Bank Form With Account Information

Description

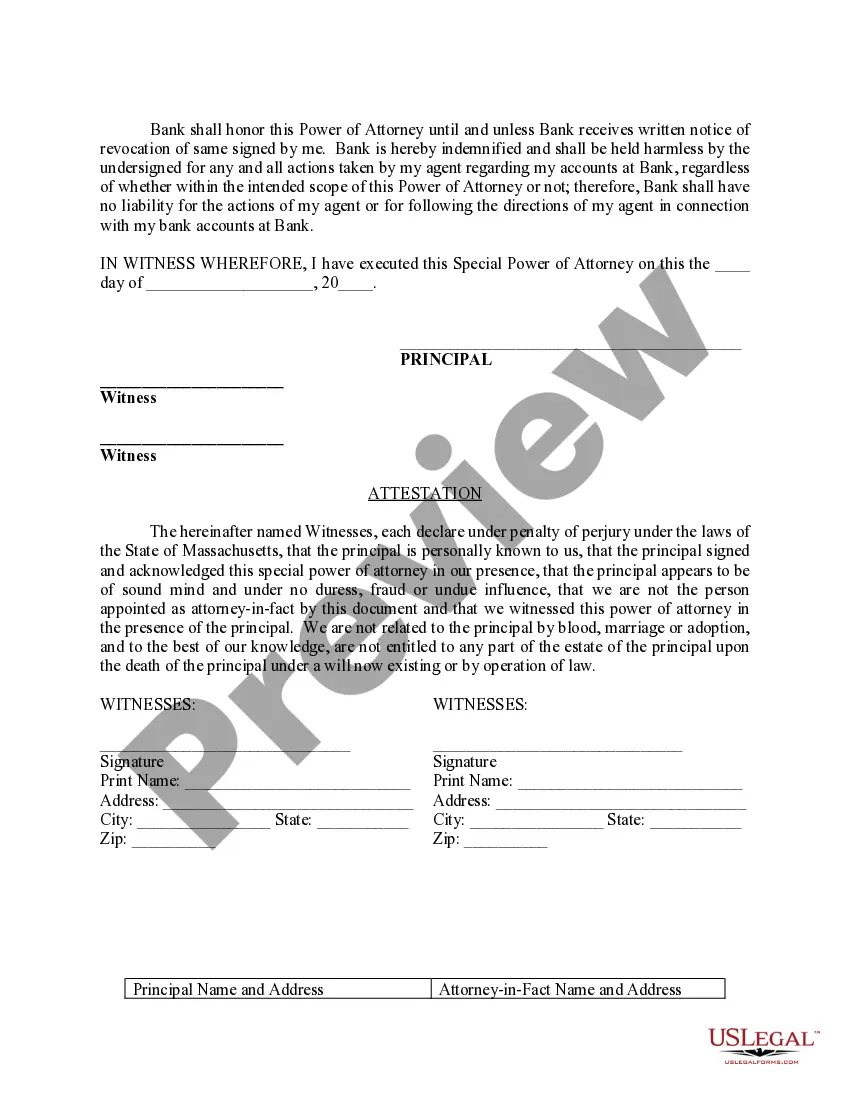

How to fill out Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

- Begin by checking the Preview mode and reading the form description. Verify that the selected form is suitable for your needs and adheres to local jurisdiction requirements.

- If you find a discrepancy, utilize the Search feature at the top to locate the correct template. Alternatively, consider other options available in the library.

- Proceed to purchase your document by clicking the Buy Now button, then select your preferred subscription plan. You will need to create an account to access the expansive library.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After purchasing, download your bank form with account information to your device for immediate use. You can also find it in the My Forms section of your account for future access.

US Legal Forms empowers users with a robust collection of over 85,000 easily fillable and editable legal forms. This extensive library not only provides forms at a competitive cost but also grants access to premium experts for precise document completion.

In conclusion, securing a bank form with account information is simple with US Legal Forms. Take advantage of their comprehensive resources and expertise today. Start your journey by visiting US Legal Forms now!

Form popularity

FAQ

Yes, you can access bank account information online through your bank's official portal or app. Most banks offer secure login options for you to view your account details. By using a bank form with account information, you can also request additional details securely. This quick access saves time and keeps your information manageable.

To retrieve your bank account details, consider using a bank form with account information. This form allows you to request specifics directly from your bank, ensuring you get what you need efficiently. You can typically submit these forms online or in person at your bank branch. Make sure you have your identification handy for verification.

You can find bank account information by visiting your financial institution's website or mobile app. Look for sections dedicated to account services or forms. Additionally, using a bank form with account information can help you request further details if needed. Always ensure you are on a secured platform for safety.

To obtain bank account information, you need to fill out a bank form with account information. Typically, your bank provides these forms online or in branches. After completing the form, submit it according to your bank's instructions. This process ensures you receive accurate and secure access to your information.

Account opening refers to the process of creating a new bank account with a financial institution. This involves submitting the required bank form with account information and agreeing to the bank’s terms. Successfully opening an account allows you to enjoy the benefits of banking services, such as deposits, withdrawals, and financial management tools.

A bank letter stating account information is an official document from your bank that verifies your account details, such as balance and account status. This letter can serve various purposes, like applying for loans or verifying your identity. Having a reliable bank form with account information helps streamline the process when you need such documentation.

Open account information refers to the data associated with a bank account that is accessible to you as a customer. This typically includes your account balance, transaction history, and any fees associated with the account. Understanding this information helps you manage your finances effectively and ensure your bank form with account information is up to date.

To add your bank account to your tax return, you will typically need to report any interest income earned through that account. Ensure you have all necessary bank form with account information, including your account numbers and the bank's details. This information helps you accurately report your income and make sure you comply with IRS requirements.

Yes, you need to report foreign bank accounts if the total balance exceeded $10,000 at any point during the year. This requirement comes from the Bank Secrecy Act, which mandates transparency in banking practices. Keeping accurate records, including any bank form with account information, can help you adhere to this regulation.

An account opening form usually requests specific information, such as your name, address, date of birth, Social Security number, and employment details. Banks may also ask for your financial information and any supporting documentation. Providing complete and accurate bank form with account information simplifies the processing of your request.