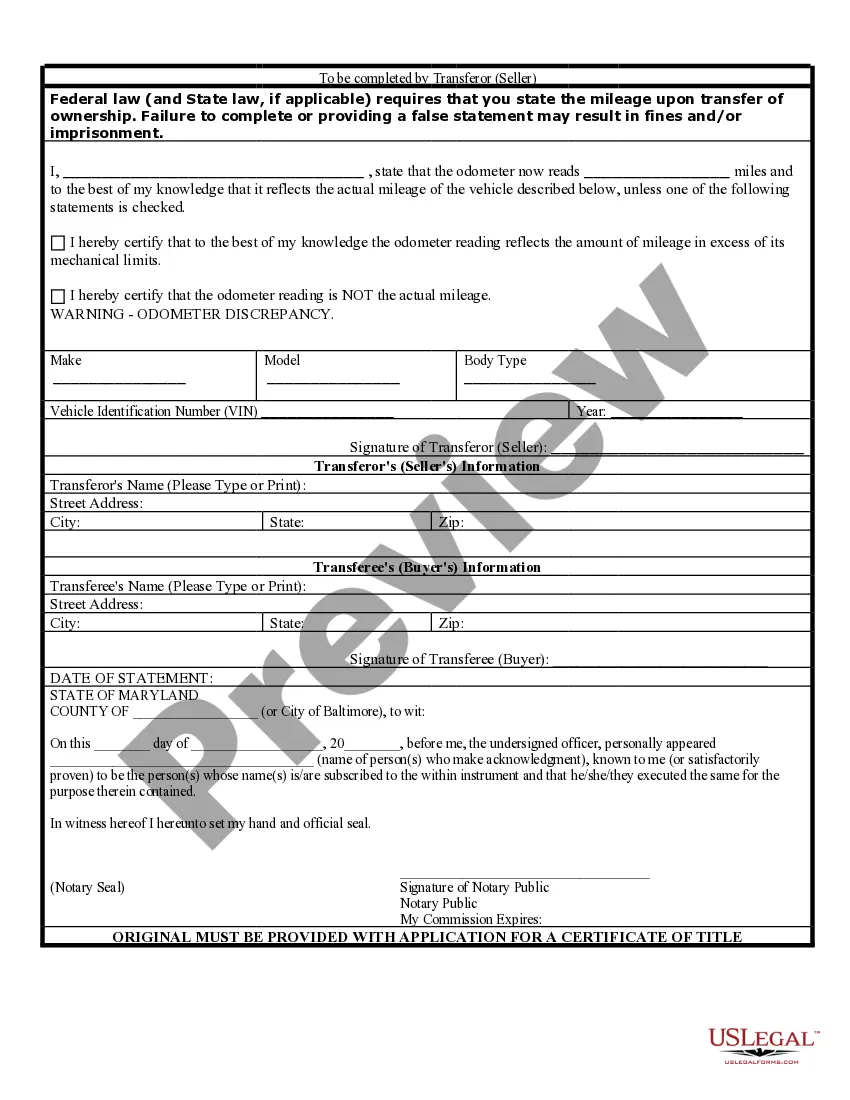

Md Odometer Statement For Lease Buyout

Description

How to fill out Maryland Bill Of Sale Of Automobile And Odometer Statement?

Getting a go-to place to take the most recent and relevant legal templates is half the struggle of handling bureaucracy. Discovering the right legal files calls for precision and attention to detail, which is why it is important to take samples of Md Odometer Statement For Lease Buyout only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and check all the details concerning the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Md Odometer Statement For Lease Buyout:

- Utilize the library navigation or search field to locate your template.

- View the form’s information to check if it suits the requirements of your state and region.

- View the form preview, if available, to ensure the template is definitely the one you are looking for.

- Resume the search and look for the proper document if the Md Odometer Statement For Lease Buyout does not match your needs.

- When you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Pick the file format for downloading Md Odometer Statement For Lease Buyout.

- When you have the form on your device, you may change it with the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal paperwork. Discover the extensive US Legal Forms collection where you can find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

A notice of security interest filing is mailed to the lending institution or person and the title is mailed to the owner. After the lien is satisfied, the security interest document must be mailed to the owner and kept with the title. Both documents are required to sell or trade the vehicle.

APPOINTMENTS REQUIRED ? You Name the Time and Place, We'll Take Care of the Rest. Not sure if your transaction can be completed at home? Visit our Online Services tab below to see what services are available right now!

In most cases, the dealer will handle the titling and registration of your previously leased vehicle through the MVA.

Payments for lease periods due are subject to tax at the 6% rate. Is the tax on out-of-state purchases computed the same way as the tax on sales in Maryland? Basically, yes. Maryland does, however, grant a credit for the sales tax paid to another state up to the amount of the Maryland tax.

In most cases, the dealer will handle the titling and registration of your previously leased vehicle through the MVA. The dealer will provide you with a bill of sale (or sales receipt) and either temporary (cardboard) or permanent (metal) license plates before you drive the vehicle off the lot.