Bill Sale Note For Trailer

Description

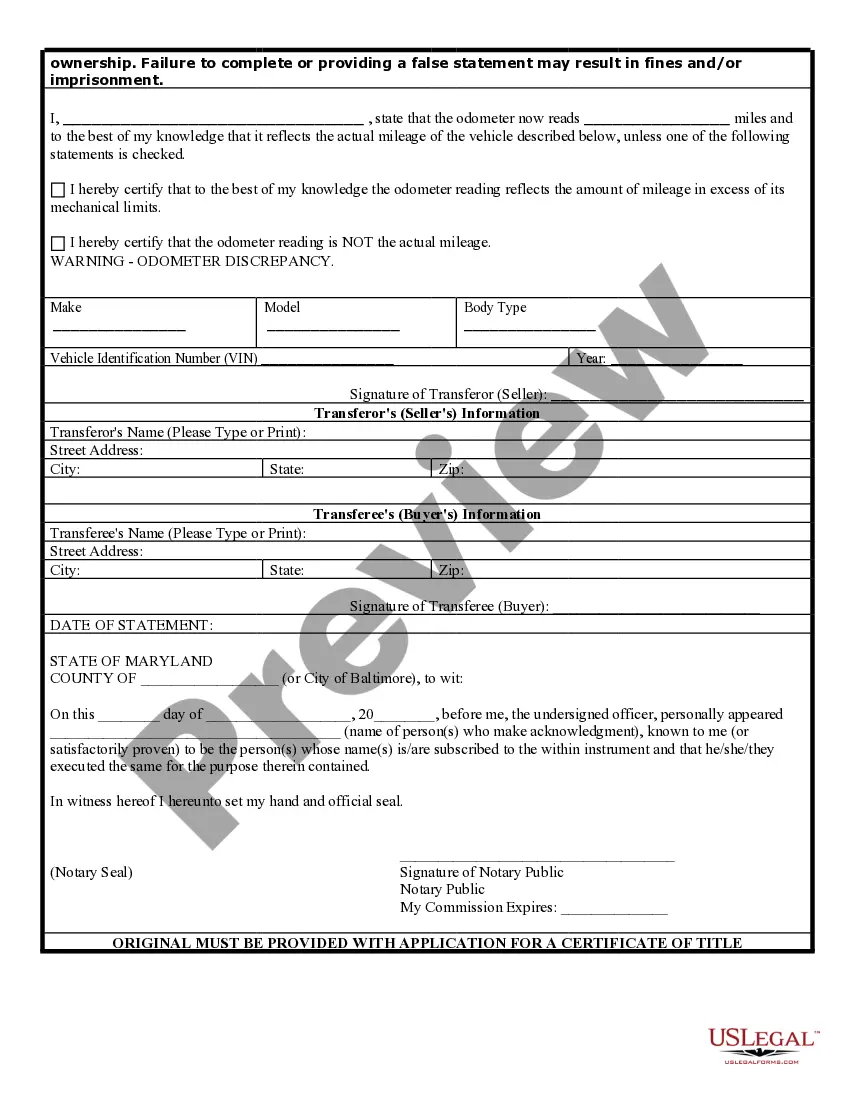

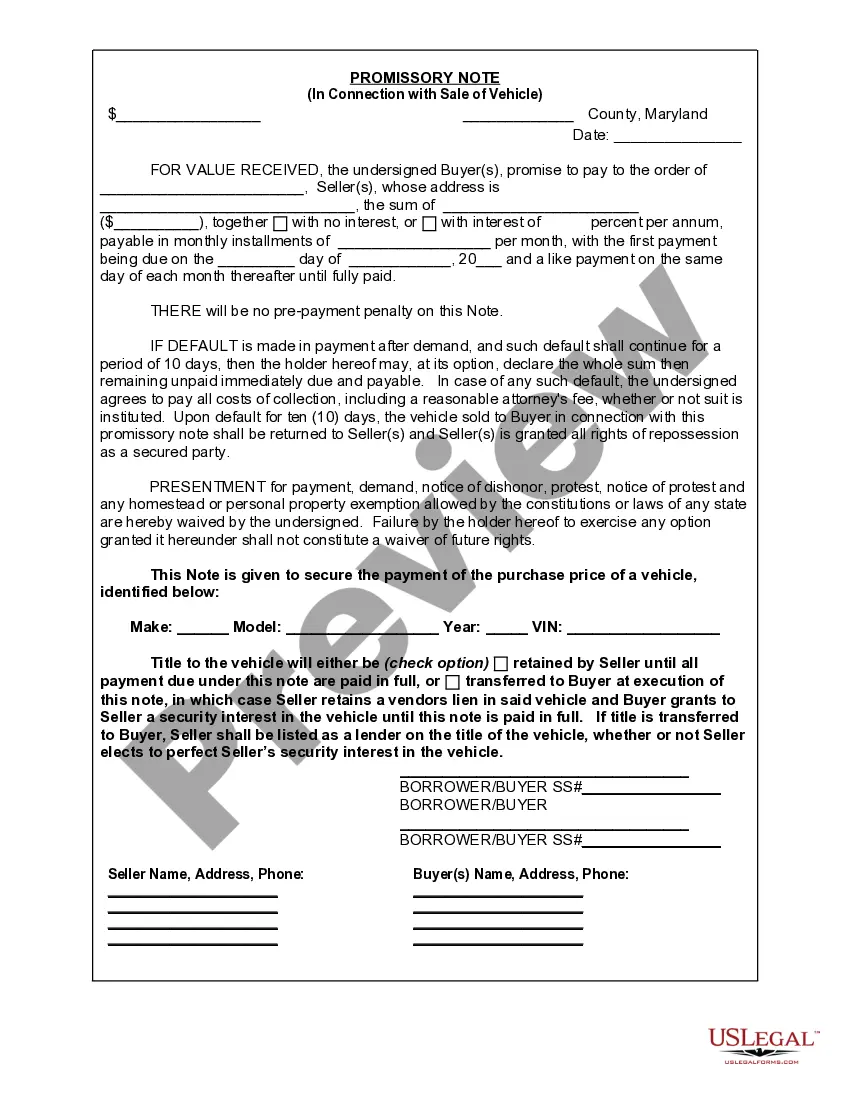

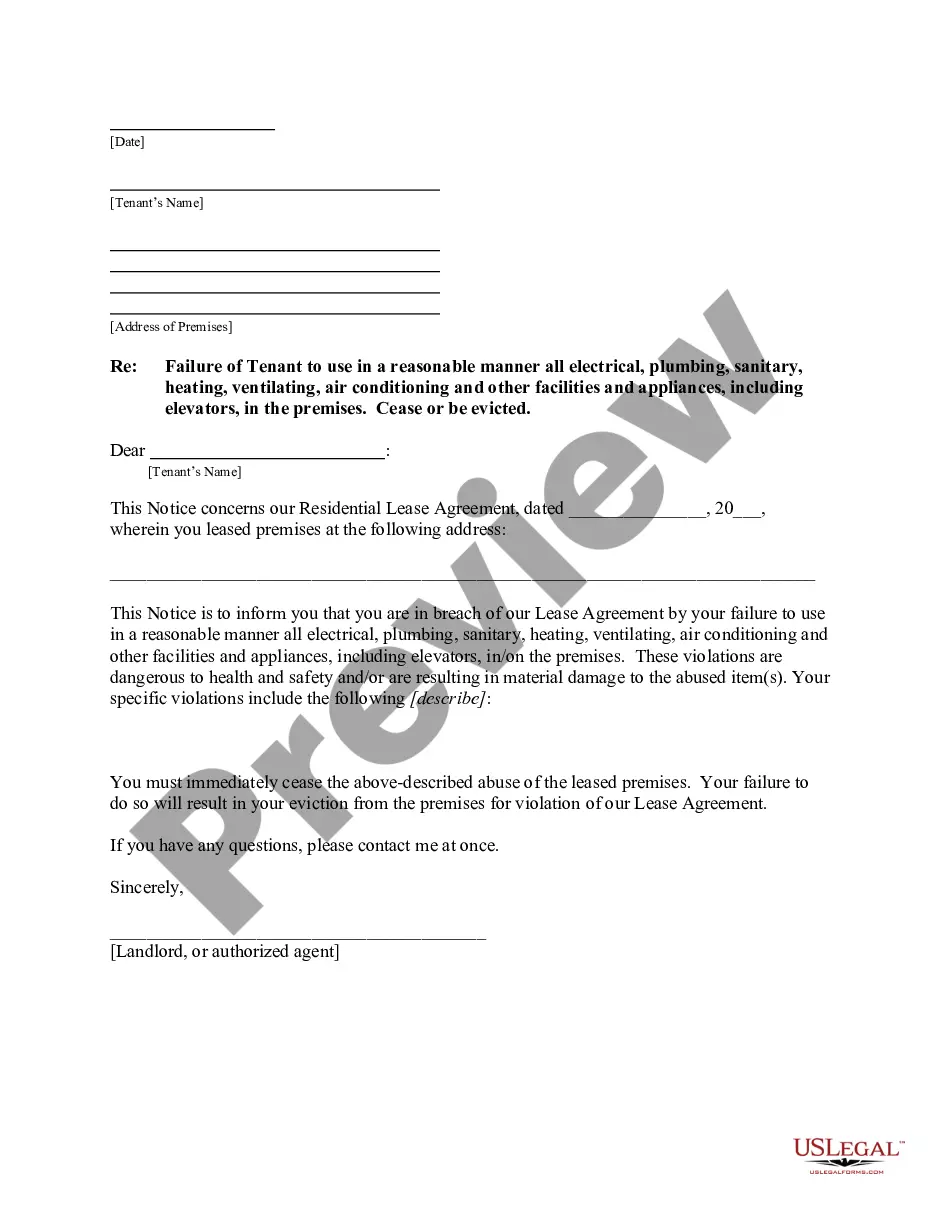

How to fill out Maryland Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

Securing a reliable destination to obtain the most up-to-date and pertinent legal templates is half the challenge of managing bureaucracy.

Selecting the appropriate legal documents requires precision and careful attention to detail, which is why it’s essential to obtain examples of Bill Sale Note For Trailer exclusively from trustworthy sources, like US Legal Forms. An incorrect template will squander your time and postpone the matter at hand.

Eliminate the stress associated with your legal paperwork. Explore the extensive US Legal Forms catalog to discover legal templates, assess their applicability to your situation, and download them immediately.

- Use the catalog browsing or search option to find your template.

- Review the description of the form to ensure it meets the stipulations of your state and county.

- Inspect the form preview, if accessible, to confirm that the form corresponds to your interests.

- Return to the search and seek the appropriate template if the Bill Sale Note For Trailer does not fulfill your requirements.

- When you are confident about the document’s applicability, download it.

- If you are a registered customer, click Log in to verify and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to procure the template.

- Choose the pricing option that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Bill Sale Note For Trailer.

- After obtaining the form on your device, you can modify it with the editor or print and fill it out manually.

Form popularity

FAQ

You can easily change your Connecticut LLC name. The first step is to file a form called the Certificate of Amendment with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in Connecticut. The filing fee for a Certificate of Amendment in Connecticut is $120.

CT.GOV-Connecticut's Official State Website.

Make sure you and new hires complete employment forms required by law. W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

How Long Will a Name Change Take? StateTime to CompleteCO4-5 monthsCT3-5 weeksDC6-8 weeksDE6 months or longer47 more rows

Connecticut's current budget Connecticut also enacted numerous tax cuts in calendar year 2022, including a one-time tax rebate. Under the American Rescue Plan, Connecticut will receive $2.8 billion in direct state fiscal aid and $1.4 billion in local government aid from the federal government.

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.

It costs $120 to change your LLC name in Connecticut. This is the filing fee for the Certificate of Amendment form. The fee is the same whether you file the form online or by mail.

If you file electronically, you do not have to mail in a paper Form CT-8822. Visit the DRS website at .ct.gov/DRS, click on the TSC logo, and follow the instructions. Use Form CT-8822 to notify DRS that you changed your home or business mailing address or the physical location of your business.