Wage Garnishment Form

Description

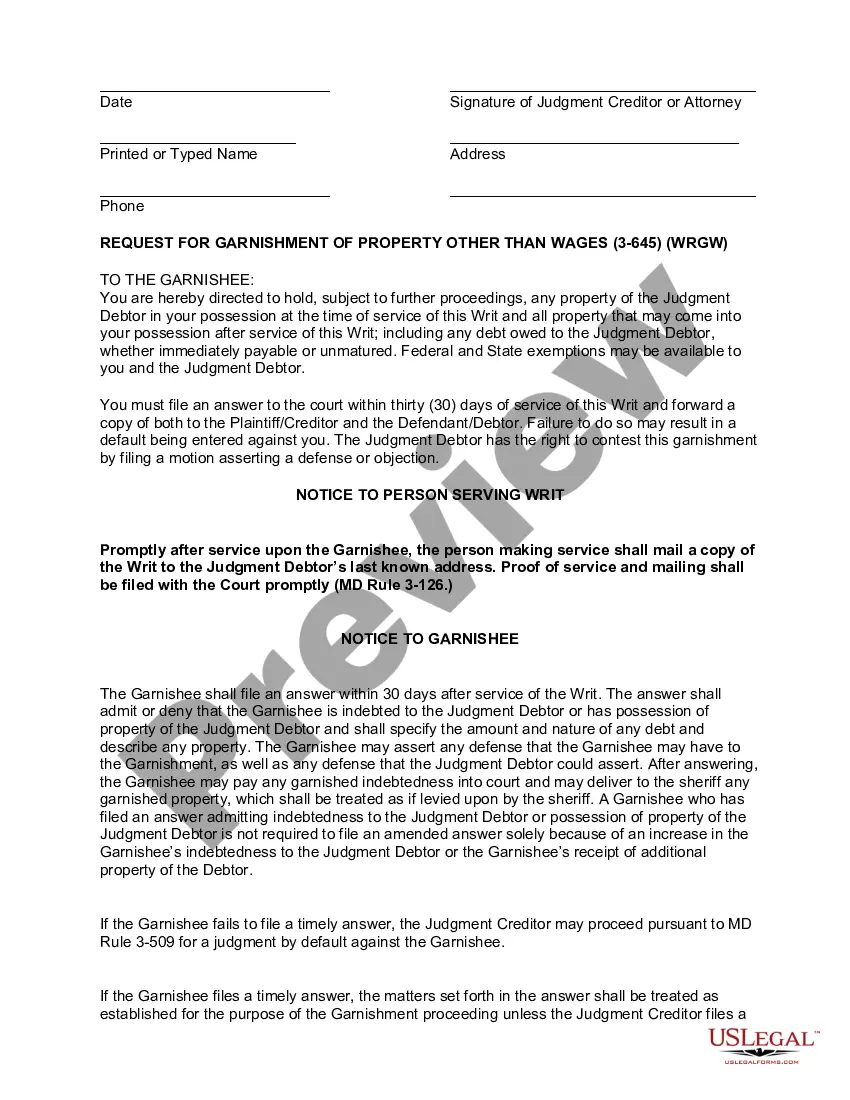

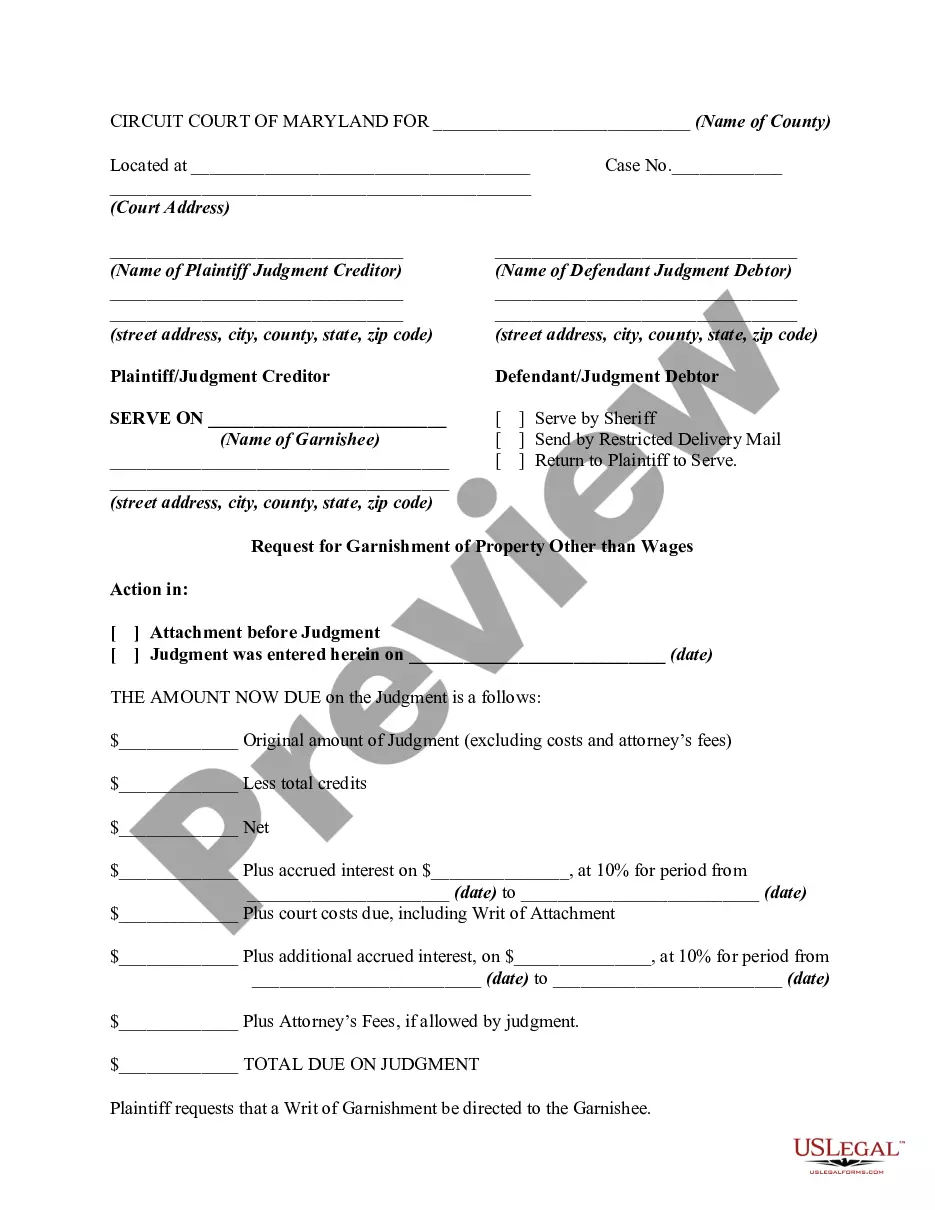

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Individuals frequently link legal documentation with something intricate that solely an expert can manage.

In a certain respect, this is accurate, as preparing Wage Garnishment Form requires considerable expertise in subject matter, including state and local statutes.

Nonetheless, with US Legal Forms, the process has become more straightforward: pre-made legal templates for any personal and business event specific to state regulations are gathered in one online repository and are now accessible to all.

All templates in our library are reusable: once purchased, they remain stored in your profile. You can access them at any time through the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- Thoroughly review the webpage content to ensure it meets your requirements.

- Examine the form description or confirm it using the Preview option.

- If the previous form does not match your needs, find another template using the Search field above.

- When you identify the correct Wage Garnishment Form, click Buy Now.

- Select a pricing plan that aligns with your preferences and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the file format and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

Writing a wage garnishment letter requires clarity and accuracy to effectively communicate with the necessary parties. Start by including your personal information, the recipient's details, and a clear statement of the garnishment request. Be sure to provide the relevant details about the debt and attach the completed wage garnishment form to support your claim. Utilizing our platform, US Legal Forms, can help you craft a professional letter that meets all legal requirements.

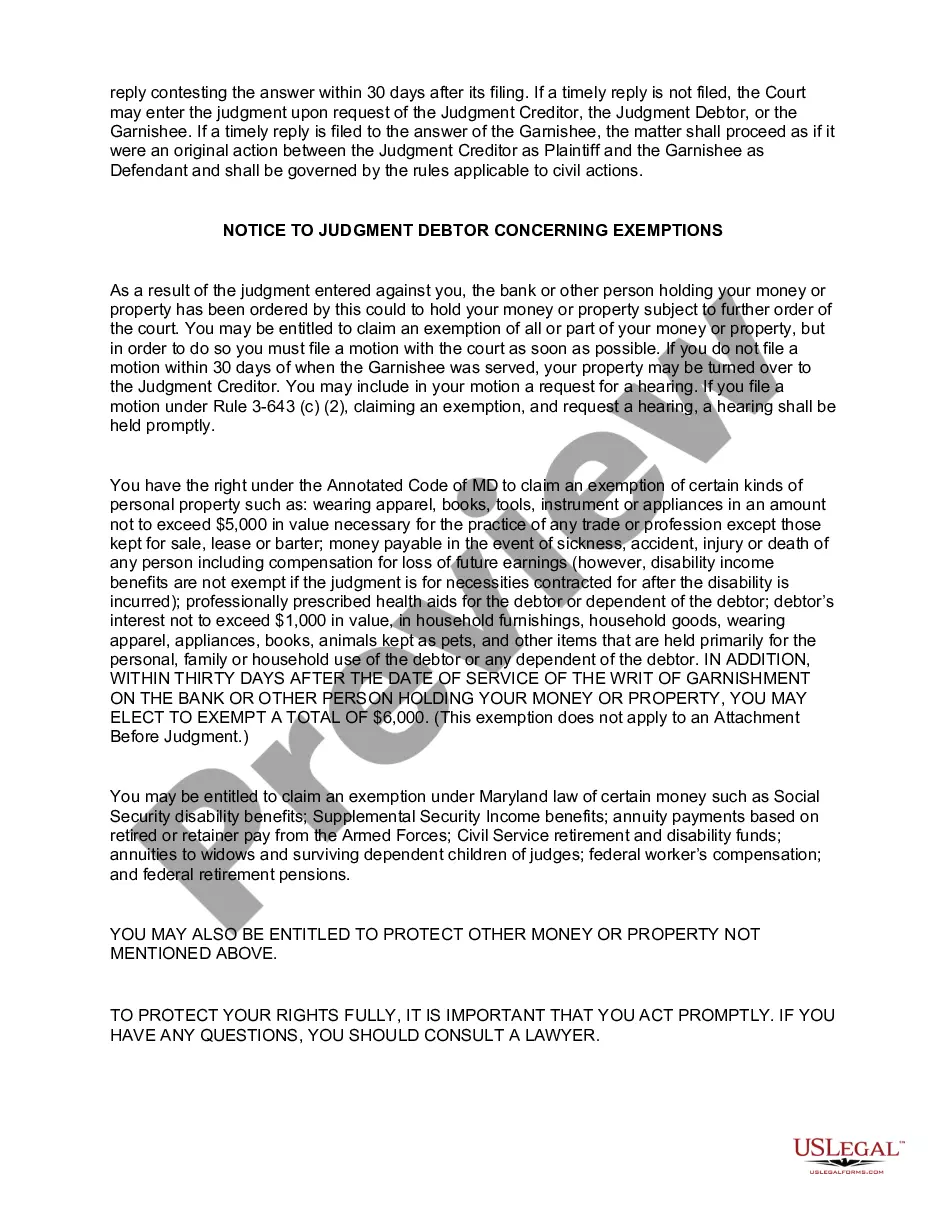

The maximum amount that can be garnished from your paycheck depends on your income and the type of debt. Generally, creditors can garnish up to 25% of your disposable earnings, which is your paycheck after taxes and other deductions. Additionally, federal law protects a portion of your wages from garnishment, ensuring that you have enough to meet your basic needs. To obtain the necessary details, you can find and complete a wage garnishment form that is specific to your situation.

An example of a wage garnishment would be a situation where a creditor has secured a judgment against you for unpaid credit card debt. The court may issue a wage garnishment order that requires your employer to deduct a portion of your wages and send it directly to the creditor. Using a wage garnishment form ensures that this process follows legal protocols, protecting both your rights and those of the creditor.

The most common type of garnishment is for child support payments. In many cases, employers are required to withhold a specific amount from wages to ensure that children receive consistent support. Wage garnishment forms are used to initiate this process legally. Understanding how garnishments work can help you better manage your finances and obligations.

To fill out a challenge to garnishment form, start by providing your personal information, including your name, address, and the case number associated with the garnishment. Clearly state the reasons for your challenge; these can include disputes over the validity of the debt or the amount garnished. If you need assistance, our platform offers resources that guide you through the process of completing the necessary forms.

When wage garnishment occurs, you will notice a deduction on your paycheck. This deduction will appear in the itemized section, often labeled as a garnishment or levy. The amount taken will depend on the judgment amount and legal limitations set by state law. If you're unsure about the details, using a wage garnishment form can help clarify the amounts and your obligations.

Several debts can be repaid through a wage garnishment form. Common examples include overdue child support payments, income tax debts, student loans, credit card obligations, and personal injury judgments. Each type of debt has specific rules that govern how garnishment is applied. It is crucial to note that the process can vary depending on the laws in your state.

To stop a wage garnishment immediately in New Jersey, you may need to file an exemption claim or negotiate a payment plan with the creditor. Communicating directly with your creditor may lead to a resolution that suits both parties. Additionally, consulting with legal professionals can provide guidance on completing the necessary wage garnishment form. Taking quick action is crucial to protect your finances.

Yes, it is possible for a creditor to garnish your wages without prior notice. They may obtain a court order in your absence, meaning you may not realize it until you see a reduced paycheck. To stay informed, regularly review any debts and maintain a good line of communication with creditors. If you need to respond to a wage garnishment form, act quickly to protect your rights.

To write a letter of garnishment, start with a clear subject line and address the recipient by name. Include the specific details about the garnishment amount, the reason for the garnishment, and any relevant deadlines. A wage garnishment form can be a helpful template; just ensure that you customize it to fit your situation. This letter serves an important legal purpose and should be clear and concise.