Letter to debt collector telling them to correctly apply your payment

What is this form?

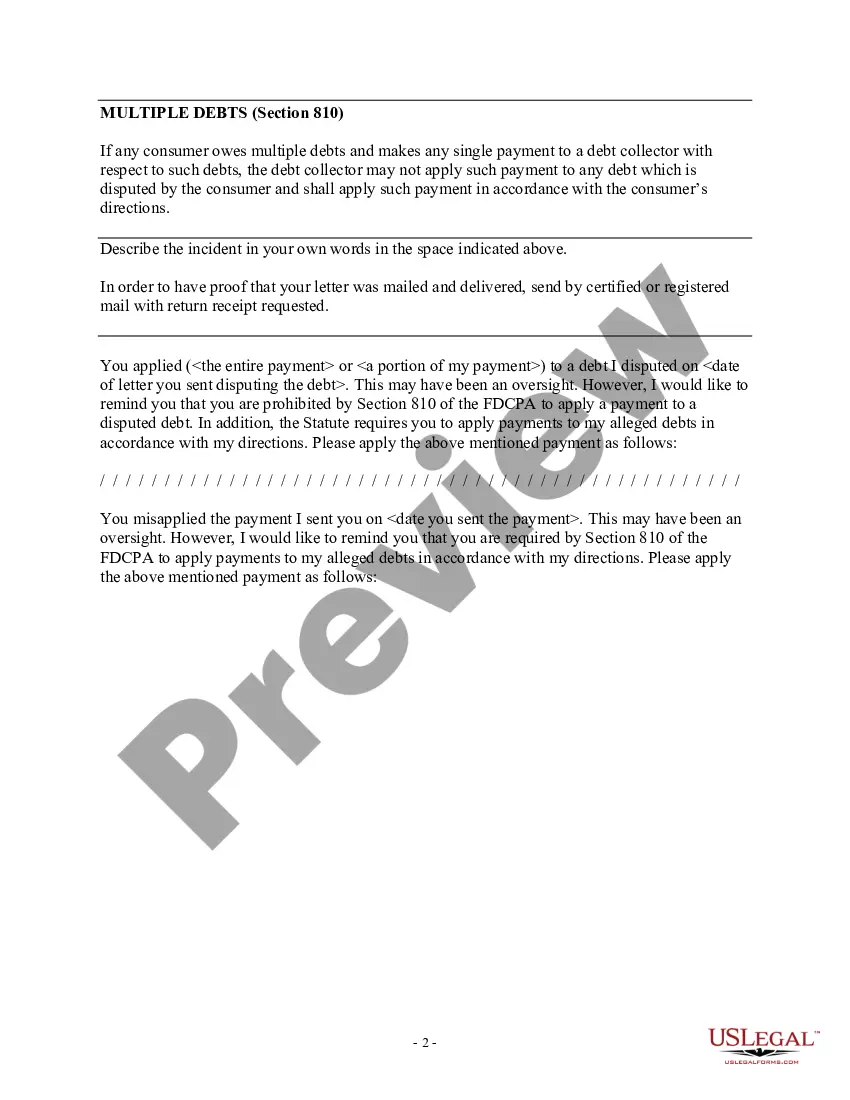

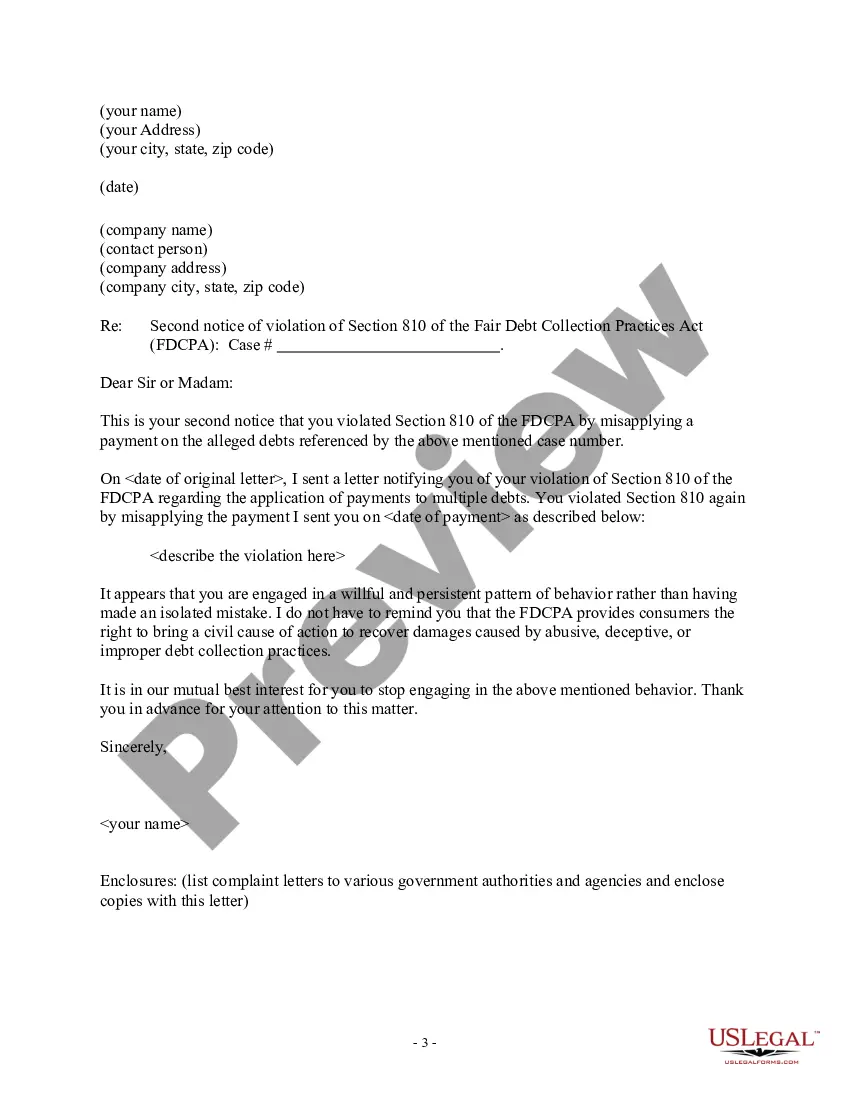

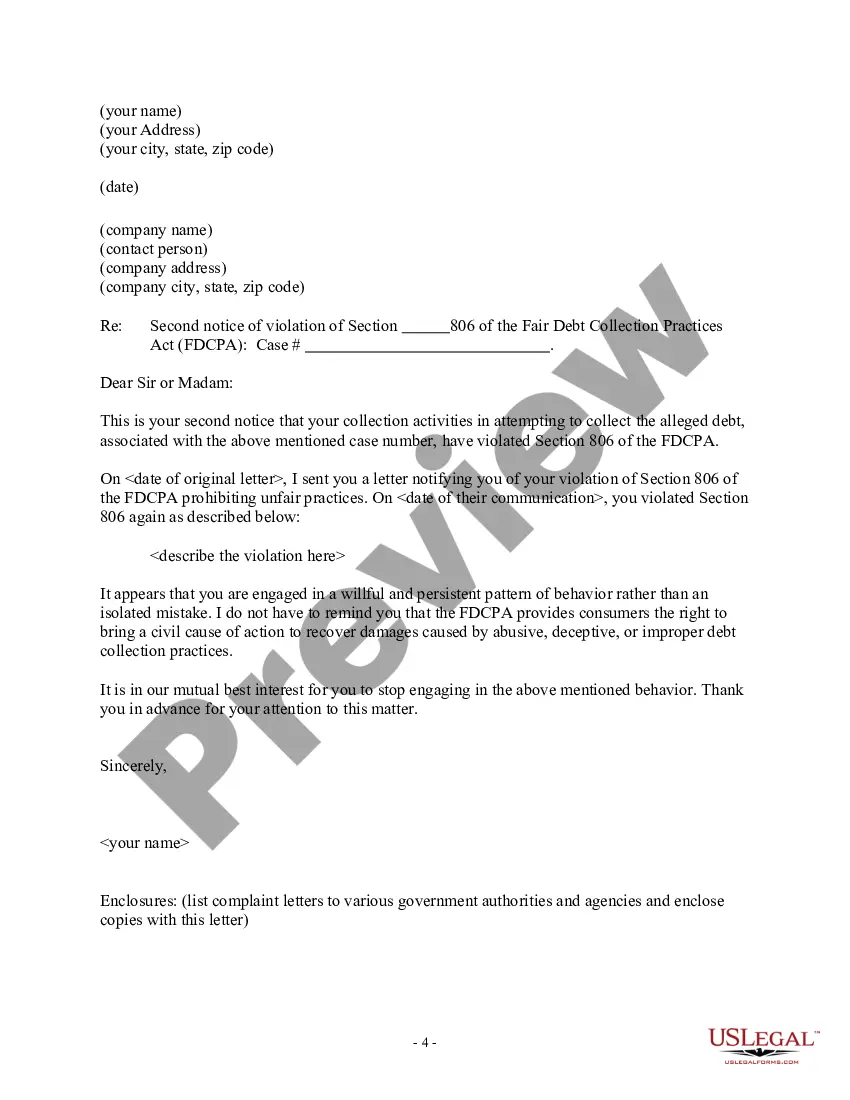

This form, known as the letter to a debt collector telling them to correctly apply your payment, is designed to inform debt collectors when they have improperly applied payments to disputed debts. It allows consumers to assert their rights under the Fair Debt Collection Practices Act (FDCPA) by directing how their payments should be allocated. This letter serves as a crucial communication tool, emphasizing the debt collector's obligation to adhere to consumer payment directions and maintain compliance with federal laws.

What’s included in this form

- Your personal information, including name and address.

- The debt collector's information for accurate communication.

- A section for detailing the specific debt in dispute.

- Clear directives on how to reapply the payment correctly.

- Provisions for follow-up communications if the debt collector fails to comply.

When to use this form

Use this form if you have made a payment toward a debt and believe that the debt collector has misapplied that payment or applied it to a debt you are disputing. It is particularly useful when you want to ensure that your payments are allocated according to your specific instructions. By notifying the debt collector formally, you reinforce your position under the FDCPA, making it more likely they will correct their actions.

Who needs this form

- Consumers who have made payments but feel these have been applied incorrectly.

- Individuals who are disputing one or more debts with a debt collector.

- Anyone seeking to assert their rights under the Fair Debt Collection Practices Act (FDCPA).

How to prepare this document

- Fill in your personal information at the top of the form, including your name and address.

- Provide the debt collector's contact details accurately to ensure delivery.

- Clearly describe the incident of misapplication of payment in the indicated section.

- Specify how you would like your payment to be allocated, according to your preferences.

- Sign and date the letter before sending it via certified mail to ensure proof of receipt.

Is notarization required?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Common mistakes

- Failing to include complete contact information for both parties.

- Not detailing the specific debt that has been disputed.

- Omitting the payment direction or failing to clarify how the payment should be applied.

- Sending the letter without proof of mailing, which can undermine further actions.

Benefits of completing this form online

- Instant access to a professionally drafted form ensures accuracy and legal compliance.

- Editable fields allow you to customize the content to suit your specific situation.

- Conveniently download and print the form from any device, anytime.

- Eliminates the need for in-person appointments with legal professionals for basic debt communication.

State law considerations

This form is suitable for use across multiple states but may need changes to align with your state’s laws. Review and adapt it before final use.

Legal use & context

- This form serves to invoke rights under the FDCPA, helping protect consumers from unlawful debt collection practices.

- It provides clear documentation that can be used in future legal actions if the debt collector continues to misapply payments.

Form popularity

FAQ

Your full name and address. The collections agency's name and address. A request for the amount of the debt claimed to be owed. A request for the name of the original creditor. A request for the judgment information (if applicable) A request for proof of the company's license.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

This is not a good time. Please call back at 6. I don't believe I owe this debt. Can you send information on it? I prefer to pay the original creditor. Give me your address so I can send you a cease and desist letter. My employer does not allow me to take these calls at work.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay. Also, provide them with a clear description of what you expect in return, such as removal of missed payments or the account shown as paid in full on your report.

Their name. Company name. Address. Call-back phone number. Website URL. State license number, if available as not all states license collectors.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

I am responding to your contact about a debt you are attempting to collect. You contacted me by phone/mail, on date. You identified the debt as any information they gave you about the debt. Please stop all communication with me and with this address about this debt.

When a Debt Collector Calls, How Should You Answer? The phone call from a debt collector never comes at a good timebut the best response is to confront the state of these affairs head-on. You may want to hide or ignore the situation and hope it goes awaybut that can make things worse.

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.