Bill Sale Note For School

Description

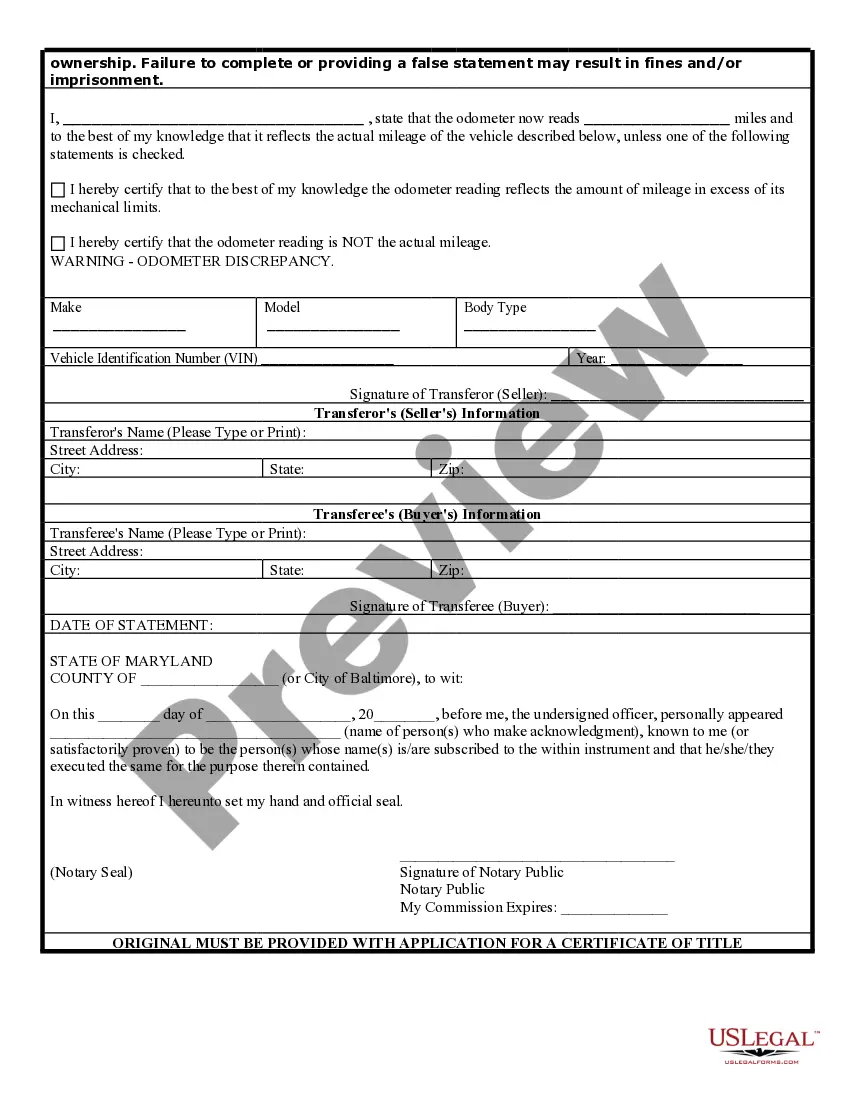

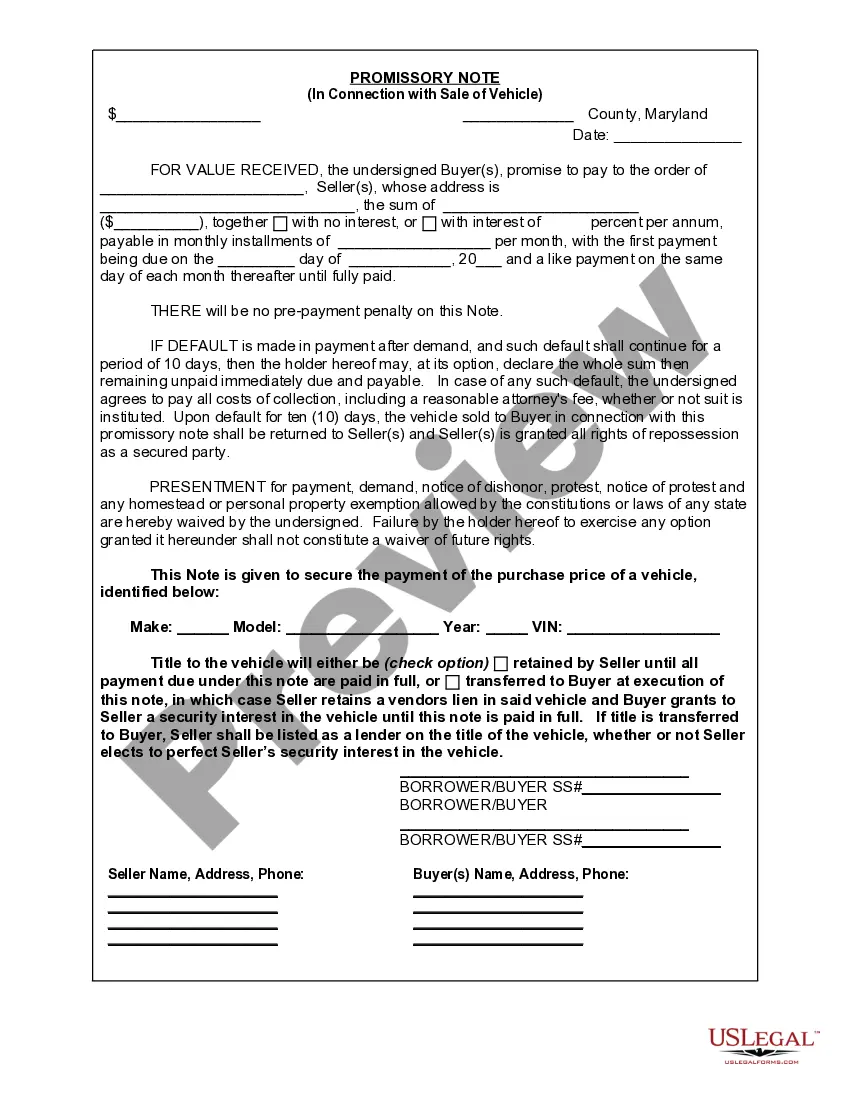

How to fill out Maryland Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

It’s widely recognized that you can’t transform into a legal expert in a day, nor can you easily learn how to promptly draft a Bill Sale Note For School without possessing a specific skill set.

Assembling legal documents is a lengthy endeavor requiring particular training and expertise. So why not entrust the creation of the Bill Sale Note For School to the specialists.

With US Legal Forms, one of the most extensive legal template collections, you can find anything from court documents to templates for office correspondence. We recognize how vital compliance and adherence to federal and local laws and regulations are. This is why all forms on our site are location-specific and current.

You can regain access to your forms from the My documents section at any time. If you’re an existing client, you can simply Log In, and locate and download the template from the same section.

Regardless of the intent behind your paperwork—be it financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the form you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Bill Sale Note For School is what you’re seeking.

- Restart your search if you require another template.

- Create a free account and select a subscription plan to purchase the form.

- Select Buy now. After the payment is processed, you can obtain the Bill Sale Note For School, fill it out, print it, and send it to the necessary parties or organizations.

Form popularity

FAQ

The Connecticut Department of Revenue Services (DRS) offers a variety of fast and convenient taxpayer service options. Business Hours: Monday through Friday a.m. ? p.m. By Phone: 860-297-5962.

Go to myconneCT, under Business Registration, click New Business/Need a CT Registration Number? There is a $100 fee for registering to collect sales and use tax. After registering, you will receive a Sales and Use Tax Permit that should be displayed conspicuously for your customers to see.

The ID number issued by the Secretary of the State is called the Business ID. To look up your Business ID: Go to the business search and search by the business name.

TELEPHONE: Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463(Connecticut calls outside the Greater Hartford calling area only) or 860-297-5962(from anywhere).

Contact Us PHONE NUMBERS, HOURS AND EMAILSMain Line(860) 713-6100 am-pmAccess to the drop box available am-pmMedia InquiriesKaitlyn.Krasselt@ct.gov4 more rows

DSS is now available online (.connect.ct.gov), on the phone (1-855-6-CONNECT, or 1-855-626-6632), and in person at 12 offices (Field Offices).

Connecticut State Tax Payment Options Go to the Connecticut TSC site to submit your estimated payment. Pay via credit or debit card through Official Payments. Complete voucher Form CT-1040ES. Mail the voucher and check/money order to the Form CT-1040ES address here.

Free tax help is available to lower-income residents through the Volunteer Income Tax Assistance program East Hartford VITA, 840 Main Street, East Hartford, 860-290-4329. Manchester VITA, 78 N Main St, Manchester, 860-236-4511. The Village South, 331 Wethersfield Ave, 860-236-4511.