can be seized under certain circumstances, such as for unpaid debts or legal judgments against one of the owners. The specifics depend on the ownership structure and the laws in Maryland. Additionally, if disputes arise among owners, a partition action may become necessary to resolve ownership and sales issues, often utilizing a Maryland petition for sale of property with pool.

To force the sale of jointly owned property in Maryland, you may need to file a partition action in court. This legal proceeding allows a co-owner to request the court to sell the property if an agreement cannot be reached among co-owners. Utilizing a Maryland petition for sale of property with pool can help guide you through the process effectively and ensure all legal requirements are met.