How Do I Turn My Bank Account Into A Joint Account

Description

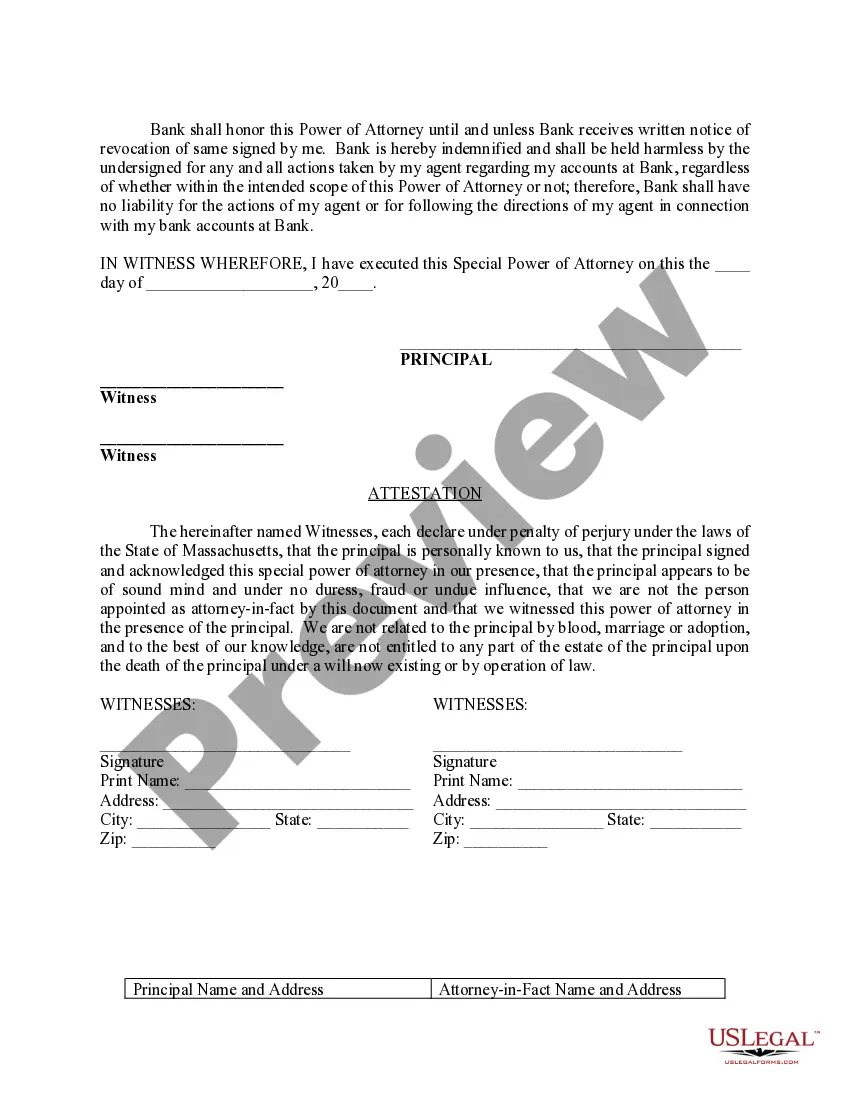

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- Log in to your US Legal Forms account if you're an existing user to access your documents. If your subscription has expired, ensure you renew it promptly.

- For new users, begin by reviewing the legal form collection. Confirm that you select the joint account conversion form that aligns with your state requirements.

- If needed, utilize the search function to explore other relevant templates to ensure you find the perfect match.

- Proceed to purchase the document by clicking the appropriate option and selecting a subscription plan that suits your needs.

- Complete the purchase by entering your payment information, either via credit card or PayPal account.

- Once your transaction is successful, download the form to your device. You can also find it under 'My Forms' in your profile for future access.

Using US Legal Forms empowers you with a vast library of over 85,000 editable legal documents, making the process straightforward and efficient. With expert assistance available, you can ensure your documents are completed accurately.

Take control of your finances today by transforming your sole account into a joint one. Visit US Legal Forms now to get started!

Form popularity

FAQ

Yes, making a single account into a joint account is possible. Most financial institutions provide an option to add another person to your existing account. When considering, 'How do I turn my bank account into a joint account?' be sure to gather the necessary information about the individual you wish to add. Utilizing services like USLegalForms can streamline the process and ensure you complete all required steps efficiently.

You can indeed turn a personal account into a joint account. The procedure may vary by bank, but it usually includes submitting an application and possibly updating account details. If you're wondering, 'How do I turn my bank account into a joint account?' consult with your bank representative for detailed steps. USLegalForms offers resources that can help simplify this transition.

Yes, you can convert your personal account to a joint account. Most banks allow this process, which typically involves filling out a form and providing information about the new account holder. When asking, 'How do I turn my bank account into a joint account?' remember to check with your bank for any specific requirements. If you need assistance, platforms like USLegalForms can guide you through the necessary documentation.

Yes, you can switch a single account to a joint account by contacting your bank. Typically, a bank representative will guide you through the process, which may involve filling out specific forms and providing identification for both account holders. This change allows you to share funds and manage the account collaboratively. If you are unsure about the steps or require assistance, consider using the resources available on US Legal Forms to help you turn your bank account into a joint account smoothly.

Switching a single bank account to a joint account is a common procedure offered by many banks. Contact your bank to ascertain their requirements, as they may ask for specific documents from both account holders. Understanding how do I turn my bank account into a joint account will assist you in ensuring all steps are taken care of.

You can certainly convert an existing account to a joint account by following your bank's guidelines. Typically, both parties must provide identification and agree on the joint ownership terms. Consulting with your bank can clarify how do I turn my bank account into a joint account and make the transition smoother.

Converting a single account to a joint account is possible through your bank's procedures. It's essential to approach your bank and express your intention, as they will provide the necessary forms and requirements. This method is a reliable way to ensure you understand how do I turn my bank account into a joint account.

Yes, changing your personal bank account to a joint account is usually straightforward. You need to arrange a meeting with your bank representative to discuss the details. They will guide you through completing the forms and adding another person as a co-owner. This process helps you understand better how do I turn my bank account into a joint account.

To make a personal account a joint account, start by checking with your bank regarding their specific process. Generally, both account holders must be present to provide identification and fill out the necessary paperwork. After submitting the required information, your account should be updated in no time. Inquiring how do I turn my bank account into a joint account ensures you stay informed about the next steps.

Yes, you can turn a single account into a joint account. To do this, you typically need to visit your bank branch or use your bank's online platform. It's important to provide identification for both yourself and the person you want to add. Understanding how do I turn my bank account into a joint account can significantly enhance your banking experience.